- Home

- »

- Advanced Interior Materials

- »

-

U.S. Copper Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Copper Market Size, Share & Trends Report]()

U.S. Copper Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Primary Copper, Secondary Copper), By Product (Wire, Rods, Bars & Sections, Tube, Foil), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-675-8

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Copper Market Summary

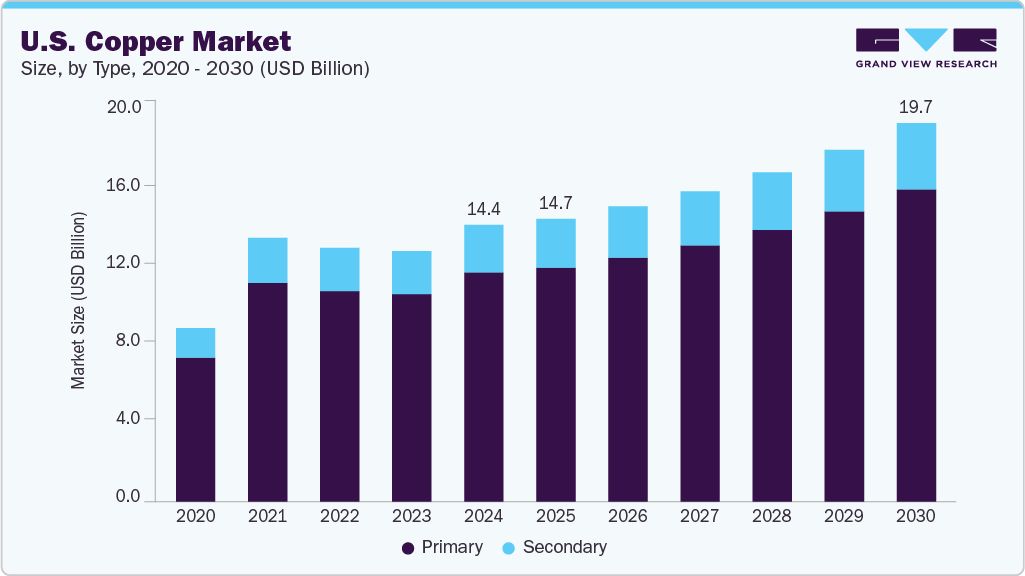

The U.S. copper market size was estimated at USD 14.39 billion in 2024 and is projected to reach USD 19.68 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. Copper plays a vital role in U.S. infrastructure, valued for its excellent electrical conductivity and resistance to corrosion.

Key Market Trends & Insights

- By type, the primary segment held the highest market share of 81.4% in 2024.

- By product, the wire segment held the highest market share in 2024.

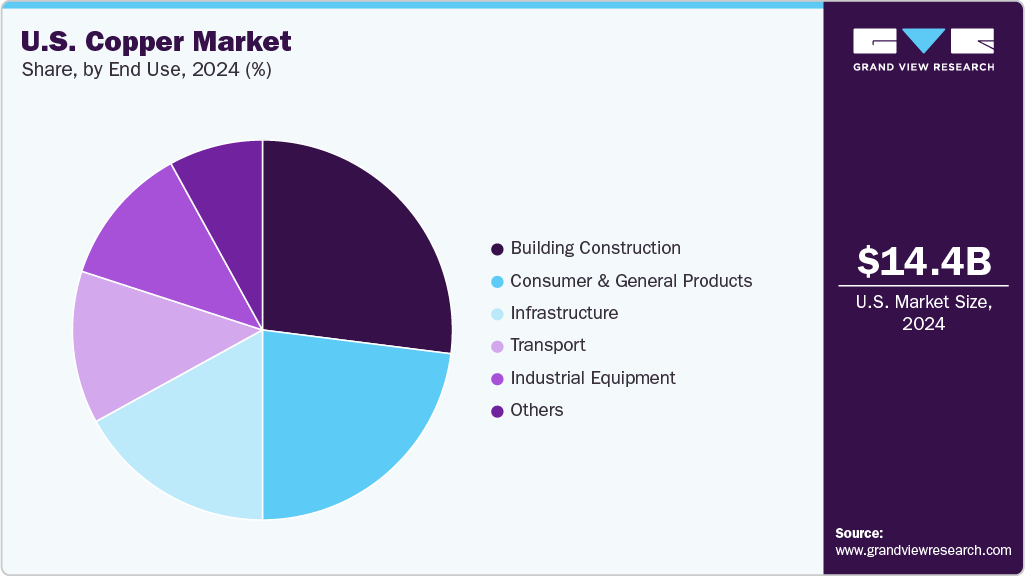

- By end use, the building construction segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.39 Billion

- 2030 Projected Market Size: USD 19.68 Billion

- CAGR (2025-2030): 6.0%

It is widely used in building wiring, plumbing, roofing, and various structural components. For decades, copper has been essential in the production of telecommunications equipment, electric vehicles, and power distribution systems, making it a cornerstone of modern technological and infrastructure development.Copper is one of the oldest metal used and has played a big role in the growth of civilization. With properties such as being easy to shape, a great conductor of heat and electricity, and rust-resistant, copper has become one of the most important industrial metal after iron and aluminum. The drivers for the U.S. copper industry is the shift toward electrification, such as electric vehicles, renewable energy infrastructure, and energy storage, which significantly increases copper usage due to its critical role in electrical systems. These factors shape a complex and evolving copper market in the U.S.On the supply side, domestic copper production from major mines such as Morenci and Kennecott is crucial, and also recycled copper makes up a significant portion of the market.

