- Home

- »

- Medical Devices

- »

-

U.S. Brain Tumor Market Size & Share, Industry Report 2034GVR Report cover

![U.S. Brain Tumor Market Size, Share & Trends Report]()

U.S. Brain Tumor Market (2025 - 2034) Size, Share & Trends Analysis Report By Tumor Type (Malignant, Non-malignant), By Treatment Type (Surgery, Radiation Therapy, Interventional Device-Based Procedures, Chemotherapy), And Segment Forecasts

- Report ID: GVR-4-68040-534-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2024 - 2034

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Brain Tumor Market Size & Trends

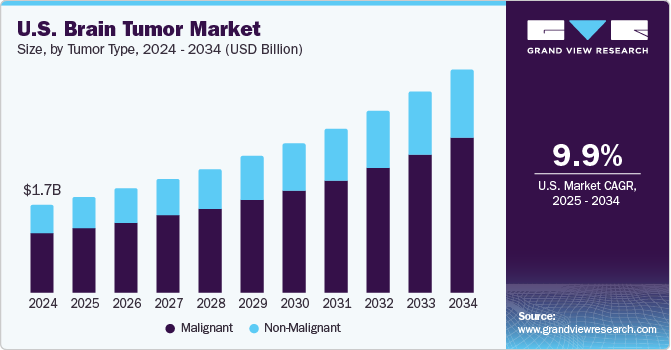

The U.S. brain tumor market size was estimated at USD 1.7 billion in 2024 and is expected to grow at a CAGR of 9.87% from 2025 to 2034. The growth is primarily driven by the increasing prevalence of brain cancer and rising number of brain tumor diagnoses in the U.S. For instance, according to the National Brain Tumor Society report, an estimated one million Americans are currently living with a primary brain tumor, highlighting a substantial patient population in need of effective treatment options. Among these tumors, approximately 72% were estimated to be benign, while 28% were malignant in 2023, indicating a diverse range of treatment needs and approaches. Furthermore, according to the same source, non-malignant meningiomas represent the most prevalent type of primary non-malignant brain tumors, comprising approximately 39.7% of all brain tumors and 55.4% of all non-malignant tumors.

Increasing funding and investments from both public and private sectors are also driving market expansion and further fueling market growth. For instance, in January 2025, GT Medical Technologies, Inc. announced that it had raised USD 37 million in a series D financing round to expand GammaTile, a radiation therapy product in the U.S. market for patients with operable brain tumors. In addition, in September 2024, GT Medical Technologies, Inc. secured a USD 35 million venture loan facility, with an initial USD 15 million funded by Horizon Technology Finance Corporation, an affiliate of Monroe Capital. The funding will fuel strategic commercial and clinical expansion plans for GammaTile. The initiatives supported by the loan will focus on improving access to care for patients diagnosed with high-grade gliomas, brain metastases, and aggressive meningiomas.

Recent Funding and Investments, 2023-2024

Company

Funding

Year

Description

GT Medical Technologies, Inc.

USD 37 Million

January, 2025

The company raised USD 37 million in a series D financing round to expand GammaTile, a radiation therapy product in the U.S. market for patients with operable brain tumors.

GT Medical Technologies, Inc.

USD 35 Million

September, 2024

GT Medical Technologies, Inc. secured a USD 35 million venture loan facility, with an initial USD 15 million funded by Horizon Technology Finance Corporation, an affiliate of Monroe Capital. The funding will fuel strategic commercial and clinical expansion plans for GammaTile. The initiatives supported by the loan will focus on improving access to care for patients diagnosed with high-grade gliomas, brain metastases, and aggressive meningiomas.

ZAP Surgical Systems, Inc.

USD 78 Million

November, 2024

ZAP Surgical Systems, Inc., one of the global leaders in non-invasive robotic brain surgery, secured USD 78 million in a Series E funding round. The company plans to use the funding to advance the commercialization of its ZAP-X Gyroscopic Radiosurgery platform.

