- Home

- »

- Medical Devices

- »

-

U.S. Cryoablation Probes Market Size, Industry Report, 2033GVR Report cover

![U.S. Cryoablation Probes Market Size, Share & Trends Report]()

U.S. Cryoablation Probes Market (2025 - 2033) Size, Share & Trends Analysis By Application (Cardiac Arrhythmias, Oncology, Dermatology), By End Use (Hospitals, Specialty Clinics, Ambulatory Surgery Centers (ASCs)), And Segment Forecasts

- Report ID: GVR-4-68040-623-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cryoablation Probes Market Summary

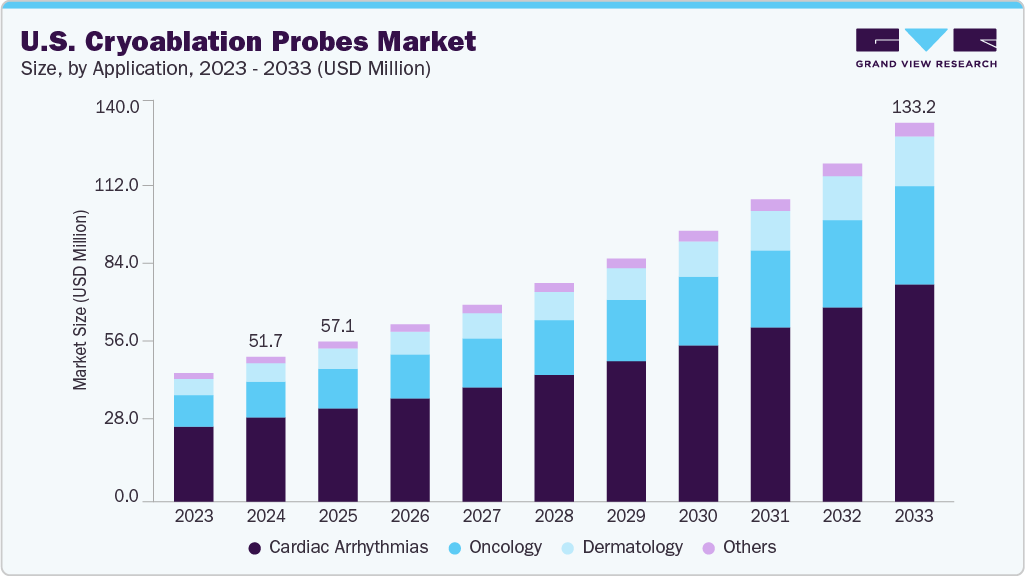

The U.S. cryoablation probes market size was estimated at USD 51.71 million in 2024 and is projected to reach USD 133.16 million by 2033, growing at a CAGR of 11.16% from 2025 to 2033. The market is witnessing significant growth driven by several key factors. These include the increasing prevalence of cardiovascular and oncological diseases, which necessitate minimally invasive treatment options.

Key Market Trends & Insights

- Cardiac arrhythmias segment dominated the U.S. market with the largest revenue share of 58.30% in 2024.

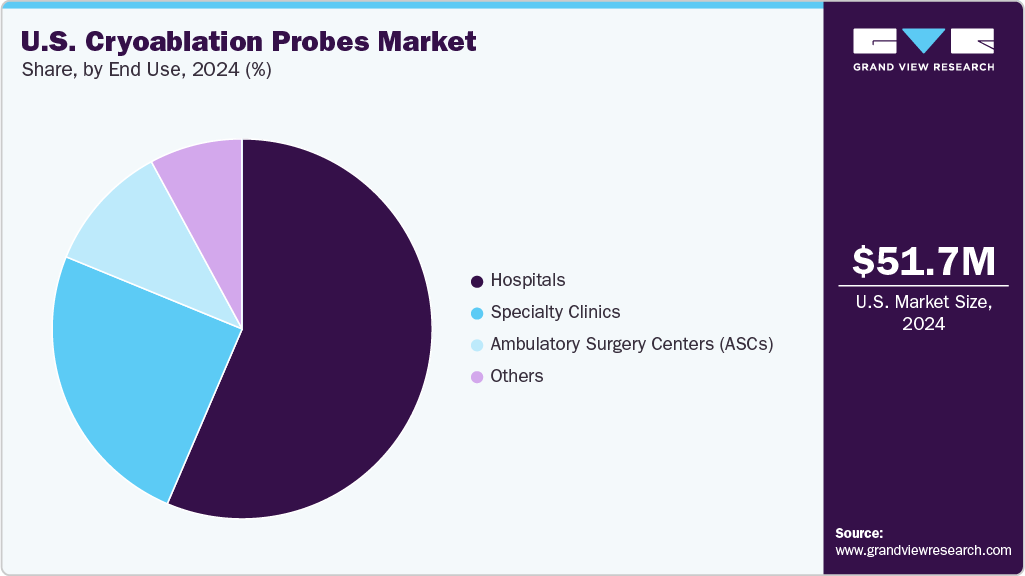

- By end use, the hospitals segment led the U.S. market with the largest revenue share of 56.54% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 51.71 Million

