- Home

- »

- Advanced Interior Materials

- »

-

U.S. Copper Wire Market Size & Share, Industry Report 2030GVR Report cover

![U.S. Copper Wire Market Size, Share & Trends Report]()

U.S. Copper Wire Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage (Low, Medium, High), By Application (Building Wire, Power Distribution, Automotive, Communication, Renewable Energy), And Segment Forecasts

- Report ID: GVR-4-68040-627-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Copper Wire Market Size & Trends

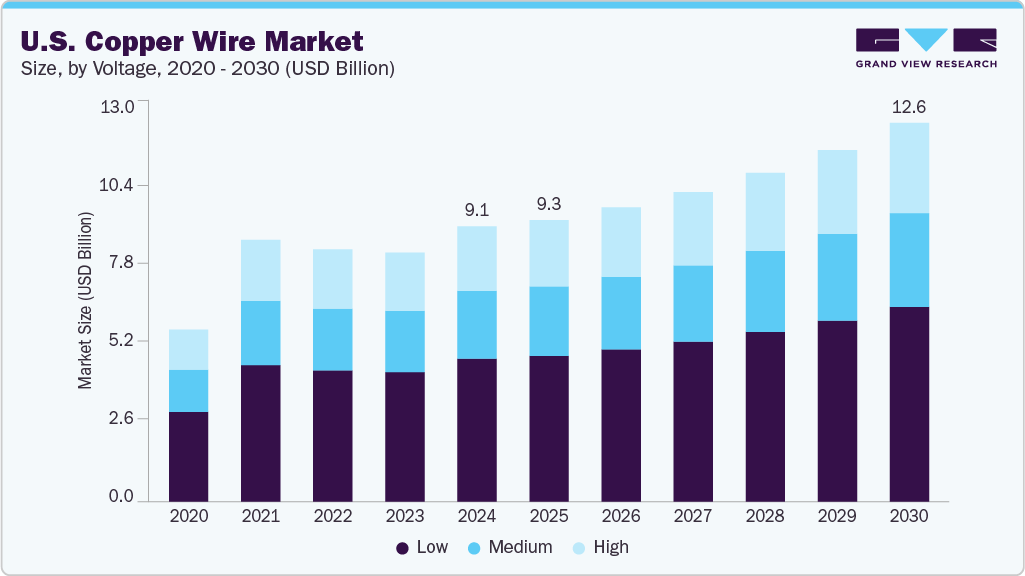

The U.S. copper wire market size was estimated at USD 9.14 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. This market is experiencing robust growth due to its essential role in electrical infrastructure, energy systems, automotive wiring, and telecommunications. Copper’s unmatched conductivity, thermal stability, and recyclability ensure its dominance in building wire and power distribution applications. Increasing investment in infrastructure modernization, rising construction activities, and the transition to renewable energy drive the need for high-performance copper wire across residential, commercial, and industrial projects. Advancements in energy-efficient technologies and electrification trends across transportation and utilities continue reinforcing copper wire’s relevance and long-term demand in the U.S. copper wire industry.

In the U.S. copper wire industry, the renewable energy sector remains a strong demand driver, particularly due to copper's essential role in transmitting electricity efficiently. In September 2024, Southwire announced a partnership with Statewide Renewable to install a solar system at one of its North Campus plants in Georgia, underscoring its commitment to renewable energy. The establishment is expected to produce around 5 megawatts of direct current electricity, supplying 15% to 20% of the site's energy needs, sufficient to power over 400 homes for a year. This highlights the growing demand for copper wiring in utility-scale renewable projects, as system operators prioritize materials with high conductivity and durability for reliable performance under extreme conditions. The initiative underscores America’s transition to clean energy.

In the automotive sector, copper wire continues to be indispensable for vehicle electrification and advanced communication systems. With the rapid advancement of Electric Vehicles (EVs), automakers are increasingly turning to high-voltage copper wiring to support battery systems, regenerative braking, and onboard diagnostics. General Motors has significantly bolstered its investment in EV charging infrastructure. In December 2024, GM teamed up with ChargePoint to install up to 500 ultra-fast DC charging ports under the "GM Energy" brand at dealerships and public locations across the U.S., featuring both CCS or NACS compatibility to improve charging access and efficiency for EV owners.