Openwater

USD 100 Million

August, 2024

The company announced a USD 100 million funding round from both new and existing investors, including Plum Alley Ventures, Khosla Ventures, and BOLD Capital Partners, to advance treatments targeting diseases at the cellular level.

Stryker

USD 25,000

May, 2024

In a significant move to accelerate brain tumor research, Stryker will match all donations (up to a maximum of USD 25,000) made to the National Brain Tumor Society (NBTS) throughout May 2024. NBTS has a strong track record of supporting brain tumor research, having been awarded over USD 38 million in grants to numerous researchers at leading institutions, all in the pursuit of more effective treatments and, ultimately, a cure.

RefleXion

USD 105 Million

November, 2023

RefleXion Medical has secured USD 105 million in initial equity funding, led by The Rise Fund, TPG's global impact investing strategy. This significant investment will enable RefleXion to expand the commercialization of its groundbreaking SCINTIX therapy, a revolutionary treatment for various stages of indicated solid tumor cancers, including aggressive metastatic disease.

Continued innovation in treatment options, including targeted therapies, immunotherapies, and advancements in surgical techniques is playing a crucial role in market expansion. Breakthroughs in precision medicine allow for more personalized treatment plans, which enhance patient outcomes and attract investment. For instance, in May 2024, GT Medical Technologies, Inc. announced that in March 2024, Grandview Medical Center made history by becoming the first hospital in Alabama to utilize Surgically Targeted Radiation Therapy (STaRT) for patients with brain tumors. This specialized treatment is designed for individuals with newly diagnosed malignant brain tumors as well as recurrent cases, glioblastomas, meningiomas, and brain metastases.

In addition, Varian Medical Systems, Inc. (Siemens Healthineers) offers TrueBeam radiotherapy system, which is renowned for its high precision, and seamlessly integrates hardware, software, treatment protocols, safety features, third-party solutions, and innovative advancements. The HyperArc high-definition radiotherapy module in TrueBeam radiotherapy system enables the planning of both single and multiple metastases, along with primary brain tumors, all utilizing a single isocenter.

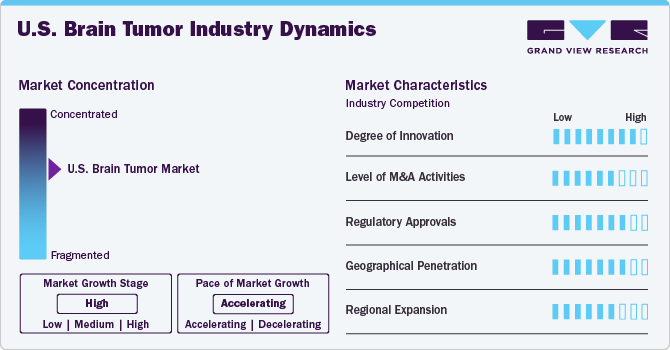

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The industry is characterized by growth owing to the rising prevalence of brain tumors, along with better diagnostic tools, innovations in treatment modalities, such as targeted therapies, substantial funding for brain tumor research from government, non-profits, and private sectors, and availability of a wide range of treatment options, including surgery, radiation therapy, and chemotherapy, among others.

Industry players and researchers are concentrating on developing advanced brain tumor treatment types. Innovative therapies, such as targeted therapies, Laser Interstitial Thermal Therapy (LITT), Focused Ultrasound (FUS), Low-Intensity Focused Ultrasound (LIFU), and Tumor Treating Fields (TTF), have emerged as promising alternatives to traditional approaches such as chemotherapy and radiation. These new modalities lead to improved patient outcomes and reduced side effects.

Several companies have recently received Orphan Drug Designation (ODD) from U.S. FDA approval for their products that are designed to open blood-brain barrier (BBB). For instance, in May 2024, Carthera announced that it had received Orphan Drug Designation (ODD) from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for the use of carboplatin in the treatment of malignant glioma. Carthera is utilizing carboplatin in the inaugural registrational trial of its SonoCloud technology for the treatment of recurrent glioblastoma (rGBM). This randomized, multicenter, two-arm clinical trial follows a 1:1 ratio and aims to enroll 560 patients across 40 sites in Europe and the U.S. The open-label, comparative pivotal trial will assess overall survival in patients receiving carboplatin chemotherapy in conjunction with the SonoCloud-9 system, which is designed to open the Blood-Brain Barrier (BBB).

