- Home

- »

- Pharmaceuticals

- »

-

U.S. Cannabis Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Cannabis Market Size, Share & Trends Report]()

U.S. Cannabis Market Size, Share & Trends Analysis Report By Source (Hemp, Marijuana), By Derivatives (CBD, THC), By End-use (Medical Use, Recreational Use), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-978-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Cannabis Market Size & Trends

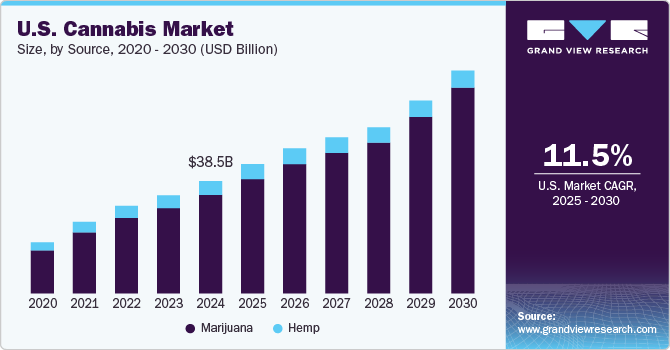

The U.S. cannabis market size was estimated at USD 15.82 billion in 2023 and is expected to grow at a CAGR of 13.7% from 2024 to 2030. In the U.S., cannabis is used in the pharmaceutical, cosmetic, and food & beverage industries. Growing acceptance of its use for medical purposes and the rising legalization of cannabis are the key factors driving the market growth. The increasing research activities on the use of cannabis and its medicinal properties have led to its increased use to treat various chronic conditions.

Cannabis is effective in treating chronic pain and nausea caused due to chemotherapy. Furthermore, the constant rise in the legitimization of medical cannabis has resulted in the growth of the market. For instance, the Food and Drug Administration (FDA) has approved the use of cannabis-derived drug products, such as Epidiolex, Cesamet, etc., for treating seizures and chemotherapy-induced side effects.

Moreover, a positive attitude of consumers towards the consumption of cannabinoid (CBD) based products has led to the increased penetration of cannabis. For instance, according to the Gallup Survey, approximately half of adults in the U.S., spanning various genders, age ranges, and educational backgrounds, have tried marijuana, based on combined data from 2022 and 2023.

The increasing number of companies entering the local markets to cater to the growing demand for cannabis and favorable government initiatives support the market growth. In addition, a dynamic startup scene in the U.S. boosts the market growth. For instance, in June 2023, Governor Kathy Hochul announced that "Chicago Atlantic Admin, LLC ("Chicago Atlantic") is investing up to USD 150 million senior secured capital in the New York State Cannabis Social Equity Investment Fund." Furthermore, according to data published in Reuters, Dutchie, Inc., an Oregon-based company, raised a Series D funding of around USD 350 million in 2021.

The cannabis industry is booming due to the increasing adoption of cannabis for medical and recreational use. Moreover, the price of legal marijuana is lower than medical marijuana. However, taxes can be levied on marijuana products after legalization. Therefore, cultivators are focusing on its production in areas exempt from taxes. For instance, in New York, marijuana cultivators are focusing on tribal regions to get exemptions from the taxes levied by the government. This is expected to lower the overall cost of cultivation of marijuana in the state, and cultivators can sell marijuana at lower prices. Lower prices are further anticipated to boost the adoption of marijuana in the market. Thus, the marijuana industry is anticipated to grow after its imminent legalization.

In addition, there is a high demand for various CBD-infused products, such as cannabis oil, beauty products, gummies, beverages, capsules, etc. CBD can enter the human body through different means, including smoking, vaping, and through the skin. In the U.S. states where cannabis is legal, it is utilized to produce personal care products and medical drugs. Legalizing cannabis-based products has opened up significant opportunities for various end-use industries to expand their product offerings.