The U.S. copper industry plays a vital role in the national economy, supporting over 395,000 jobs and contributing more than USD 160 billion in economic output. It directly employs around 65,000 workers and supports an additional 330,000 indirectly, generating over USD 77 billion in direct and USD 83 billion in indirect economic output. The U.S. ranked 5th globally in copper mine production, contributing 6% of global output in 2020, while its consumption of refined copper reached 1.77 million tons that yea . Copper, being good at carrying electricity, is widely used in electric wires and cables, making it a key part of energy technologies such as wind turbines, solar panels, batteries, and power grids. As these technologies grow, the need for copper is expected to increase over the years.

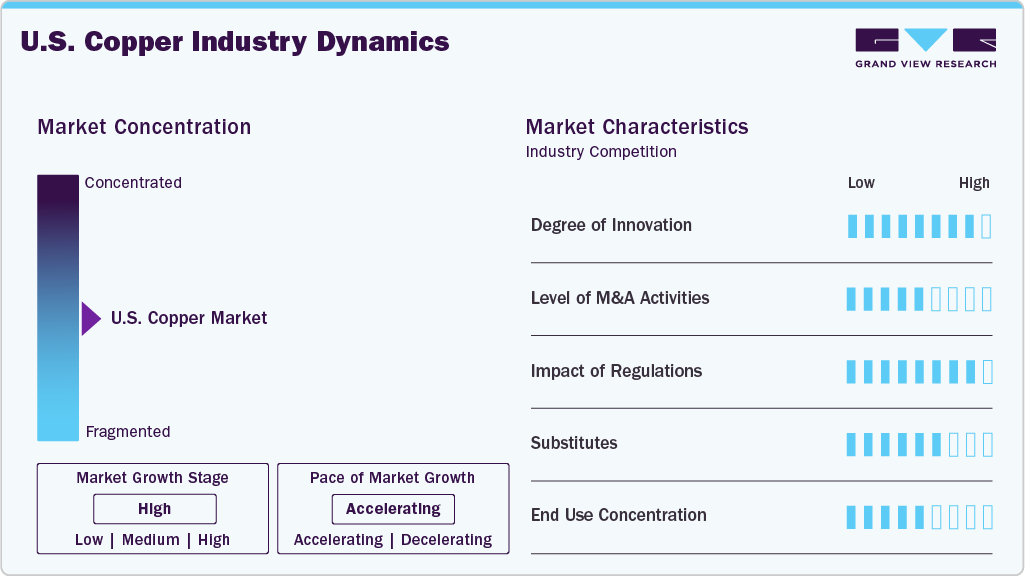

Market Concentration & Characteristics

The market growth stage is moderate to high, and the pace of growth is accelerating due to the expansion of renewable energy infrastructure and the rapid adoption of electric vehicles. Copper is a critical material in electrical wiring, solar panels, wind turbines, and EVs, which are gaining momentum as the U.S. advances its clean energy goals.

The U.S. copper industry is also subject to high regulatory scrutiny. In February 2025, the White House issued an executive order declaring copper a critical material vital to U.S. national security, economic stability, and industrial resilience. The U.S. faces growing vulnerabilities in its copper supply chain, primarily due to its increasing reliance on foreign sources for mined, smelted, and refined copper. The President has directed the U.S. Department of Commerce to investigate under Section 232 of the Trade Expansion Act of 1962 to assess the national security implications of copper imports, including copper concentrates, refined products, scrap, and derivatives.

Type Insights

The primary copper segment dominated the U.S. copper industry and accounted for a revenue share of 81.4% in 2024. This type of copper comes directly from mined ore and is known for its excellent ability to conduct electricity. That makes it very useful in power lines, renewable energy systems, and car parts. The need for high-quality primary copper is growing.

The secondary copper segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. In the U.S., a significant portion of copper supply comes from secondary sources such as machine shop punchings, turnings, borings, surplus or defective manufacturing goods, automobile radiators, pipes, wires, bushings, bearings, and by-products from metallurgical processes.

