- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Digestive Health Products Market, Industry Report 2030GVR Report cover

![U.S. Digestive Health Products Market Size, Share & Trends Report]()

U.S. Digestive Health Products Market Size, Share & Trends Analysis Report By Product (Dairy Products, Bakery & Cereals), By Ingredient (Prebiotics, Probiotics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-242-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

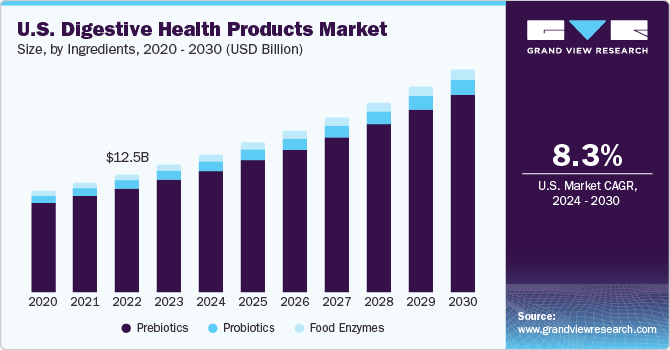

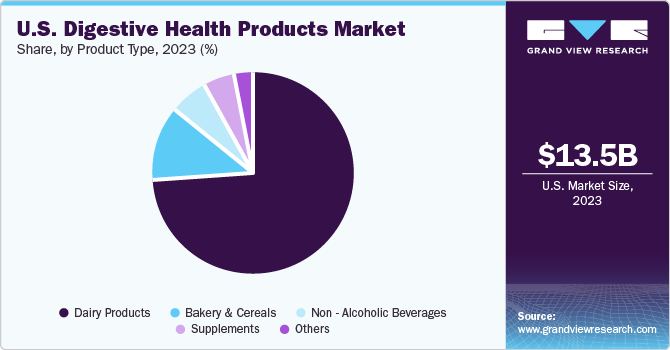

The U.S. digestive health products market size was estimated at USD 13.53 billion in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030. A growing focus on health and the increasing demand for nutritional and fortifying food additives are key factors driving the market.A strong foothold of key players in the country, government support for new product development, and technological advancements in probiotics and prebiotics are major factors contributing to the market growth over the forecast period.

U.S. digestive health products market accounted for the share of 26.21% of the global digestive health products market in 2023. The market growth is attributed by growing consumption of protein-enriched functional foods and dietary supplements in the region. Key global market players have a strong manufacturing presence in the U.S., along with a rising number of new protein source start-ups. This will continue to drive the demand for functional foods. Functional foods contain phytochemicals, which prove to be beneficial for both human and animal health. Thus, the rising demand for nutraceutical products is expected to have a positive impact on functional foods such as digestive health products, which is a subset market of the nutraceuticals and functional foods industry.

The use of digestive health products, including probiotics, for the treatment of mental illness is a growing trend in the U.S., and this is one of the factors driving the probiotics market in the country. Research has shown that the gut microbiome plays an important role in regulating brain function and mental health, and this has led to increased interest in using probiotics to support mental well-being. In addition, the incorporation of probiotics into fitness modules is also contributing to the growth of the market in the U.S., as more consumers seek products that can support their overall health and well-being. This is particularly important in light of the increasing cases of obesity and stress disorders in the country.

Manufacturers are increasingly fortifying food and beverage products with enzymes, probiotics, and prebiotics. This is attributed to consumer demand for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. This is expected to fuel the growth of the market over the forecast period.

Digestive ingredients, such as probiotics, are widely used in fish oil and yogurt to reduce the risk of gut health issues.Awareness regarding maintaining gut health through holistic approach to healthy living supports market growth. In addition, the high prevalence of obesity, digestive disorders, and lifestyle-related diseases on account of poor eating habits and high consumption of processed high-sodium and ready-to-eat foods are likely to boost the demand for digestive health products in the country.

Market Concentration & Characteristics

The U.S. digestive health products industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Product innovations and technological advancements are expected to be major factors attributable to the expansion of the market over the forecast period. Probiotics now have diverse applications, such as probiotic drinks, probiotic dairy products, probiotic supplements, and probiotic cosmetics, as well as in animal agriculture, especially aquaculture. Consumers’ belief in the health benefits associated with these products has been the key driver for this market over the past few years, and the trend is anticipated to continue over the forecast period.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players.The key players are extensively investing in R&D activities to introduce novel food ingredients. In addition, the key players are expected to acquire emerging small-sized companies to expand their portfolios and geographical footprint in the coming years.Market players are adopting various strategies such as collaborations and expansion of product portfolios to gain a competitive edge. For instance, in November 2020, Kerry announced the acquisition of Bio-K Plus, a Canadian manufacturer of probiotic supplements and beverages. This acquisition was in line with Kerry's strategy to expand its capabilities and strengthen its leadership position in the growing probiotics market.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players.The key players are extensively investing in R&D activities to introduce novel food ingredients. In addition, the key players are expected to acquire emerging small-sized companies to expand their portfolios and geographical footprint in the coming years.Market players are adopting various strategies such as collaborations and expansion of product portfolios to gain a competitive edge. For instance, in November 2020, Kerry announced the acquisition of Bio-K Plus, a Canadian manufacturer of probiotic supplements and beverages. This acquisition was in line with Kerry's strategy to expand its capabilities and strengthen its leadership position in the growing probiotics market.End-user concentration is a significant factor in the U.S. digestive health products market. The demand for healthy food and beverage option is driving the market growth. Customers may depend on on natural dietary sources of digestive health-promoting elements, such as fermented foods, fiber-rich foods, and probiotic-rich yogurts, as alternatives to supplement products.

