- Home

- »

- Next Generation Technologies

- »

-

U.S. Edge Computing Market Size And Growth, Report, 2030GVR Report cover

![U.S. Edge Computing Market Size, Share & Trends Report]()

U.S. Edge Computing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Remote Monitoring, Content Delivery), By Industry Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-195-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Edge Computing Market Size & Trends

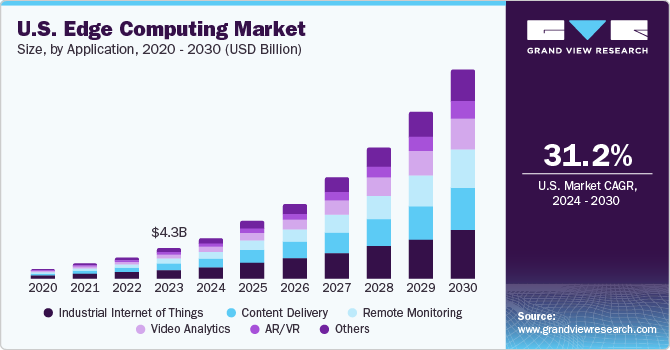

The U.S. edge computing market size was valued at USD 6.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 31.2% from 2024 to 2030. The growth can be attributed to the rising demand for edge computing for collecting, processing, and analyzing vast data to make informed decisions. Edge computing provides data processing near to the device itself, improving the efficiency of the organization. Edge computing expedites data gathering and sharing process, thereby driving the efficiency of enterprises.

The rising adoption of the latest technologies such as IoT and big data across various sectors, including education, healthcare, and manufacturing is generating large volumes of data. As the volumes of data are increasing, computing is getting more complex. The increasing penetration of cloud services and IoT is expected to impact the industry’s growth positively.

Moreover, low latency of current IoT infrastructure, the need to perform analytics at the edge of the network, and a higher awareness regarding data security amongst businesses have substantially contributed to the industry growth. Various players within the ecosystem, including cloud service providers, communication technology providers, platform providers, and system integrators are increasingly exploring opportunities created by the cross-sector application of edge computing technology, thereby generating contemporary revenue sources.

Edge computing has grown into a solution-specific technology, with special tools and architectures designed for specific use cases. Some use cases where the edge is expected to acquire a considerable share throughout the predicted time include next-generation CDNs, network function, 5G virtualization, and game streaming.

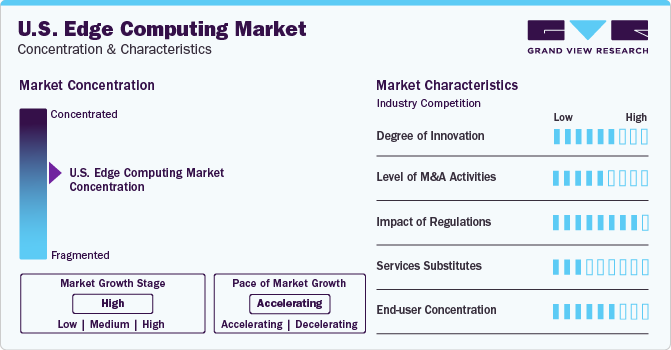

Market Concentration & Characteristics:

The market is characterized by a moderate to high level of innovation. This is due to the surge in the adoption of connected devices and 5G technology, and technological advancements in terms of AI. It increases the demand for processing and analyzing vast amount of data across various industries.

The market is also characterized by a significant level of mergers and acquisitions among the leading players. For instance, in June 2023, HPE acquired Athonet, a leading private cellular networking specialist. This acquisition is expected to help HPE revolutionize the private networking market, in part through simplifying and accelerating the deployment of private 5G.

The market is also subject to increasing regulatory scrutiny due to concerns related to data privacy and security, and compliance standards. In order to ensure data integrity, edge computing solutions need to align with sector-specific regulations, security, and regulatory compliances. In addition to compliance benefits, edge computing can reduce latency in data processing and transmission, thus improving overall performance and user experience for employees and customers.

