- Home

- »

- Medical Devices

- »

-

U.S. Compression Tape Market Size, Industry Report, 2033GVR Report cover

![U.S. Compression Tape Market Size, Share & Trends Report]()

U.S. Compression Tape Market (2026 - 2033) Size, Share & Trends Analysis Report By Indication (Sports Injuries, Post-operative Edema, Lymphedema), By Compression Class (Class 1, Class 2), And Segment Forecasts

- Report ID: GVR-4-68040-831-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Compression Tape Market Summary

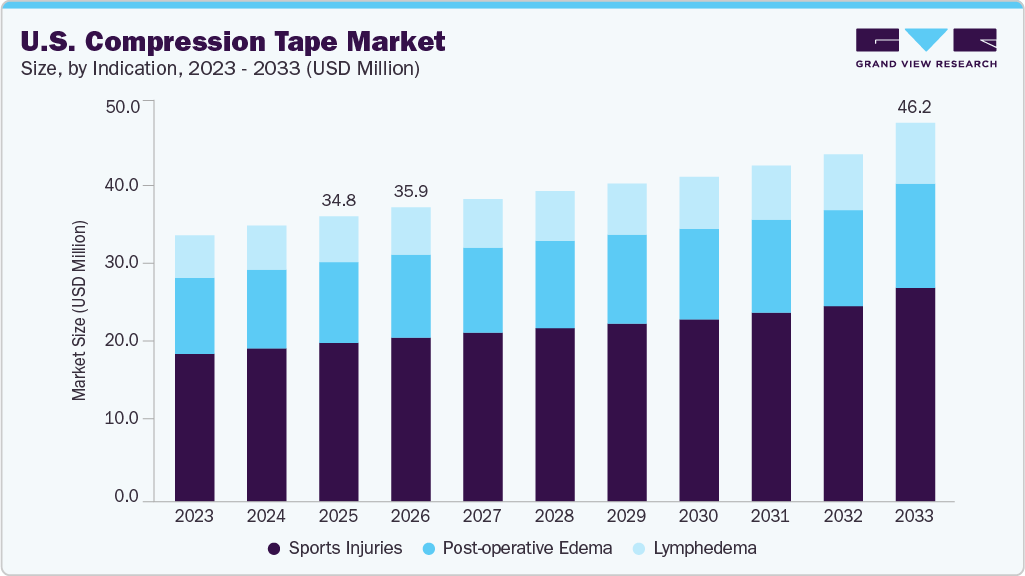

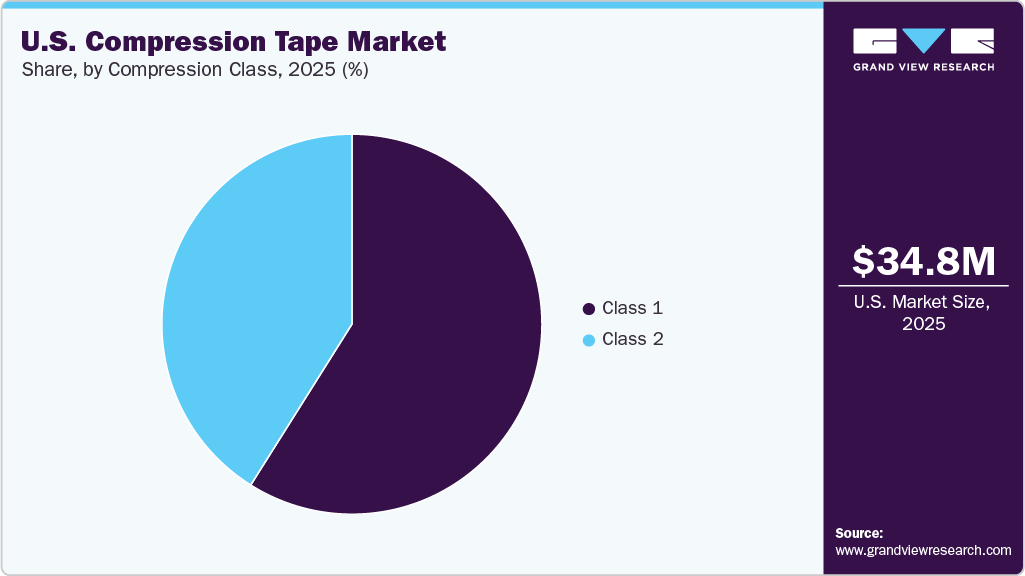

The U.S. compression tape market size was estimated at USD 34.79 million in 2025 and is expected to reach USD 46.18 million by 2033, growing at a CAGR of 3.68% from 2026 to 2033. The market is expanding as healthcare providers increase the use of compression solutions for injury management, post-operative care, and swelling control. Growing participation in sports and fitness is driving higher demand for preventive and recovery-focused taping. Hospitals, outpatient centers, and home-care settings are adopting compression products to support faster mobilization and reduce secondary complications. Broader access through retail and e-commerce channels is further supporting volume growth across user groups.