The Food and Drug Administration (FDA), establishes quality and safety standards for medical devices, including the medical devices used in brain tumor treatment and that are under investigation in clinical studies. In the U.S. brain tumor market, many products have received approval for clinical trials and commercialization. For instance,

-

In November 2024, Novocure announced that the U.S. FDA has approved its new Head Flexible Electrode (HFE) transducer arrays for use with Optune Gio in the treatment of adult patients with glioblastoma multiforme (GBM). Optune Gio is a portable, wearable device that generates alternating electric fields called Tumor Treating Fields (TTF). These fields are delivered through non-invasive, wearable arrays designed to treat brain tumors.

-

In February 2024, NaviFUS announced that it had received clearance from the U.S. FDA to proceed with an Investigational Device Exemption (IDE) clinical trial utilizing its NaviFUS System focused ultrasound device. This pilot-early feasibility study, set to take place at the University of Virginia, aims to investigate the synergistic benefits of utilizing the NaviFUS System to non-invasively open the blood-brain barrier (BBB) in combination with bevacizumab (Avastin) treatment for patients suffering from recurrent glioblastoma multiforme (rGBM).

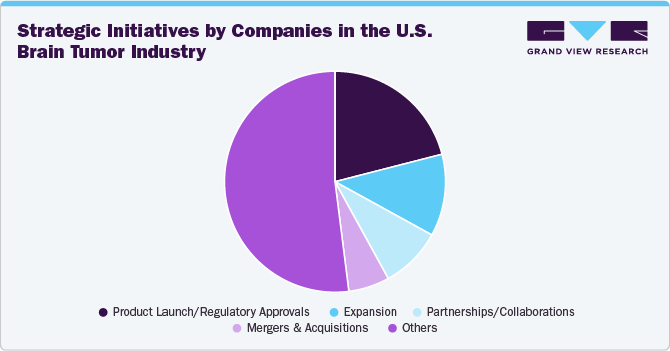

The industry has witnessed a notable increase in mergers and acquisitions (M&A) activities in recent years. This trend is driven by the urgent need for innovative therapies, as well as the increasing incidence of brain tumors, which has stimulated the demand for new treatment options. For instance, in September 2024, Stryker announced the successful completion of its acquisition of NICO Corporation, a private entity specializing in innovative, minimally invasive surgical solutions for tumor treatment and intracerebral hemorrhage (ICH) management. This strategic acquisition underscores Stryker's dedication to advancing neurotechnology, specifically in the areas of tumor and stroke care, by expanding its portfolio of cutting-edge solutions.

The industry for non-malignant and malignant brain tumors is moderately fragmented. The market includes a broad range of treatment options for each tumor type. For instance, treatment options for malignant tumors include surgery, radiation therapy, interventional device-based procedures, chemotherapy, targeted therapy, TTF, LITT, and LIFU, among others. Notable players in this market include Varian Medical Systems, Inc. (Siemens Healthineers), Elekta, Accuray Incorporated, ZAP Surgical Systems, Inc., and GT Medical Technologies, Inc., among others.

Tumor Type Insights

The malignant segment accounted for the largest revenue share of 67.2% in 2024 driven by the rising prevalence of brain cancer and increasing incidence of glioblastoma and high-grade malignant brain tumors. For instance, according to the National Brain Tumor Society report, brain cancer was the 10th leading cause of cancer-related deaths in 2023. In addition, according to the National Brain Tumor Society report the same source, glioblastoma is the most prevalent primary malignant brain tumor, representing more than 14.2% of all brain tumors in 2023. Malignant brain tumors, including glioblastomas, often require aggressive treatment approaches, which typically involve a combination of surgery, chemotherapy, and radiation therapy.

