- Home

- »

- Electronic & Electrical

- »

-

U.S. Combi Oven Market Size & Share, Industry Report 2033GVR Report cover

![U.S. Combi Oven Market Size, Share & Trends Report]()

U.S. Combi Oven Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Electrical, Gas), By Power Rating (Low, Medium, High), By Application (Restaurants/QSRs, Hotels & Hospitality), And Segment Forecasts

- Report ID: GVR-4-68040-768-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Combi Oven Market Size & Trends

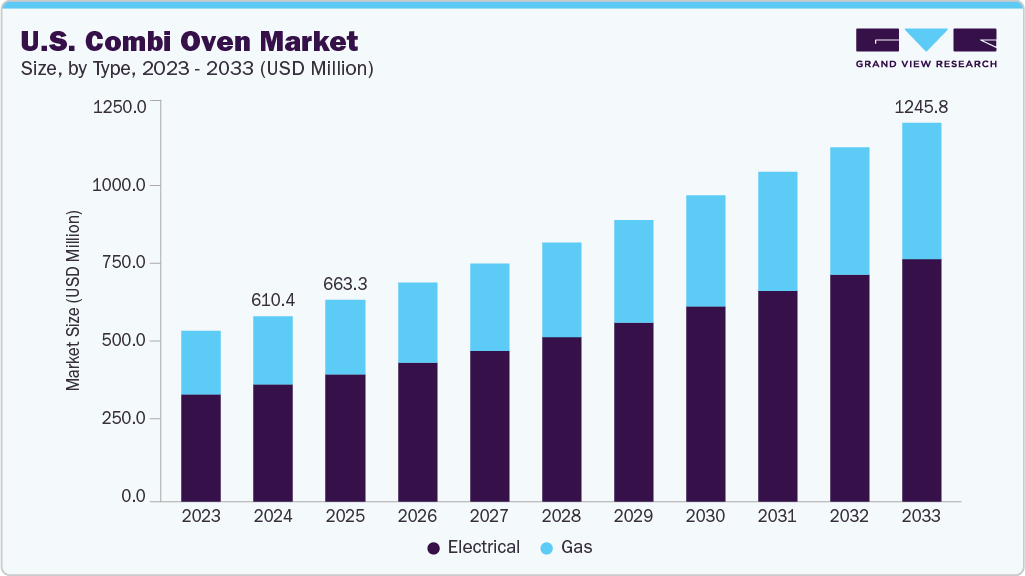

The U.S. combi oven market size was estimated at USD 610.4 million in 2024 and is projected to reach USD 1,245.8 million by 2033, growing at a CAGR of 8.2% from 2025 to 2033. The market is experiencing strong growth in 2025, primarily due to a surge in demand for versatile, energy-efficient, and technologically advanced cooking solutions within the commercial foodservice industry. The multifaceted cooking capabilities of combi ovens, which blend convection, steam, and hybrid cooking methods, make them highly attractive for restaurants, hotels, catering services, and institutional kitchens where high throughput, consistency, and operational flexibility are paramount.

A major factor fueling market expansion is the rapid rise of quick-service restaurants (QSRs), ghost kitchens, and meal-preparation companies that require compact, high-performance, and space-saving kitchen equipment. These businesses benefit from combi ovens' ability to efficiently handle varied menu items and ensure rapid turnaround, which is crucial in high-traffic, fast-paced environments. In addition, the popularity of cloud kitchens and the overall trend towards delivery-focused food businesses continue to drive the adoption of combi ovens.

Technological innovation is another key driver of growth. Manufacturers are integrating advanced features, including digital touchscreens, AI-assisted cooking, programmable cycles, self-cleaning systems, and remote monitoring. These innovations enhance ease of use, facilitate labor-saving automation, and help mitigate the skills gap resulting from shortages of trained kitchen staff. Integrating IoT and AI capabilities enhances consistency, reduces food waste, and contributes to sustainable kitchen operations.

Sustainability concerns and regulatory changes are also accelerating adoption. The U.S. regulations increasingly promote energy-efficient appliances and sustainable cooking practices within the hospitality sector. Combi ovens-by virtue of lower energy and water consumption and improved food quality through precise moisture and heat management-help operators align with these mandates while reducing operational costs.

The sector's focus on operational efficiency and food safety further contributes to its growth. Automated cleaning, programmable cooking cycles, and consistent performance allow food service operators to comply more easily with hygiene regulations and quality standards. The ability to cook diverse foods simultaneously without flavor transfer improves kitchen productivity and customer satisfaction in commercial settings.

Competitive pressures and growing investment in food service technology are influencing more establishments to upgrade from traditional ovens to smart, multifunctional combi ovens. As manufacturers tailor their offerings to be more intuitive and cost-effective-in response to rising labor costs and the ongoing kitchen skills shortage-the U.S. market is set for sustained double-digit growth throughout the next decade.