The U.S. compression tape market continues to expand, driven by growing use of adhesive and wrap-style products for localized compression. Demand is supported by rising incidence of venous and lymphatic conditions such as chronic venous insufficiency, deep-vein thrombosis, post-thrombotic syndromes, and lymphedema. Increasing surgical volumes, obesity, and inactive lifestyles further contribute to utilization, with compression tapes used across hospital, outpatient, and home-care settings for swelling management, stabilization, and post-procedure support.

Table 1: U.S. Healthcare & Disease Burden Indicators Supporting Compression Tape Demand (2024-2025)

Indicator & Source

Key Statistic / Fact

Hospital inpatient surgeries in U.S. - Centers for Disease Control and Prevention (CDC) “Inpatient Surgery, FastStats”

51.4 million inpatient surgeries performed annually in the U.S. (CDC)

Annual incidence of venous thromboembolism (VTE) - CDC data

Up to 900,000 Americans per year are affected by VTE (DVT or PE). (CDC)

Prevalence of major chronic diseases - CDC (2024 chronic disease summary)

~129 million U.S. adults have at least one major chronic disease (e.g. cardiovascular, diabetic conditions) that may raise risk of circulatory/venous complications. (CDC)

Physician office visits (all causes) - CDC FastStats (2024 estimate)

~1.0 billion physician-office visits per year (≈ 320.7 visits per 100 persons). (CDC)

Source: Centers for Disease Control and Prevention (CDC)

