- Home

- »

- Consumer F&B

- »

-

U.S. Catering Services Market Size & Share Report, 2030GVR Report cover

![U.S. Catering Services Market Size, Share & Trends Report]()

U.S. Catering Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Workplace/ Office Catering, Event Catering), And Segment Forecasts

- Report ID: GVR-4-68040-137-3

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Catering Services Market Size & Trends

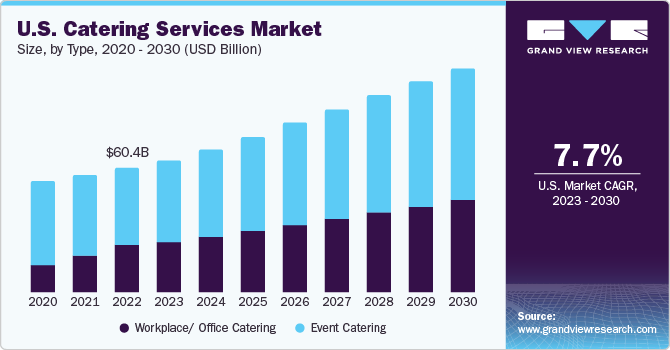

The U.S. catering services market size was estimated at USD 60.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The catering service industry in the U.S. is witnessing growth owing to the resurgence of corporate events. According to the 2022 International Caterers Association (ICA) industry survey, 48% of caterers reported corporate events, such as full-service and staffed events, as their largest area of growth. However, weddings also contributed significantly to sales growth for 35% of caterers and remained the largest source of revenue for catering companies in 2022.

The business catering segment is emerging as a significant driver of the U.S. catering service industry. Several factors contribute to this growth, including changes in workplace dynamics, the demand for office meals to boost productivity, and the need for food at corporate gatherings and training sessions. The rise of the gig economy and the adoption of more flexible work arrangements have compelled employers to adopt methods such as providing food as an incentive to retain talent.

According to a February 2023 ConnectedEconomy Monthly Report: The Evolving Digital Daily Edition, surveying 4,000 U.S. consumers, highlights a decline in the percentage of consumers working remotely daily, dropping from 26% in 2022 to 23% in 2023, despite the rise in digital activities. This shift suggests a return to in-office work arrangements, potentially driving the demand for corporate catering services as employees return to the workplace.

Partnerships, such as Olo's collaboration with DeliverThat in 2023, have emerged to enable catering options for customers. Fast-casual brands like Sweetgreen have launched catering programs, while companies like DoorDash and Instacart have upgraded their corporate catering services. Catering for employees is increasingly viewed as a retention and business development tool, encouraging in-office work and attracting external clients. As employees return to the office, the growing demand for corporate meal solutions is projected to drive the demand for catering services in the U.S.

The growing demand for unique culinary experiences significantly drives the U.S. catering services market. As consumers increasingly seek memorable and personalized events, catering services are adapting to offer distinct themes, innovative menus, and immersive dining experiences. One notable example includes the introduction of Giada Catering, an Italian-inspired catering service across Southern California, in February 2023.

Many companies are recognizing the potential of the corporate catering service market and are making strategic entries into this sector. Examples include major brands such as Subway, KFC, and Chick-fil-A, as well as retail giants like Costco, Walmart, and Target. These diverse brands are leveraging their existing strengths to tap into the growing demand for catering services, highlighting the opportunities within the corporate catering services market in the U.S. However, established caterers need to adhere to strict regulations and safety standards to ensure food quality and safe service for larger events. Apart from this, home cooks selling food introduce variables in quality control and consistency, potentially impacting the reputation of the broader industry.