- 2033 Projected Market Size: USD 133.16 Million

- CAGR (2025-2033): 11.16%

Increasing prevalence of chronic diseases, such as cardiovascular diseases, mainly cardiac arrhythmia, such as atrial fibrillation, cancer, particularly lung, prostate, liver, and kidney cancers, among others, has heightened demand for minimally invasive treatment options like cryoablation. For instance, according to the American Heart Association, Inc., currently, an estimated five million Americans are living with atrial fibrillation (AFib), which is the most common type of cardiac arrhythmia, and this number is expected to increase to over 12 million by 2030.

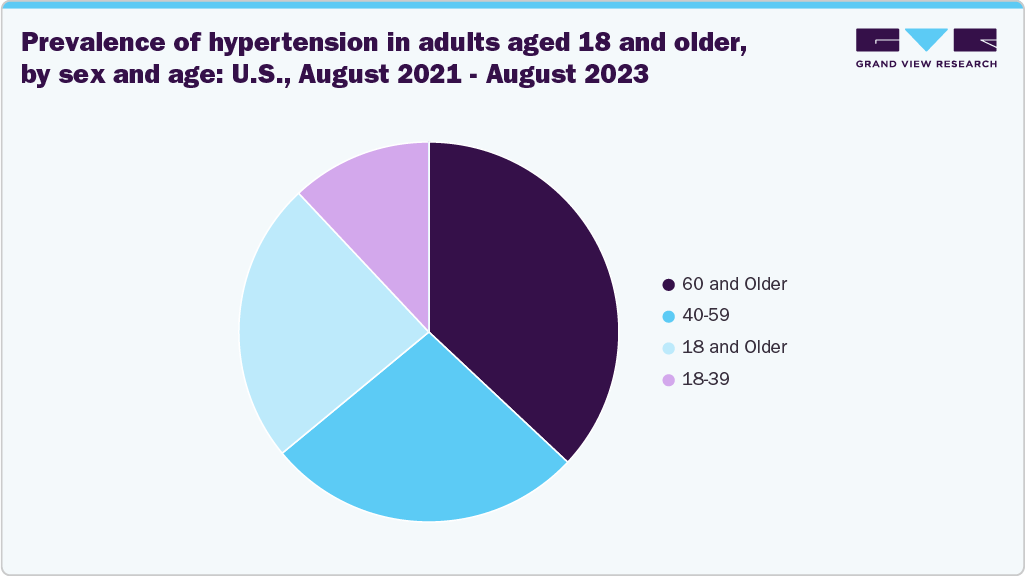

Furthermore, according to a research article published in February 2025 and an American Heart Association report, in 2022, the highest rate of high blood pressure among U.S. adults was observed in Mississippi at 40.2%, while Colorado had the lowest at 24.6%. Hypertension prevalence tends to rise with age, reaching 28.5% among individuals aged 20 to 44, 58.6% among those aged 45 to 64, and 76.5% in adults aged 65 and older. As a result, the growing prevalence of hypertension is further driving the market growth.

In addition, the growing prevalence of cancer is also expected to boost demand during the forecast period. For instance, according to the American Cancer Society report, in the U.S. in 2025, approximately 316,950 new cases of invasive breast cancer are expected to be diagnosed in women, along with approximately 2,800 cases in men. In addition, an estimated 59,080 cases of ductal carcinoma in situ (DCIS) will be diagnosed in women. The year is projected to see around 42,680 breast cancer-related deaths, with 42,170 occurring in women and 510 in men.

Advances in medical technology have led to the development of more precise and effective cryoablation devices, enhancing their adoption among healthcare providers. The expanding geriatric population and growing preference for targeted tumor therapies further boost demand. In addition, regulatory approvals and strategic collaborations among key players enhance market expansion. Increasing applications in cardiology, dermatology, and pain management contribute to market growth. In addition, growing awareness and acceptance of minimally invasive procedures, coupled with benefits such as reduced recovery time and fewer complications, are fueling market expansion. The rising geriatric population, who are more susceptible to cancer and other conditions treatable with cryoablation, further propels demand. Moreover, the increasing investment in healthcare infrastructure and research activities aimed at improving cryoablation techniques contributes to the market’s upward trajectory. Overall, these factors collectively drive the adoption of cryoablation probes, positioning the market for continued growth in the coming years.

