- Home

- »

- Next Generation Technologies

- »

-

U.S. Digital Textile Printing Market, Industry Report, 2030GVR Report cover

![U.S. Digital Textile Printing Market Size, Share & Trends Report]()

U.S. Digital Textile Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Printing Process (Direct To Fabric, Direct To Garment), By Operation, By Textile Material, By Ink Type, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-236-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Digital Textile Printing Market Trends

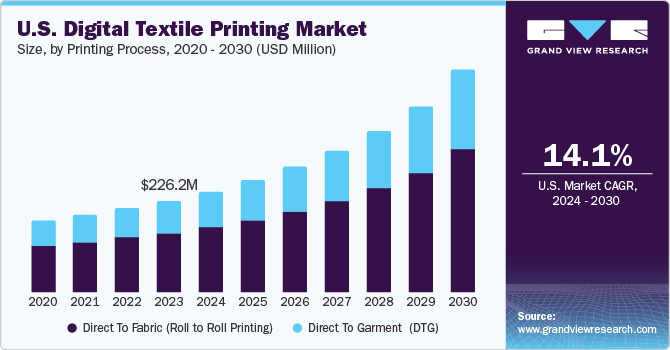

The U.S. digital textile printing market size was estimated at USD 226.2 million in 2023 and is projected to grow at a CAGR of 14.1% from 2024 to 2030. Digital textile printing provides better precision than conventional textile printing, which is among the key factors fueling the market growth. Due to its versatile nature, it finds application in different kinds of textiles such as clothing, bedsheets, banners, sports apparel, flags, vehicle wrapping, and interior textiles, which in turn propels the market growth. The growth of the industry can also be attributed to rapidly changing fashion trends and the need for manufacturers to quickly adapt to those trends to stay relevant in the market.

In 2023, the U.S. accounted for approximately 7.67% share of the global digital textile printing market. The digital textile printing industry is at an evolving stage as compared to the conventional textile printing industry. However, many application sectors are rapidly transitioning to digital textile printing, due to its high precision, efficiency, and versatility. The rapid adoption of digitally printed design trends and the increase in disposable incomes are anticipated to propel the market growth in the U.S. The increased use of printed textiles in car interior décor and vehicle wrapping is anticipated to propel the target market.

Technological advancements such as additive manufacturing for textile applications are anticipated to propel market growth in the upcoming years. Digital textile printing helps in faster turnaround times and high outputs, therefore, manufacturers can efficiently make quicker deliveries, meet customers' requests, and accept more projects. Therefore, fast-fashion businesses prefer it for faster delivery of ready garments and are hence shifting to digital technology for faster turnarounds.

Digital textile printing requires advanced machinery as it provides high-precision output. However, the advanced machinery costs are high and there is an acute shortage of skilled manpower to operate these advanced machines. In addition, the fluctuating cost of raw materials such as ink and print heads, the harmful effects of inks, and the high costs of digital textile printers are anticipated to restrain market expansion to a certain extent.

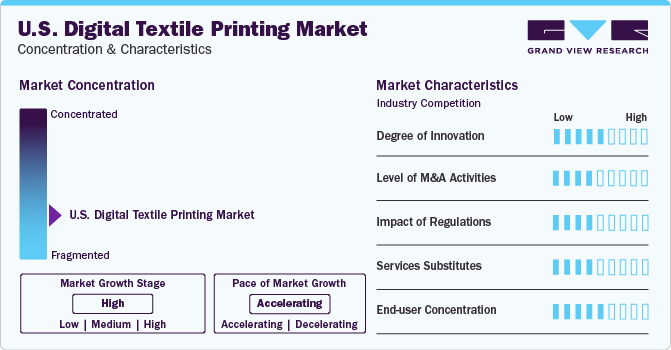

Market Concentration & Characteristics

The stage of market growth is high and the pace of growth is accelerating. The digital textile printing industry in the U.S. is fragmented as there is a presence of several large and small companies in the market. To obtain a competitive edge and increase their market share, providers of digital technology are making significant investments in their R&D and engaging in M&A activities.