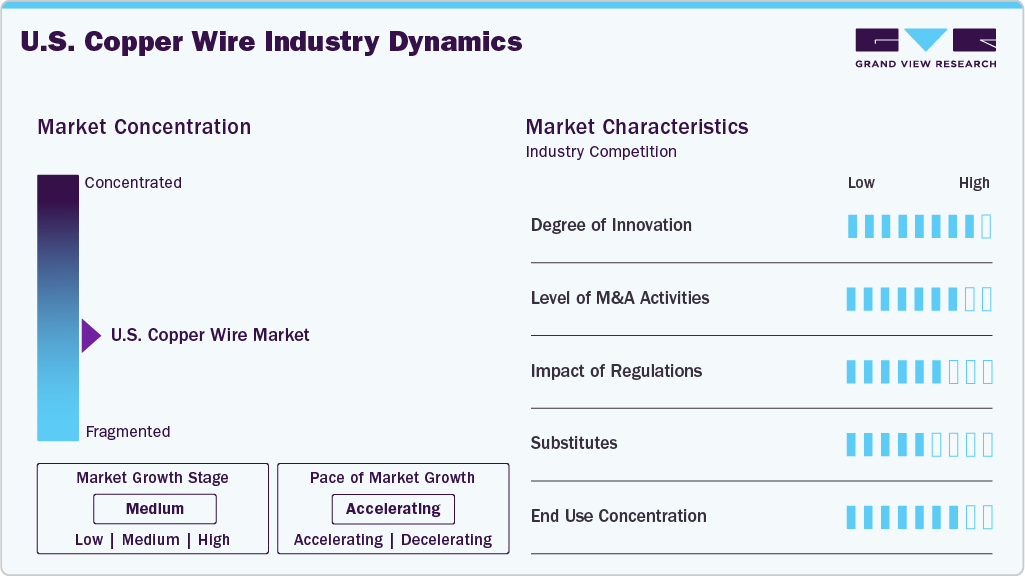

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of market growth is steady. The U.S. copper wire market continues to grow steadily, driven by its indispensable role across core infrastructure, including residential and commercial construction, power transmission, automotive systems, and communication networks. Copper wire remains preferred due to its superior electrical conductivity, thermal performance, and long-term reliability. The demand for durable, high-efficiency wiring systems is expected to accelerate as the country shifts toward electrification and renewable energy integration. Industry players are responding by ramping production capabilities, enhancing process efficiencies, and investing in sustainable technologies to meet regulatory and commercial expectations.

Innovation remains a defining feature of the U.S. copper wire industry, with manufacturers focusing on modernizing production facilities, integrating digital monitoring technologies, and reducing environmental impact. Companies are implementing advanced rod mill systems, energy-efficient manufacturing lines, and traceability solutions to improve product quality and operational performance. Merger and acquisition activity has played a pivotal role in shaping the U.S. market, with several strategic consolidations aimed at expanding market presence and improving operational synergies. In April 2024, Prysmian Group announced the acquisition of Encore Wire and completed this acquisition in July 2024. The deal, valued at approximately €3.9 billion (USD XX billion), will enhance Prysmian's North American footprint and broaden its product offering in building and power wire segments.

Voltage Insights

The low segment registered the largest revenue share of 51.9% in 2024. This is attributable to its significant utilization in residential, commercial, and light industrial applications like building wiring, LAN cabling, and appliance power supply. A recent development reinforcing this dominance is ABB’s announcement of a USD 120 million investment in March 2025 to expand its low-voltage electrification production in Selmer, Tennessee, and Senatobia, Mississippi. This initiative will boost manufacturing capacity by over 50% and support increased demand from data centers, utilities, and building projects.

The high segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. This growth can be attributed to rising investments in utility-scale infrastructure and grid modernization and the growing transmission requirements of renewable energy systems. These applications rely on copper's high conductivity and thermal stability to ensure electricity's safe and efficient delivery across long distances and demanding environments. As government initiatives and private sector projects increasingly prioritize grid resilience and electrification, the role of high-voltage copper wire in power infrastructure is expected to expand significantly, reinforcing its strategic importance in the evolving energy landscape.