Product Type Insights

U.S. digestive dairy products market accounted for a revenue share of around 74% in 2023.Dairy products are a rich source of probiotics and other digestive health ingredients that help improve gut health and support overall wellbeing. The increasing demand for dairy products can be attributed to a variety of factors, including growing per capita income, rising consumer awareness of healthy and nutritious foods, and the increasing government intervention in regulating the growth and production of dairy products.

U.S. digestive health supplements market is expected to grow at a CAGR of 8.5% over the forecast period.The aging population and growing concerns about gut health are also major driving forces for the demand for digestive health supplements. As people age, their digestive system can become less efficient, leading to several health issues. Digestive health products can help support gut health and promote overall wellbeing. The rising consumer spending on products that improve the health of the intestines is expected to further boost the demand for digestive health products over the forecast period.

Ingredient Insights

The probiotics segment accounted for a revenue share of 88.20% in 2023. Probiotics are live microorganisms that are beneficial for the host when consumed in adequate amounts. They are often referred to as "good bacteria" because they help maintain a healthy balance of microorganisms in the gut and support overall health. Probiotics can be found naturally in fermented foods like yogurt, kefir, sauerkraut, and kimchi, or they can be taken as supplements in the form of capsules, tablets, or powders.Several market players are launching new products owing to the increasing popularity of the ingredient, thereby driving the growth of the market. For instance, in March 2023, Good Culture collaborated with the largest U.S. dairy co-op to introduce a new product called Good Culture Probiotic Milk. The product is a lactose-free, long-life milk that contains the BC30 probiotic, also known as Bacillus coagulans GBI-30, 6086. The addition of BC30 probiotic in the milk makes it a healthy option that can promote gut health and improve digestion.

The food enzymes segment is projected to grow at a CAGR of 9.2% from 2024 to 2030. The growing awareness of the importance of healthy eating and the demand for natural, organic, and clean-label products has further driven the growth of the enzymes market, as consumers seek alternatives to synthetic ingredients and chemical additives. There are many different types of food enzymes, each with its own specific function. For instance, amylase breaks down carbohydrates, protease breaks down proteins, and lipase breaks down fats. Enzymes can be derived from a variety of sources, including plants, animals, and microorganisms. There is an increasing demand for food enzymes in digestive health products for several reasons. Many people suffer from digestive issues such as bloating, gas, and indigestion, and enzymes help to break down food molecules and ease these symptoms.

Key U.S. Digestive Health Products Company Insights

Some of the key players operating in the market include International Flavors & Fragrances Inc, DuPont de Nemours, Inc., and Nestle SA

-

International Flavors & Fragrances Inc. is a manufacturer of fragrances and flavors. The company provides its products under business segments Scent, Pharma Solutions, Nourish, Health & Biosciences. The company’s Nourish segment offers plant-based food ingredients, flavor compounds, and savory solutions.

-

DuPont de Nemours, Inc. was established in 2019 after its separation from DowDuPont, Inc.It is a multinational conglomerate delivering a wide range of products and services to diverse industries with subsidiaries in over 70 countries and manufacturing units in around 40 countries.

Cargill, Incorporated, Sanofi, and Danone are some of the other participants in the U.S. digestive health products market,

-

Cargill, Incorporated is a multinational corporation. It is a privately-held company, with a focus on agriculture and food. The firm has grown to become a leading provider of food, agriculture, financial, and industrial products and services. The company operates in more than 70 countries.

-

Danone is a multinational food corporation, which operates through various business lines including fresh dairy products, early life nutrition, and medical nutrition. It specializes in manufacturing yogurt, packaged water, dairy products, and baby nutrition products. It offers its products to various end-use industries including food & beverage, life nutrition, and pharmaceuticals.

Key U.S. Digestive Health Products Companies:

- International Flavors & Fragrances Inc

- DuPont de Nemours, Inc.

- Nestle SA

- Cargill, Incorporated

- Sanofi

- Danone

- Arla Foods amba

- Herbalife

- General Mills

- Amway

U.S. Digestive Health Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.62 billion

Revenue forecast in 2030

USD 23.53 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, distribution channel

Country scope

U.S.

Key companies profiled

International Flavors & Fragrances Inc; DuPont de Nemours, Inc.; Nestle SA; Cargill, Incorporated; Sanofi; Danone; Arla Foods amba; Herbalife; General Mills; Amway

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Digestive Health Products Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. digestive health products market report based on product, ingredient, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Bakery & Cereals

-

Non - Alcoholic Beverages

-

Supplements

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotics

-

Probiotics

-

Food Enzymes

-

Animal Based

-

Plant Based

-

Microbial Based

-

-

Frequently Asked Questions About This Report

b. The U.S. digestive health products market size was estimated at USD 13.53 billion in 2023 and is expected to reach USD 14.62 billion in 2024.

b. The U.S. digestive health products market is expected to grow at a compounded growth rate of 8.3% from 2024 to 2030 to reach USD 23.53 billion by 2030.

b. The probiotics segment accounted for a revenue share of 88.20% in 2023. Probiotics are live microorganisms that are beneficial for the host when consumed in adequate amounts. They are often referred to as "good bacteria" because they help maintain a healthy balance of microorganisms in the gut and support overall health.

b. Some key players operating in the U.S. digestive health products market include International Flavors & Fragrances Inc; DuPont de Nemours, Inc.; Nestle SA; Cargill, Incorporated; Sanofi; Danone; Arla Foods amba; Herbalife; General Mills; Amway

b. Key factors that are driving the U.S. digestive health products market growth include the growing focus on health and the increasing demand for nutritional and fortifying food additives are key factors driving the market. A strong foothold of key players in the country, government support for new product development, and technological advancements in probiotics and prebiotics are major factors contributing to the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."