- Home

- »

- Biotechnology

- »

-

U.S. Computational Biology Market, Industry Report, 2030GVR Report cover

![U.S. Computational Biology Market Size, Share & Trends Report]()

U.S. Computational Biology Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Database, Infrastructure & Hardware, Software Platform), By Application (Preclinical Drug Development, Clinical Trial), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-243-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Computational Biology Market Trends

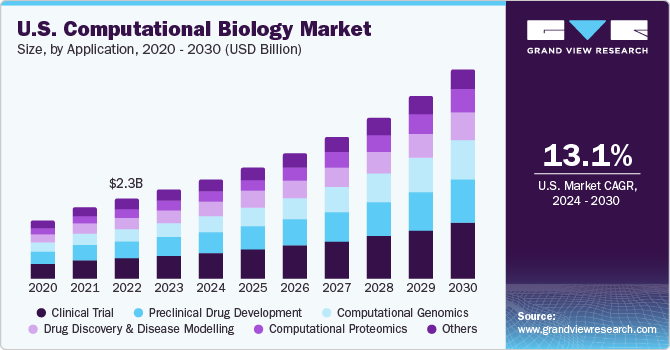

The U.S. computational biology market was valued at USD 2.54 billion in 2023 and is expected to grow at a CAGR of 13.1% from 2024 to 2030. The discoveries in genomics, molecular biology, cellular & tissue engineering, bio-imaging & new drug discovery, and delivery techniques are expected to create opportunities to improve diagnostic capabilities and expand therapeutic options.

Most of the clinical development in life sciences technologies for applications in oncology and infectious diseases is being carried out in the U.S. Successful completion of the human genome project paved the way for the development of personalized medicine approaches. Research, development, and commercialization of personalized medicine services and products occur faster in the U.S. than in other countries around the globe. Moreover, introducing automated solutions is anticipated to increase the adoption of life sciences tools among the end users. For instance, the Smart Extraction technology developed by Analytik Jena is used to extract high molecular weight DNA from a range of samples. This automated extraction and purification of nucleic acids simplifies the workflow and increases efficiency, yield, and DNA quality.

In 2023, the U.S. computational biology market accounted for over 46% of the global computational biology market. The presence of key biotechnology organizations, including the National Biotechnology Board (NBTB) and The Department of Biotechnology (DBT), encourages funding to support technological development and R&D for computational biology. Increasing need to study chronic diseases at a molecular level and formulate therapeutic solutions is expected to support these organizations to fund R&D programs. Government funding for life sciences research is projected to fuel market growth. Organizations, including the National Institutes of Health (NIH) and the National Human Genome Research Institute (NHGRI), are actively involved in funding several life sciences projects. The NHGRI collaborates with scientists and researchers to deliver genomic research funds, such as the identification of genomic basis of diseases and determining the complexities of the human genome. NHGRI focuses on expanding genomic technology applications to improve patient care and benefit society.

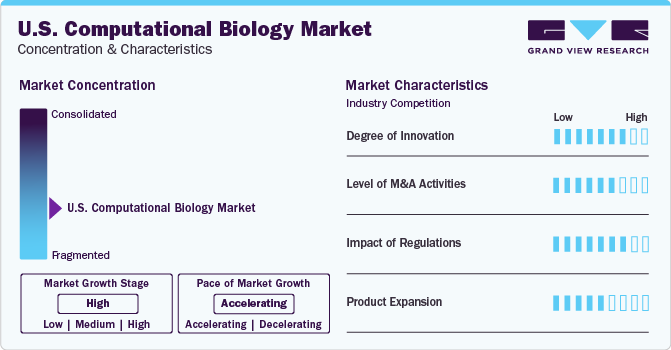

Market Characteristics & Concentration

The industry growth stage is high (CAGR >10%) and pace of the growth depicts an accelerating trend. The U.S. computational biology industry is moderately fragmented, which is marked by the presence of large number of companies competing for the market share.

Increasing advancements in IT sector have steered developments in computational biology. Advancements in genome sequencers, gene finders, sequence databases, multiple sequencing, and protein visualization has surged the adoption of computational biology solutions. Several companies and universities that process and store large amounts of data are adopting grid computing. Although hardware or physical infrastructure is up to the mark with developments in these sectors, companies are focusing on the development of robust and advanced software for data mining and analysis. Development of innovative solutions is expected to drive the market as they reduce the time required to analyze large sets of data.

The U.S. computational biology industry is characterized by significant M&A and collaboration activities undertaken by key manufacturers. Key companies are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in April 2023, IBM entered into a strategic collaboration with Moderma to leverage generative AI in integration with quantum computing for the development of advanced mRNA technology for applications in the discovery and development of vaccines.

The number of approved nanomedicine products has been increasing significantly since 1980. As of 2021, 50 nanomedicines have received regulatory approval from the FDA. Thus, increasing regulatory approvals for advanced solutions is expected to positively impact the demand.

Service Insights

The software platforms segment accounted for the largest market share of 39.2% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. Software platforms comprise a diverse set of tools and technologies, including data analysis platforms, bioinformatics software, modeling and simulation software, and other technologies. These tools are crucial for the management and analysis of large volumes of biological data, including genomics, proteomics, and structural biology data. Furthermore, the growing demand for personalized medicines and rapid development in drug discovery & development are boosting the segment growth.

