- Home

- »

- Homecare & Decor

- »

-

U.S. Carpet & Rug Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Carpet And Rug Market Size, Share & Trends Report]()

U.S. Carpet And Rug Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Tufted, Needle Punched, Knotted, Woven), By Material (Silk, Cotton, Wool, Polyester), By End Use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-625-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Carpet And Rug Market Size & Trends

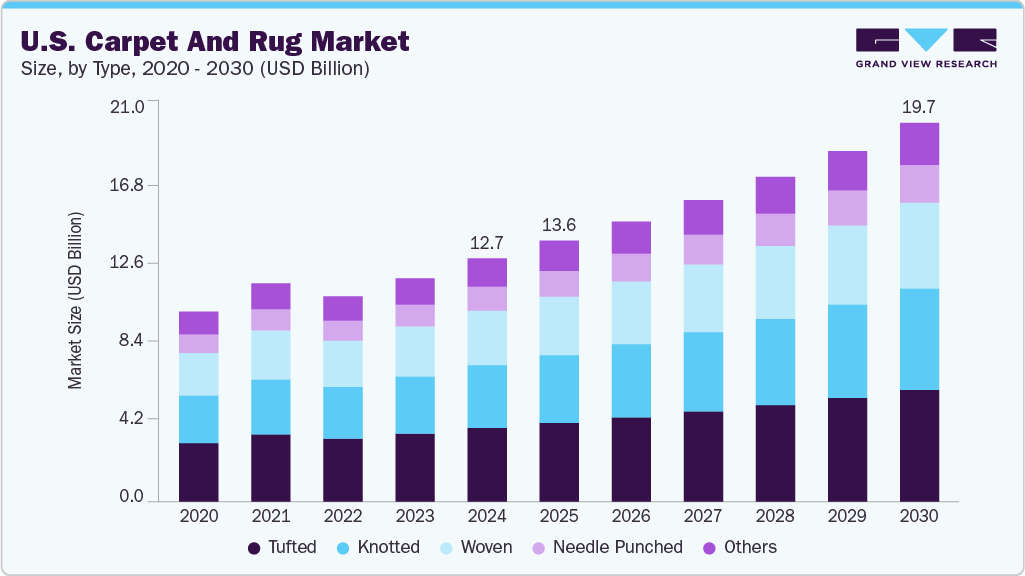

The U.S. carpet and rug market size was estimated at USD 12,663.3 million in 2024 and is expected to grow at a CAGR of 7.7% from 2025 to 2030. The U.S. carpet and rug market has witnessed substantial growth due to an increase in residential remodeling and home renovation. With more Americans spending time at home, especially in the wake of hybrid work models, home improvement has become a priority, including Carpet & Rug. According to the Joint Center for Housing Studies at Harvard, remodeling expenditures in the U.S. continue to grow, particularly among middle- and upper-income households.

The Harvard Joint Center for Housing Studies (JCHS) reports that annual spending on home remodeling surged from USD 404 billion in 2019 to USD 611 billion in 2022, and is projected to remain above USD 600 billion through 2025. In addition, average per-project homeowner spending rose to around USD 4,700 in 2023.

Carpet and rug are often replaced during flooring upgrades for comfort, sound insulation, and aesthetic enhancement. For example, Mohawk Industries, one of the leading U.S. flooring manufacturers, reported strong demand in its residential soft flooring segment, supported by increased remodeling activity. Eco-friendly carpet options are gaining traction in home renovation projects, contributing to broader U.S. carpet & rug industry growth. Add-on innovations, such as Airo Carpet by Mohawk Industries, which features simplified installation and aligns with remodeling convenience trends, serve as concrete examples of companies capitalizing on this boom.

A prominent trend shaping the U.S. carpet and rug market is the shift toward sustainable products made from recycled or biodegradable materials. Consumers are increasingly eco-conscious and seek home furnishings that align with their values. This has led to product innovations such as Interface’s “Carbon Neutral Floors” and Mohawk’s “EverStrand” carpets. Mohawk contributes with recycledPET “EverStrand” carpets and PVC‑free innovation efforts, aligning with growing consumer expectations for greener home décor.

By integrating carbon-negative materials in the CQuestBioX backing with advanced yarn technologies and specialized tufting techniques, Interface delivers carpet tiles that not only meet high standards of durability and design excellence but also contribute to a reduced environmental impact, offering a truly carbon-negative flooring solution. The company offers 38 cradle-to-gate carbon-negative products across 378 color options in the region.

