- Home

- »

- Next Generation Technologies

- »

-

U.S. Consumer Drone Market Size, Industry Report, 2030GVR Report cover

![U.S. Consumer Drone Market Size, Share & Trends Report]()

U.S. Consumer Drone Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Multi-Rotor, Nano, Others), By Application (Prosumer, Toy/Hobbyist, Photogrammetry), And Segment Forecasts

- Report ID: GVR-4-68040-248-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Consumer Drone Market Size & Trends

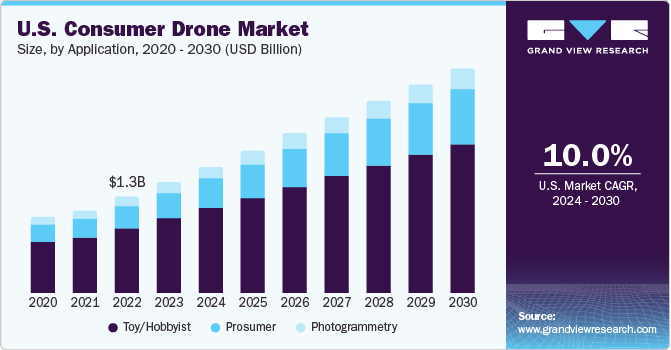

The U.S. consumer drone market size was valued at USD 1.48 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030. Consumer drones are used for aerial photography and videography. Sometimes, people also fly drones as leisure activities and interests for fun, resulting in a significant increase in product demand. Furthermore, the seamless integration of artificial intelligence and machine learning technologies has augmented the capabilities of consumer drones, enhancing their performance and making them useful for versatile applications. Such advancements are anticipated to increase the outlook of the consumer drone market in the U.S.

In 2023, the U.S. accounted for over 30% of the consumer drone market. The demand for drones is rising due to the growing popularity of steady and high-quality aerial photography and videography on various occasions. Technological advancements and manufacturing innovations have further made the product popular among users. The latest technologies offer navigation systems linked to the user's device, high range, and control systems that are reliable, safe, efficient, and provide better control & speed. In February 2022, Phystech Ventures, a U.S.-based venture capital firm, stated that there had been a USD 5 billion investment in drone technology in the past two years.

Today, drones are being equipped with 4K cameras to provide customers with high-resolution photographs or videos. Manufacturers, such as DJI and Skydio have equipped drones with 4K cameras which offer cinema-quality footage with 8 million pixels wide in video resolution. For shooting personal videos, theatrical films, and marketing or live TV reporting, shooting 4K footage from a height results in a quality content.

Moreover, with the growing technological innovations and flourishing disposable incomes, consumers find it easy to spend on leisurely activities, such as flying drones, during their tours. The sale of consumer drones is expected to be supplemented by this trend, thereby augmenting the number of drone units sold.

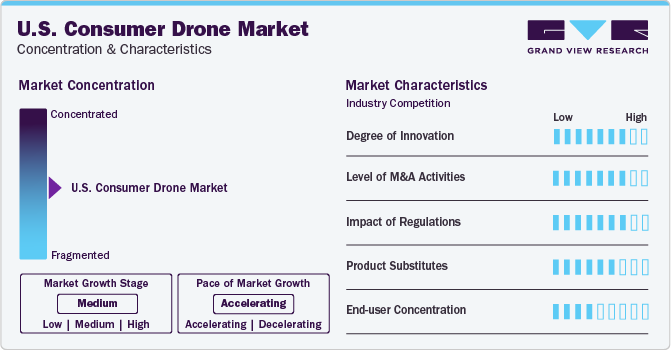

Market Concentration & Characteristics

The market is characterized by a medium to high degree of innovation. Companies have developed miniature and hybrid-powered drones. Companies are also using artificial intelligence to automate consumer drones, allowing the drone to program its flight instructions. Incorporation of IoT, deep-learning algorithms, and other machine learning techniques are also being applied in the market.

For instance, the integration with Sony Electronics’ mirrorless cameras enabled Skyfish drones to gather the data required to generate precise 3D models of large infrastructures, among other applications. Similarly, DJI launched the Mini 3 Pro drone in May 2022, which weighs 249 grams and provides additional flight control capabilities along with a high-quality picture and video recording functionality.

The market is also impacted by rules and regulations imposed by the government. For instance, Drones weighing more than 250 grams need to be registered with the Federal Aviation Administration (FAA) of the U.S. The Recreational UAS Safety Test (TRUST) must be undertaken by pilot as per the Federal Aviation Administration (FAA) guidelines. Also, drones must be flown below 400 feet to keep the drone in sight and must not go near airports and other sensitive areas.

The market also witnesses frequent merger and acquisition activities among prominent companies. For instance, in June 2021, aircraft manufacturer Kitty Hawk acquired 3D Robotics. Kitty Hawk produces electric personal air vehicles. The end-use concentration is also high in the market. Drones are being used extensively across many industries, including construction, manufacturing, e-commerce, agriculture, media and entertainment, sports, etc.

Application Insights

Based on applications, the toy/hobbyist drone segment dominated the market with largest revenue share in 2023. Drones are going through rapid technological advancements and some toy drones now fly without operator guidance as autonomous flying technology has become widespread, which is increasing the popularity of the segment. Nano drones are used in toy/hobbyist applications by aviation enthusiasts for recreational purposes.