The higher mortality rate associated with these tumors has spurred advancements in medical technologies, as well as increased funding for research into novel therapies. For instance, in September 2024, GT Medical Technologies, Inc. announced that it had secured a USD 35 million venture loan facility, with an initial USD 15 million funded by Horizon Technology Finance Corporation, an affiliate of Monroe Capital. The funding will fuel strategic commercial and clinical expansion plans for GammaTile, GT Medical's innovative treatment for brain tumors. The initiatives supported by the loan will focus on improving access to care for patients diagnosed with high-grade gliomas, brain metastases, and aggressive meningiomas. These plans are crucial for GT Medical's corporate objectives, aiming to broaden GammaTile's reach and benefit more patients suffering from these challenging conditions. The expansion will enhance GT Medical's ability to deliver its advanced technology and improve patient outcomes in the treatment of aggressive brain tumors. As a result, medical device companies are focusing their efforts on developing innovative treatment options, including targeted therapies specifically aimed at malignant tumors. This heightened focus has significantly contributed to the expansion of the market segment dedicated to malignant tumors.

Furthermore, the rising burden on healthcare systems resulting from complications associated with these tumors drives demand for advanced diagnostic tools and therapeutic interventions.

The non-malignant segment is expected to witness significant growth during the forecast period due toincreasing incidence of non-malignant brain tumors, such as meningiomas, schwannomas, and pituitary adenomas.Furthermore, the growing aging population in the U.S. is driving the incidence of non-malignant brain tumors. As age is a significant risk factor for many types of tumors, the rise in life expectancy and the demographic shift toward an older population will likely lead to more individuals being diagnosed with brain tumors. This trend is anticipated to amplify the demand for treatment options, monitoring, and management strategies, thereby bolstering market growth.

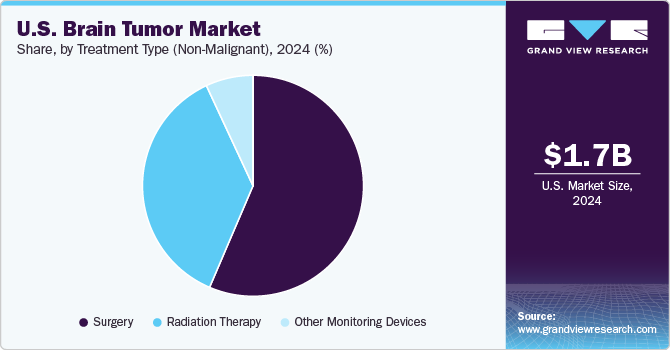

Treatment Type Insights

The surgery segment accounted for the largest market share in 2024 due to several compelling factors. Firstly, surgical intervention remains the primary approach for managing many types of brain tumors, particularly malignant tumors such as glioblastomas. Surgical procedures, including craniotomy and tumor resection, aim to remove as much of the tumor as possible, which can relieve pressure on the brain, alleviate symptoms, and improve overall patient outcomes. This efficacy in immediate management gives surgery a distinct advantage over other treatment modalities such as chemotherapy and radiation therapy, which are often used as adjuncts rather than standalone solutions.

Additionally, advancements in surgical techniques and technologies have significantly enhanced the safety and effectiveness of brain surgeries. Innovations such as intraoperative imaging, robotic surgery systems, and minimally invasive approaches have reduced the risks associated with surgery, leading to quicker recovery times and better prognoses. These technological improvements instill greater confidence in both neurosurgeons and patients, further driving the preference for surgical interventions.

The radiation therapy segment is anticipated to witness the fastest growth from 2025 to 2034. One of the primary reasons for this growth is the continual advancements in radiation technology, such as Surgically Targeted Radiation Therapy (STaRT) and External Beam Radiation Therapy (EBRT)/Stereotactic Radiosurgery (SRS) devices. These cutting-edge techniques allow for higher precision in targeting tumors while minimizing damage to surrounding healthy brain tissue. As a result, patients experience fewer side effects and improved quality of life, making radiation therapy an increasingly attractive treatment option.