There are limited technological substitutes for the market. Cloud computing can be used as an alternative to edge computing; however, they typically deliver a different level of performance or result depending on the specific needs of the end-user or application.

End-user concentration is also a significant factor in the market, as there are a number of end-user industries that are creating demand for edge computing solutions. Rising demand for edge computing technology across various industries is creating opportunities for industry players.

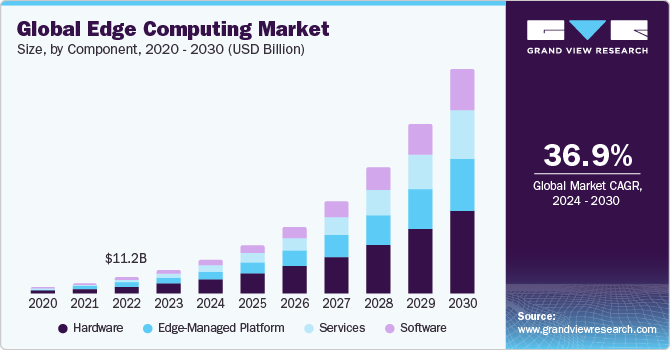

Component Insights

Based on components, the hardware segment accounted for the largest market share of over 43.0% in 2023. This can be credited to the increasing popularity of hardware in the managed services industry. With the growing application of IoT and IIoT devices, the volume of data created by these devices is also increasing. As a result, enterprises are increasingly adopting hardware components, such as edge computing gear to minimize the load on cloud and data centers.

The hardware segment can be bifurcated into Edge Nodes/Gateways (Servers), Sensors/Routers, and others. The rising number of data centers boosts the demand for edge routers, linking local and wide-area networks. Edge data centers should be well-equipped with flexible and powerful edge routers capable of handling a large volume of incoming traffic while maintaining low latency. The demand for secure and efficient data processing at the edge of the network is likely to boost the growth of the hardware segment during the forecast period.

Industry Vertical Insights

Based on the industry vertical, the industrial segment captured a significant market share in 2023. The real-time monitoring function increases the operational efficiency and productivity of the manufacturing companies. Edge computing is the best solution for remote sites where cloud connectivity is not stable. Thus, the remote oil fields are widely adopting edge computing technology.

Moreover, in the data-sensitive industry and regions where data compliances are very strict, edge computing acts as an effective solution for processing the data. As the convergence of IIoT with edge computing is favoring the adoption of connected factories among manufacturers in the U.S., several startups have evolved to deliver platforms for developing edge-enabled solutions that are anticipated to boost the regional industry's growth.

Application Insights

Based on application, the IIoT segment dominated the market in 2023. Edge computing is playing a key role in helping organizations in the digitization of their facilities. The demand for edge infrastructure is projected to increase as service intricacy rises and the infrastructure edge becomes more accessible. Edge computing helps manufacturers to reach the goal of digitization of their facilities. The demand for edge infrastructure is projected to increase as service intricacy rises and edge infrastructure becomes more accessible.

The Industry 4.0 initiative also creates a framework for modernizing manufacturing concerning industry disruptions, preparing the path for edge deployment. It encourages operational agility by using technologies that bring uniformity to the cyber and physical systems. Smart factories can use edge platforms to transmit only processed data to their cloud servers, which also boosts the market for AI edge computing. The edge works as a path by analyzing data locally and sending summarized data to the cloud.

Key U.S. Edge Computing Market Company Insights

Some of the key players operating in the market include ABB, Amazon Web Services (AWS), Inc., Microsoft, etc.

-

ABB is a multinational electronics and electrical manufacturing firm specializing in electrification, industrial automation, motion, robotics, and discrete automation. The company serves the demands of organizations in many industries, such as automotive, chemical, data centers, food & drinks, mining & metals, oil & gas, power distribution, process automation, and power generation.

