U.S. Diatomite Market Size & Trends

"2030 U.S. diatomite market is expected to reach USD 449.3 million"

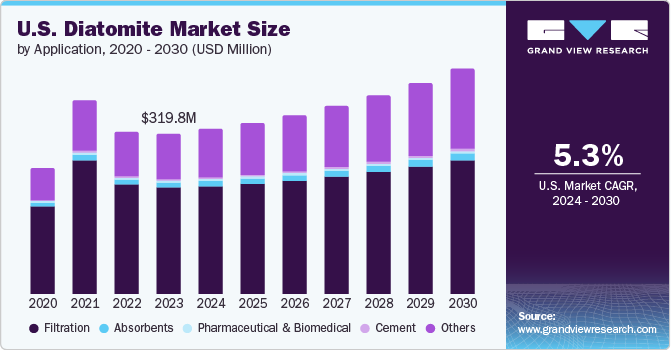

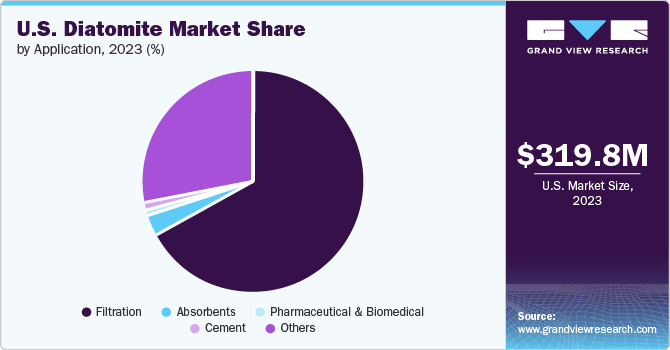

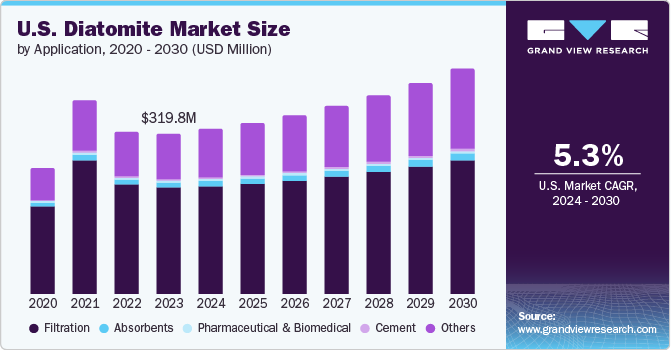

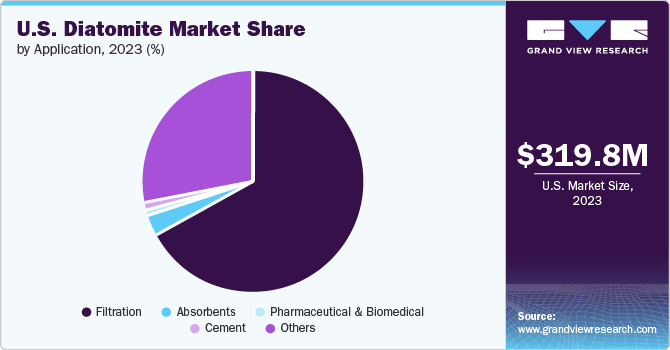

The U.S. diatomite market size was estimated at USD 319.8 million in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. The market is primarily driven by an increasing demand for diatomite in the filtration sector owing to its superior filtering capabilities. The unique properties of the mineral have made it an essential component in various industrial processes, particularly where fine particulate filtration is crucial, such as beverage processing. The market is expected to grow steadily, considering the increasing appetite for beer and the growing number of breweries.

Furthermore, product application in the agriculture and horticulture sectors supported market growth. This is due to diatomite’s pivotal role as a soil conditioner and insecticide. It is widely applied to enhance soil retention and aeration. In addition, it is also used as a natural pest control to improve crop yield. This has further contributed to sustainable farming practices.