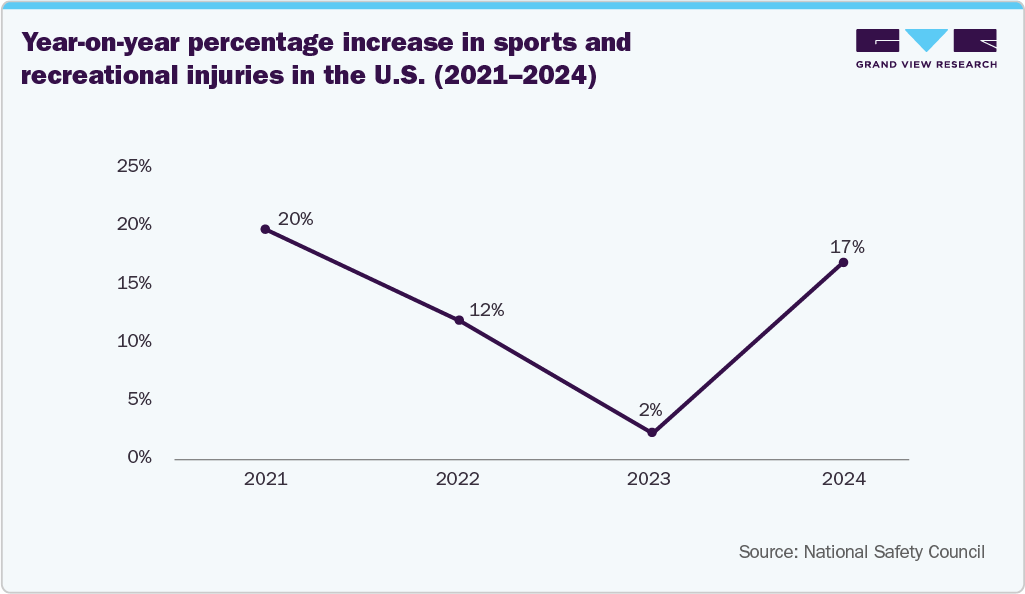

Sports participation and injury incidence form another driver of demand. Compression tapes are applied directly on skin or over dressings to support muscles, tendons, and joints, manage swelling, and assist circulation during activity or recovery. The high volume of injuries among children and adolescents in organized sports increases consumption in athletic and physiotherapy channels. Tapes provide flexible support without restricting full movement, making them suitable for rehabilitation and repeated-use scenarios.

The market also benefits from their role in post-operative care. Protocols in hospitals and ambulatory surgery centers integrate compression for swelling management and complication reduction. Growth in home-care and direct-to-consumer channels supports wider use of tape formats that are low-cost, easy to apply, and adaptable to varied limb shapes. Trends include custom-fit wrap options, improved textile systems to support patient use, and adhesive formats designed for extended wear. Manufacturers respond with tape-wrap hybrids, multi-day adhesive products, and early integration of monitoring features.

The increasing prevalence of chronic venous disorders, including chronic venous insufficiency (CVI), varicose veins, deep vein thrombosis (DVT), and venous leg ulcers-is a key driver of the compression tape market. Factors such as sedentary lifestyles, obesity, aging populations, and prolonged periods of standing or sitting at work are significantly contributing to the growing global burden of these conditions.

According to data published by the Society for Vascular Surgery in July 2025, chronic venous insufficiency affects up to 40% of Americans. Similarly, data from WebMD LLC published in July 2025 indicate that in the U.S., more than 11 million men and 22 million women aged 40-80 years suffer from varicose veins, while over 2 million individuals are affected by advanced CVI. Each year, more than 20,000 people are diagnosed with ulcers resulting from CVI.

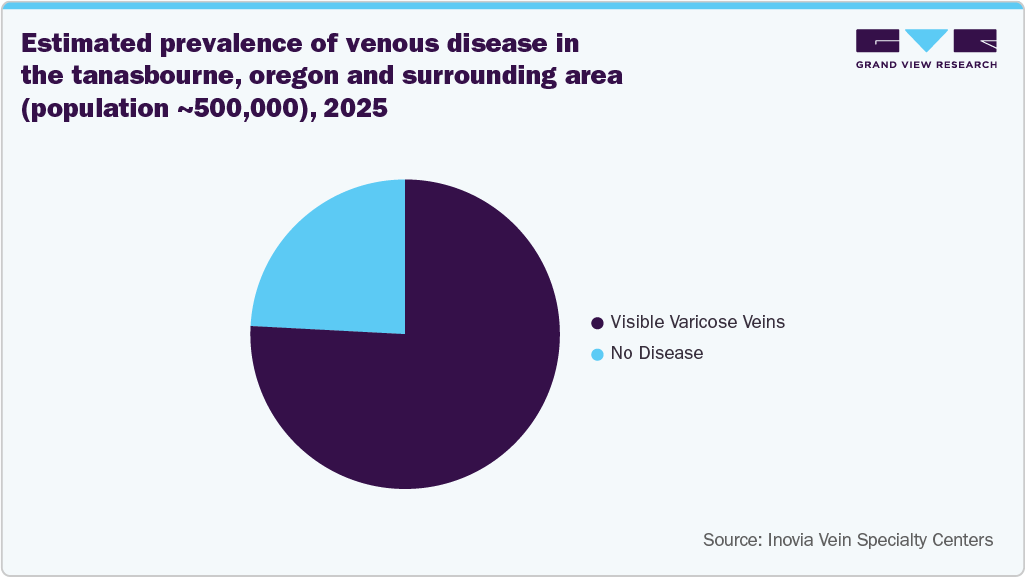

According to data released by Inovia Vein Specialty Centers in March 2025, an estimated 24% of residents, around 120,000 individuals, in Tanasbourne, Oregon, and nearby communities such as Hillsboro, Beaverton, and Cedar Mill, among others are affected by visible varicose veins, while approximately 6% (about 30,000 people) suffer from advanced chronic venous disease. With a total population of roughly 500,000, the region represents a substantial patient pool. The high prevalence of venous disorders is expected to significantly increase the demand for compression tape products in the market.