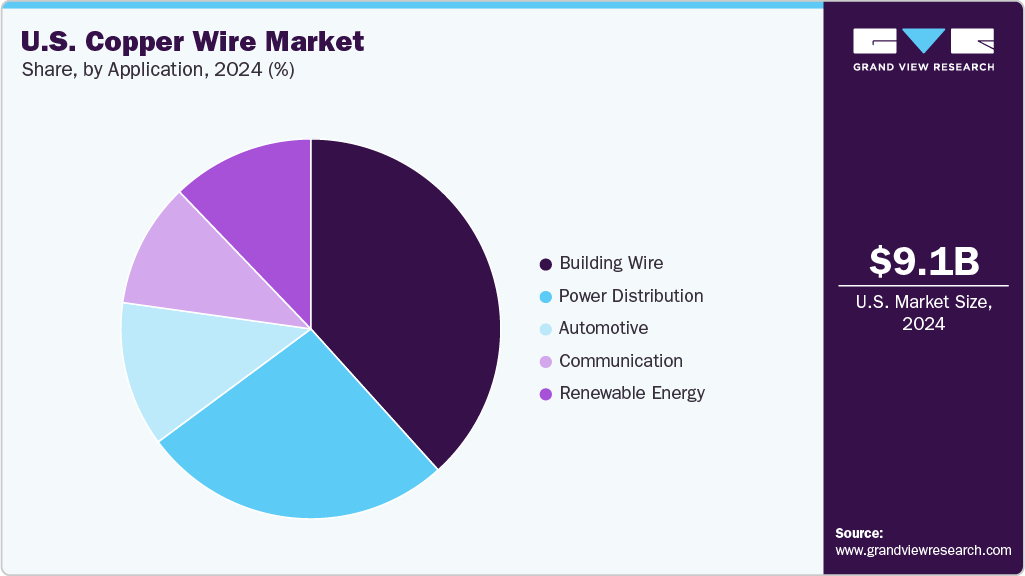

Application Insights

The building wire segment accounted for the highest revenue share of the U.S. copper wire market in 2024. This segment serves as the backbone for residential and commercial construction, power distribution, lighting systems, and appliance connectivity sectors. In June 2023, Southwire Company announced a 30% expansion of its Florence, Alabama, manufacturing campus, adding approximately 340,000 square feet. This development directly supports the company's goal of increasing commercial and residential copper building wire output capacity, which remains among the highest demand applications in the U.S. copper wire industry. The expanded facility will enable Southwire to meet growing construction and infrastructure needs across housing, commercial spaces, and institutional buildings. With construction scheduled for completion in 2025, this move reflects the company's long-term commitment to scaling production with rising demand for efficient, high-quality copper wiring solutions in the building sector.

The renewable energy segment is expected to grow at the fastest rate over the forecast years. This growth can be attributed to the scaling up of solar farms, wind turbines, and associated grid interconnection infrastructure. Copper's exceptional conductivity, resilience to thermal stress, and recyclability make it ideal for these renewable installations, particularly in long-length cables and grounding systems. Alongside renewable energy, automotive applications also rely heavily on copper wiring. Modern EVs integrate copper in safety sensors, infotainment systems, charging ports, and battery management circuits, underscoring the metal's versatility across various sectors.

Key U.S. Copper Wire Company Insights

The U.S. copper wire market is highly competitive, with numerous large companies vying for higher market share. Some key players in the U.S. copper wire industry are Aviva Metals, Kris-Tech Wire, and Kalas. The market is projected to experience steady growth, fueled by increased investments in electrical networks, the expansion of renewable energy, and advancements in industrial automation. However, it remains quite fragmented due to the presence of various regional and local competitors. The market is also experiencing mergers and acquisitions as larger firms buy regional companies to enhance their geographic reach and product offerings, thereby influencing the competitive landscape of the industry.

-

Encore Wire, founded in 1989 in McKinney, Texas, is a premier U.S. manufacturer of copper and aluminum residential, commercial, and industrial wire and cable. Operating from a 460‑acre campus covering over 3.5 million square feet, the company is focused on superior product quality, rapid delivery, and customer-focused service. It is supported by innovations like Reel Payoff, Cyclone Barrel Pack, and PullPro that improve efficiency on job sites.

-

Aviva Metals is a manufacturer based in the U.S. It distributes brass, bronze, and specialty copper alloys, with over 40 years of experience and over 10 million pounds in inventory holdings. Operating a state-of-the-art foundry in Lorain, Ohio, since 1998, the company is known for continuous cast bronze and brass production, complemented by an international distribution hub in Toulon, France. Its extensive stock encompasses over 100 copper alloy grades across various shapes, including tubes, rounds, sheets, and made-to-order profiles, serving industries like aerospace, oil & gas, marine, and electronics.

Key U.S. Copper Wire Companies:

- Aviva Metals

- Kris-Tech Wire

- Kalas. Manufacturing

- Encore Wire Corporation

- Technical Cable

- Southwire Company, LLC.

- Philatron.

- Rea.

- International Wire

Recent Developments

-

In February 2024, Encore Wire Corporation declared a two-cent per share cash dividend, payable April 19, 2024, reflecting strong earnings and cash flow. The move demonstrates Encore Wire's financial strength and commitment to delivering shareholder value.

-

In July 2023, Kris‑Tech Wire initiated a major expansion of its Rome, New York manufacturing facility, doubling production, warehouse, and office space to support its growing portfolio, including tray cable, tracer wire, and utility-grade products. This project is part of a strategic multiyear plan to fulfill emerging market demand in industrial and utility segments, underscoring the company's commitment to growth and enhanced product capabilities.

U.S Copper Wire Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 12.58 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kiloton, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, application

Key companies profiled

Aviva Metals, Kris-Tech Wire, Kalas. Manufacturing, Encore Wire Corporation, Technical Cable*, Southwire Company, LLC., Philatron., Rea., International Wire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Copper Wire Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. copper wire market report based on voltage and application:

-

Voltage Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Application Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

Building Wire

-

Power Distribution

-

Automotive

-

Communication

-

Renewable Energy

-

Frequently Asked Questions About This Report

b. The U.S. copper wire market size was estimated at USD 9.14 billion in 2024 and is expected to reach USD 9.35 billion in 2025.

b. The U.S. copper wire market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 12.58 billion by 2030.

b. The building wire segment dominated the market with a revenue share of over 37.0% in 2024.

b. Some of the key vendors of the global copper wire market are Aviva Metals, Kris-Tech Wire, Kalas Manufacturing, Encore Wire Corporation, Technical Cable, Alanwire, Southwire Company, LLC, Philatron, Rea, International Wire, among others.

b. The key factor that is driving the growth of the U.S. copper wire market is the growing demand for efficient and reliable electrical conductivity solutions across sectors such as construction, telecommunications, power generation, and automotive—particularly with the rising adoption of electric vehicles and renewable energy systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.