The advent of 3D printing is significantly transforming the digital textile industry as it allows the implementation of various shapes and structures leading to innovative products. There have also been innovations in textiles, such as in materials and fabric compositions that include smart fabrics, conductive textiles, and sustainable blends, which enhance aesthetics and functionality. In addition, the digitization has streamlined the entire textile manufacturing process, which has enhanced the efficiency. Machine learning algorithms analyze vast amounts of data, optimizing production processes, predicting trends, and enhancing design decisions. AI-driven insights drive efficiency and creativity.

The regulations laid down by the Environmental Protection Agency significantly impact the U.S. digital textile industry. Some of the regulations include microfiber pollution control, the textile industry is urged to design fabrics that shed fewer microfibers and adopt manufacturing processes that minimize emissions, as microfibers shed during laundering contribute to water pollution. Clean Water Act effluent limit guidelines specifically for the textile industry specifically regulate the discharge of pollutants in the water bodies. The EPA encourages the adoption of circular practices in the textile industry. This includes fabric recycling, improved inventory management, and extending the life of garments through repair incentives, fashion rental programs, and resale platforms. Such initiatives contribute to reducing greenhouse gas emissions.

Printing Process Insight

In terms of the printing process, the market is segmented into Direct to Fabric (Roll to roll) and Direct to Garment (DTG) segments. The Direct to Fabric (DTF) printing segment dominated the market in 2023 with the largest market share of more than 67%. In DTF printing, designs and patterns are printed directly on a big roll of fabric. DTF printing can be done using a broad range of inks such as dye-sublimation inks, acid dyes, pigment inks, and reactive dyes. Companies provide both types of printers as the demand for each type is growing significantly.

The direct-to-garment segment registered the fastest CAGR of 14.4% over the forecast period. The direct-to-garment method entails the direct application of designs onto clothing items. The escalating demand for on-demand garment printing and the growing requirement for personalized designs on t-shirts and shirts are propelling the need for direct-to-garment printing. Customized garments are in high demand, especially among sports clubs, schools (for uniforms), and for corporate gifting. Digital printing is becoming increasingly popular for custom apparel due to its ability to print any design on the fabric. Among various printing processes, direct-to-garment is emerging as the most rapidly expanding segment.

Operation Insight

Based on operation segment, the market is divided into two categories, single pass and multi pass segments. Single-pass printing is a newer type of digital textile printing that enables faster printing at a higher quality. Single-pass printers achieve remarkable speed because they disperse ink simultaneously using multiple printheads positioned over the substrate as it moves through the printing process. Despite the speed, single-pass printing maintains excellent print quality, making it ideal for mass production of various printed materials. These advantages of single pass printing have propelled the growth of the segment and it is anticipated to witness the fastest CAGR of 14.3% over the coming years.

The multi pass operation segment dominated the U.S. market in 2023 with the largest market share of over 61%. The large share of the multi pass printing is attributed to the advantages offered by it such as it minimizes the initial costs required for printing technology as it has a smaller number of print heads. If a printhead malfunctions during multi-pass printing, subsequent passes can rectify any discrepancies in the print, thereby, resulting in a better-quality print. Multi-pass printers are versatile and can handle a variety of different materials, such as fabric, paper, or other substrates.

Ink Type Insight

The sublimation segment dominated the U.S. market in 2023 with the largest market share of more than 52%. This large share is attributed to the rising demand for de-sublimation in customized printing services, which is among the key factors for the segment growth. Sublimation inks are more durable than other ink types as they are absorbed into the fabric rather than just adding a layer of color on the fabric. The sublimation segment is also anticipated to register the fastest CAGR over the projected period. Synthetic fibers such as polyester primarily use sublimation inks. This method is environmentally friendly as compared to other ink types as it does not require washing of the textile after printing.

The reactive ink type is expected to be the second fastest-growing segment with a CAGR of 14.2% from 2024 to 2030. Reactive inks are primarily used for cotton as reactive inks produce high-quality and rich colors, especially when printing on cotton or viscose fabrics. The printed colors remain intact even after multiple wash cycles. Reactive inks are versatile and can be used on various natural fibers, including cotton, silk, wool, and viscose. Their flexibility allows textile printers to work with different fabric types, which in turn, drives the market growth of this segment.

Acid inks are mostly used on textile materials that do not easily retain the printed colors such as wool, and silk. Pigments and dispersed inks are used most commonly in the conventional textile printing. However, in digital textile printing these ink types have the least usage.

Application Insight

In terms of application, the U.S. digital textile printing industry is segmented into clothing/apparel, home décor, soft signage, and industrial. Clothing/apparel held the largest market share of more than 52% in 2023. Digital textile printing has become a game-changer in the cloth apparel industry. Its advantages include high-resolution prints, faster sampling and delivery, reduced fabric waste, environmental friendliness, and the ability to explore diverse designs. By embracing digital printing, businesses can create customized, visually appealing garments while minimizing their ecological footprint.

Digital textile printing has transformed the landscape of soft signage. Digital printing delivers high-resolution graphics with vivid colors and intricate details. Whether it’s event banners or retail displays, soft signage benefits from eye-catching visuals that immediately capture attention. Unlike traditional methods that involve screen setups and minimum print runs, digital textile printing is cost-effective even for small quantities. This flexibility caters to businesses with varying signage needs, allowing them to produce customized soft signage efficiently. Fabric-based soft signage is inherently lightweight and easy to transport. Digital printing ensures that these textiles remain durable while maintaining their lightweight properties, making setup and relocation hassle-free. These advantages have led to the growth of the segment and it is anticipated to be the second fastest growing segment among applications.

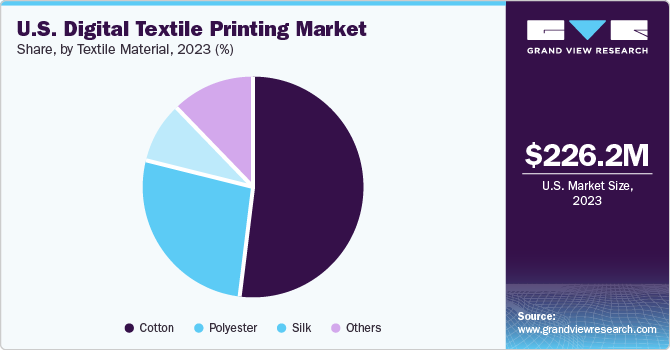

Textile Material Insight

The cotton segment dominated the market in 2023 with the largest revenue share of more than 52%. Cotton is extensively used in fashion and sportswear owing to properties of excellent moisture absorption and extended durability. Cotton has excellent printability and durability, which makes it a suitable choice for garments, especially fashion wear. Cotton is also preferred for various home décor textiles such as bedsheets, curtains, cushion covers, and table covers owing to its softness, easy washability, and attractiveness. These factors are aiding the demand for printed cotton fabrics and garments.

The polyester material segment is anticipated to register the fastest CAGR of 15.0% over the forecast period. This growth can be attributed to various factors such as sublimation ink is predominantly utilized for substrates made of polyester fabric. In addition, due to its wrinkle and abrasion resistance, as well as its affordability, polyester has become a popular choice in the fashion industry. These properties of polyester are driving the segment growth.

Key U.S. Digital Textile Printing Company Insights

Some of the key companies in the U.S. digital textile printing industry are Mimaki Engineering, Epson America, and Kornit Digital, among others.

-

Mimaki USA Inc., a branch of Mimaki Engineering, is renowned for its wide range of digital textile printers, cutting plotters, latex, software, and finishing products. With its main office in Atlanta and several other locations across the United States, the company has a strong national footprint. Mimaki has an extensive product line of over 50 items, serving the sign graphics, textile & apparel, industrial, and 3D markets. The company’s mission is to design smarter machinery that enhances customer workflow and business growth. Mimaki USA Inc. is a global provider of innovative solutions.

-

Epson America, an electronics manufacturer, offers a broad range of products, including printers, professional imaging products, projectors, scanners, system devices, and factory automation products. As a member of the global Epson Group, it serves a variety of sectors, including sports, fashion, augmented reality, and personal healthcare. In addition to its traditional offerings, Epson America provides home entertainment products, glasses, fitness and sports products, modules, kiosk products, displays, disc publishers, supplies, and accessories.

Roland DGA and Durst are some of the emerging companies in the U.S. digital textile printing industry.

-

Roland DG Corp (Roland) is a manufacturer and marketer of 3D milling machines, 3D printers, engraving machines, and desktop fabrication devices. The company’s product offerings include wide-format color inkjet printers, vinyl cutting machines, inkjet printers, inkjet cutters, 3D milling machines, engraving machines, 3D printers, dental 3D printers, dental milling machines, and photo impact printers for largescale signage and posters.

-

Durst Imaging Technology US is a leading provider of innovative digital printing solutions, specializing in advanced technologies for a wide range of applications, including textiles, signage, packaging, and industrial printing. As a subsidiary of the Durst Group, a global leader in digital printing technology, Durst Imaging Technology US leverages decades of expertise and a commitment to innovation to deliver cutting-edge solutions tailored to the evolving needs of its customers.

Key U.S. Digital Textile Printing Companies:

- Epson America

- Mimaki USA, Inc.

- Kornit Digital

- Roland DGA Corporation

- Dover Corporation

- Konica Minolta

- Brother Industries

- Colorjet

- Durst Image Technology US, LLC

- ROQ International

Recent Developments

-

In January 2024, Epson unveiled a new addition to the SureColor F-Series, a direct-to-garment (DTG) printer. This versatile, entry-level printer is engineered to cater to the needs of garment decorators, entrepreneurs, artisan businesses, and print service providers, offering a variety of DTG and direct-to-film (DTFilm) printing applications. The hybrid printer merges exceptional image quality, user-friendly operation, and adaptable performance in a compact package, freeing designers to focus more on their creative process.

-

In March 2023, Mimaki USA, a producer of broad-format inkjet printers and cutters, introduced its inaugural direct-to-film (DTF) printer, the "TxF150-75," along with a heat transfer pigment ink, "PHT50," specifically designed for DTF applications. The TxF150-75 is an inkjet printer capable of producing DTF print transfer sheets with a maximum width of 80 cm (31.5"). The newly developed PHT50 heat transfer pigment ink, suitable for DTF applications, comprises five colors (CMYK and white). It is set to receive the ECO PASSPORT certification by the end of March 2023, a crucial requirement for complying with the international safety standard for textile products, "OEKO-TEX."

U.S. Digital Textile Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 248.9 million

Revenue forecast in 2030

USD 549.3 million

Growth rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Printing process, textile material, operation, ink type, application

Country scope

U.S.

Key companies profiled

Epson America; Mimaki USA, Inc.; Kornit Digital; Roland DGA Corporation; Dover Corporation; Konica Minolta; Brother Industries; Colorjet: Durst Image Technology US, LLC; ROQ International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Textile Printing Market Report Segmentation

The report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. digital textile printing market report based on printing process, operation, textile material, ink type, and application:

-

Printing Process Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct To Fabric (Roll to Roll Printing)

-

Direct To Garment (DTG)

-

-

Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Pass

-

Multi Pass

-

-

Textile Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Cotton

-

Silk

-

Polyester

-

Others

-

-

Ink Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sublimation

-

Pigment

-

Reactive

-

Acid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Clothing/Apparel

-

Home Décor

-

Soft Signage

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. digital textile printing market size was estimated at USD 226.2 million in 2023 and is expected to reach USD 248.9 million in 2024.

b. The U.S. digital textile printing market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 549.3 million by 2030.

b. The multi pass segment dominated the U.S. digital textile printing market with a share of over 61.2% in 2023.

b. Some key players operating in the U.S. digital textile printing market include Epson America; Mimaki USA, Inc.; Kornit Digital; Roland DGA Corporation; Dover Corporation; Konica Minolta; Brother Industries; and Colorjet

b. Key factors driving the market growth include increasing demand for customized and on-demand printing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.