Furthermore, data from the Cleveland Clinic published in September 2025 show that approximately 1 to 3 in every 1,000 adults in the U.S. develop DVT or pulmonary embolism (PE) annually. These conditions account for up to 300,000 deaths each year, making DVT/PE the third most common vascular disease, following heart attacks and strokes.

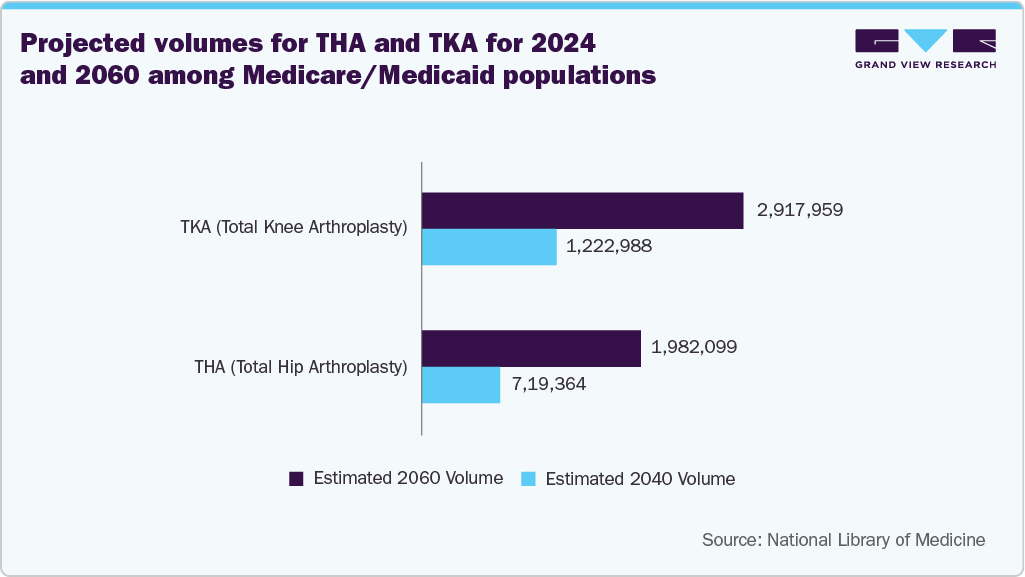

Moreover, the growing number of surgical procedures, including orthopedic surgeries and minimally invasive procedures, is expected to drive demand for the compression tape market. Even when surgeries are performed on an outpatient or same-day basis, compression socks are often prescribed as part of postoperative care. Patients who must remain off their feet for an extended period, especially following hip, knee, leg, or abdominal surgeries, are at an increased risk of developing DVT. Longer procedures requiring general anesthesia for more than 90 minutes further elevate this risk. In such cases, wearing compression garments until patients are fully mobile is considered a critical component of recovery and DVT prevention.

The number of orthopedic procedures is rising significantly. According to a study published by the National Library of Medicine in April 2023, the 2022 American Joint Replacement Registry (AJRR) Annual Report included data from over 2.8 million hip and knee procedures performed across more than 1,250 institutions in all 50 U.S. states and the District of Columbia. This represented a 14% year-over-year increase in registered procedural volume, solidifying the AJRR’s status as the largest arthroplasty registry in the world. Furthermore, the American College of Rheumatology reported in March 2025 that approximately 790,000 total knee replacements and 544,000 total hip replacements are performed annually in the U.S.