Estimated Number of New Cases for Selected Cancers in the U.S., 2025

Cancer Type

Number of New Cases

Female Breast

316,950

Colon & Rectum

154,270

Leukemia

66,890

Lung & Bronchus

226,650

Melanoma of the skin

104,960

Non-Hodgkin Lymphoma

80,350

Prostate

313,780

Urinary Bladder

84,870

Uterine Cervix

13,360

Uterine Corpus

69,120

Estimated Number of New Cancer Cases by State, U.S., 2025

U.S. State

New Cancer Cases

California

199,980

Florida

171,960

Texas

150,870

New York

123,430

Pennsylvania

90,240

Illinois

78,870

Ohio

77,010

North Carolina

71,320

Georgia

66,210

Michigan

66,040

New Jersey

59,840

Virginia

50,510

Washington

46,500

Massachusetts

44,000

Arizona

42,560

Indiana

42,150

Source: American Cancer Society

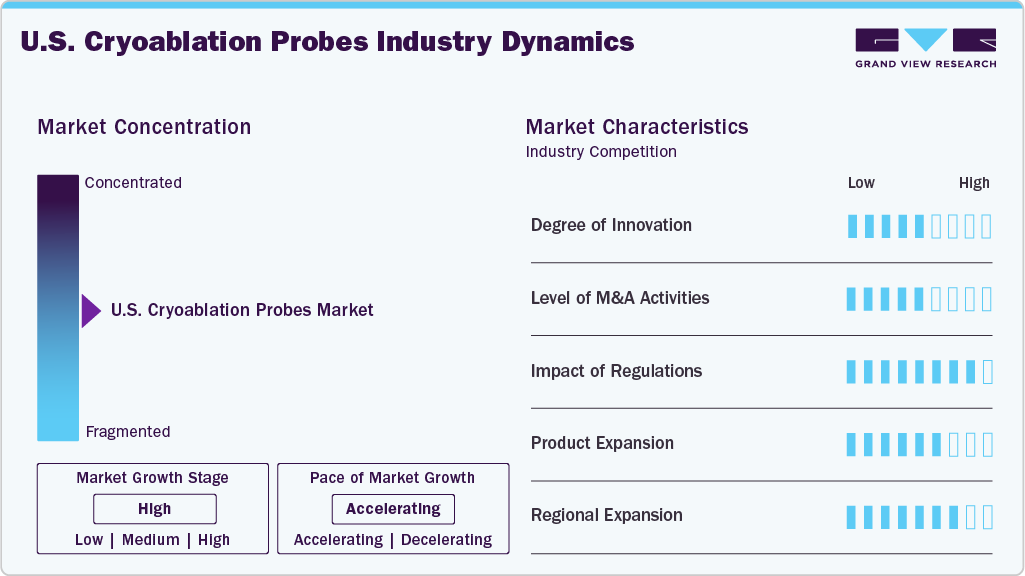

Market Concentration & Characteristics

The cryoablation devices industry in the U.S. is moderately concentrated, with key players such as Atricure, Inc., Medtronic, Varian, A Siemens Healthineers Company, and IceCure Medical driving innovation. It is characterized by rapid technological advancements, increasing regulatory approvals, and expanding applications in oncology, cardiology, and dermatology. Market growth is fueled by rising demand for minimally invasive procedures and improved patient outcomes. The industry features strong R&D investments, strategic partnerships, and geographic expansions to enhance market presence. In addition, increasing awareness and favorable reimbursement policies support adoption. While barriers to entry include high development costs and regulatory hurdles, innovation and clinical efficacy continue to shape the competitive landscape. The cryoablation probes industry has witnessed significant advancements.

The U.S. cryoablation probes industry is experiencing notable innovation, with companies such as AtriCure, Inc. and Siemens Healthineers leading the way in innovations. For instance, in October 2024, AtriCure, Inc., one of the leading innovators in surgical treatments for atrial fibrillation (Afib), left atrial appendage (LAA) management, and post-operative pain management, announced the launch of the cryoSPHERE MAX cryoablation probe. This new probe features a larger ball tip designed to enhance Cryo Nerve Block (cryoNB) therapy. The cryoSPHERE MAX reduces freeze times by 50% compared to AtriCure’s original cryoSPHERE probe and over 30% compared to the cryoSPHERE+ model, improving procedural efficiency.

Regulatory agencies such as the Food and Drug Administration (FDA) establish quality and safety standards for medical devices, including cryoablation probes. These devices are classified into different categories based on the associated risk levels, with regulatory scrutiny varying accordingly. For instance, in June 2024, IceCure Medical, one of the developers of minimally invasive cryoablation technology that destroys tumors through freezing as an alternative to surgery, obtained marketing authorization from the U.S. Food and Drug Administration (FDA) for its next-generation single-probe cryoablation system, the XSense Cryoablation System with CryoProbes.

The U.S. cryoablation probes industry has seen a moderate level of mergers and acquisitions, driven by the need for expanded product portfolios and technological capabilities. Companies are strategically aligning to enhance distribution networks and enter new regional markets. These consolidations support innovation while maintaining competitive pricing and compliance with evolving healthcare regulations.

The U.S. cryoablation probes industry is moderately fragmented, with numerous regional players competing based on product innovation, pricing, and regulatory compliance. While a few established companies hold significant market share, emerging players continue to enter with niche offerings.

Regional expansion in the U.S. cryoablation probes industry is actively driven by strategic investments and collaborations to address healthcare challenges.

Application Insights

The cardiac arrhythmias segment dominated the market in 2024 with the largest revenue share of 58.30% in application landscape in the U.S. owing to factors such as increasing prevalence of cardiovascular diseases like coronary artery disease and hypertension; rising incidence of arrhythmias, such as atrial fibrillation; advancements in cryoablation technology; and increasing awareness among healthcare providers and patients about the benefits of cryoablation for arrhythmia management. According to a research article published in US Cardiology Review, Radcliffe Medical Media, namely, Catheter Cryoablation of Cardiac Arrhythmias, suggests that for numerous cardiac arrhythmias, catheter cryoablation has become a safe and effective alternative to radiofrequency (RF) ablation. Furthermore, a number of hospitals and clinics, such as The General Hospital Corporation and Stanford Health Care, use cryoablation for the treatment of atrial fibrillation as an alternative therapy. Hence, the growing preference for cryoablation for the treatment of atrial fibrillation is further fueling the market growth.

The oncology segment is projected to grow at the fastest CAGR of 11.83% over the forecast period. Advances in cryoablation technology have enabled minimally invasive, precise, and effective treatment options for various types of tumors, including liver, kidney, lung, and prostate cancers. The growing prevalence of cancer worldwide, coupled with the increasing adoption of minimally invasive procedures to reduce patient recovery time and improve outcomes, is fueling demand for cryoablation solutions. In addition, the favorable safety profile of cryoablation, which minimizes damage to surrounding healthy tissue, makes it an attractive alternative to traditional surgical methods. Rising awareness among healthcare providers about the benefits of cryoablation in oncology, along with ongoing clinical research demonstrating its efficacy, further propels its adoption. These factors collectively position the oncology segment for rapid growth within the cryoablation probes industry in the coming years.

End Use Insights

The hospitals segment held the largest share of 56.54% in 2024. Hospitals typically have access to advanced medical technologies and specialized healthcare professionals, making them the primary setting for complex procedures like cryoablation. The availability of comprehensive infrastructure, including cath labs and surgical suites, enables hospitals to perform minimally invasive and specialized treatments efficiently. In addition, hospitals often serve as centers of excellence for cardiovascular care, attracting patients seeking advanced treatment options. The integration of cryoablation procedures into standard hospital services is supported by favorable reimbursement policies, which encourage hospitals to adopt these technologies. Furthermore, the presence of trained personnel and the capacity to handle potential complications make hospitals the preferred environment for performing cryoablation, thereby driving their dominance in the market.

The ambulatory surgery centers (ASCs) segment is expected to grow the fastest in the coming years. ASCs offer a cost-effective, convenient, and efficient setting for minimally invasive procedures like cryoablation, which reduces hospital stays and accelerates patient recovery. The growing preference for outpatient procedures among patients and healthcare providers, driven by advancements in cryoablation technology that enable safer and simpler interventions, further fuels this growth.In addition, the increasing adoption of cryoablation for treating various conditions, such as cardiac arrhythmias and tumors, in outpatient settings is supported by favorable reimbursement policies and the availability of skilled specialists.

Key U.S. Cryoablation Probes Company Insights

Atricure, Inc., Varian, A Siemens Healthineers Company, IceCure Medical, Medtronic, Bruker, Erbe USA, Incorporated, Keeler, and HealthTronics, Inc. are some of the major players in the U.S. market. Companies are expanding their portfolios of cryoablation probes to gain a competitive advantage in the coming years.

Key U.S. Cryoablation Probes Companies:

- Atricure, Inc.