In 2024, Shaw Industries also expanded its "EcoWorx" BIO PVC‑free carpet backing technology to more product lines, supporting recyclability at end-of-life, achieving Cradle‑to‑Cradle certification, and recyclability as part of a circular economy push. Commercial buyers aiming to meet LEED certification and corporate sustainability goals are also reinforcing this trend. Manufacturers are investing in circular economy models, reducing virgin raw material use while marketing these products to younger, environmentally aware consumers.

There are promising opportunities in the commercial and hospitality sectors, where carpets and rugs are essential for noise control, safety, and branding aesthetics. The shift toward hybrid work models has prompted office redesigns, with carpets playing a vital role in creating quieter and more inviting environments. Furthermore, increased investments in hotels, retail spaces, and senior living facilities are opening up avenues for durable, easy-to-clean carpet solutions that meet both functional and decorative needs.

The rise in demand for antimicrobial and stain-resistant carpets in healthcare and educational facilities also presents a key growth opportunity. Companies that prioritize performance, sustainability, and design versatility are well-positioned to capitalize on these emerging market segments.

Consumer Surveys & Insights

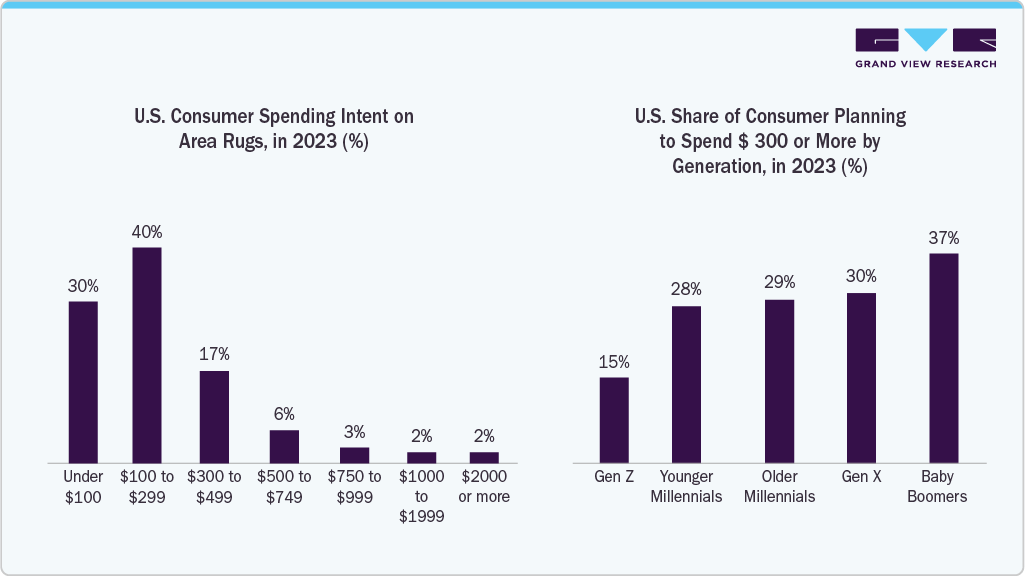

A 2023 survey conducted by the Consumer Intelligence for the Home Furnishings Industry revealed that nearly 29% of surveyed U.S. households planned to buy an area rug in the first half of 2023. Gen Z (up to age 26) showed the highest interest, with 34% indicating purchasing intent. Younger millennials (ages 27-34) and older millennials (35-42) followed closely at 29%, while baby boomers (ages 59-75) were slightly lower at 26%. This data underscores that younger consumers, particularly those in their 20s and 30s, are the most active demographic, signaling a strong opportunity for brands to tailor marketing and product designs to this age group.

In terms of budget, about 40% of consumers intend to purchase rugs within the USD100-USD299 price range, making it the most popular spending category. Around 30% are looking for options under USD100, while 17% plan to spend between USD300 and USD499. Interest in higher-end rugs drops notably, with just 13% considering purchases above USD500-6% of them targeting the USD500-USD749 range, and only 2% each planning to spend between USD1,000-USD1,999 or over USD2,000.

