- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Digestive Health Products Market Size & Share Report, 2030GVR Report cover

![Digestive Health Products Market Size, Share & Trend Report]()

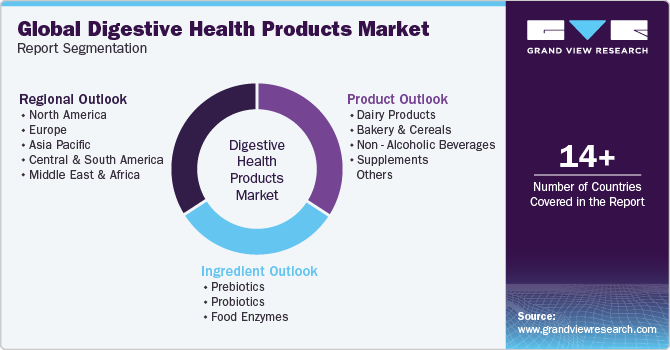

Digestive Health Products Market Size, Share & Trend Analysis Report By Product (Dairy Products, Bakery & Cereals, Non-alcoholic Beverages, Supplements, Others), By Ingredient, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-054-5

- Number of Report Pages: 138

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Digestive Health Products Market Trends

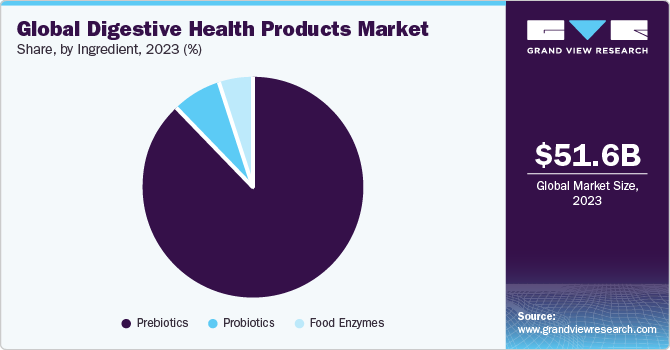

The global digestive health products market size was valued at USD 51.62 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. Growing demand for fortifying and nutritional food additives is one of the major factors driving the market. Digestive health products help in boosting immunity and fight bad bacteria. In addition, the rising awareness about improved health is motivating consumers to pay for better health, thereby boosting the sales of digestive health products. Manufacturers are increasingly launching food and beverage products with enzymes, probiotics, and prebiotics. This is attributed to high consumer demand for food items with higher nutritional and fiber content.

Digestive ingredients, such as probiotics, are widely used in fish oil and yogurt to reduce the risk of gut health issues. This is expected to fuel the growth of the market over the forecast period. In addition, the support of authoritative bodies, such as the European Commission and the EPA, toward the production and consumption of naturally derived ingredients is likely to act in favor of the market. In addition, awareness regarding maintaining gut health through holistic approach to healthy living supports market growth. In addition, the high prevalence of obesity, digestive disorders, and lifestyle-related diseases on account of poor eating habits and high consumption of processed high-sodium and ready-to-eat foods are likely to boost the demand for digestive health products globally.

Various enzymes found in digestive health products, such as lipase, amylases, and lactase, contribute to maintaining stomach acid levels and improving digestion. The growing demand for nutritional food additives and nutritional supplements is one of the key factors driving the market. Digestive health products are expected to witness high demand from the dairy industry for use in milk, cheese, yogurt, and beverage products. These products are expected to drive the market expansion over the next few years owing to the growing use of probiotics and food enzymes in infant formula as well as increasing health concerns among adults.

The European Commission and EPA have framed supportive regulations to augment the production as well as consumption of naturally derived ingredients due to the rising concerns about reducing Greenhouse Gas (GHG) emissions. As a result, food and beverage manufacturers are undertaking efforts to fortify naturally derived additives in their product offerings, thereby positively benefitting market growth. The outbreak of COVID-19 severely impacted global industrial production owing to nationwide lockdowns in major economies in the first quarter of 2020. However, with digestive health products aiding in gut health and improving immunity, the demand for supplements and dairy products increased during the pandemic.

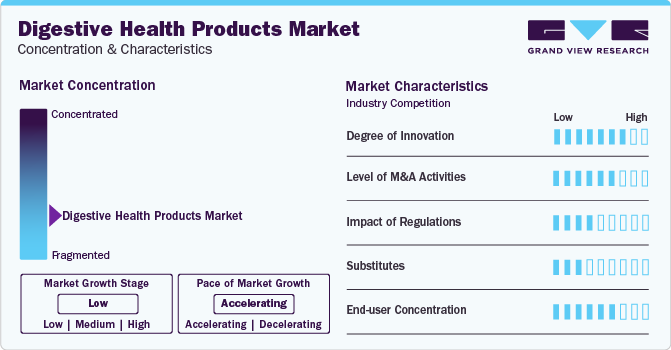

Market Concentration & Characteristics

Innovation in the Digestive Health Products market is thriving, with a focus on advanced formulations and novel ingredients to address consumer concerns and preferences. Probiotics, prebiotics, and enzymes continue to be key areas of innovation, with an emphasis on delivering targeted and effective solutions for digestive well-being.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Regulatory bodies often set standards for the formulation and ingredients of digestive health products. Compliance with these standards is crucial for ensuring product safety and efficacy. Regulatory requirements may include permissible levels of probiotics, prebiotics, and other active ingredients.