- Varian, A Siemens Healthineers Company

- IceCure Medical

- Medtronic

- Bruker

- Erbe USA, Incorporated

- Keeler

- HealthTronics, Inc.

Recent Developments

-

In October 2024, AtriCure, Inc., one of the leading innovators in surgical treatments for atrial fibrillation (Afib), left atrial appendage (LAA) management, and post-operative pain management, announced the launch of the cryoSPHERE MAX cryoablation probe. This new probe features a larger ball tip designed to enhance Cryo Nerve Block (cryoNB) therapy. The cryoSPHERE MAX reduces freeze times by 50% compared to AtriCure’s original cryoSPHERE probe and over 30% compared to the cryoSPHERE+ model, improving procedural efficiency.

-

In April 2024, AtriCure, Inc. announced the launch of the cryoSPHERE+ cryoablation probe. This new device incorporates advanced insulation technology, enabling a 25% reduction in freeze times compared to the company's previous cryoSPHERE device. Currently, the cryoSPHERE+ is in an extended limited launch phase within the U.S., with a full commercial rollout anticipated by the end of the second quarter.

-

In June 2024, IceCure Medical, one of the developers of minimally invasive cryoablation technology that destroys tumors through freezing as an alternative to surgery, obtained marketing authorization from the U.S. Food and Drug Administration (FDA) for its next-generation single-probe cryoablation system, the XSense Cryoablation System with CryoProbes.

-

In May 2023, Varian, a Siemens Healthineers company, announced the launch of Isolis cryoprobe, a single-use, disposable device engineered for use with CryoCare systems. This innovative tool aims to enhance procedural efficiency and precision during cryoablation procedures.The new Isolis cryoprobe provides interventional radiologists with enhanced operational control, featuring design elements that improve predictability, precision, and efficiency. It is equipped with a compact 2.1mm (14-gauge) shaft and a sharp probe tip, enabling smooth and accurate placement during procedures.

KoL Responses

-

“cryoSPHERE+ is a meaningful innovation that I believe will improve patient care, enhance outcomes, and enable physicians to perform procedures with greater ease and confidence. Since the launch of our pain management franchise over five years ago, we’ve seen a significant impact on patients’ lives, and with this launch, we look forward to serving even more people in the future,” said Michael Carrel, President and Chief Executive Officer at AtriCure.

-

“We are hopeful that the FDA will grant market authorization for ProSense for early-stage breast cancer in the first quarter of 2025 following the FDA Advisory Panel's positive vote in November 2024. Authorization, if granted, is expected to increase direct sales of ProSense systems and disposable probes in the U.S, which is currently led by our VP of Sales North America, Mr. Shad Good, and our U.S. team.”- Eyal Shamir, CEO and Director at IceCure Medical

U.S. Cryoablation Probes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 57.13 million

Revenue forecast in 2033

USD 133.16 million

Growth rate

CAGR of 11.16% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 – 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Country scope

U.S.

Key companies profiled

Atricure, Inc.; Varian, A Siemens Healthineers Company; IceCure Medical; Medtronic; Bruker; Erbe USA, Incorporated; Keeler; HealthTronics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cryoablation Probes Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cryoablation probes market report based on application and end use:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiac Arrhythmias

-

Oncology

-

Lung cancer

-

Prostate cancer

-

Breast cancer

-

Kidney cancer

-

Liver cancer

-

Others

-

-

Dermatology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers (ASCs)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cryoablation probes market size was estimated at USD 51.71 million in 2024 and is projected to reach USD 133.16 million by 2033.

b. The U.S. cryoablation probes market is expected to grow at a CAGR of 11.16% from 2025 to 2033

b. The Cardiac Arrhythmias segment held the largest market share of 58.44% in 2024 owing to factors such as increasing prevalence of cardiovascular diseases such as coronary artery disease and hypertension, rising incidence of arrhythmias, such as atrial fibrillation, advancements in cryoablation technology, and increasing awareness among healthcare providers and patients about the benefits of cryoablation for arrhythmia management.

b. Some prominent players in the U.S. cryoablation probes market include Atricure, Inc., Varian, A Siemens Healthineers Company, IceCure Medical, Medtronic, Bruker, Erbe USA, Incorporated, Keeler, and HealthTronics, Inc.

b. The driving factors of the U.S. cryoablation probes market include the increasing prevalence of cancer and cardiac arrhythmias, which demand minimally invasive treatment options. Advances in cryoablation technology and growing adoption of such procedures in hospitals and outpatient settings also contribute to market growth. Additionally, rising awareness of the benefits of cryoablation, such as reduced recovery times and fewer complications, further propel market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.