Furthermore, most consumers still favor purchasing area rugs in-store, with 58% preferring brick-and-mortar locations compared to 42% who opt for online shopping. However, traditional home furnishings retailers, regardless of size, are up against strong competition from major chains like Walmart, Lowe’s, and Costco, which are among the top physical retail choices.

In Addition, Amazon is the leading online alternative. Online shopping is especially popular among older millennials and apartment dwellers, while other age groups continue to lean toward in-person purchases. Additional preferred retailers include national furniture chains (16%), Wayfair (11%), local or regional furniture stores (8%), and local designers (3%).

Type Insights

The tufted carpet & rug accounted for a revenue share of 30.32% of the overall U.S. carpet & rug market in 2024. The growth is due to its efficient manufacturing process, which supports high-volume production and cost-effectiveness, making it the go-to option for residential and commercial spaces. Tufted carpets are created by inserting yarn into a backing material, allowing for faster production compared to woven or knotted alternatives. This method enables greater design flexibility and accommodates trends such as textured finishes and multi-tone patterns.

In addition, tufted carpets are often paired with stain-resistant treatments and synthetic fibers such as nylon or polyester, further enhancing their appeal for high-traffic areas. The segment continues to benefit from demand in fast-paced construction projects and multi-family housing developments where affordability, performance, and speed of installation are crucial.

The knotted carpet & rug segment is expected to grow at a CAGR of 8.5% from 2025 to 2030. The growth of the knotted carpet and rug segment is fueled by increasing consumer interest in artisanal, heritage-driven home décor. Knotted rugs, often hand-crafted using traditional techniques, are valued for their intricate patterns, craftsmanship, and long-lasting quality. This segment appeals to luxury buyers and consumers seeking authenticity and cultural richness in interior design.

As sustainability and slow design gain popularity, hand-knotted rugs made from natural materials such as wool or silk are becoming favored choices. Brands such as Jaipur Living and Tufenkian Artisan Carpets offer collections that highlight traditional knotting techniques from regions such as India, Nepal, and Turkey. These rugs are not only functional but also regarded as collectible pieces, often passed down across generations. The rising preference for eco-conscious, artisanal products in the premium U.S. carpet & rug industry continues to drive the demand for knotted carpets, especially among interior designers and high-end retailers.

Material Insights

Polyester carpets & rugs held a share of 30.22% of the U.S. carpet & rug market in 2024 driven by their affordability and stain-resistant properties, making them a popular choice for budget-conscious consumers and families with kids or pets. Polyester fibers, particularly those made from recycled PET bottles, also appeal to eco-aware buyers, helping brands align with sustainability goals. A growing trend in this segment is the focus on soft texture and vibrant colors, made possible by advanced dyeing techniques that allow polyester to hold color exceptionally well.

For example, Mohawk Industries has expanded its EverStrand collection, a popular line of carpets made from 100% recycled polyester, combining value with environmental responsibility. These carpets often target residential markets, especially rental properties and starter homes, where cost and ease of maintenance are critical factors.

Wool carpet & rug is expected to grow at a CAGR of 8.6% from 2025 to 2030. Wool carpets and rugs are driven by consumer demand for natural, durable, and luxurious materials. Wool is naturally hypoallergenic, biodegradable, and fire-resistant, making it attractive to premium buyers looking for long-lasting flooring solutions. A prominent trend in this space is the rise in artisanal and handcrafted wool rugs, often featuring traditional techniques and heritage patterns.

High-end brands like Nourison and Stanton are introducing wool collections that combine classic textures with modern aesthetics, appealing to upscale homeowners and designers. The U.S. carpet & rug industry is also seeing increased interest in undyed or minimally processed wool, reflecting broader trends in clean living and eco-conscious interiors.