The prosumer segment is expected to witness the highest CAGR over the forecast period. This growth can be attributed to the implementation of the latest technologies in electronics, which has fascinated gaming enthusiasts to accept drones as their new source of entertainment. Drone racing as a recreational hobby is becoming popular, enhancing the acceptance of drones for prosumer applications. Moreover, UAVs and drones are also replacing conventional inhabited aircraft to approach wildlife from the air.

Product Insights

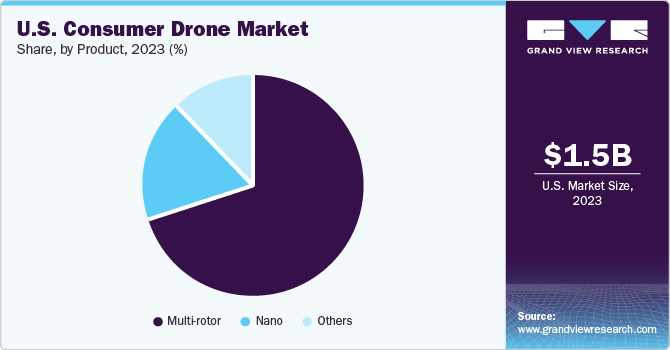

Based on products, the multi-rotor segment dominated the market with largest revenue share of over 70.0% in 2023. Multi-rotor drones are used for aerial photography and filming as they offer the advantage of vertical take-off and landing. These drones have higher payload capacity, which makes it suitable for different uses. These drones are used by law enforcement authorities to get better inspection and payload carrier applications, which need higher precision maneuvering, the capacity to fly over challenging terrain, and for extended periods.

Other drones, such as hybrid-type and fixed-wing drones are expected to grow with the highest CAGR during the forecast period. Small rotary-wing and fixed-wing drones are often used for still photography and filming. Their ability to carry multiple gadgets and sensors accounts for their popularity. Fixed-wing drones have the advantage of flying at a higher altitude compared to other drones.

Key U.S. Consumer Drone Company Insights

Some of the leading companies in the market include Horizon Hobby, LLC, SZ DJI Technology Co., Ltd., and Eachine.

-

DJI is a leading company in the market. It offers various imaging solutions, including aerial, handheld and pro imaging, as well as drones for consumer and commercial application purposes. It also provides industrial solutions that consist of airframes, flight controller, aerial gimbals, transmission, propulsion systems, infrared cameras, developers and pro-developer.

-

Eachine offers its services in Radio Control (RC) toys, FPV racer and FPV system. The company also offers spare parts and multirotor parts for RC toys and FPV racer.

3DR, Inc. (Kitty Hawk), and SkyTech Drone are among the emerging companies in the U.S. consumer drone market.

-

SkyTech Drone caters to several industry verticals which includes agriculture, security, sports, photography, power engineering, rescue, army, among others.

-

3DR, Inc. offers products & services in GPS, ready to fly UAVs, R/C electronics, cables and connectors, servos, sensors and IMUs.

Key U.S. Consumer Drone Companies:

- 3DR, Inc.

- Autel Robotics

- Eachine

- EXO Drones

- Horizon Hobby, LLC

- Hubsan

- Parrot Drone SAS

- SkyTech Drone Sp. z o. o

- SZ DJI Technology Co., Ltd.

- Yuneec International Co., Ltd.

Recent Developments

-

In February 2022, Skyfish, a U.S. drone manufacturer, announced a technical collaboration with Sony Electronics to deliver drones with high-quality data gathering and photogrammetry capabilities.

-

In April 2021, Horizon Hobby acquired Real Flight, a prominent remote-controlled (RC) flight simulation software from the company named Knife Edge Software. Through this acquisition, the company aims to enhance the simulation software with cutting-edge and innovative features in their RC flights.

U.S. Consumer Drone Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.00 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

3DR, Inc.; Autel Robotics, EXO Drones; SZ DJI Technology Co., Ltd.; Eachine; Yuneec International Co., Ltd.; SkyTech Drone Sp. z o. o; Horizon Hobby, LLC; Parrot Drone SAS; Hubsan

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Consumer Drone Market Report Segmentation

This report forecasts and estimates volume and revenue growth at country level and analyzes the latest market trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. consumer drone market report based on product and application:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Multi-rotor

-

Nano

-

Others (Fixed-wing, Hybrid)

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Prosumer

-

Toy/Hobbyist

-

Photogrammetry

-

Frequently Asked Questions About This Report

b. The global U.S. consumer drone market size was valued at USD 1.48 billion in 2023 and is expected to reach USD 1.69 billion in 2024.

b. The global U.S. consumer drone market is expected to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030 to reach USD 3.00 billion by 2030.

b. The multi-rotor segment dominated the market with largest revenue share of over 70.0% in 2023. These drones are used by law enforcement authorities to get better inspection and payload carrier applications, which need higher precision maneuvering, the capacity to fly over challenging terrain, and for extended periods. This in turn, is expected to fuel the segment growth in the coming years.

b. Some key players operating in the U.S. consumer drone market include 3DR, Inc., Autel Robotics, Eachine, EXO Drones, Horizon Hobby, LLC, Hubsan, Parrot Drone SAS, SkyTech Drone Sp. z o. o, SZ DJI Technology Co., Ltd., Yuneec International Co., Ltd.

b. The integration of artificial intelligence and machine learning technologies, growing popularity of steady and high-quality aerial photography and videography is driving the U.S. consumer drone market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.