Consumers may choose to rely on natural dietary sources of digestive health-promoting elements, such as fiber-rich foods, fermented foods, and probiotic-rich yogurts, as alternatives to supplement products.

Product Insights

The dairy products segment dominated the market and accounted for the highest revenue share of around 74% in 2023. The market is driven by the growing consumer inclination towards preventive healthcare coupled with the development of efficient probiotic strains for dairy products to aid intestinal inflammation, and improve gut health and immunity. The popularity of functional beverages, including relaxation drinks, sports drinks, and kombucha, has considerably increased owing to their unique flavors and health benefits. Thus, the incorporation of functional ingredients, including prebiotics and probiotics, is expected to increase in non-alcoholic beverages, which, in turn, is expected to benefit market growth.

In addition, unhealthy food habits and a sedentary lifestyle are boosting the demand for digestive dairy products as consumers look for ways to improve their health and well-being. Manufacturers are responding to this demand by introducing innovative products with several digestive health benefits. For instance, in July 2021, Biocatalysts Ltd. launched an enzyme Lipomod 4MDP (L004MDP), specially designed for the dairy flavor market. This enzyme can generate significant quantities of short-chain fatty acids while minimizing the production of medium- to long-chain fatty acids. This unique feature results in a flavor profile that delivers a sharp, cheesy, and salty taste.

The supplement segment is predicted to expand at a CAGR of 9.0% from 2024 to 2030.The positive outlook towards nutrition and health, driven by increasing awareness about the benefits of an active lifestyle and nutritional supplements, is expected to significantly promote digestive health products. The aging population and growing concerns about gut health are also major driving forces for increased product demand. As people age, their digestive system can become less efficient, leading to several health issues. Digestive health products can help support gut health and promote overall well-being. The rising consumer spending on products that improve intestine health is expected to further boost product demand over the forecast period.

Ingredient Insights

The probiotics segment dominated the industry and accounted for the largest share of 87.6% in 2023. The popularity of probiotic ingredients in healthy food and nutritional supplements is attributed to the growing consumer awareness about their potential health benefits, such as supporting immune function, improving digestive health, reducing inflammation, and promoting mental health. This trend is driven in part by a growing concern about health and wellness, as well as an increasing desire for natural and healthy dietary options. Furthermore, probiotic ingredients are believed to have a positive impact on a range of health issues, including allergies, autoimmune disorders, and mental health.

As such, they are increasingly being incorporated into a wide range of products, including yogurts, kefir, and other fermented foods, as well as dietary supplements and other health products. Several market players are launching new products owing to the increasing popularity of the ingredient, thereby driving the growth of the market. For instance, in March 2023, Good Culture collaborated with the largest U.S. dairy co-op to introduce a new product called Good Culture Probiotic Milk. The product is a lactose-free, long-life milk that contains the BC30 probiotic, also known as Bacillus coagulants GBI-30, 6086. The addition of BC30 probiotic in the milk makes it a healthy option that can promote gut health and improve digestion.

The food enzymes segment is anticipated to grow at a CAGR of 9.3% from 2024 to 2030. The multi-functionality of food enzymes and the growing demand for enzyme cultures from the food & beverage industry are expected to drive the segment growth over the forecast period. Food enzymes are mainly used in dairy product manufacturing and processing. They are widely used across the food industry to enhance the quality, texture, and flavor of various products. The application areas in the food industry include traditional ones like baking, brewing, and cheese-making, as well as newer areas, such as the modification of fat and the development of new sweeteners.

Regional Insights

The North America digestive health products market accounted for a share of 33.39% of the global revenues in 2023. The strong foothold of the key players in the region coupled with government support for new product development and technological advancement in probiotic and prebiotic space are factors that contributed to the high market share of the region. Furthermore, growing healthcare costs, changes in food laws affecting label and product claims, rapid advances in science & processing technologies, a rising geriatric population, and increasing interest in attaining wellness through diet will support the region’s future growth.

