- Home

- »

- Next Generation Technologies

- »

-

U.S. Cryptocurrency Market Size And Share Report, 2030GVR Report cover

![U.S. Cryptocurrency Market Size, Share & Trends Report]()

U.S. Cryptocurrency Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Hardware (Central Processing Unit, Graphics Processing Unit), By Software, By Process, By Type, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-059-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

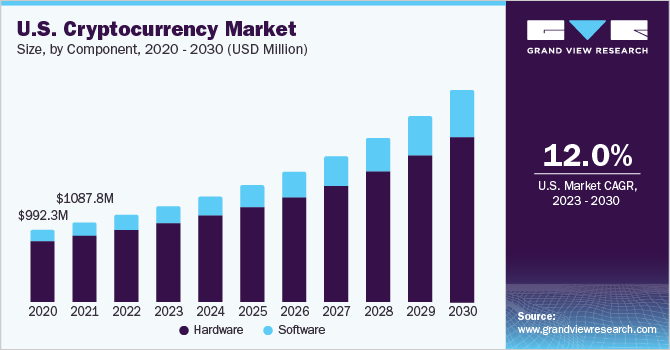

The U.S. cryptocurrency market size was valued at USD 1.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. The market has witnessed rapid growth in recent years, driven by various factors, including rising awareness about blockchain technology. Another key growth driver is the increasing adoption of cryptocurrencies by mainstream financial institutions. Major banks and asset managers have been investing in cryptocurrencies, providing custody services, and offering crypto-related investment products to their clients.

The trend toward legitimizing cryptocurrencies as a viable investment option attracts more investors and drives demand. The growing acceptance of digital assets as a means of payment is another growth driver. Major payment processors, such as PayPal, have enabled their users to buy, sell, and hold cryptocurrencies, while some retailers have started accepting cryptocurrencies as payment. It helped to increase the use cases and utility of cryptocurrencies, making them more attractive to consumers.

Regulatory developments have also played a significant role in shaping the U.S. cryptocurrency industry. The Securities and Exchange Commission (SEC) has been guiding the regulatory status of cryptocurrencies. It has helped to clarify the legal framework for crypto-related activities. This has made it easier for companies to comply with regulations and has given investors more confidence in the legitimacy of the market.

The rise of Decentralized Finance (DeFi) has also been a key growth driver for the U.S. cryptocurrency market. DeFi is a growing movement that seeks to build financial applications on blockchain technology, enabling peer-to-peer transactions without the need for intermediaries. It has the potential to disrupt traditional financial services, and many investors are betting on the success of DeFi projects. The U.S. is a major hub for DeFi innovation, and many of the leading DeFi projects are based in the country.

However, the regulatory environment for cryptocurrencies in the U.S. is complex, with multiple agencies having overlapping jurisdictions and different interpretations of what constitutes a security or a commodity. This lack of clarity creates uncertainty and hinders the growth and adoption of cryptocurrencies in the U.S. To overcome this restraint, there is a need for clear and comprehensive regulations that can provide a framework for legitimate cryptocurrency businesses to operate and for investors to invest confidently in the market.

In recent years, some progress has been made toward this goal, with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) guiding the classification of cryptocurrencies and the requirements for Initial Coin Offerings (ICOs).

COVID-19 Impact Analysis

COVID-19 has positively impacted the market, as it has accelerated the adoption of digital currencies as a means of payment and investment. The pandemic has led to an increased demand for contactless payment options, as people are wary of handling physical cash and prefer to make transactions from the safety of their homes. This has led to a surge in the use of cryptocurrencies, which offer a secure and decentralized alternative to traditional payment methods.

Furthermore, the economic uncertainties brought about by the pandemic have led many investors to seek refuge in digital assets such as Bitcoin, which has seen a significant increase in value over the past year. As a result, more institutional investors are looking to enter the cryptocurrency market, which is driving up demand and increasing liquidity. COVID-19 has also accelerated the development of blockchain-based solutions in various industries, such as supply chain management and healthcare, which are expected to further fuel the growth of the market in the country.

Component Insights

The hardware segment accounted for the largest revenue share of more than 82.0% in 2022. The growth is expected to be driven by various factors such as lowered power consumption of cryptocurrency miners and higher processing speed. To meet the changing expectations of consumers, many businesses have developed Bitcoin mining hardware. Moreover, mining devices require swift, effective, and stable hardware, such as graphics processing units. These factors are expected to create significant growth opportunities for the industry over the projected period.

The software segment is anticipated to register significant growth over the forecast period. The expansion of the segment can be attributed to the rising need for software applications that are specialized for cryptocurrency mining and exchange. The development of software solutions to effectively handle the vast amount of data generated by cryptocurrencies is anticipated to boost the growth of this segment. In addition, the growing demand for cryptocurrencies has increased the need for cryptocurrency wallets and exchange software, which is likely to fuel the growth of this segment.