The increasing number of clinical trials evaluating compression tape products is creating significant growth opportunities for market participants. Academic institutions, research organizations, and medical device companies are increasingly investing in clinical research to assess the safety, efficacy, and performance of compression tape products, thereby bringing novel solutions to market. These trials support regulatory approvals and foster innovation in the U.S. compression tape market. Favorable results from these trials are expected to accelerate product development and market expansion.

Accelerate Product Development And Market Expansion

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

Locations

Assessing Connected-Health, Pressure-Monitoring Technology for Improving Compression Therapy in Venous Leg Ulcer Treatment

Venous Leg Ulcers (VLUs)

DEVICE: A connected-health, pressure-sensing system for monitoring sub-bandage pressure during compression therapy

Feeltect Limited

40

12/31/2026

U.S.

A Study Evaluating an Advanced Pneumatic Compression Device Versus Usual Care for Treatment of Head and Neck Lymphedema

Lymphedema|Lymphedema of Face|Lymphedema, Secondary|Lymphedema Due to Radiation|Lymphedema; Surgical

DEVICE: Advanced Pneumatic Compression Device (APCD)|OTHER: Usual Care

Tactile Medical

236

3/31/2025

U.S.

Cryocompression With or Without Cilostazol for the Prevention of Paclitaxel-induced Neuropathy in Patients With Gynecological Cancers

Cervical Carcinoma|Fallopian Tube Carcinoma|Malignant Solid Neoplasm|Malignant Uterine Neoplasm|Ovarian Carcinoma|Primary Peritoneal Carcinoma|Vulvar Carcinoma

OTHER: Best Practice|DRUG: Cilostazol|DEVICE: Cryocompression Therapy|DRUG: Paclitaxel|OTHER: Quality-of-Life Assessment

Emory University

70

12/31/2027

U.S.

Clinical Trial Assessing Human Placental Membrane Products and Standard of Care Versus Standard of Care in Nonhealing DFUs and VLUs

Pathologic Processes Diabetes Mellitus|Glucose Metabolism Disorders|Metabolic Diseases|Endocrine System Disease|Diabetic Angiopathies Vascular Diseases Cardiovascular Diseases Leg Ulcer|Skin Diseases|Diabetes Complications|Diabetic Neuropathies|Foot Diseases|Diabetic Foot|Foot Ulcer|Diabetes Mellitus, Type 2|Ulcer|Foot Ulcer Unhealed

OTHER: Standard of Care - DFU|OTHER: AM/Single - DFU|OTHER: AM/Double - DFU|OTHER: Standard of Care - VLU|OTHER: AM/Single - VLU|OTHER: AM/Double - VLU

C5 Biomedical

177

1/22/2027

U.S.

Physical Rehabilitation Evaluation and Optimal Physical Therapy (PRE-OPT)

Breast Cancer

BEHAVIORAL: Physical Therapy: Dependent on Patient's Needs

Masonic Cancer Center, University of Minnesota

135

2026-12

U.S.

Plantar Fasciitis Randomized Clinical Control Trial

Plantar Fascitis

PROCEDURE: Local Steroid Injection into the plantar heel|PROCEDURE: Ultrasound Guided Injection|PROCEDURE: Anatomical Guided injection

University of Pennsylvania

62

10/31/2026

U.S.