Type Insights

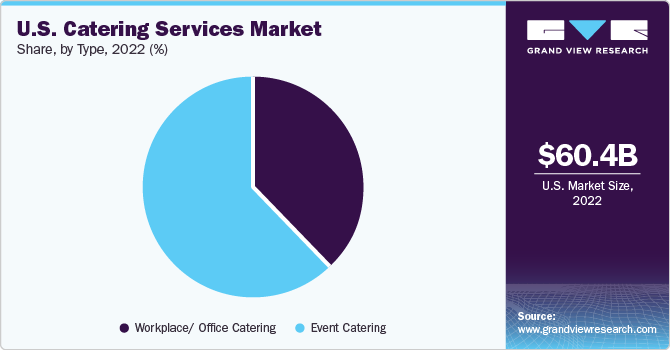

In terms of revenue, the event catering segment led the market and accounted for a revenue share of 61.74% in 2022. The U.S. is home to many annual public events that emphasize the need for these services in the state. A few of the common annual events include the Coachella Valley Music and Arts Festival, San Diego Comic-Con International, California State Fair, Monterey Jazz Festival, San Francisco's Golden Gate Park, the Outside Lands Music and Arts Festival, Rose Parade and Rose Bowl Game, and Palm Springs International Film Festival. These events create a demand for light snacks and other refreshments, contributing to the event's appeal and aiding organizers in maintaining attendee engagement.

The workplace/ office catering segment is anticipated to grow at a CAGR of 8.8% from 2023 to 2030. The surge in new corporate offices and employment opportunities within office environments is fueling the demand for catering services in California. In February 2023, Tesla unveiled its new engineering headquarters in California. Likewise, in May 2023, Amazon revealed plans to expand its Tech Hubs in Southern California, creating around 2,500 new jobs in areas such as San Diego, Irvine, and Santa Monica.

Key Companies & Market Share Insights

The U.S. catering services market includes both international and regional participants. Key market players are focusing on service innovation to enhance their portfolios.

-

In April 2023, Global Gourmet Catering provided catering services for a wedding held at San Francisco City Hall's rotunda, with the grand staircase serving as a picturesque backdrop. Global Gourmet Catering crafted a menu that drew inspiration from Filipino, Asian, and Hawaiian culinary traditions, a nod to the bride's heritage and her time living in Honolulu. Guests enjoyed offerings such as glazed pork belly lettuce wraps and miniature Thai tombo tuna tacos. The specialty cocktail, the Calamansi Margarita, featured fresh juice extracted from the Filipino citrus fruit.

-

In March 2022, Paula LeDuc, the founder of Paula LeDuc Fine Catering & Events, officially retired and passed the reins of the company to a group of seasoned executives. This experienced team will continue to manage the brand under a fresh corporate entity.

Some prominent players in the U.S. catering services market include:

-

Bi-Rite Catering

-

Paula LeDuc Fine Catering & Events

-

The Party Helpers

-

Ann Walker Catering, Inc (AWC)

-

Corporate Caterers

-

Elegante Catering

-

Grace Street Catering

-

Catered Too

-

Global Gourmet Catering

-

La Bonne Cuisine Catering and Events

-

Hugh Groman Catering

-

ANOUSH CATERING

U.S. Catering Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 109.4 billion

Growth rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Bi-Rite Catering; Paula LeDuc Fine Catering & Events; The Party Helpers; Ann Walker Catering, Inc (AWC); Corporate Caterers; Elegante Catering; Grace Street Catering; Catered Too; Global Gourmet Catering; La Bonne Cuisine Catering and Events; Hugh Groman Catering; ANOUSH CATERING

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Catering Services Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. catering services market based on type:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Workplace/ Office Catering

-

Breakfast

-

Lunch

-

Snacks

-

Dinner

-

-

Event Catering

-

Weddings

-

Corporate Events

-

Social Events

-

Cultural Events

-

Sports Events

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. catering services market was estimated at USD 60.40 billion in 2022 and is expected to reach USD 64.57 billion in 2023.

b. The U.S. catering services market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 109.4 billion by 2030.

b. The event catering segment led the market and accounted for a 61.74% share of the revenue in 2022. The frequent occurrence of major events such as Coachella Valley Music and Arts Festival, San Diego Comic-Con International, California State Fair, etc. creates a high demand for light snacks and other refreshments, contributing to the event's appeal and aiding organizers in maintaining attendee engagement.

b. Some key players operating in the U.S. catering services market include Bi-Rite Catering, Paula LeDuc Fine Catering & Events, The Party Helpers, Ann Walker Catering, Inc (AWC), Corporate Caterers, Elegante Catering, Grace Street Catering, Catered Too, Global Gourmet Catering, La Bonne Cuisine Catering and Events, Hugh Groman Catering, and ANOUSH CATERING.

b. Key factors that are driving the U.S. catering services market growth include the growing demand for corporate meal solutions, the growing demand for unique culinary experiences, and the resurgence of corporate events.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.