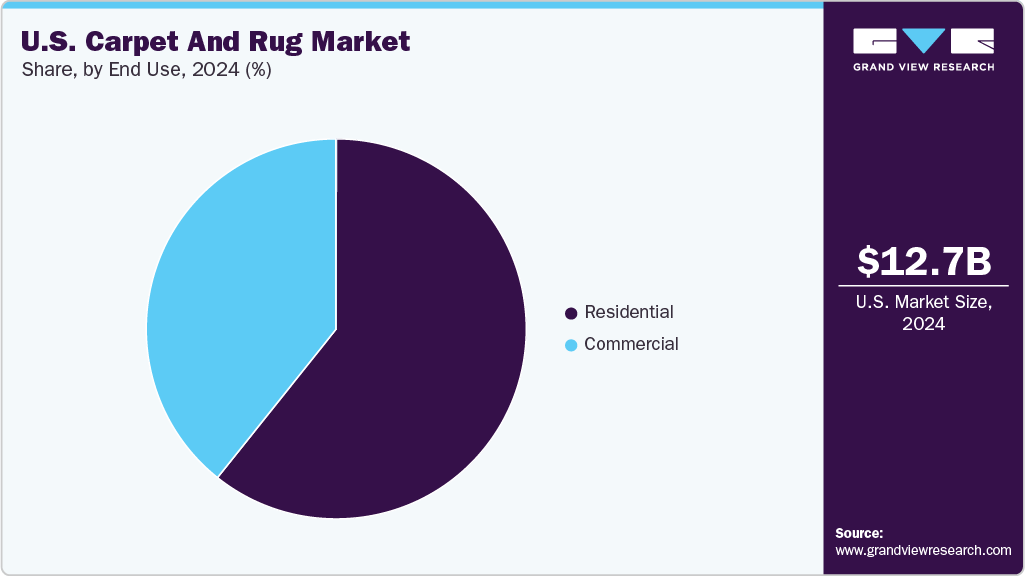

End Use Insights

Carpet & rug used at residential properties accounted for a revenue share of 60.72% of the overall U.S. carpet & rug industry in 2024 driven by the growing preference for comfort and warmth in home interiors. Homeowners are increasingly choosing soft flooring options like carpets and area rugs to create cozy, sound-insulated, and child-friendly spaces, especially in bedrooms and living areas. The rise in single-family housing construction and home renovation projects further supports this trend. Aesthetics and customization also play a major role; consumers are opting for bold patterns, layered textures, and sustainable fibers that complement modern décor.

For example, Rugs USA’s “Custom by Rugs USA” program caters to personalized sizing and design preferences, reflecting this demand. Additionally, pet-friendly and stain-resistant technologies, like Shaw Floors’ Pet Perfect+, are seeing strong traction among families with pets, combining style with function.

U.S. carpet & rug used at commercial properties is expected to grow at a CAGR of 8.0% from 2025 to 2030. In the commercial sector, sustainability and performance are shaping the carpet and rug landscape. Offices, hospitality venues, and public buildings are increasingly investing in modular carpet tiles and low-maintenance rugs with a focus on durability, acoustic control, and eco-friendly materials.

For instance, Interface’s CQuesBioX-backed products, which are cradle-to-gate carbon negative, align with corporate sustainability goals. Design flexibility is another trend, commercial buyers now favor carpet tiles that support branding or zoning through color, texture, or biophilic design. Moreover, the post-pandemic return-to-office wave has driven demand for flooring that supports wellness and hybrid work layouts, such as those seen in collaborative lounges and flexible workstations.

Key U.S. Carpet And Rug Company Insights

The U.S. carpet and rug market is highly competitive, characterized by a blend of established industry giants and emerging innovators. Dominant players such as Mohawk Industries and Shaw Industries Group, among others, lead the U.S. carpet & rug industry. These companies leverage strategies like mergers and acquisitions, product diversification, and expansion into sustainable offerings to maintain their competitive edge.

In addition, companies such as Interface and Tarkett are focusing on sustainability, with initiatives such as carbon-neutral flooring and the use of recycled materials, aligning with the growing consumer demand for eco-friendly products. The U.S. carpet & rug market also sees the rise of direct-to-consumer brands that capitalize on e-commerce platforms and customization options to cater to evolving consumer preferences. This dynamic landscape reflects a continuous push towards innovation, sustainability, and responsiveness to consumer trends, ensuring that the U.S. carpet and rug market remains vibrant and competitive.

-

Shaw Industries is one of the largest flooring manufacturers in the world, operating as a subsidiary of Berkshire Hathaway. The company offers a wide range of products including carpet, hardwood, laminate, resilient, and tile flooring for residential and commercial use. Headquartered in Dalton, Georgia, Shaw operates manufacturing facilities across the U.S. and globally. Its focus on innovation, sustainability, and customer service has positioned it as a leader in the flooring industry. Shaw also invests in cradle-to-cradle certified products and circular design initiatives.

