- Home

- »

- Homecare & Decor

- »

-

U.S. Cycle Tourism Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Cycle Tourism Market Size, Share & Trends Report]()

U.S. Cycle Tourism Market (2025 - 2033) Size, Share & Trends Analysis Report By Group (Groups/Friends, Couples, Family, Solo), By Booking Mode (Direct, Travel Agent, Marketplace Booking), By Age Group (18 to 30 Years, 31 to 50 Years, Above 50 Years), And Segment Forecasts

- Report ID: GVR-4-68040-696-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cycle Tourism Market Size & Trends

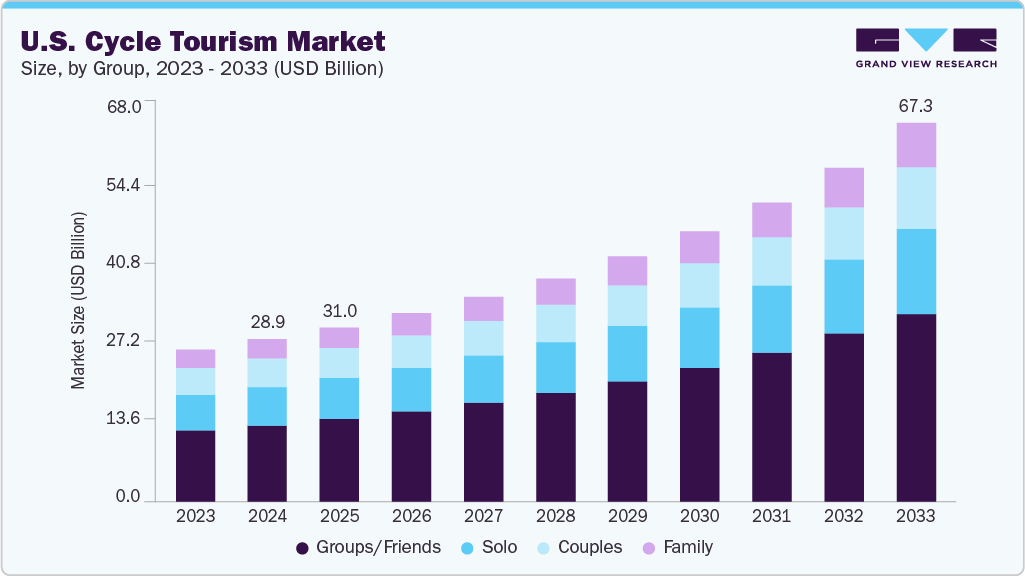

The U.S. cycle tourism market size was estimated at USD 28.87 billion in 2024 and is expected to reach USD 67.32 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. The growth of cycle tourism in the U.S. is fueled by rising health and wellness awareness, improved cycling infrastructure, and the increasing popularity of e-bikes, which make longer routes more accessible to a wider range of travelers. At the same time, a shift toward sustainable and eco-friendly travel encourages tourists to choose cycling as a low-impact alternative, while major events such as RAGBRAI and Cycle Oregon continue to draw thousands, boosting interest and participation nationwide.

The ongoing development of dedicated bike corridors, such as the Great American Rail‑Trail, Pacific Coast Bike Route, and East Coast Greenway, makes long-distance, scenic cycling in the U.S. safer and more appealing. For instance, the Great American Rail‑Trail, a planned 3,700‑mile coast-to-coast route, is now over 55% complete with more than 2,068 miles of bikeable trail.

Cycling aligns closely with the values of environmentally conscious travelers by offering a zero-emission mode of transport that significantly reduces individual carbon footprints. As an eco-tourism, bike tourism minimizes air pollution and energy consumption while promoting slower, more immersive travel that fosters deeper connections with local communities and landscapes. Recognizing this, local governments and tourism boards in the U.S. are actively promoting bike-friendly tourism through initiatives such as expanding bike paths, supporting trail development, and partnering with local businesses to offer cycling‑based experiences that emphasize sustainability and community benefits.

Popular multi‑day cycling events such as RAGBRAI in Iowa, Ride the Rockies in Colorado, and Cycle Oregon draw thousands of riders annually, significantly boosting local economies. RAGBRAI alone injects roughly USD 25 million per year into rural communities across Iowa, with overnight towns receiving between USD 5,000 and USD 15,000 in event stipends and local businesses, including restaurants, lodging, and retail, seeing major spikes in sales during the event. Cycle Oregon, a non‑profit tour across rural Oregon, was designed with the state’s tourism board to highlight scenic landscapes while delivering a tangible financial impact for small towns.