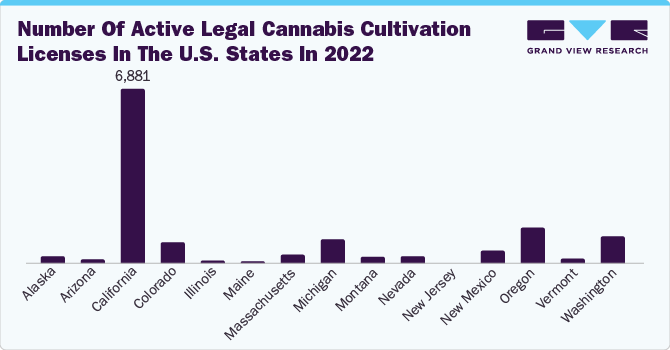

Other factors contributing to the growth include the favorable cultivation norms which help cater to the biomass demand in the U.S. Some major states such as Florida, Oregon, Nevada, California, Washington, and Colorado are the major producers of cannabis, owing to favorable climatic conditions and the legalization of medical marijuana. Furthermore, the increasing number of companies in cannabis businesses due to the ease with which wholesale procurement of cannabis can be carried out, and product development can be achieved is driving the market growth in the U.S.

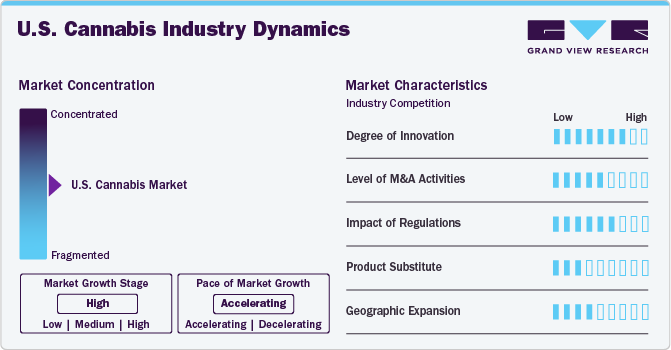

Market Concentration & Characteristics

The U.S. cannabis market is characterized by a high degree of innovation owing to the rising legalization of cannabis, rising demand for cannabis-infused products, and growing awareness among people regarding the medicinal benefits of cannabis, increasing R&D activities on the use of cannabis and its medicinal properties. For instance, The University of Utah launched the Center for Medical Cannabis Research (CMCR) in July 2023, aiming to provide essential research opportunities for cannabis use in Utah.

The market is characterized by a medium level of merger and acquisition (M&A) to shape the business landscape. Companies are seeking strategic partnerships and acquisitions to enhance presence and drive growth in the industry. For instance, in May 2022, Canopy Growth Corporation entered into a definitive agreement to acquire Lemurian, Inc., a producer of high-quality cannabis extracts, to broaden Canopy Growth’s portfolio of premium brands with significant opportunities to scale across North America.

This industry is positively impacted by the structured regulatory framework for the cultivation, consumption, and sale of cannabis. The regulatory authorities vary from state to state, which are as follows,

State

Regulatory Authority for Medical Cannabis

Washington

Washington State Department of Health

Montana

Department of Public Health and Human Services

North Dakota

Division of Medical Marijuana for patients and caregivers

Minnesota

Minnesota Department of Health--Division of Health Policy--Office of Medical Cannabis

Michigan

Bureau of Medical Marihuana Regulation (BMMR) housed in the Department of Licensing and Regulatory Affairs (LARA)

New York

Office of Cannabis Management for adult use and medical, with a Cannabis Control Board overseeing it. The Cannabis Control Board is currently creating regulations for the adult-use market.

Vermont

Cannabis Control Board

Some non-cannabis cannabinoids are considered to have similar health benefits as cannabis derivatives. The National Center for Complementary and Integrative Health offers information on various natural substances used to address symptoms and conditions similar to those treated with marijuana. These include Kava-kava, Valerian root, Ginger, Turmeric, black pepper, and Coneflower (Echinacea).

The potential for improved accessibility, cost-effectiveness, and outcomes propels the industry. Established industry leaders are venturing into emerging markets, and indigenous startups are experiencing growth. Several players are adopting geographical expansion strategies to strengthen their positions in the market. Charlotte's Web, a U.S.-based cannabis company, signed a distribution agreement with Energy Hemp Biotechnology Ltd. This agreement gave Energy Hemp exclusive distribution rights for the company's CBD products in Hong Kong, China.

