- Home

- »

- HVAC & Construction

- »

-

U.S. Data Center Cooling Market Size & Share Report, 2030GVR Report cover

![U.S. Data Center Cooling Market Size, Share & Trends Report]()

U.S. Data Center Cooling Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Solution, By Service, By Type, By Containment, By Structure, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-187-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

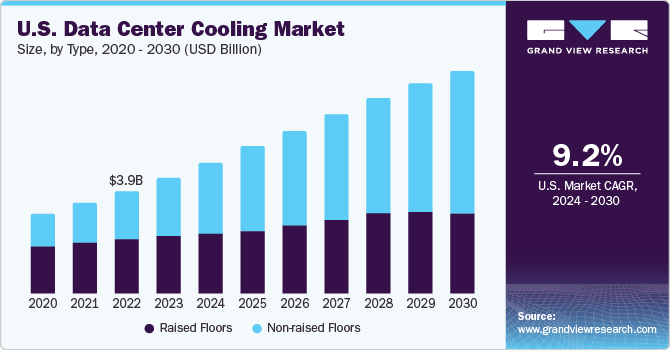

The U.S. data center cooling market size was estimated at USD 4.45 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030.The promising growth prospects of the market size can be attributed to the rapid increase in data generation and the subsequent rise in the demand for data centers. As the number of connected devices increases and Industry 4.0 standards continue to evolve, several IT organizations will have to rely on big data analytics to improve the efficiency of their operations while securing their data. However, having realized that in-house data management can be a complex and time-consuming task, several IT organizations are moving toward data centers.

The subsequent rise in the number and size of data centers is presenting the need for efficient power and cooling equipment to ensure the continuous and smooth functioning of data centers. Data centers consume a large amount of power and generate an enormous amount of heat, which presents the need for efficient cooling equipment. However, advancements in data centers, coupled with the rapid increase in data center sizes, have compelled several vendors to design liquid cooling systems suitable for data centers. Liquid cooling is a conduction heat transfer method and is considered more efficient compared to air cooling in carrying away heat from the IT infrastructure in data centers. Liquid cooling ensures optimum and fast heat transfer at high rack densities in a cost-effective manner. According to a recent study conducted by Schneider Electric Co., liquid cooling costs less than air cooling for the same as well as higher rack densities. Liquid cooling enables IT compaction, which eventually leads to CapEx savings. Based on the findings in the study, liquid cooling facilitates 10% cost savings for a 2X compaction (20kW/rack) and 14% cost savings for a 4X compaction (40kW/rack).

Complex data center cooling architectures make it difficult for designers and engineers to predict the power requirements of every cooling cabinet in data centers, which leads to high investment and overbuilding of data center cooling facilities to accommodate future power requirements. Solutions such as intelligent power distribution units, power management software, and overhead busways ensure seamless power distribution in a data center. These innovative power supply system’s account for growth as well as scalability, subsequently reducing the total cost of ownership. With the increasing computing demands of customers, data center cooling managers are expected to deploy such intelligent power supply systems to ensure peak operating efficiency in data centers, driving U.S. data center cooling market growth.

The expansion of the market can be attributed to the U.S. government's significant investments in data center cooling companies. For instance, in May 2023, the U.S. Department of Energy (DOE) granted USD 5 million to Nvidia to develop a data center cooling solution. The solution combines two-phase direct-to-chip and immersion cooling techniques using environmentally compliant per- and Polyfluorinated Alkyl Substances (PFAs) and low-GWP refrigerants. Nvidia's financing is a component of the DOE's Cooling Operations Optimized for Leaps in Energy, Reliability and Carbon Hyper efficiency for Information Processing Systems (COOLERCHIPS) program, which has released funds to research centers, universities, HP Development Company, L.P., Flexnode, and Intel Corporation Federal programs. With its USD 5 million grant, Nvidia has made the largest contribution to a project under the DOE program.

U.S. Data centers are moving to public and private cloud platforms at an increasing pace. There are various benefits associated with moving to the cloud, such as reduced capital expenditure, improved scalability & elasticity, and an overall decrease in operational costs. Moreover, the large amount of data traffic and the emergence of big data have further increased the need for more secure data centers. The U.S. IT industry is highly dynamic and characterized by technological developments and innovation. The shift from mainframes to client/server to internet computing has changed the way end-users build, purchase, consume, and deliver technology. In recent times, the market share has witnessed a significant shift owing to the emergence of mobility, big data, social networking, and cloud computing. The proliferation of smartphones has also affected the IT industry. The advent of trends such as BYOD has significantly increased the data center demand in the business world.