Bikepacking, a blend of minimalist camping and cycling, has emerged as a rapidly growing niche within the U.S. cycle tourism market, especially appealing to adventure-driven minimalists who crave self-sufficiency and immersive outdoor experiences. With lightweight, integrated gear setups, riders can explore remote trails across national parks and public lands, particularly in states such as Utah, Montana, and Arizona. Iconic routes such as the Kokopelli Trail (Colorado to Utah), the Arizona Trail, and the White Rim in Canyonlands National Park attract an increasing number of enthusiasts drawn to the freedom and connection with nature that bikepacking offers.

Consumer Insights

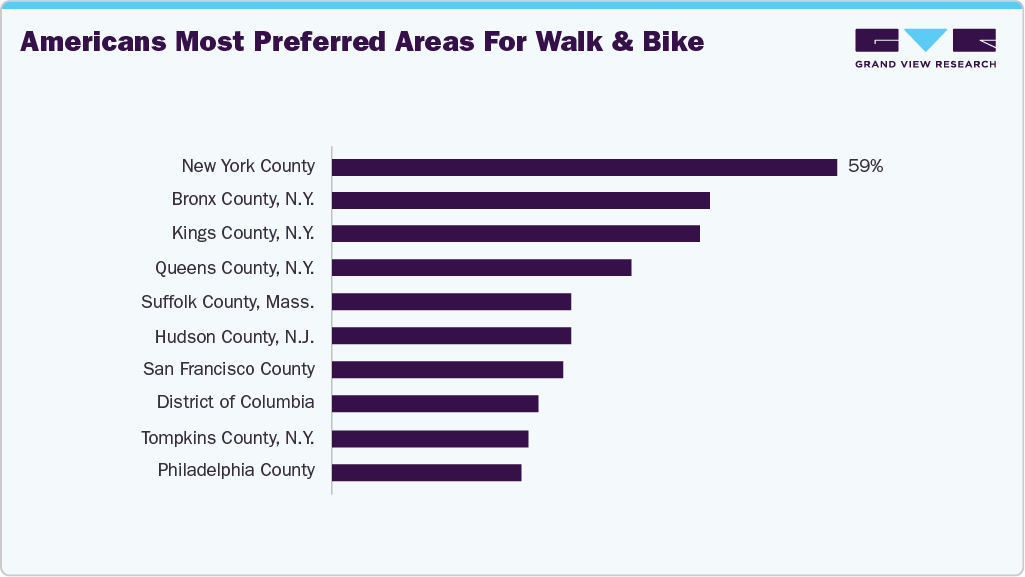

In the U.S., consumer preferences are increasingly shaped by a desire for active, sustainable, and experience-rich travel. Many tourists favor scenic routes, national parks, and small-town trails that combine physical activity with cultural or nature-based exploration.

Group and family-oriented tours are popular for their social and supportive environments, while solo travelers seek flexibility and personal challenge. Convenience also plays a key role; travelers value easy booking options, guided support, and high-quality rental bikes.

Group Insights

The group/friends segment accounted for a revenue share of 47.08% of the U.S. cycle tourism market in 2024. Cycling in groups with friends or through organized clubs adds a strong social and recreational appeal to the experience, making it especially popular among people who value shared adventures and bonding. Group riding also offers safety and mutual support, particularly on long-distance or rural routes, encouraging participation from less experienced cyclists. Flagship events like RAGBRAI in Iowa, Cycle Oregon, and Ride the Rockies attract thousands of group riders annually. According to the State of the Cycling Tours Operators Industry Survey 2024, 29% of the consumers come from the USA, followed by Germany (16%) and the UK (13%).

The family segment is expected to grow at a CAGR of 10.3% from 2025 to 2033. Families increasingly seek active, outdoor vacations promoting wellness, quality time, and screen-free experiences. Cycling has emerged as a popular choice in the U.S., offering a low-impact activity suitable for all ages while enabling exploration of scenic and cultural destinations. The growing availability of bike-friendly infrastructure, such as national park paths, dedicated family trails, and long-distance greenways such as the Great American Rail-Trail, has made it safer and more appealing for family travel. Moreover, tour operators now provide tailored services such as kid-sized bikes, trailers, tandem options, and guided packages, making the experience convenient and enjoyable. This shift reflects a broader desire among families to bond, stay active, and engage in educational, nature-based travel experiences.