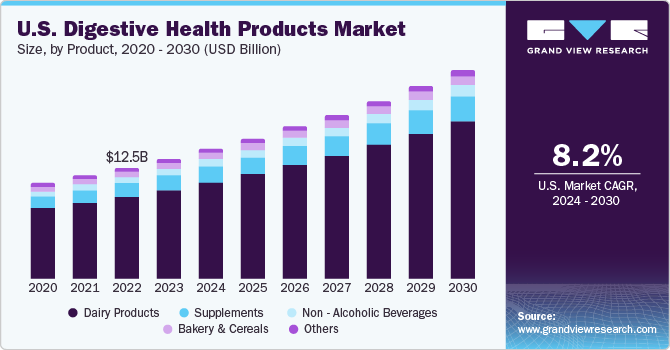

U.S. digestive health products market

The digestive health products market in the U.S. is expected to grow at a CAGR of 8.2% from 2024 to 2030, as a result of factors such as surge in demand as consumers prioritize gut health and well-being. Factors such as a growing awareness of the link between digestive health and overall wellness, increased interest in functional foods, and a rise in digestive issues have contributed to the heightened demand for products aimed at supporting digestive health in the American market.

Market players are adopting various strategies, such as collaborations and expansion of product portfolios, to gain a competitive edge. For instance, in November 2020, Kerry announced the acquisition of Bio-K Plus, a Canadian manufacturer of probiotic supplements and beverages. This acquisition was in line with Kerry's strategy to expand its capabilities and strengthen its leadership position in the growing probiotics market.

The Asia Pacific digestive health products market is anticipated to grow at the fastest CAGR of 9.6% during the forecast period. The region is expected to witness a surge in demand for digestive health products as major players in the industry are employing strategies, such as launching their brands in untapped markets of Southeast Asian countries.

With rapid urbanization and increasing spending power, consumers have shifted to processed and fast foods, which has led to digestive issues, such as acid reflux, constipation, and Irritable Bowel Syndrome (IBS). This has developed a need for products that improve digestive health and alleviate these conditions. There has been a significant increase in the availability and accessibility of digestive health products in India. This has been driven partly by the growth of e-commerce platforms and online retailers, such as Amazon.com, Inc., Flipkart.com, and Nutrabay.com, which have made it easier for consumers to access a wide range of products from across the country and around the world.

India digestive health products market

The digestive health products market in Indiais projected to grow at a CAGR of over 11% from 2024 to 2030, owing to a heightened focus on overall wellness and increased awareness of digestive health. As consumers in India become more health-conscious, there is a growing inclination towards digestive health products, driven by factors such as lifestyle changes, dietary preferences, and a rising awareness of the importance of gut health in maintaining overall well-being.

Key Companies & Market Share Insights

The global market is expected to witness intense competition among companies due to the presence of several players. Key players are focused on the Southeast Asian market due to the presence of a target consumer base in the region. Manufacturers are expanding their production capacities, tracking the changing demand of the food & beverage industry, investing in R&D, and launching new products to meet the growing product demand from various application industries.

For instance, in March 2023, BASF and Cargill (Provimi) expanded their existing agreement for developing and distributing feed enzymes in South Korea. By utilizing BASF’s strengths in enzyme R&D and Cargill’s expertise in application and extensive market coverage, the partners aim to establish a joint innovation pipeline for animal protein producers in South Korea.

Key Digestive Health Products Companies:

The following are the leading companies in the digestive health products market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these digestive health products companies are analyzed to map the supply network.

- BASF SE

- Chr. Hansen Holding A/S

- Nestle SA

- International Flavors & Fragrances Inc.

- DuPont de Nemours, Inc.

- Bayer AG

- Danone

- Arla Foods amba

- Sanofi

- Cargill, Inc.

Recent Developments

-

In August 2023, Herbalife introduced Herbalife V, a new line of plant-based supplements to meet the growing consumer demand for plant-based products, including supplements. These products have obtained certifications such as USDA Organic, verified non-GMO, certified kosher, and certified plant-based and vegan by FoodChain ID.

Digestive Health Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 55.77 billion

Revenue forecast in 2030

USD 68.17 billion

Growth Rate (Revenue)

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE, Saudi Arabia

Key companies profiled

BASF SE; Chr. Hansen Holding A/S; Nestle SA; International Flavors & Fragrances Inc.; DuPont de Nemours, Inc.; Bayer AG; Danone; Arla Foods amba; Sanofi; Cargill, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digestive Health Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global digestive health products market report on the basis of product, ingredient, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Bakery & Cereals

-

Non - Alcoholic Beverages

-

Supplements

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotics

-

Probiotics

-

Food Enzymes

-

Animal Based

-

Plant Based

-

Microbial Based

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global digestive health products market size was estimated at USD 47.8 billion in 2022 and is expected to reach USD 51.62 billion in 2023

b. The digestive health products market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 89.87 billion by 2030.

b. The dairy segment accounted for a 74% share in 2022 owing to the rising demand for foodstuffs that are rich in dietary fiber against abdominal diseases.

b. Some of the key market players in the Digestive Health Products market are International Flavors & Fragrances Inc.,Nutri-Pea ,COSCURA, Roquette Frères, PURIS ,Burcon, Shandong Jianyuan Group,SOTEXPRO , The Scoular Company ,FENCHEM,The Green Labs LLC

b. Key factors that are driving the Digestive Health Products market growth is increasing consumer awareness regarding wellness & health, and increasing investments in the meat substitute industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."