Another significant factor driving the market growth is diatomite’s lightweight insulating properties. Diatomite is extensively used to reduce the weight of concrete, facilitating easier transportation and handling in the construction sector. It is also used to improve thermal insulation in buildings, aligning with efficiency goals.

Moreover, the increasing consumer knowledge about diatomite’s advantages in a broad application range, from food-grade products to insecticides, is anticipated to boost its demand in the U.S. In addition, minerals play a significant role in expanding the paints and coatings industry owing to their ability to enhance paint reflectivity. This is projected to influence the market positively.

However, diatomite's elevated production and processing expenses are increasingly resulting in the mineral’s replacement with alternatives, such as perlite, silica sand, ground mica, lime, and talc. Perlite, with a similar silica content of approximately 85%, serves as an ideal alternative for diatomite when applied as a filler, filter aid, and absorbent.

Application Insights

"The absorbent segment is expected to witness growth at 5.7% CAGR."

The filtration sector led the market with a share of 66.8% in 2023 owing to the superior filtering capabilities of diatomite minerals. The unique porous structure of diatomite, including a vast number of microscopic channels, provides excellent particulate retention. These minerals allow the efficient removal of contaminants from various mediums with improved cost efficiency. Such properties have made diatomite an indispensable resource in water purification, waste treatment, and industrial processes requiring fine filtration. Advancements in processing technologies have further enhanced the performance characteristics of diatomite, leading to improved filtration efficiency. The development of calcined and flux-calcined diatomite products has provided options with increased porosity and surface area, catering to more demanding filtration needs.

Several key market players, including EP Minerals, Thomasnet, and ALAR Corp., have also contributed to the growth of diatomite in the filtration sector. These companies increasingly invest in R&D activities to optimize diatomite’s filtration properties and expand its use cases. Collaborations between industry leaders and research institutions have led to innovative applications, reinforcing diatomite’s position as a critical component in modern filtration systems.

In terms of application, the absorbents segment is expected to register the fastest CAGR during the forecast period. The market was significantly propelled by the mineral’s wide surface area, high silica content, and abrasiveness, which made it an excellent material for absorbents. With its equivalent weight in fluid, diatomite absorbents facilitate the containment and cleanup of chemical spills and pet waste. Industries, including machine diesel motors, restaurants, packaging plants, pet shops, and ships, widely use Diatomaceous Earth (DE) as absorbents to reduce slippage hazards.

U.S. Diatomite Company Insights

Some of the prominent companies in the U.S. diatomite market include Imerys, EP Minerals, and Showa Chemical Industry Co., Ltd. These companies undertake strategies, such as capacity expansion, joint ventures, acquisitions, new product launches, and partnerships, to meet the growing industrial demand and drive market growth.

-

EP Minerals offers specialized materials derived from DE that are utilized as filter aids, absorbents, and functional additives across various sectors, such as food and beverage, biofuels, swimming pools, oil & gas, agriculture, home gardening, landscaping, sports fields, paint, plastics, and insecticides

Key U.S. Diatomite Companies:

- Absorbent Products Ltd.

- Dicalite Minerals Corporation

- EP Minerals

- Imerys

- Stellar Exports

- PF Harris

- Reade Advanced Materials

- Barentz

- Calgon Carbon Corporation

- Diatomite CJSC

Recent Developments

-

In May 2024, Imerys S.A. entered into exclusive negotiations to acquire the European diatomite and perlite business from Chemviron, a Calgon Carbon Corp. subsidiary, to enhance their footprint in Europe and expand their portfolio in filtration and life sciences

-

In April 2024, Dicalite Minerals Corp. expanded its mining claims by acquiring diatomite claims in Nevada from Sunrise Resources Plc. This indicated growth in Dicalite’s resource base and production capabilities

U.S. Diatomite Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 329.4 million

|

|

Revenue forecast in 2030

|

USD 449.3 million

|

|

Growth rate

|

CAGR of 5.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Key companies profiled

|

Absorbent Products Ltd.; Dicalite Minerals Corp.; EP Minerals; Imerys; Stellar Exports; PF Harris; Reade Advanced Materials; Barentz; Calgon Carbon Corp.; Diatomite CJSC

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Diatomite Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. diatomite market report based on application: