- Home

- »

- Medical Devices

- »

-

U.S. Dental Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Dental Services Market Size, Share & Trends Report]()

U.S. Dental Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Dental Implants, Orthodontics, Laser Dentistry), By End-use (Hospitals, Dental Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-220-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dental Services Market Size & Trends

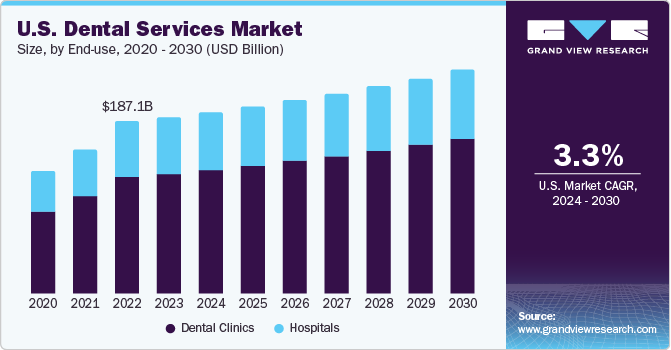

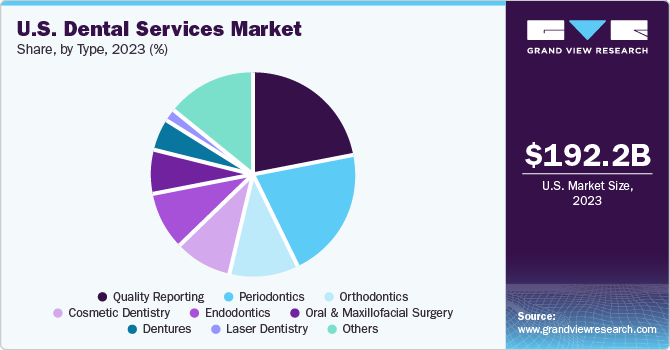

The U.S. dental services market size was estimated at USD 192.22 billion in 2023 and is expected to grow at a CAGR of 3.3% from 2024 to 2030. Dental services encompass the diagnosis, prevention, and treatment of dental ailments, delivered by dentists and other dental professionals. The expansion of this sector can be attributed to several key factors. These include increasing public awareness about dental health, a surge in dental caries and other gum diseases, advancements in dental technology, and a high demand for cosmetic and laser dentistry.

The dental care industry has been profoundly affected by the ongoing COVID-19 pandemic. Strict social distancing measures led to the closure of dental practices in the country. The American Dental Association’s Health Policy Institute (HPI) data indicates that the dental industry came to a halt during the early stages of the pandemic, with dental practices only permitted to handle emergency cases. In March 2020, the American Dental Association (ADA) issued public guidance to postpone elective dental procedures. The ADA has stated that certain procedures should be postponed. These include oral check-ups, regular cleanings, X-rays, aesthetic treatments, and orthodontic procedures that don’t involve pain control. However, emergency dental services, such as treatment for oral bleeding, dental or facial injuries, painful tooth decay, broken teeth, and unusual tissue biopsies continue.

Dental treatments encompass a broad range of services that aid many patients in enhancing their oral health. Various treatments utilize fillings and cement. The current trend of smile makeover procedures is increasingly popular. Furthermore, advancements in endodontics have facilitated the use of root canal procedures. Invisible braces, which assist in the reshaping and alignment of teeth, are highly sought after. Therefore, with the advent of new and improved technologies like dental caps, dentures, and drills, the market is expected to experience substantial growth in the coming years.

Dentists’ recommendations have helped in increasing the demand for a variety of dental services. Furthermore, the shifting focus on marketing efforts to commercialize the practices involves free dental camps, online campaigns, and dental education programs. In addition, the existence of numerous unmet needs and a broad range of services in oral care have encouraged dental equipment manufacturers to invest in research and development (R&D) activities to create and profit from innovative technologies.

With the constant economic expansion and swift urbanization in U.S., people’s disposable incomes have witnessed a consistent rise. Furthermore, the per capita spending on healthcare services is projected to see a substantial increase in the future. The heightened awareness of health and wellness among millennials, coupled with their increasing buying power, is anticipated to fuel market growth over the forecast period.

Market Concentration & Characteristics

The degree of innovation is high in the market. As the market sees more innovations, it is anticipated that more patients will utilize these services in the future. In April 2020, Pacific Dental Services (PDS), a prominent dental support organization, launched the TeleDentistry platform for patients in the U.S. The ongoing COVID-19 pandemic continues to strain urgent care centers and hospital emergency rooms, and the platform’s launch is expected to positively impact the community.

The dental services market in U.S. is marked by a significant number of mergers and acquisitions. Major market players are broadening their range of products and highlighting the importance of innovative oral care products. For instance, Henry Schein, a U.S.-based company, acquired Elite Computer Italia S.r.L that delivers modern dental practice management software to dental laboratories and dental clinics in Italy. Moreover, dental clinics are focused on improving the experience of their customers.

Regulatory impacts on the market are multifaceted, affecting pricing, accessibility, and the overall structure of the industry. Two primary areas of regulation that have influenced the dental services market include the Affordable Care Act (ACA) and occupational regulations. The U.S. Health Insurance Portability and Accountability Act (HIPAA) privacy & breach notification rules require the service providers and manufacturers of products to maintain controls to protect integrity and confidentiality of patient health information.

The R&D in the field of dental implants has increased in the past few years and is anticipated to expand in the future, offering better biomaterials, surface modifications, and improved implant designs. Some of the cosmetic dental procedures include teeth whitening to remove staining and treat discolorations. Moreover, the patients prefer crowns, inlays & onlays, composite bonding, veneers, among others, to improve their oral appearance.

The dental care practices rely on geographic expansion to strengthen their market presence. Market players are constantly expanding their regional reach in U.S. and broadening their product portfolio. For instance, Aspen Dental, a key company in U.S. dental services market, launched a digital check-in platform in its offices across 41 states in June 2020 to improve patient experience and convenience. This expansion strategy allows dental care providers to reach more patients, strengthen their market position, and offer innovative services to enhance patient care.

End-use Insights

Dental clinics segment held the largest revenue share of more than 68.1% in 2023 and is expected to grow at the fastest rate during the forecast period. A significant number of dental patients prefer private dental clinics due to the presence of specialists. More than 80% of these practices are owner-operated. The rise in independent practices is a trend that’s expected to persist in the future, driven by cost-effectiveness, specialist availability, and the use of advanced technology. The market encountered numerous challenges during the early stages of COVID-19 pandemic, as dental offices were potential hotspots for virus transmission. Dental clinics ceased operations initially but gradually resumed normal services. Amid these extraordinary circumstances, it’s crucial for dental professionals to stay updated with the latest regulatory guidelines to prevent virus spread.

The hospitals segment is expected to attain lucrative growth during the forecast period. Long waiting periods for dental care in most developing countries have affected the adoption of dental procedures in the hospitals. In addition, the dental care costs in hospitals are comparatively higher than the clinics or independent practices. Mostly the dental patients are treated by dental students in most of the academic hospitals. These factors are expected to restrain market growth during the forecast period.

Type Insights

Dental implants dominated the market and held a revenue share of over 21.2%. Dental implant restoration, an advanced oral procedure, offers patients practical and aesthetically pleasing alternatives for replacing teeth. As per the American Association of Oral and Maxillofacial Surgeons (AAOMS), about 70% of adults between the ages of 35 and 44 have permanently lost at least one tooth due to disease, decay, or an accident. Consequently, the demand for implants is increasing. The past few years have seen a surge in research and development in the dental implant field, and this trend is expected to continue, leading to the availability of superior biomaterials, enhanced surface modifications, and improved implant designs.

Cosmetic dentistry is expected to grow at the fastest CAGR of 6.9% from 2024 to 2030, owing to an increase in the uptake of procedures that enhance the appearance of teeth, cosmetic dental treatments are gaining popularity. These treatments range from teeth whitening, which eliminates stains and addresses discoloration, to the use of crowns, inlays, onlays, composite bonding, veneers, and more. Patients are opting for these methods to enhance their dental aesthetics, which is expected to fuel market growth in the coming years.

Key U.S. Dental Services Company Insights

Key companies in U.S. dental services market have resorted to varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and expansion among regions. Due to the imposed social distancing guidelines in the early phase of the COVID-19 pandemic, dental practices were closed in many countries. The dental care services industry had a severe impact. Therefore, the service providers are focusing on introducing innovative ways to improve patient care experience.

Key U.S. Dental Services Companies:

- Aspen Dental Management Inc.

- Heartland Dental

- Pacific Dental Services

- Align Technology

- DentaQuest

- InterDent, Inc.

- National Health Service England

- The British United Provident Association Limited

- Coast Dental

- Dental Service Group

Recent Developments

- In May 2023, Allisone Technologies announced the acquisition of Spotimplant, Spotimplant, a software that uses AI for identifying dental implants. This move signifies the shared dedication of both companies towards the application of intelligent technology in the field of dental implants.

- In November 2022, Smile Generation partnered with Pacific Dental Services. The collaboration between these organizations aimed to gather funds to broaden the reach of dental care to patients with special needs and to offer specialized training to clinicians in the field of special needs dentistry.

- In 2020, Aspen Dental Management has rebranded as TAG - The Aspen Group. This new positioning represents the company’s rapid expansion beyond the dental industry into healthcare businesses, including general dentistry, dental implants, urgent care, and medical aesthetics.

U.S. Dental Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 197.77 billion

Revenue forecast in 2030

USD 242.88 billion

Growth rate

CAGR of 3.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Country scope

U.S.

Key companies profiled

Aspen Dental Management Inc.; Heartland Dental; Pacific Dental Services; Align Technology; DentaQuest; InterDent, Inc.; National Health Service England; The British United Provident Association Limited; Coast Dental; Dental Service Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Services Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental services market based on type, and end-use:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Implants

-

Orthodontics

-

Periodontics

-

Endodontics

-

Cosmetic Dentistry

-

Laser Dentistry

-

Dentures

-

Oral & Maxillofacial Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

Frequently Asked Questions About This Report

b. The U.S. dental services market size was estimated at USD 192.22 billion in 2023 and is expected to reach USD 197.77 billion in 2024.

b. The U.S. dental services market is expected to grow at a CAGR of 3.3% from 2024 to 2030 to reach USD 242.88 billion in 2030.

b. The dental clinics segment held the largest revenue share of more than 68.1% in 2023 and is expected to grow at the fastest rate during the forecast period. A significant number of dental patients prefer private dental clinics due to the presence of specialists.

b. Some prominent players in the U.S. dental services market include Aspen Dental Management Inc., Heartland Dental, Pacific Dental Services, Align Technology, DentaQuest, InterDent, Inc., National Health Service England, The British United Provident Association Limited, Coast Dental, Dental Service Group

b. Dental services encompass the diagnosis, prevention, and treatment of dental ailments, delivered by dentists and other dental professionals. The expansion of this sector can be attributed to several key factors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.