Hardware Insights

The application-specific integrated circuit segment accounted for the largest revenue share of over 43.0% in 2022. Application-Specific Integrated Circuits (ASICs) are electronic circuits specifically designed for mining virtual currencies like Bitcoin, Litecoin, and Ethereum. Companies increasingly adopt ASIC miners for cryptocurrency mining, driven by the need for low-energy consumption devices. ASIC miners also require less maintenance and allow for efficient energy usage, which is expected to fuel the growth of the segment.

The graphics processing units segment is anticipated to register significant growth over the forecast period. Graphics Processing Units (GPUs) are high-performance chips used for rendering graphics and images. However, the increasing demand for cryptocurrency mining has led to the adoption of GPUs as they can perform complex mathematical calculations required for mining cryptocurrencies. GPUs provide a cost-effective alternative to specialized mining hardware like ASICs, as they can be used for other purposes as well. Moreover, GPUs can handle multiple algorithms, which allows for flexibility in mining different types of cryptocurrencies.

Software Insights

The exchange software segment held the largest revenue share of over 32.0% in 2022, due to the growing popularity of cryptocurrencies as a mode of payment and investment. Cryptocurrency exchanges enable users to buy, sell and trade digital currencies, providing a platform for traders and investors to transact securely and efficiently. The increasing demand for cryptocurrencies has led to the growth of exchanges, driving the demand for exchange software. In addition, the growing trend of Initial Coin Offerings (ICOs), where new cryptocurrencies are offered to investors, has also contributed to the growth of the exchange software segment.

The wallet segment is expected to register significant growth over the forecast period. The increasing demand for cryptocurrency investment has led to the need for secure storage options. Cryptocurrency wallets offer a secure way to store digital assets and protect them from theft or hacking. In addition, with the growing popularity of DeFi, there is a need for more advanced wallet solutions that enable users to access and manage multiple cryptocurrencies and interact with decentralized applications. Moreover, the increasing adoption of cryptocurrencies by merchants for payments has led to the need for user-friendly wallets that can be easily used for everyday transactions.

Process Insights

The mining segment dominated the market in 2022 and accounted for a revenue share of more than 74.0%, due to its significant role in validating transactions and adding new blocks to the blockchain network. Cryptocurrency mining is the process of solving complex mathematical algorithms using powerful computers, which create new coins.

With the rising popularity of digital currencies and their increasing adoption, the demand for mining hardware and software has also increased. Moreover, the introduction of new and advanced mining hardware, such as ASICs, has further fueled the growth of the mining segment.

The transaction segment is anticipated to register significant growth over the forecast period. The segment is witnessing rapid growth, due to the increasing demand for faster and more secure transactions. With the growth in the popularity of cryptocurrencies, there is a need for a seamless and secure payment process.

Blockchain technology has enabled the development of payment processing systems that provide secure and fast transaction processing. Furthermore, the integration of cryptocurrency payment systems with existing payment processing platforms is expected to further propel the growth of the transaction segment.

Type Insights

The Bitcoin segment dominated the market in 2022 and accounted for a revenue share of more than 35.0%. It was the first cryptocurrency to be introduced and gained significant popularity among users. In addition, Bitcoin has a limited supply of 21 million coins, which makes it a scarce and valuable asset.

The cryptocurrency also has a robust and secure blockchain network that ensures transactions are transparent and irreversible. Furthermore, Bitcoin has become widely accepted by merchants and businesses, making it easier for users to transact using cryptocurrency.

The Ethereum segment is anticipated to register significant growth over the forecast period. One of the primary reasons for its popularity is the Ethereum network's ability to support smart contracts, which has opened up a world of possibilities for Decentralized Applications (dApps) and DeFi.

Many developers and businesses have built dApps and DeFi platforms on top of the Ethereum network, leading to increased adoption and usage of cryptocurrency. In addition, Ethereum's strong community of developers and supporters has helped to drive its growth, with many working on improving the network's scalability, security, and usability.