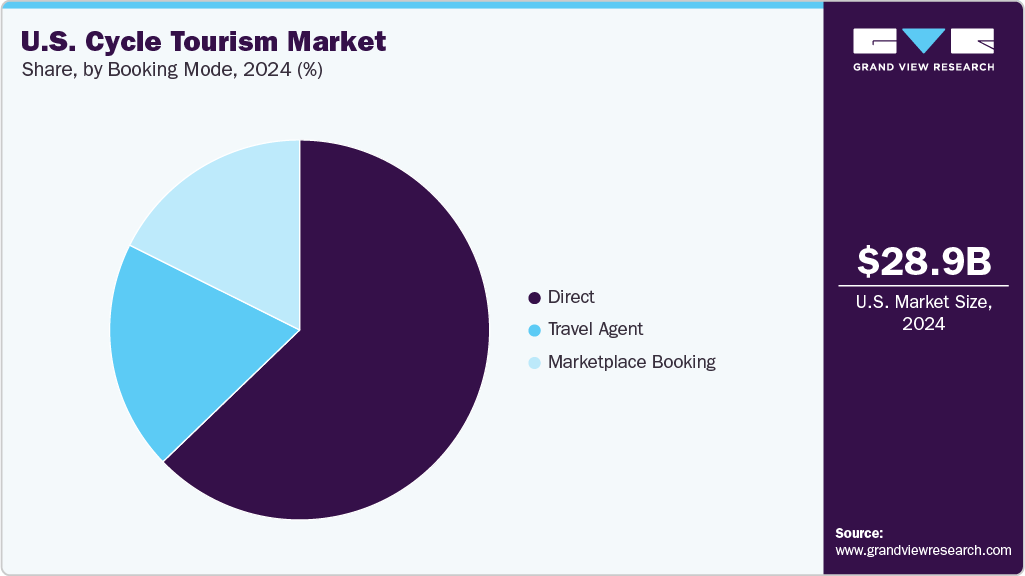

Booking Mode Insights

Direct booking accounted for a revenue share of 62.80% of the U.S. cycle tourism market in 2024. Direct bookings offer cost savings, greater customization, and enhanced trust. Travelers avoid third-party fees and benefit from transparent pricing by booking directly with service providers, such as tour operators, bike rental companies, or accommodations. It also enables better personalized itineraries and services, allowing cyclists to tailor their trips to specific needs and preferences. Moreover, dealing directly with providers fosters clearer communication and builds trust, which is especially important for handling logistics, special requests, or last-minute changes in cycling tours.

Marketplace booking is expected to grow at a CAGR of 10.8% from 2025 to 2033. Marketplace booking offers a convenient, centralized platform for travelers to compare a wide range of cycling tours, rentals, and packages. These platforms provide access to user reviews, ratings, and photos, which help build trust and guide informed decisions. This is particularly valuable for first-time or unfamiliar travelers. Additionally, their mobile-friendly interfaces and instant booking capabilities, including real-time availability and secure payments, cater to today’s tech-savvy, on-the-go consumers seeking efficiency and reliability.

Age Group Insights

The 31 to 50 age group accounted for a revenue share of 51.10% of the U.S. cycle tourism market in 2024. Due to their higher disposable income, strong focus on health and wellness, and preference for experiential travel. Individuals in this age range are financially stable and more willing to spend on premium cycling experiences, including guided tours and high-quality gear. Their active lifestyles align with the physical and recreational appeal of cycling, while their interest in meaningful, immersive travel makes cycle tourism especially attractive. In addition, increased work-life balance and flexible work arrangements allow more frequent, activity-based trips.

The 18 - 30 age group is expected to grow at a CAGR of 10.6% from 2025 to 2033 due to their strong preference for affordable, adventure-driven, and environmentally conscious travel experiences. This demographic is drawn to cycling as it aligns with their active lifestyles and desire for immersive, off-the-beaten-path exploration. The influence of social media further fuels interest, as sharing visually appealing travel moments becomes a key motivator. In addition, increased access to e-bikes and flexible, budget-friendly tour options has made cycling more accessible and attractive to younger travelers seeking meaningful and engaging ways to explore new destinations.