Furthermore, the rising incidence of brain tumors, particularly malignant types such as glioblastomas, necessitates effective treatment modalities. Radiation therapy is often employed as a primary treatment or as an adjuvant therapy post-surgery, enhancing its utilization in treatment regimes. The surge in diagnoses has led healthcare providers to seek effective solutions that can be quickly integrated into patient care, solidifying the role of radiation therapy in comprehensive treatment plans.

Companies Conducting Clinical Trials for Brain Tumor Treatment in the U.S.

In the U.S., several prominent companies are at the forefront of conducting clinical trials aimed at developing innovative treatments for brain tumors. These trials are essential for advancing therapies and improving patient outcomes.

Company Name

Month, Year

Description

GT Medical Technologies, Inc.

November, 2024

The company announced the achievement of two significant clinical milestones, paving the way for broader adoption of GammaTile, its FDA-cleared device revolutionizing brain brachytherapy delivery.

Alpheus Medical Inc.

November, 2024

Alpheus Medical, Inc., a private clinical-stage oncology company at the forefront of pioneering sonodynamic therapy (SDT) for the treatment of solid tumors, announced promising results from its Phase 1/2 clinical trial involving patients with recurrent or refractory high-grade gliomas.

Carthera

April, 2024

Carthera announced the launch of a phase 2a clinical trial (NCT05864534). Sponsored by Northwestern University, this trial will utilize Carthera’s SonoCloud-9 device in combination with Agenus’ checkpoint inhibitors balstilimab and botensilimab for patients newly diagnosed with glioblastoma (GBM) who have completed radiotherapy.

NaviFUS

March, 2024

A new clinical trial is studying sonodynamic therapy for patients with recurrent glioblastoma. This trial marks the first time in the U.S. that the NaviFUS device is being utilized, which integrates neuronavigation technology with a mobile, noninvasive focused ultrasound system.

Source: ClinicalTrials.gov and Company Website

Key U.S. Brain Tumor Company Insights

Varian Medical Systems, Inc. (Siemens Healthineers), Accuray Incorporated, Elekta, GT Medical Technologies, Inc., Novocure, and Aesculap, Inc. - a B. Braun company, are some of the major players in the U.S. brain tumor market. These companies are expanding their portfolios in this sector and acquiring smaller firms to strengthen their competitive edge in the rapidly growing industry. Moreover, industry players are launching advanced products to meet the increasing demand.

Key U.S. Brain Tumor Companies:

- GT Medical Technologies, Inc.

- Novocure

- ZAP Surgical Systems, Inc.

- Aesculap, Inc. - a B. Braun company

- Accuray Incorporated

- Carthera

- Alpheus Medical Inc.

- Alpha Tau Medical Ltd

- Elekta

- IMRIS Inc.

- Medtronic

- Monteris

- Openwater

- Acoustic MedSystems, Inc.

- NaviFUS Corp

- Insightec

- Varian Medical Systems, Inc. (Siemens Healthineers)

- RefleXion

- MagnetTx Oncology Solutions Ltd.

- NICO Corporation (Stryker)

- Terumo Interventional Systems

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- IBA Worldwide

Recent Developments

-

In January 2025, GT Medical Technologies, Inc. raised USD 37 million in a series D financing round to expand GammaTile, a radiation therapy product in the U.S. market for patients with operable brain tumors.

-

In November 2024, Novocure announced that the U.S. Food and Drug Administration (FDA) has approved its new Head Flexible Electrode (HFE) transducer arrays for use with Optune Gio in the treatment of adult patients with glioblastoma multiforme (GBM).

-

In September 2024, GT Medical Technologies, Inc. secured a USD 35 million venture loan facility, with an initial USD 15 million funded by Horizon Technology Finance Corporation, an affiliate of Monroe Capital. The funding will fuel strategic commercial and clinical expansion plans for GammaTile.