Product Insights

The wire segment accounted for the highest revenue share in 2024. Copper wire plays a critical role in power distribution, telecommunications, and grounding systems across residential, commercial, and industrial settings due to its exceptional electrical conductivity, flexibility, and corrosion resistance. Key growth drivers for this segment include the rapid expansion of EV charging networks, federal investment in grid resilience and broadband connectivity, and ongoing electrification initiatives to decarbonize transportation and buildings. In addition, residential and commercial construction growth supports copper wire demand and the increasing integration of smart electrical systems that require dependable and high-capacity wiring solutions.

The flat rolled products segment is anticipated to register at the fastest CAGR over the forecast period, due to rising demand from the automotive and construction industries, infrastructure development and increased manufacturing activity. In September 2024, Aurubis AG sold its Buffalo site, New York flat rolled products facility to the Wieland Group, a German manufacturer of semi-finished copper and copper alloy products, as part of its strategic shift to focus more heavily on primary copper production, recycling, and its multimetal smelter operations.

End Use Insights

The building construction segment accounted for the highest revenue share in 2024. Copper has long been a favored material due to its durability and visual appeal in the building and construction sector. It is commonly used in roofing, spires, shingles, doors, and architectural details. Designers and architects are especially drawn to copper for its natural oxidation process, which creates a distinctive green and blue color over time. This not only enhances its aesthetic value but also forms a protective layer that resists corrosion, increasing the material’s lifespan in both historic and modern structures.

The infrastructure segment is anticipated to register the fastest CAGR over the forecast period, owing to the expansion of high-speed internet access, especially in rural areas, which increases copper use in communication systems. Public transportation projects, such as electric railways and buses, also rely on copper for electrical components. In addition, initiatives to replace old lead or steel water pipes with corrosion-resistant copper piping are underway in many cities. Sustainable building trends further support demand, with copper used in solar panels, energy-efficient HVAC systems, and green construction materials. The rapid growth of electric vehicle charging infrastructure is also a major driver, as it depends heavily on copper wiring and connectors.

Key U.S. Copper Company Insights

Some of the key companies in the U.S. copper market include Freeport-McMoRan Inc., Aurubis Buffalo Inc., Mueller Industries, Inc. and others.

-

Freeport-McMoRan Inc. is one of the world’s largest publicly traded copper producers, with significant mining operations in North and South America. The company is a key supplier to the U.S. infrastructure, energy, and manufacturing sectors.

-

Aurubis AG is a global leader in copper production and one of the largest copper recyclers in the world. The company processes copper concentrates and recycling materials to produce high-purity copper cathodes, which are further transformed into wire rod, profiles, and flat-rolled products.

Key U.S. Copper Companies:

- Freeport-McMoRan Inc.

- Aurubis Buffalo Inc.

- Mueller Industries, Inc.

- Wieland Metals Inc.

- Southwire Company, LLC

- Revere Copper Products, Inc.

- Cambridge-Lee Industries LLC

- Cerro Flow Products LLC

- Hussey Copper Ltd.

- ASARCO (Grupo México)

Recent Developments

-

In 2025, Aurubis AG, Europe’s leading copper producer, is making a major strategic move into the U.S. market with an USD 800 million investment in a state-of-the-art copper recycling facility in Richmond, Georgia. The plant is anticipated to process 180,000 metric tons of complex copper scrap annually and produce 70,000 tons of refined copper.

U.S. Copper Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 19.68 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Type, product, end use

Key companies profiled

Freeport-McMoRan Inc., Aurubis Buffalo Inc., Mueller Industries, Inc., Wieland Metals Inc., Southwire Company, LLC, Revere Copper Products, Inc., Cambridge-Lee Industries LLC, Cerro Flow Products LLC, Hussey Copper Ltd., ASARCO (Grupo México)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Copper Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. copper market report based on type, product, and end-use:

-

Type Outlook (Volume in Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

Product Outlook (Volume in Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Wire

-

Rods, Bars & Sections

-

Flat Rolled Products

-

Tube

-

Foil

-

-

End Use Outlook (Volume in Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Industrial Equipment

-

Transport

-

Infrastructure

-

Building Construction

-

Consumer & General Products

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. copper market size was estimated at USD 14.39 billion in 2024 and is expected to reach USD 14.70 billion in 2025

b. The U.S. copper market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 19.68 by 2030.

b. The primary copper segment dominated the market with a revenue share of 82.8% in 2024.

b. Some of the key players of the U.S. copper market are Jiangxi Copper Corporation; Aurubis AG; Codelco; Glencore; BHP; AngloAmerican; Teck Resources Limited; Antofagasta plc.; KGHM; Rio Tinto; Freeport-McMoRan; GRUPO MÉXICO, and others.

b. The key factor that is driving the growth of the global copper market is driven by the increasing demand from renewable energy systems, electric vehicles, and infrastructure development, all of which require significant amounts of copper for electrical conductivity, thermal efficiency, and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.