Key U.S. Cycle Tourism Company Insights

The U.S. cycle tourism market features a mix of established operators and emerging service providers. Leading companies adapt to travel preferences by innovating tour experiences and expanding their offerings to enhance convenience, sustainability, and overall rider satisfaction. This strategic approach enables them to stay competitive and reinforce their position in a rapidly growing and dynamic tourism industry.

-

Backroads is a leading U.S.-based active travel company specializing in premium cycling tours, hiking adventures, and multisport vacations. Founded in 1979, Backroads offers both guided and self-guided bike tours across the United States and internationally, featuring scenic routes, top-tier accommodations, and gourmet dining.

-

Trek Travel is a U.S.-based leader in luxury and active cycling vacations. Founded in 2002 by Trek Bicycle Corporation, it now operates independently while maintaining strong brand synergy. It specializes in handcrafted guided and self-guided tours across North America and globally, featuring premium Trek bikes, expert e‑bikes, expert support, and thoughtfully curated itineraries.

Key U.S. Cycle Tourism Companies:

- Backroads

- Trek Travel

- DuVine Cycling + Adventure Co.

- Butterfield & Robinson Inc.

- ExperiencePlus! Bicycle Tours

- SpiceRoads Cycling

- Ride and Seek

- Arbutus Routes

- Saddle Skedaddle Ltd.

- Adventure Cycling Association

Recent Developments

-

In June 2025, Cities such as Philadelphia, Austin, and Seattle likely to join established cycling hotspots such as San Francisco, New York, Miami, and Minneapolis in positioning themselves as premier U.S. destinations for cycle-based travel. These cities are heavily investing in expanded cycling infrastructure, like greenways, car-free corridors, and protected bike lanes, to cater not only to commuters but also to leisure and tourist riders.

-

In June 2025, Brand USA launches a national promotional campaign encouraging bike-based travel across the U.S., spotlighting everything from mountain biking in Bentonville to scenic cycling on the coast and commemorating major 2026 events like the U.S. Bicentennial and World Cup tours.

-

In June 2025, the Gordie Howe International Bridge opened between Detroit and Windsor. It included a toll-free bike and pedestrian pathway, creating a significant new cross-border green tourism route and connecting multiple trail networks.

U.S. Cycle Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.04 billion

Revenue forecast in 2033

USD 67.32 billion

Growth rate (Revenue)

CAGR of 10.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Group, booking mode, age group

Country scope

U.S.

Key companies profiled

Backroads; Trek Travel; DuVine Cycling + Adventure Co.; Butterfield & Robinson Inc.; ExperiencePlus! Bicycle Tours; SpiceRoads Cycling; Ride and Seek; Arbutus Routes; Saddle Skedaddle Ltd.; Adventure Cycling Association

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cycle Tourism Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cycle tourism market report by group, booking mode, and age group:

-

Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

Groups/Friends

-

Couples

-

Family

-

Solo

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct

-

Travel Agent

-

Marketplace Booking

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

18 to 30 Years

-

31 to 50 Years

-

Above 50 Years

-

Frequently Asked Questions About This Report

b. The U.S. cycle tourism market was estimated at USD 28.87 billion in 2024 and is expected to reach USD 31.04 billion in 2025.

b. The U.S. cycle tourism market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2033 to reach USD 67.32 billion by 2033.

b. The group/friends segment accounted for a revenue share of 47.08% of the U.S. cycle tourism market in 2024. Cycling in groups with friends or through organized clubs adds a strong social and recreational appeal to the experience, making it especially popular among people who value shared adventures and bonding.

b. Some of the key players in the U.S. cycle tourism market is Backroads; Trek Travel; DuVine Cycling + Adventure Co.; Butterfield & Robinson Inc.; ExperiencePlus! Bicycle Tours; SpiceRoads Cycling; Ride and Seek; Arbutus Routes; Saddle Skedaddle Ltd.; Adventure Cycling Association.

b. The growth of cycle tourism in the U.S. is fueled by rising health and wellness awareness, improved cycling infrastructure, and the increasing popularity of e-bikes, which make longer routes more accessible to a wider range of travelers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.