-

AWS is the world's most comprehensive and widely used cloud platform, providing over 200 fully featured services from data centers around the world. Startups, largest enterprises, and leading government agencies, use AWS.

Aricent, Inc., Atos, Cisco Systems, Inc., etc. are some other participants in the U.S. edge computing market.

-

Atos helps businesses achieve their digital transformation goals by offering innovative solutions and technologies in the areas of high-tech transactional services, cloud, unified communications, cybersecurity, and big data. Atos, Atos Consulting, Atos Syntel, Atos Healthcare, Bull, Atos Worldgrid, Worldline, Unify, and Canopy are some of the company's global brands.

-

Cisco Systems Inc. provides IP-based networking solutions and collaboration services to a variety of industries, including automotive, education, energy, finance, manufacturing, materials and mining, retail, and transportation. The company provides a wide range of service packages, as well as advanced services and technical support.

Recent Developments

-

In May 2023, Dell Technologies launched NativeEdge, an edge operations software platform. NativeEdge centralizes deployment and management of edge infrastructure and applications across geo-distributed locations and helps enterprises securely scale their edge operations using automation, open design, zero-trust security principles, and multicloud connectivity.

-

In July 2022, ABB Ltd. collaborated with Red Hat for the growth of process automation and industrial software by using Red Hat's enterprise platform and application services built on Red Hat Enterprise Linux.

Key U.S. Edge Computing Companies:

The following are the leading companies in the U.S. edge computing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. edge computing companies are analyzed to map the supply network.

- ABB Ltd.

- Amazon Web Services (AWS), Inc.

- Atos SE

- Capgemini

- Cisco Systems, Inc.

- General Electric Company

- Hewlett Packard Enterprise Development

- Honeywell International Inc.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Rockwell Automation, Inc

- SAP SE

- Siemens AG

U.S. Edge Computing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 43.05 billion

Growth rate

CAGR of 31.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Application, Industry Vertical

Regional scope

U.S.

Key companies profiled

ABB; Amazon Web Services (AWS), Inc.; Aricent, Inc.; Atos; Cisco Systems, Inc.; General Electric Company; Hewlett Packard Enterprise Development; Honeywell International Inc.; IBM Corporation; Intel Corporation; Microsoft Corporation; Rockwell Automation, Inc; SAP SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Edge Computing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edge computing market report based on component, application, and industry vertical:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Hardware by Type

-

Edge Nodes/Gateways (Servers)

-

Sensors/Routers

-

Others

-

-

Hardware by End-Point Devices

-

Cameras

-

Drones

-

HMD

-

Robots

-

Others

-

-

-

Software

-

Services

-

Edge-Managed Platform

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Internet of Things (IIoT)

-

Remote Monitoring

-

Content Delivery

-

Video Analytics

-

AR/VR

-

Connected Cars

-

Smart Grids

-

Critical Infrastructure Monitoring

-

Traffic Management

-

Assets Tracking

-

Security & Surveillance

-

Smart Cities

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Energy & Utilities

-

Healthcare

-

Agriculture

-

Transportation & Logistics

-

Retail

-

Data Centers

-

Wearables

-

Government & Public Sector

-

Media & Entertainment

-

Manufacturing

-

Telecom & IT

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. edge computing market size was estimated at USD 6.08 billion in 2023 and is expected to reach USD 8.44 billion in 2024.

b. The U.S. edge computing market is expected to grow at a compound annual growth rate of 31.2% from 2024 to 2030 to reach USD 43.05 billion by 2030.

b. Based on component, the hardware segment dominated the market in 2023 owing to the upsurge in integration of Industry 4.0 technologies and associated demand for high performance hardware components.

b. The key players in this industry are ABB, Amazon Web Services (AWS), Inc., Cisco Systems, Inc., Honeywell International Inc., IBM Corporation, Microsoft Corporation, and others.

b. Key factors that are driving the U.S. edge computing market growth include increasing significance of big data, proliferation of smart devices, and high demand for low-latency processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.