Key challenges confronting the U.S. market include high initial investment costs, technical complexity, and the need for skilled labor. Advanced combi ovens require substantial capital expenditures for purchase and installation, often exceeding the budgets of small and medium-sized food service operators. Moreover, integrating these ovens into existing infrastructure may necessitate costly kitchen layouts and utility connections.

Maintenance requirements and repair costs present another challenge to market expansion. Due to their sophisticated technology, combi ovens need regular servicing by trained professionals, which adds ongoing expenses for operators. If not adequately maintained, these ovens face reliability concerns, deterring smaller businesses with limited resources from investing.

Type Insights

The sale of electric combi ovens in the U.S. exceeded USD 380 million in 2024, driven by a strong emphasis on energy efficiency, precise temperature control, and compliance with sustainability mandates. The adoption rate is accelerating due to government regulations, such as zero-emission kitchen legislation in states like California, widespread decarbonization initiatives, and the increasing integration of IoT for remote monitoring and enterprise ESG reporting. Electric models also benefit from easier installation, reduced insurance premiums, and compatibility with urban locations where access to natural gas is limited or discouraged. Advancements in electric heating elements now deliver fast heat-up times that rival traditional gas, addressing productivity concerns and lowering operational costs for high-throughput kitchens.

The growth of electric combi ovens is closely linked to rising demand for sustainable and energy-saving appliances, regulatory mandates favoring electrification, and increasing chef acceptance of digital kitchen technology. Restaurant chains, QSRs, and institutional facilities increasingly prioritize electric models for easier maintenance, enhanced safety, and seamless integration into bright, automated kitchens. Moreover, retrofit kits and building electrification grants are making the switch from older gas systems more accessible, further accelerating market expansion.

Gas combi ovens remain relevant in select regions and operational environments, particularly where gas infrastructure is prevalent and energy costs are favorable for gas. These ovens appeal to commercial kitchens prioritizing rapid heat generation and menu styles requiring intense open-flame browning. Gas ovens can provide a cost advantage in areas without strict carbon pricing and still serve legacy operations where retrofits to electric systems may not be feasible or cost-effective. Despite a smaller share in new installations, their robust performance under high demand can be attractive for specific culinary applications.

Gas combi ovens continue to grow in niche markets where infrastructure, lower energy costs, or specific menu needs drive demand. While new commercial kitchen designs increasingly feature electric ovens, gas models remain a choice for establishments that require high-temperature cooking, have existing gas hookups, or operate in regions with less emphasis on carbon reduction policies. However, their share gradually shrinks as electricity grids move toward renewables and regulatory pressures mount.

Application Insights

The restaurant sector is the most prominent application for combi ovens and is expected to grow at a CAGR of 8.4% from 2025 to 2033. Growth in this segment is driven by a surge in quick-service restaurants, fast-casual outlets, and ghost kitchens that require fast, consistent, and high-quality cooking with minimal labor requirements. Combi ovens help QSRs deliver a varied menu efficiently, allow rapid menu switching, and support high throughput during peak hours. Automation, energy savings, and the need to maximize kitchen space further support the adoption of combi ovens, making them crucial in delivery-focused kitchens and urban restaurants where operational efficiency and cost control are vital.

Hotels and hospitality venues increasingly adopt combi ovens to handle diverse and large-scale meal preparations, particularly for buffets, banquets, and room service. Their ability to ensure food consistency and quality across high-volume servings is a significant growth driver. Integrating innovative technologies and energy-efficient features helps meet the rising expectations for sustainability and premium service among hotel guests. At the same time, automation reduces reliance on specialized culinary staff and enhances consistency in food production.

Bakeries turn to combi ovens for their versatility-efficiently baking, steaming, and roasting a range of products with precise control over moisture and temperature. The trend toward automation in bakery operations, combined with a growing demand for artisanal and specialty baked goods, further contributes to growth. Key drivers in this category include the push for consistent results, the capacity to handle artisanal trends, and the need for energy-efficient, space-saving kitchen appliances in retail and wholesale bakeries.

Institutional kitchens, such as those in hospitals, schools, and corporate cafeterias, utilize combi ovens to efficiently prepare large meals that meet strict dietary, safety, and timing requirements. The primary growth factors are the demand for high-volume batch cooking, reliability, food safety compliance, and the ability to offer diverse menus catering to various dietary needs. Automation and programmable settings help reduce labor costs, ensure food safety standards, and boost kitchen productivity, making combi ovens an optimal solution for institutions requiring streamlined service and operational control.