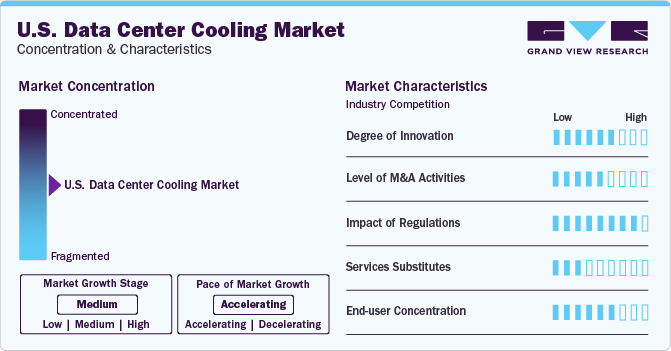

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The growth of e-commerce platforms has created new sales channels in the U.S. data center cooling business. The U.S. producers are using online platforms to promote their products, such as air conditioners, chillers, and precision air conditioners, and offer technical information to facilitate direct sales. Due to the technological complexity of data center cooling solutions, their sales and distribution require a high level of expertise. The U.S. key companies must be well-versed in the complexities of cooling technologies, data center designs, and industry standards to be able to effectively communicate value propositions to distributors and end users.

The U.S. data center cooling solutions are adopted across various industries, including energy & utilities, healthcare, retail, manufacturing, BFSI, and Telecom & IT. Solutions specific to the client’s requirements are delivered based on Service Level Agreements (SLA) between vendors and customers. U.S. data center cooling solution providers usually offer free inspection and maintenance services up to a certain period to maintain a competitive edge in the market. Several providers also collaborate with cloud-based storage and data center vendors to deploy customized solutions as per the requirements of end-use enterprises.

With the increasing size and complexity of data center, operators often struggle with ensuring the optimal energy management of data center cooling systems to resolve these issues, several data center operators are expected to implement intelligent power distribution and monitoring systems to monitor, control, and ensure efficient and effective cooling distribution in data centers. The growing number of large hyperdata centers is expected to reduce the use of traditional Computer Room Air Conditioning (CRAC) units. The U.S. companies are focusing on implementing a combination of liquid cooling, free cooling, and chilled water-cooling techniques. For instance, tech giants such as Google, Apple Inc., and Meta deploy new technologies such as modular, outdoor Air Handling Units (AHUs), and evaporative cooling. Internet of Things (IoT) tools enable real-time monitoring and control of cooling systems. Sensors linked together collect data on temperature, humidity, and equipment performance is anticipated to propel the U.S. data center cooling market growth in the forecasted period.

Component Insights

Solution led the market and accounted for the highest global revenue in 2023. The adaptability of solutions such as air conditioners, precision air conditioners, chillers and air handling units among others to varying heat loads is one of the key factors driving the growth of the segment. Modern data centers are built to be modular, with- IT resources often scaled up or down in response to dynamic data demands. Since solution systems can efficiently handle fluctuations in heat production, they are well-suited to the cooling needs of modern data centers. Energy efficiency is an essential issue in data center operations, and have the potential to help businesses reach their sustainability goals.

Services is anticipated to witness significant CAGR from 2023 to 2030 in the market. The increased popularity of OTT platforms and streaming services, post COVID-19 pandemic, has led to a notable rise in data volumes. This is expected to fuel the demand for new data centers, which is anticipated to open up avenues for data center cooling equipment vendors to introduce innovative services with intelligent controls and gain a competitive edge in the market. The service segment is experiencing a rapid increase in demand for data-intensive services, which is being pushed by technologies such as IoT, 5G, and edge computing. Data centers have become essential for providers since these services necessitate complex data storage and processing features.

Solution Insights

Air conditioners led the market and accounted for more than 30.0% of the global revenue in 2023. Air-cooling systems use air ducts to cool computer rooms. With the ever-changing nature of IT infrastructures, the adaptability of U.S. data center cooling is an essential element. Modular air conditioners are accessible, allowing data centers to scale their cooling capacity to efficiently meet the changing demands. Modern data center air conditioners often include smart controls and monitoring features. Their integration with modern technologies, such as the Internet of Things (IoT) sensors, enables the real-time monitoring of environmental conditions. The incorporation of Artificial Intelligence (AI) further improves the role of air conditioners which is anticipated to foster market share in the forecasted period.

Air Handling Units (AHU)is anticipated to witness a significant CAGR from 2024 to 2030 in the market. The modular and scalable design ensures that as demand develops, data centers can quickly modify and expand their cooling systems, supporting a flexible and future-proof strategy for thermal management. The adoption of AHUs provides U.S. data center operators with a competitive edge, enabling them to save operational costs and increase profitability. Moreover, AHUs provide increased energy efficiency, which aligns with the industry's growing emphasis on sustainability and affordability. They also enable data centers to achieve optimal cooling while consuming minimal energy by offering precise control over the circulation of air and ventilation.

Services Insights

Installation & Deployment led the market and accounted for the highest global revenue in 2023. Higher-density installations are impacting the IT power plan for increasing installation, and deploying liquid-based heat removal equipment can have a significant impact on power-supporting climate control systems, which is fostering the installation & deployment segment growth. The service includes other coolants and installing fans, which facilitates balancing design and optimization, implementing both efficacy and efficiency. Strategic installation & deployment combined with optimization, ensures that the cooling equipment can function without excess heating while reducing environmental impact.

The maintenance & service segment is anticipated to witness significant CAGR from 2024 to 2030 in the market. The maintenance & service data center cooling solutions enable organizations to swiftly extend their supporting improvements infrastructure, power consumption and storage capacity. The maintenance & service segment facilitates modular designs seamless integration and development, providing businesses the ability to adjust their cooling systems as their technological needs alter. The market is projected to witness continued innovation in the maintenance & service segment which includes liquid cooling technologies, and the increasing use of direct-to-chip cooling methods for improved thermal management.

Type Insights

The non-raised floor segment accounted for the largest market revenue share in 2023. The non-raised floor segment plays a crucial role in integrating modern thermal assessment and surveillance systems. It provides real-time monitoring of temperature fluctuations across the data center, allowing service providers to identify and address any issues before they occur. The reduced construction procedure minimizes initial expenses by using fewer materials and workforce. More non-raised floor solutions are being designed with a focus on energy savings and sustainability. Design, cooling technology, and material advancements are expected to help reduce the negative environmental impact of the U.S. data centers.

Raised is expected to register the fastest CAGR during the forecast period. The advancement in technology is driving the growth of the raised-floor data center cooling in the U.S market.Raised floors aid in managing airflow patterns within data centers. Containment techniques, such as cool aisle and hot aisle combinations, are being implemented using the underfloor chamber. The strategic airflow control improves cooling system efficiency by avoiding the mixing of hot and cold air, thus boosting the cooling system's overall effectiveness. Raised floors make it easier to integrate advanced technologies such as sensors and tracking systems. These solutions offer real-time data on environmental conditions, enabling the proactive management of the cooling tower infrastructure in the market.

Containment Insights

Raised floors with containment segment accounted for the largest market revenue share in 2023. Raised floors with containment help save operating costs by improving energy efficiency and lowering the total cooling capacity expenses. With reliable airflow management and containment measures, data center operators can achieve significant cost savings in their operational budgets, boosting the economic viability of their facilities. AI algorithms are being used to examine sensor data and previous performance to identify prospective errors, allowing data center managers to schedule maintenance proactively, minimize interruptions, and optimize the service life of essential systems. Thus, driving the growth of the segment in the market.

Raised floors without containment segment is expected to register the fastest CAGR during the forecast period. The absence of additional containment structures decreases construction complexity and material needs, resulting in reduced expenses during the data center facility's initial build-out phase. Raised floors without containment are expected to be further integrated with energy-efficient technologies, improved airflow management technologies, and predictive controls over the forecast period. Control system innovations, such as the use of advanced algorithms and real-time data processing, are anticipated to help provide more precise and adaptive monitoring of the environment. Thus, driving the growth of the segment in the market.

Structure Insights

Room based cooling segment accounted for the largest market revenue share in 2023. Room-based cooling systems are widely used with cloud-based management platforms. The integration with cloud solutions enables remote surveillance, analysis of data, and effective control of the cooling system. Cloud-based technology allows U.S. data center managers to oversee the cooling equipment from any location, thus increasing operational efficiency. Room-based cooling systems address issues associated with Indoor Air Quality (IAQ). One of the most current developments in room-based cooling systems is the incorporation of air filtering and purification technologies into cooling units to improve the quality of air circulating within the data center. Thus, driving the growth of the segment in the market.

Row-based cooling segment is expected to register the fastest CAGR during the forecast period. Row-based cooling systems have witnessed advancements in circulation management. Advanced containment structures and procedures are being developed to enhance the separation of hot and cold air within the data center. Row-based cooling is becoming more popular in hyperscale data centers. These solutions provide flexibility and effectiveness to large-scale institutions with considerable computer infrastructure. The industry is working to standardize row-based cooling setups. Standardized designs and specifications make row-based systems simpler to adopt and operate for data center operators. Thus, driving the growth of the segment in the market.

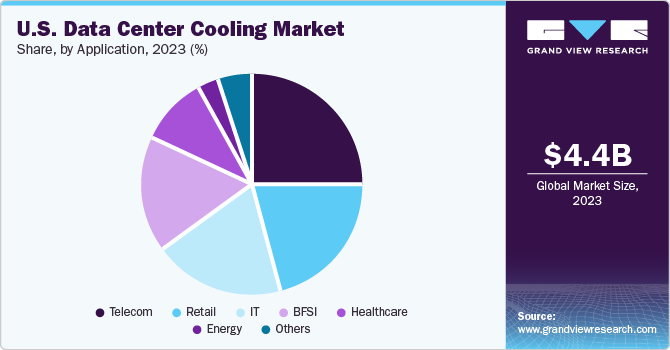

Application Insights

Telecom application segment is accounted for the largest market revenue share in 2023. Telecom firms are becoming increasingly conscious of the need for cost reduction, and utilization of sustainable resources. Modular and scalable data center cooling technologies provide adaptability to shifting demand patterns. The telecom industry is experiencing a rapid increase in demand for data-intensive services, which is being pushed by technologies such as IoT, 5G, and edge computing. Data centers have become essential for telecom providers since these services necessitate complex data storage and processing features. Thus, driving the growth of the IT & telecommunications segment in the market.

The IT end-use segment is projected to witness the highest growth rate over the forecast period. The dynamic nature of the IT ecosystem necessitates scalable systems that can adapt to changing computational demands. Scalable data center cooling solutions enable IT organizations to smoothly extend their infrastructure, supporting improvements in power consumption and storage capacity. Modular designs allow for seamless integration and development, providing businesses the ability to adjust their cooling systems as their technological needs alter. Thus, driving the growth of the IT segment in the market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Fujitsu; Hitachi, Ltd.; Schneider Electric; andNTT Limited.

-

FUJITSU's product portfolio includes multiple computing devices, integrated systems, storage solutions, HVAC solutions, and network switches. The company also offers its products through various distributors, including Westcon-Comstor, Synnex Corporation, Arrow Electronics, Inc., and Ingram Micro, Inc. FUJITSU operates through three business segments, namely Technology Solutions, Device Solutions, and Ubiquitous Solutions.The company's Technology Solutions segment offers various software and system products, including servers and storage systems, and network products.

-

Schneider Electric is engaged in offering automation management electricity distribution solutions to customers globally. The company also manufactures components for energy management systems. It operates through two primary business segments, namely Energy Management and Industrial Automation.The data center cooling market belongs to the secure power subsegment. The company also provides solutions such as access to energy, banking and finance, cloud & service providers, data centers and networks, electric utilities, food & beverage, healthcare, hotels, marine, and metals.

Asetek, Inc.; STULZ GMBH; Telx Inc, Green Revolution Cooling, Inc.; and Iceotope are some of the emerging market participants in the market.

-

Iceotope is a liquid cooling solution provider whose target audience includes CSPs (Cloud Service Provider), telecom companies, HPC/AI, retailers, financial service providers, and healthcare service providers, among others. Some of the major attributes of the cooling solution offered by Iceotope include up to 40% less power usage, less water usage, less carbon emission, and less cooling usage.

-

Green Revolution Cooling, Inc. offers liquid immersion cooling solutions for enterprise/cloud/hyperscale, edge, and HPC, among others. The major highlight of the cooling solution offered by Green Revolution Cooling, Inc. includes increased performance, enabling transformation of data center density, and delivering rack density of up to 368 kW.