Source: ClinicalTrials.Gov

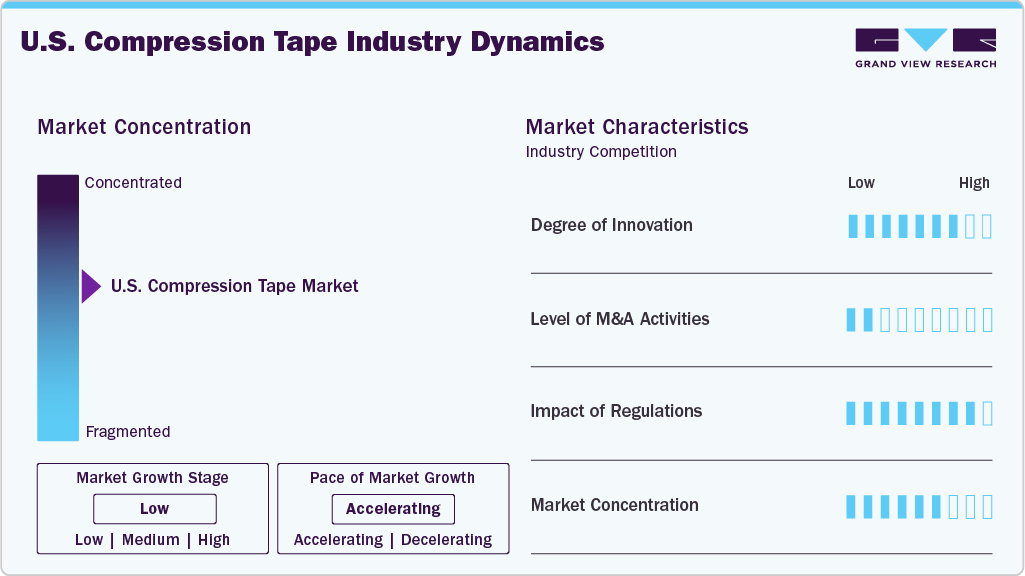

Market Concentration & Characteristics

The U.S. compression tape market is growing as hospitals, outpatient centers, sports medicine facilities, and home-care settings increase the use of adhesive and wrap-style tapes for swelling control, musculoskeletal support, post-operative management, and injury prevention. Demand is supported by higher prevalence of venous and lymphatic disorders, rising surgical volumes, growth in organized sports participation, and broader adoption of self-care practices.

Innovation is driven by advances in elastic, cohesive, and adhesive materials that improve conformity, durability, and skin performance. Manufacturers are introducing wrap-tape hybrids, extended-wear adhesive systems, latex-free constructions, and designs that enable controlled pressure without application complexity. Development activity also includes solutions tailored for post-surgical protocols, lymphedema management, and sports-recovery routines, as well as formats compatible with home-use and retail channels.

M&A activity is steady and oriented toward portfolio expansion, access to compression-tape technology, and entry into sports and rehabilitation channels. Partnerships with distributors and sports-medicine networks remain more common than large acquisitions. Companies pursue agreements that expand retail reach, strengthen supply chains, or integrate compression tapes into broader wound-care and musculoskeletal-care portfolios.

Compression tapes fall under general medical-device and consumer-health product frameworks, depending on the intended use. Products positioned for medical compression must comply with applicable FDA Class I requirements, labeling standards, and manufacturing controls. Clinical protocols for edema and post-operative management influence product adoption, while reimbursement structures for lymphedema and chronic venous conditions support demand for medically oriented compression systems. Regulatory expectations for skin-contact materials and biocompatibility shape design and validation timelines.

The market is moderately fragmented, consisting of sports-medicine brands, wound-care suppliers, and medical compression manufacturers. Key U.S. suppliers include 3M (Coban), Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN/Jobst, Hartmann, and Andover Healthcare. Competition is shaped by material technology, product range across compression classes, distribution strength, and the ability to serve both clinical and consumer channels. Demand for consistent compression performance and easy-to-apply formats reinforces the position of firms offering diverse tapes that address sports, post-operative, and chronic-condition needs.

Indication Insights

Sports injuries segment held the largest revenue share in 2025, due to high participation in organized sports, increased training intensity, and frequent soft-tissue injuries requiring immediate support. Compression tapes are routinely used for sprains, strains, tendon stress, joint instability, and overuse conditions, making them a standard tool in athletic training rooms, emergency care, and physiotherapy settings. Their role in swelling control, functional support, and on-field management drives consistently high utilization, supported by growing self-care and home-based injury management across consumer channels.

The post-operative edema segment is expected to register moderate growth during forecast period as surgical volumes rise across inpatient, outpatient, and ambulatory centers. Compression tapes are increasingly incorporated into protocols to manage swelling, support tissue stability, and reduce post-procedure complications. Adoption is further supported by shifts toward same-day surgeries and expanded home-care recovery pathways, where easy-to-apply compression solutions are preferred over bulkier systems. Hospitals and clinicians continue integrating tape-based compression into standardized recovery workflows, reinforcing sustained growth in this segment.