The infrastructure & hardware segment is expected to witness lucrative growth over the forecast period. The demand for robust hardware infrastructure services for supporting complex computations is anticipated to surge as computational biology research advances. Furthermore, the increasing investments by various healthcare organizations are expected to augment the segment growth during the forecast period. For instance, in February 2021, Rescale, a startup that focuses on enhancing scientific and engineering simulation through its software and hardware infrastructure, secured a funding of USD 50 million.

Application Insights

Clinical trials held the highest market share of 26.9% in 2023. This dominance is attributable to the increasing demand for drug discovery & development, personalized medicines, and target identification & validation. Furthermore, with the increase in accessibility of patient data, such as electronic health records and genomics, computational biology is being widely adopted for data interpretation and analysis for taking informed decisions in clinical trials.

The computational genomics segment is expected to grow at the fastest CAGR from 2024 to 2030. Computational genomics focuses on the interpretation and analysis of genomic data with the help of computational tools. Increasing prevalence of cancer has driven the development of advanced treatments, thereby fueling computational genomics demand in oncology.

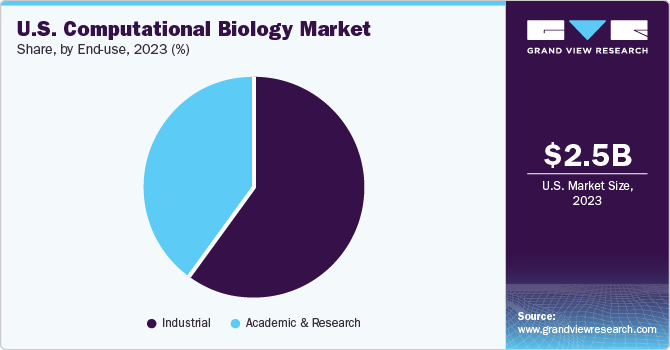

End-use Insights

The industrial segment accounted for the largest market share of 62.6% in 2023 owing to the increasing advancements in analysis and visualization of biological structures. With the growing demand to gain better insights into metabolic interactions within the biotechnology sectors, companies are harnessing the power of advanced technologies including artificial intelligence and machine learning.

Academics & research is expected to exhibit the fastest CAGR during the forecast period. Market growth is attributed to the increasing need for computational software to innovate genome analysis with the help of rising research and development activities conducted by various academic institutions and research organizations. Furthermore, the increase in collaborative investments and efforts between private and public entities to launch new research institutes is projected to boost segment growth.

Key U.S. Computational Biology Company Insights

Key U.S. computational biology companies include Thermo Fisher Scientific, Inc.; DNAnexus, Inc.; and Illumina, Inc. among others. Leading companies are focusing on extensive R&D activities for the development of technologically advanced and cost-efficient products. Several business strategies, including new product launches and mergers & acquisitions are being undertaken by the companies to expand their market presence.

U.S. Computational Biology Companies:

- DNAnexus, Inc.

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Schrodinger, Inc.

- Compugen

- Aganitha AI Inc.

- Genedata AG

- QIAGEN

- Simulations Plus, Inc.

- Fios Genomics

Recent Developments

-

In May 2023, Genialis unveiled the launch of Genialis Expressions 3.0. The software is designed to accelerate the process of discovering clinical and translational biomarkers. It also focuses on complex biological mechanisms for novel disease treatment methodologies.

-

In February 2023, Accenture announced its investment in Ocean Genomics, an AI-driven biotechnology company focusing on the development of advanced computational platforms. This deal was planned to support biotechnology companies for the discovery and development of personalized medicines.

U.S. Computational Biology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.01 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Service, application, end-use

Country Scope

U.S.

Key companies profiled

DNAnexus, Inc.; Illumina, Inc.; Thermo Fisher Scientific, Inc.; Schrodinger, Inc.; Compugen, Aganitha AI Inc.; Genedata AG; QIAGEN; Simulations Plus, Inc.; Fios Genomics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Computational Biology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. computational biology market based on service, application, and end-use:

-

Service Outlook (USD Million, 2018 - 2030)

-

Databases

-

Infrastructure & Hardware

-

Software Platform

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Drug Discovery & Disease Modelling

-

Target Identification

-

Target Validation

-

Lead Discovery

-

Lead optimization

-

-

Preclinical Drug Development

-

Pharmacokinetics

-

Pharmacodynamics

-

-

Clinical Trial

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Computational Genomics

-

Computational Proteomics

-

Others

-

-

End-use Outlook (USD Million, 2018 - 2030)

-

Academic & Research

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. computational biology market was valued at USD 2.54 billion in 2023.

b. The U.S. computational biology market is expected to grow at a compound annual growth rate (CAGR) of 13.1% from 2024 to 2030 to reach USD 6.01 billion by 2030.

b. The industrial segment accounted for the largest market share of 62.6% in 2023, owing to the increasing advancements in analysis and visualization of biological structures.

b. Some of the key companies operating in the U.S. computational biology market include DNAnexus, Inc.; Illumina, Inc.; Thermo Fisher Scientific, Inc.; Schrodinger, Inc.; Compugen, Aganitha AI Inc.; Genedata AG; QIAGEN; Simulations Plus, Inc.; Fios Genomics.

b. The discoveries in genomics, molecular biology, cellular & tissue engineering, bio-imaging & new drug discovery, and delivery techniques are expected to create opportunities to improve diagnostic capabilities and expand therapeutic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.