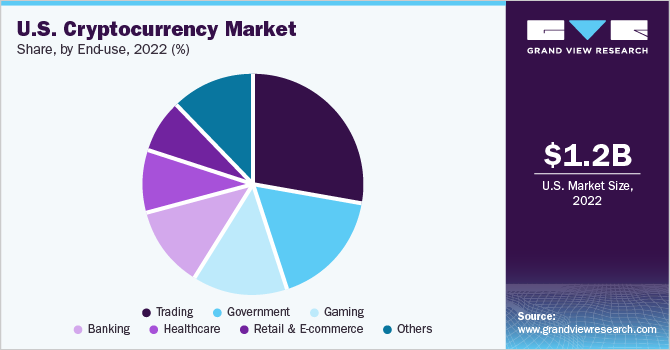

End-use Insights

The trading segment dominated the U.S. cryptocurrency industry in 2022 and accounted for a revenue share of over 28.0%. The increasing adoption of cryptocurrencies as an investment asset and the growing number of crypto trading platforms have led to the segment's dominance. In addition, the ease of trading, low transaction fees, and high liquidity of cryptocurrencies have attracted several traders to invest in them.

Moreover, the growing trend of peer-to-peer trading and the increasing number of cryptocurrency exchanges offering advanced trading features have further propelled the segment's growth. With the rising awareness and acceptance of cryptocurrencies, the trading segment is expected to continue dominating the market over the projected years.

The retail & e-commerce segment is expected to witness the fastest growth over the forecast period. The adoption of cryptocurrencies as a payment method by major retail and e-commerce players has significantly boosted the segment's growth. Furthermore, the low transaction fees associated with cryptocurrencies, compared to traditional payment methods, have encouraged small and medium-sized businesses to adopt cryptocurrencies. In addition, the convenience and speed of cryptocurrency transactions have made them popular among online shoppers.

Key Companies & Market Share Insights

Prominent players are aggressively invested in strategic initiatives, such as mergers and acquisitions, and partnerships. As a result, they can stay ahead of the competition and offer innovative solutions to their customers. For instance, in October 2020, BitGo Inc. announced that it would use Chainlink, an extensive decentralized oracle network, to boost the auditability and transparency of Wrapped Bitcoin Collateralization (WBTC). The use of Chainlink’s proof of reserve mechanism would offer BitGo Inc.’s ability to provide its users with the most accurate assessment of its WBTC reserves.

Vendors are focusing on offering enhanced solutions to improve the customers' experience. For instance, in September 2022, Bit Digital, Inc. announced the formal commencement of Ethereum staking operations in partnership with Blockdaemon, an institutional staking provider. Through the partnership, the company expanded its operations from core Bitcoin mining to also validating transactions on the Ethereum blockchain. Some prominent players in the U.S. cryptocurrency market include:

-

Advanced Micro Devices, Inc.

-

Coinbase, Inc.

-

Robinhood

-

Kraken

-

Intel Corporation

-

Ripple

-

Bit Digital, Inc.

-

BitGo

-

NVIDIA Corporation

-

Anchorage Digital

U.S. Cryptocurrency Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.90 billion

Growth rate

CAGR of 12.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, hardware, software, process, type, end-use

Country scope

U.S.

Key companies profiled

Advanced Micro Devices, Inc.; Coinbase, Inc.; Robinhood; Kraken; Intel Corporation; Ripple; Bit Digital, Inc.; BitGo; NVIDIA Corporation; Anchorage Digital

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cryptocurrency Market Report Segmentation

The report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cryptocurrency market report based on component, hardware, software, process, type, and end-use:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Hardware Outlook (Revenue, USD Million, 2017 - 2030)

-

Central Processing Unit

-

Graphics Processing Unit

-

Application-specific Integrated Circuit

-

Field Programmable Gate Array

-

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Mining Software

-

Exchange Software

-

Wallet

-

Payment

-

Others

-

-

Process Outlook (Revenue, USD Million, 2017 - 2030)

-

Mining

-

Transaction

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bitcoin

-

Bitcoin Cash

-

Ethereum

-

Litecoin

-

Ripple

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Banking

-

Gaming

-

Government

-

Healthcare

-

Retail & E-commerce

-

Trading

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cryptocurrency market size was estimated at USD 1.19 billion in 2022 and is expected to reach USD 1.31 billion in 2023.

b. The U.S. cryptocurrency market is expected to grow at a compound annual growth rate of 12.0% from 2023 to 2030 to reach USD 2.90 billion by 2030.

b. Hardware component segment dominated the U.S. cryptocurrency market with a share of 82.81% in 2022. The growth of the hardware segment in the U.S. cryptocurrency market is expected to be driven by various factors, such as lowered power consumption of cryptocurrency miners and higher processing speed.

b. Some key players operating in the U.S. cryptocurrency market include Advanced Micro Devices, Inc.; Coinbase, Inc.; Robinhood; Kraken, Intel Corporation; Ripple; Bit Digital, Inc.; BitGo; NVIDIA Corporation; and Anchorage Digital.

b. Key factors that are driving market growth include the adoption of cryptocurrencies by mainstream financial institutions and the growing acceptance of digital assets as a means of payment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.