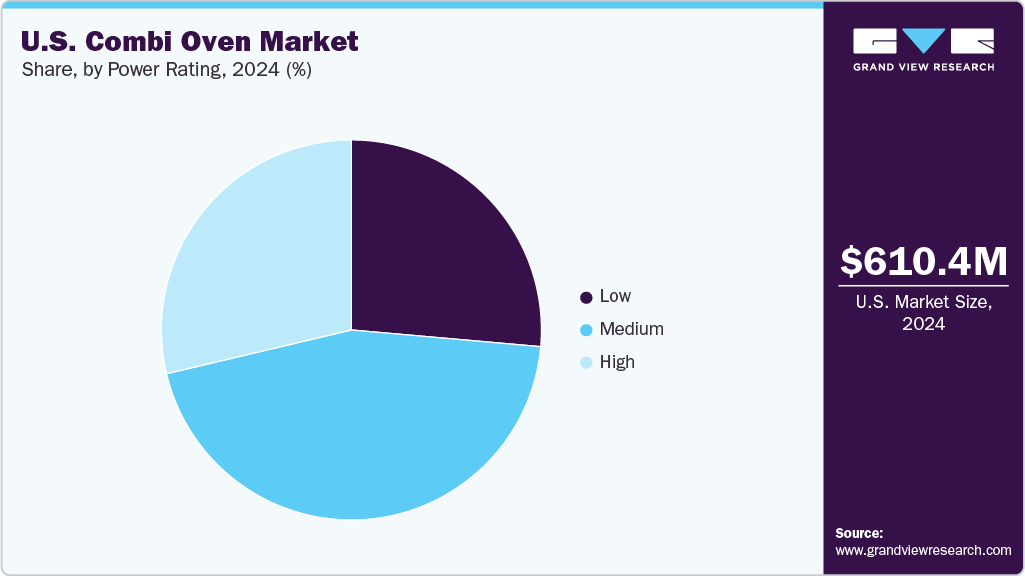

Power Rating Insights

Medium-power rating combi ovens are expected to dominate the market with a projected market share of over 45% in 2024. These ovens appeal to mid-sized restaurants, hotels, and institutional kitchens, as they balance capacity and efficiency, typically serving operations that prepare 60-400 meals per day. Their multi-tray capacity and versatility support various cooking applications-baking, roasting, and steaming-allowing larger foodservice establishments to streamline operations and optimize output without incurring excessive energy expenses.

Low-power rating ovens are an essential category for the household segment. Their growth is driven by demand from small to mid-sized restaurants, cafés, and quick-service outlets prioritizing energy efficiency, compact design, and cost-effectiveness. These ovens meet essential cooking requirements without the high energy draw, making them ideal for businesses with space or utility limitations and those seeking to reduce energy costs. Foodservice operators increasingly opt for these models due to regulatory pushes for energy efficiency and sustainability.

High-power-rated combi ovens represent a smaller market share and are critical in large-scale commercial and industrial kitchens, including institutional foodservice, catering operations, and high-traffic restaurants. Their principal growth driver is the need for continuous, large-batch cooking and operational efficiency during peak demand. Although their upfront and operational costs are higher, they are favored by operations where high throughput and speed are crucial, such as banquet services and large canteens. As catering volumes and centralized kitchens expand, this segment is expected to see steady demand, particularly in metropolitan and institutional settings.

Key U.S. Combi Oven Company Insights

The U.S. market is highly competitive and fragmented, dominated by a few leading global and regional manufacturers known for innovation, quality, and energy-efficient technologies. Manufacturers focus on continuous innovation, incorporating smart features like programmable cooking cycles, touchscreen interfaces, remote monitoring, and AI integration for precision and labor efficiency. There's an emphasis on energy efficiency, water saving, and self-cleaning technology to meet rising sustainability regulations and reduce operational costs for foodservice operators.

Key U.S. Combi Oven Companies:

- Rational USA

- Alto-Shaam

- Convotherm

- Blodgett

- Henny Penny

- Vulcan

- Southbend

- The Middleby Corporation

- Lainox

- Electrolux Professional

- Moffat

- BKI

- Garland

- Fagor Industrial

- Koma Foodservice Equipment

U.S. Combi Oven Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 663.3 million

Revenue forecast in 2033

USD 1,245.8 million

Growth rate (revenue)

CAGR of 8.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power rating, application

Country scope

U.S.

Key companies profiled

Rational USA; Alto-Shaam; Convotherm; Blodgett; Henny Penny; Vulcan; Southbend; The Middleby Corporation; Lainox; Electrolux Professional; Moffat; BKI; Garland; Fagor Industrial; Koma Foodservice Equipment

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Combi Oven Market Report Segmentation

This report forecasts revenue growth country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. Grand View Research has segmented the U.S. combi oven market report by type, power rating, and application:

-

Power Rating Outlook (Revenue, USD Million, 2021 - 2033)

-

Low

-

Medium

-

High

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Restaurants/QSRs

-

Hotels & Hospitality

-

Bakery

-

Institutional Kitchen

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.