Key U.S. Data Center Cooling Companies:

- Air Enterprises

- Asetek, Inc.

- Climaveneta

- Coolcentric

- Fujitsu

- Hitachi, Ltd.

- Infineon Technologies AG

- Iceotope

- Munters

- NTT Limited

- Schneider Electric

- STULZ GMBH

- Rittal GmBH & Co. KG

- Telx Inc

- Vertiv Group Corp.

Recent Developments

-

In February 2023, Green Revolution Cooling, Inc. announced that SK Enmove, a lubricants company based in South Korea, is joining its ElectroSafe Fluid Partner Program, thereby making SK Enmove's patented immersion cooling fluids available to its data center clients worldwide. The two companies would also be able to work together to develop, innovate, and enhance novel fluid compositions

-

In March 2023, Rittal GmBH & Co. KG and STULZ GMBH entered into a global partnership in 2021 and have now begun following the partnership in the U.S.A. Consequently, the two recognized leaders will possess enhanced capabilities to provide clients with comprehensive, customized solutions. Rittal's extensive range of IT infrastructure will profit from Stulz's enlarged line of high-end IT and precision cooling systems. Rittal provides installation services, cooling units, power supply solutions, enclosures, and data center monitoring. Through this relationship, a wide range of cooling choices are combined with the flexibility and speed to build and expand complex IT assets

-

In May 2023, In Europe, Vertiv Group Corp. unveiled a liquid cooling distribution unit. In air-cooled data centers, methods such as direct-to-chip liquid cooling can be implemented thanks to the Liebert XDU, which was introduced in the US in 2019. Europe, the Middle East, and Africa can now purchase it. Water efficiency and support for high-density data centers running analytics and machine learning applications are key architectural features of the XDU. There are two capacities available: 450kW and a variant with a maximum capacity of 1368kW

-

In June 2022, Schneider Electric unveiled the Easy Modular Data Center Solution. For enterprise and IT organizations wanting to deploy an edge computing strategy, the Easy Modular Data Centers offer outstanding value by combining all cooling, power, and IT equipment into a single, pre-configured system. With extra customizable choices, they come in four standard form factors

U.S. Data Center Cooling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.02 billion

Revenue forecast in 2030

USD 8.52 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, services, containment, type, structure, application

Country scope

U.S.

Key companies profiled

Air Enterprises; Asetek, Inc.; Climaveneta; Coolcentric; Fujitsu; Hitachi, Ltd.; Infineon Technologies AG; Iceotope; Munters; NTT Limited; Schneider Electric; STULZ GMBH; Rittal GmBH & Co. KG; Telx Inc; Vertiv Group Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Data Center Cooling Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. data center cooling market report based on component, solution, services, type, containment, structure, and application:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Conditioners

-

Precision Air Conditioners

-

Chillers

-

Air Handling Units

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Installation & Deployment

-

Support & Consulting

-

Maintenance Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floors

-

Non-raised Floors

-

-

Containment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floor with Containment

-

Hot Aisle Containment (HAC)

-

Cold Aisle Containment (CAC)

-

-

Raised Floor without Containment

-

-

Structure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rack-based Cooling

-

Row-based Cooling

-

Room-based Cooling

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom

-

IT

-

Retail

-

Healthcare

-

BFSI

-

Energy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. data center cooling market size was estimated at USD 4.45 billion in 2023 and is expected to reach USD 5.02 billion in 2024.

b. The U.S. data center cooling market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 8.52 billion by 2030.

b. The non-raised floor segment held the highest market share of 50.6% in 2023. The segment growth can be attributed to its real-time monitoring of temperature fluctuations across the data center, allowing service providers to identify and address any issues before they occur.

b. Some key players operating in the U.S. data center cooling include Air Enterprises; Asetek, Inc.; Climaveneta; Coolcentric; Fujitsu; Hitachi, Ltd.; Infineon Technologies AG; Iceotope; Munters; NTT Limited; Schneider Electric; STULZ GMBH; Rittal GmBH & Co. KG; Telx Inc; Vertiv Group Corp.

b. Key factors driving the market growth as the number of connected devices increases and Industry 4.0 standards continue to evolve, several IT organizations will have to rely on big data analytics to improve the efficiency of their operations while securing their data.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.