Source Insights

The marijuana segment dominated the market with the highest revenue share of 87.0% in 2023. The demand for marijuana in the U.S. is expected to increase due to growing awareness about its therapeutic applications, such as appetite enhancement, pain management, and eye pressure reduction, further changing consumer behavior toward recreational marijuana. Customers are interested in marijuana-derived skincare products to help reduce inflammation on a cellular level, lower sebum production, suppress itches, and reduce redness. It also improves the skin's natural healing process and reduces the length of outbreaks, boosting the use of these products in the U.S.

Furthermore, according to the American Cancer Society, several small studies investigating smoked marijuana have indicated its potential efficacy in alleviating nausea and vomiting resulting from cancer chemotherapy. Early clinical trials exploring the use of CBD in cancer treatment have been conducted in humans, with further research studies continuing. Although these studies suggest that CBD may be safe for cancer treatment, they have not demonstrated its effectiveness in managing or curing the disease.

The hemp segment is anticipated to grow at a significant CAGR from 2024 to 2030. High nutritional value and beneficial fatty acid & protein profiles drive the demand for hemp products. Foods fortified with CBD derived from hemp cover an extensive range of products, including nutritional powders, supplements, protein & nutrition bars, beverages, breakfast cereals, dairy & dairy alternative products, bakery items & snacks, animal feed, and pet food. Improving lifestyle and increasing awareness regarding the health benefits of CBD are among the factors propelling the demand for CBD-infused food products. Hemp-derived CBD in pet foods is another emerging market. CBD has similar effects on pets as on humans. Hemp-based CBD oil is a source for pet food products due to its wide range of health benefits, such as reduced pain & inflammation, reduced seizures, and improved heart health.

Derivatives Insights

The CBD segment dominated the market with the largest revenue share of 64.7% in 2023. CBD is the non-psychoactive compound found in the cannabis plant, and its adoption is increasing for a wide range of health issues. The ongoing studies signify the potential benefits of CBD in certain health conditions. For instance, a study sponsored by the University of Colorado began in February 2022 to assess the efficacy of broad-spectrum & full-spectrum CBD for reducing opioid use, pain, & anxiety and improving cognitive function & sleep. This study is expected to be completed by February 2027. Thus, the rise in research activities on CBD boosts the segment growth.

The others segment held a significant market share in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. The other derivatives of the cannabis plant, such as terpenes, flavonoids, and other minor cannabinoids, have been considered in this segment. The growing popularity of minor cannabinoids and product launches is anticipated to propel the segment growth. For instance, in October 2023, Rubicon Organics Inc., a medical cannabis company, announced the launch of Wildflower brand edibles prepared with minor cannabinoids, such as CBG, CBN, and CBD.

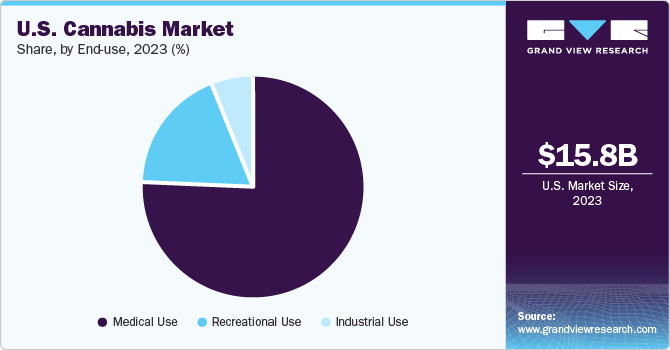

End-use Insights

The medical use segment dominated the market with a revenue share of 76.3% in 2023. The factors such as increasing acceptance of cannabis for the treatment of various chronic conditions such as diabetes, cancer, arthritis, depression and anxiety, and epilepsy, contributing to segment’s growth.

In addition, the approval of cannabis drugs for treating various conditions is driving the growth. For instance, Syndros and Marinol are the two specific drugs approved by the FDA to treat the side effects of chemotherapy, such as vomiting and nausea. Moreover, increased legalization of cannabis in U.S. states fuels the segment growth. For instance, as of April 2023, 38 U.S. states, the District of Columbia, and three territories have legalized cannabis for medical purposes.