Compression Class Insights

Class 1 compression tapes segment held the largest revenue share in 2025, driven by broad use in sports medicine, physiotherapy, and general injury management. Their light-compression profile makes them suitable for routine support, swelling control, and prevention-focused applications where mobility must be maintained. High adoption among athletes, fitness users, and individuals managing minor strains or overuse injuries supports widespread consumption across retail, clinical, and home-care channels. Growth in self-care and expanding access through pharmacies, e-commerce, and sports outlets further reinforced the segment’s leading share.

The Class 2 segment is expected to register the fastest growth during the forecast period as demand increases for moderate-compression solutions used in venous insufficiency, edema management, and post-surgical recovery. Rising prevalence of chronic venous disorders and higher volumes of outpatient procedures support wider use of tapes that deliver structured, clinically guided compression. Adoption also grows as clinicians seek adjustable, easy-to-apply formats that fit into home-care pathways. Broader clinical acceptance and expanding availability across medical supply channels reinforce sustained growth in this segment.

Key U.S. Compression Tape Company Insights

Key players in the U.S. compression tape market are expanding product lines, increasing production capacity, and strengthening distribution across hospital, outpatient, sports medicine, and home-care channels. Companies such as 3M, Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN/Jobst, Hartmann, and Andover Healthcare continue to advance elastic, cohesive, and adhesive tape technologies. Firms are investing in material innovation, compliance with skin-contact and medical-use standards, and broader partnerships with healthcare providers, retailers, and sports networks to support expanding clinical and consumer adoption.

Key U.S. Compression Tape Companies:

- Essity Aktiebolag

- Hartmann AG

- Medline Industries, LP.

- 3M

- Mueller Sports Medicine

- Dynarex

- DeRoyal

- Andover Healthcare

- Cardinal Health

Recent Developments

-

In September 2025, Cardinal Health has announced the opening of its newest distribution center in Fort Worth, Texas, dedicated exclusively to its at-Home Solutions business, a leading provider of medical supplies serving over 6 million people across the U.S. each year. The company also revealed plans to break ground on another at-Home Solutions distribution center in Sacramento, California, later this fiscal year.

-

In August 2024, Cardinal Health announced plans to open a new distribution center in Walton Hills, Ohio, to support its U.S. Medical Products and Distribution business. The new facility will incorporate advanced technology solutions, enhance operational efficiency, and expand distribution capacity in the Cleveland, Ohio region.

U.S. Compression Tape Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 35.86 million

Revenue forecast in 2033

USD 46.18 million

Growth rate

CAGR of 3.61% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, compression class

Country scope

U.S.

Key companies profiled

Essity Aktiebolag; Hartmann AG; Medline Industries, LP.; 3M; Mueller Sports Medicine; Dynarex; DeRoyal; Andover Healthcare; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Compression Tape Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. compression tape market report based on indication, and compression class.

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports Injuries

-

Post-operative Edema

-

Lymphedema

-

-

Compression Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Class 1

-

Class 2

-

Frequently Asked Questions About This Report

b. Based on product, sports injuries segment held the largest revenue share in 2025, due to high participation in organized sports, increased training intensity, and frequent soft-tissue injuries requiring immediate support.

b. The U.S. compression tape market size was estimated at USD 34.79 million in 2025 and is expected to reach USD 35.86 million in 2026.

b. The U.S. compression tape market is projected to grow at a CAGR of 3.68% from 2026 to 2033 to reach USD 46.18 million by 2033.

b. The key players in the U.S. compression tape market are 3M, Medline (CURAD), Essity (Actimove, Tensoplast, TensoSport), Mueller Sports Medicine, Dynarex, DeRoyal, BSN/Jobst, Hartmann, and Andover Healthcare .

b. The U.S. compression tape market is supported by rising use of compression solutions for injury management, post-operative recovery, and edema control. Increased participation in sports and fitness activities continues to fuel demand for preventive and rehabilitation taping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.