-

In November 2024, Alpheus Medical, Inc., one of the private clinical-stage oncology companies at the forefront of pioneering sonodynamic therapy (SDT) for the treatment of solid tumors, announced promising results from its Phase 1/2 clinical trial involving patients with recurrent or refractory high-grade gliomas.

-

In November 2024, ZAP Surgical Systems, Inc., one of the global leaders in non-invasive robotic brain surgery, secured USD 78 million in a Series E funding round. The company plans to use the funding to advance the commercialization of its ZAP-X Gyroscopic Radiosurgery platform.

-

In September 2024, Stryker announced the successful completion of its acquisition of NICO Corporation, a private entity specializing in innovative, minimally invasive surgical solutions for tumor treatment and intracerebral hemorrhage (ICH) management. This strategic acquisition underscores Stryker's dedication to advancing neurotechnology, specifically in the areas of tumor and stroke care, by expanding its portfolio of cutting-edge solutions.

-

In September 2024, NaviFUS announced that it has signed a cooperation agreement with Bracco, a global leader in ultrasound imaging agents, to enhance the capabilities of the NaviFUS System in opening the blood-brain barrier (BBB) for treating brain cancers and neurological diseases. This year, the system will undergo testing in several clinical trials, representing a significant step forward in non-invasive therapies.

-

In August 2024, IBA (Ion Beam Applications S.A., EURONEXT), one of the global leaders in particle accelerator technology and the foremost provider of proton therapy solutions for cancer treatment, announced that it has signed a Memorandum of Understanding with the University of Pennsylvania Health System. This agreement is for the installation of two Proteus ONE compact proton therapy systems at the Penn Presbyterian Medical Center in Philadelphia, PA, U.S.

-

In August 2024, Openwater announced a USD 100 million funding round from both new and existing investors, including Plum Alley Ventures, Khosla Ventures, and BOLD Capital Partners, to advance treatments targeting diseases at the cellular level.

-

In May 2024, Monteris, one of the leaders in image-guided laser interstitial thermal therapy (LITT), announced the commercial launch of its NeuroBlate NB3 FullFire 1.6mm laser probe. This is the smallest laser probe available for brain use, featuring the NeuroBlate System's cooling technology and advanced laser fiber technology. Available in a single adjustable length, the NB3 probe supports multi-trajectory procedures and provides economic benefits through streamlined inventory. The NB3 laser probe received FDA 510(k) clearance in December 2023 and has been available in a limited market release since February 2024.

-

In May 2024, in a significant move to accelerate brain tumor research, Stryker announced that it will match all donations (up to a maximum of USD 25,000) made to the National Brain Tumor Society (NBTS) throughout May 2024. NBTS has a strong track record of supporting brain tumor research, having awarded over USD 38 million in grants to numerous researchers at leading institutions, all in the pursuit of more effective treatments and, ultimately, a cure.

U.S. Brain Tumor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.87 billion

Revenue forecast in 2034

USD 4.35 billion

Growth rate

CAGR of 9.87% from 2025 to 2034

Base year for estimation

2024

Historical Range

2024 - 2034

Forecast period

2025 - 2034

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2034

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tumor type, treatment type

Country scope

U.S.

Key companies profiled

GT Medical Technologies, Inc.; Novocure; ZAP Surgical Systems, Inc.; Aesculap, Inc. - a B. Braun company; Accuray Incorporated; Carthera; Alpheus Medical Inc.; Alpha Tau Medical Ltd; Elekta; IMRIS Inc.; Medtronic; Monteris; Openwater; Acoustic MedSystems, Inc.; NaviFUS Corp; Insightec; Varian Medical Systems, Inc. (Siemens Healthineers); RefleXion; MagnetTx Oncology Solutions Ltd.; NICO Corporation (Stryker); Terumo Interventional Systems; Boston Scientific Corporation; Koninklijke Philips N.V.; IBA Worldwide.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Brain Tumor Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2034. For this study, Grand View Research has segmented the U.S. brain tumor market report based on tumor type and treatment type:

-

Tumor Type Outlook (Revenue, USD Million, 2024 - 2034), (Number of Patients Undergo Treatment Per Tumor Type)

-

Malignant

-

Glioblastomas

-

Medulloblastomas

-

Astrocytomas

-

Ependymomas

-

Others

-

-

Non-Malignant

-

Meningiomas

-

Pituitary Adenomas

-

Craniopharyngiomas

-

Hemangioblastomas

-

Others

-

-

-

Treatment Type (Malignant) Outlook (Revenue, USD Million, 2024 - 2034), (Number of Patients per Treatment), (USD Million in Terms of Number of Patients per Treatment, Volume Unit)

-

Surgery

-

Neurosurgical Instruments

-

Robotic Surgery Systems

-

Interventional Device-Based Procedures

-

Endoscopes

-

Intraoperative Imaging Systems

-

Others

-

-

Radiation Therapy

-

External Beam Radiation Therapy (EBRT)/Stereotactic Radiosurgery (SRS) Devices

-

Linear Accelerators (LINAC)

-

Gamma Knife Systems

-

Proton radiosurgery

-

-

Internal radiation/Brachytherapy Devices

-

-

Interventional Device-Based Procedures

-

Embolization Devices

-

Liquid Embolic Agents

-

Microspheres

-

-

Tumor Ablation Devices

-

-

Chemotherapy

-

Targeted Therapy

-

Tumor Treating Fields (TTF)

-

Laser Interstitial Thermal Therapy (LITT)

-

Surgically Targeted Radiation Therapy

-

Catheter-Based Ultrasound Thermal Ablation

-

Focused Ultrasound (FUS)

-

Low-Intensity Focused Ultrasound (LIFU)

-

-

Treatment Type (Non-Malignant) Outlook (Revenue, USD Million, 2024 - 2034), (Number of Patients per Treatment), (USD Million in Terms of Number of Patients per Treatment, Volume Unit)

-

Surgery

-

Neurosurgical Instruments

-

Blade, Knife, Cutter & Scissors

-

Dissector

-

Drill & Perforator

-

Others

-

-

Robotic Surgery Systems

-

Endoscopes

-

Intraoperative Imaging Systems

-

Others

-

-

Radiation Therapy

-

External Beam Radiation Therapy (EBRT)/Stereotactic Radiosurgery (SRS) Devices

-

Linear Accelerators (LINAC)

-

Gamma Knife Systems

-

Proton radiosurgery

-

-

Internal radiation/Brachytherapy Devices

-

-

Other Monitoring Devices

-

Frequently Asked Questions About This Report

b. The U.S. brain tumor market size was estimated at USD 1.71 billion in 2024 and is expected to reach USD 1.87 billion in 2025.

b. The U.S. brain tumor market is expected to grow at a compound annual growth rate of 9.87% from 2025 to 2034 to reach USD 4.35 billion by 2034.

b. Based on tumor type, malignant segment dominated the market with a 67.20% share in 2024 driven by rising prevalence of brain cancer, increasing incidence of glioblastoma and high-grade malignant brain tumors.

b. Some key players operating in the U.S. brain tumor include GT Medical Technologies, Inc.; Novocure; ZAP Surgical Systems, Inc.; Aesculap, Inc. – a B. Braun company; Accuray Incorporated; Carthera; Alpheus Medical Inc.; Alpha Tau Medical Ltd; Elekta; IMRIS Inc.; Medtronic; Monteris; Openwater; Acoustic MedSystems, Inc.; NaviFUS Corp; Insightec; Varian Medical Systems, Inc. (Siemens Healthineers); RefleXion; MagnetTx Oncology Solutions Ltd.; NICO Corporation (Stryker); Koninklijke Philips N.V.; IBA Worldwide.

b. The U.S. brain tumor market is primarily driven by rising prevalence of primary and secondary brain tumors, innovations in diagnostic imaging, surgical techniques (such as advanced neurosurgery), and therapeutic modalities (such as targeted therapies, immunotherapies, and radiotherapy), and increasing awareness and early diagnosis of brain tumor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.