The recreational use segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This segment mainly includes cannabis usage in smoking and its consumption in food & beverages. Furthermore, the legalization of cannabis for recreational purposes is fueling the growth of the segment. For instance, as of April 2023, 24 states, the District of Columbia, and two territories have legalized cannabis for recreational use.

Key U.S. Cannabis Company Insights

The rising demand for cannabis-infused food items and cosmetics is expected to drive the entry of new companies into the market, fueled by growing awareness and acceptance of cannabis for medical purposes. Key market players engage in strategic alliances such as mergers & acquisitions, collaborations, partnerships, and product launches with other industry participants to expand their market presence. For instance, in March 2023, Irwin Naturals, a provider of CBD products, introduced its new CBD 25mg Softgels in Canada under the Starseed Medicinal Medical Group platform, aiming to capture nationwide distribution. Such initiatives are projected to boost the market growth over the forecast period.

Key U.S. Cannabis Companies:

- Medical Marijuana, Inc.

- NuLeaf Naturals, LLC

- CV Sciences, Inc.

- CHARLOTTE’S WEB.

- The Cronos Group

- Organigram Holding, Inc

- Irwin Naturals

- Tilray Brands

- Canopy Growth Corporation

- Aurora Cannabis

Recent Developments

-

In April 2023, Charlotte's Web, a U.S.-based company, formed a joint venture with AJNA BioSciences PBC, a botanical drug development company, and British American Tobacco PLC. The acquisition aimed to obtain FDA approval for full spectrum hemp extract botanical drug.

-

In April 2023, CV Sciences, Inc. launched its +PlusCBD reserve collection of extra gummies. The reserve collection product line offers a blend of full-spectrum cannabinoids capable of providing relief when intense support is required.

-

In March 2023, CV Sciences, Inc. introduced its new offering, +PlusCBD Daily Balance THC-Free Softgels and Gummies. The product is an on-the-go supplement for daily use that provides CBD wellness benefits.

-

In September 2022,

NuLeaf Naturals, LLC, a provider of CBD and THC products, announced the launch of its new product line, CBD gummies. The products are accessible in a 3:1 ratio of full spectrum CBD & Cannabinol (CBN).

U.S. Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.60 billion

Revenue forecast in 2030

USD 40.10 billion

Growth rate

CAGR of 13.7% from 2024 to 2030

Actual data

2018 - 2022

Forecast data

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, end-use

Country scope

U.S.

Key companies profiled

Medical Marijuana, Inc.; NuLeaf Naturals, LLC; CV Sciences, Inc.; CHARLOTTE’S WEB.; The Cronos Group; Organigram Holding, Inc.; Irwin Naturals; Tilray Brands; Canopy Growth Corporation; Aurora Cannabis

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cannabis Market Report Segmentation

This report forecasts revenue growth and provides at country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. cannabis market report based on source, derivatives, and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp Oil

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post-Traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s Disease

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s Syndrome

-

Diabetes

-

Parkinson's Disease

-

Glaucoma

-

Others

-

-

Recreational Use

-

Frequently Asked Questions About This Report

b. The U.S. cannabis market size was estimated at USD 15.82 billion in 2023 and is expected to reach USD 18.60 billion in 2024.

b. The U.S. cannabis market is expected to grow at a compound annual growth rate of 13.7% from 2024 to 2030 to reach USD 40.10 billion by 2030.

b. The marijuana segment dominated the market with the highest revenue share of 87.0% in 2023. The demand for marijuana in the U.S. is expected to increase due to growing awareness about its therapeutic applications,

b. Some key players operating in the U.S. cannabis market include Medical Marijuana, Inc.; NuLeaf Naturals, LLC; CV Sciences, Inc.; CHARLOTTE’S WEB.; The Cronos Group; Organigram Holding, Inc.; Irwin Naturals; Tilray Brands; Canopy Growth Corporation; Aurora Cannabis

b. Growing acceptance of its use for medical purposes and rising legalization of cannabis are the key factors driving the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."