-

Mohawk Industries is a global flooring company known for its comprehensive product portfolio including carpet, rugs, ceramic tile, laminate, hardwood, and luxury vinyl flooring. Based in Calhoun, Georgia, Mohawk operates manufacturing facilities in North America, Europe, and Asia. The company markets its products under well-known brands such as Mohawk, Karastan, and Pergo. Mohawk emphasizes innovation, durability, and eco-friendly practices in product development. It serves both residential and commercial markets worldwide.

Key U.S. Carpet And Rug Companies:

- Shaw Industries Group, Inc.

- Mohawk Industries, Inc.

- Interface, Inc.

- Engineered Floors, LLC

- Milliken & Company (Flooring Division)

- Tarkett North America

- J+J Flooring Group (Division of Engineered Floors)

- The Dixie Group, Inc.

- Nourison

- Stanton Carpet Corporation

Recent Developments

-

In February 2025, Shaw Floors launched the Pet Perfect+ lineup with six additional patterns, all incorporating the new LifeGuard Spill-Proof backing technology. This addition combines ANSO High-Performance fibers with R2X stain‑and‑soil protection and ColorGuard for enhanced cleanliness and durability.

-

In February 2024, Rugs USA unveiled its Custom by Rugs USA program-a collaboration with Shaw Industries-that allows consumers to order personalized, made-to-measure rugs tailored to unique spaces. It combines the brand’s established quality with flexible sizing options designed for varied room configurations. The initiative delivers high-end, custom-sized floor coverings that blend convenience, design flexibility, and craftsmanship.

-

In September 2023, Interface launched several new flooring collections and broadened its product portfolio with the inclusion of its proprietary carbon-negative backing technology. These innovations enable customers to achieve both performance and design objectives while significantly reducing their carbon footprint.

-

Modern Trio: Interface introduces Modern Trio, a carpet tile collection inspired by the elegance of the Arts & Crafts and Art Nouveau movements. Featuring a dynamic interplay of dots, lines, and colors, the collection offers three complementary styles that can be used independently or together to create seamless transitions and visually striking floor designs. Available across America.

-

Upon Common Ground: Upon Common Ground is a biophilic carpet tile collection developed in collaboration with Australia’s First Nations communities. It features five design themes inspired by diverse natural environments, Desert, Saltwater, Rainforest, Freshwater, and Spinifex, each represented through region-specific colorways. This collection exemplifies Interface’s dedication to cultural partnership, sustainable design, and environmental storytelling. It is offered in Australia and EMEA regions.

U.S. Carpet And Rug Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 13,576.3 million

Revenue forecast in 2030

USD 19,718.0 million

Growth rate (Revenue)

CAGR of 7.7% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, end use

Key companies profiled

Shaw Industries Group, Inc.; Mohawk Industries, Inc.; Interface, Inc.; Engineered Floors, LLC; Milliken & Company (Flooring Division); Tarkett North America; J+J Flooring Group (Division of Engineered Floors); The Dixie Group, Inc.; Nourison; Stanton Carpet Corporation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Carpet And Rug Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. carpet and rug market based on type, material, and end use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tufted

-

Needle Punched

-

Knotted

-

Woven

-

Others (Knitted, Needle felt, Hooked, Braided, etc.)

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silk

-

Cotton

-

Wool

-

Polyester

-

Others (Triexta, Acrylic, Polypropylene, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. carpet & rug market was estimated at USD 12,663.3 million in 2024 and is expected to reach USD 13,576.3 million in 2025.

b. The U.S. carpet & rug market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 19,718.0 million by 2033.

b. Polyester held the largest market share in 2024, with a share of about 30.22%, driven by their affordability and stain-resistant properties, making them a popular choice for budget-conscious consumers and families with kids or pets.

b. Key players in the U.S. carpet & rug market are Shaw Industries Group, Inc.; Mohawk Industries, Inc.; Interface, Inc.; Engineered Floors, LLC; Milliken & Company (Flooring Division); Tarkett North America; J+J Flooring Group (Division of Engineered Floors); The Dixie Group, Inc.; Nourison; and Stanton Carpet Corporation.

b. Key factors that are driving the U.S. carpet & rug market growth include an increase in residential remodeling and home renovation, shift toward sustainable products made from recycled or biodegradable materials, shift toward hybrid work models and office redesigns, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.