- Home

- »

- Automotive & Transportation

- »

-

U.S. Electric Mobility Market Size, Industry Report, 2030GVR Report cover

![U.S. Electric Mobility Market Size, Share & Trends Report]()

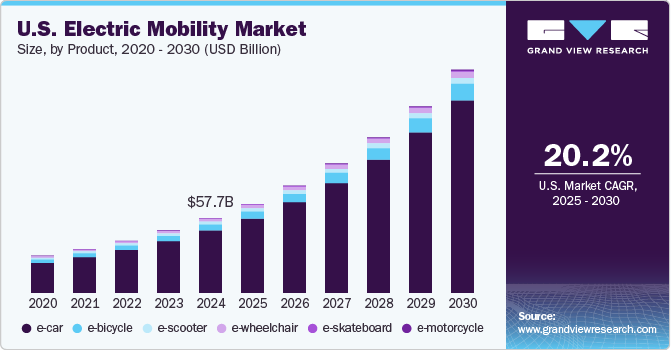

U.S. Electric Mobility Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Voltage (24V, 36V, 48V, Greater Than 48V), By Battery (Sealed Lead Acid, NiMh, Li-Ion), And Segment Forecasts

- Report ID: GVR-4-68038-328-7

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Mobility Market Size & Trends

The U.S. electric mobility market size was valued at USD 57.74 billion in 2024 and is projected to grow at a CAGR of 20.2% from 2025 to 2030. A significant emphasis on sustainability and environmental concerns has led consumers and businesses to increasingly adopt Electric Vehicles (EVs) to reduce greenhouse gas emissions. In addition, rising fuel prices have made electric mobility more considerable, prompting a shift from traditional fossil fuel-powered vehicles.

Moreover, investments in charging stations across urban and rural areas are anticipated to facilitate easier access to charging, encouraging more consumers to adopt EVs. In addition, advancements in battery technology, such as the development of solid-state and silicon anode batteries, are expected to enhance vehicle performance while reducing costs and improving driving range. These innovations make EVs more competitive compared to traditional vehicles and support the emergence of new business models, including electric ride-sharing services and e-scooter rentals, creating additional revenue streams within the electric mobility sector.

Furthermore, government policies aimed at reducing carbon emissions are anticipated to play a crucial role in shaping the future of the U.S. electric mobility industry. Several states have set targets for EV adoption and are implementing stricter emissions regulations for traditional vehicles. For instance, California's plan to ban the sale of new gasoline-powered cars by 2035 is expected to significantly accelerate the transition to electric mobility. These regulatory measures encourage consumers to switch to EVs and stimulate investments in research and development for innovative electric technologies. As consumer interest in eco-friendly transportation increases, car manufacturers are responding by broadening their electric vehicle (EV) options and enhancing current models. This development is projected to drive the U.S. electric mobility industry growth in the coming years.

Product Insights

The e-car segment dominated the market with 83.5% revenue share in 2024, primarily due to the increasing consumer preference for EVs as a sustainable transportation option. Factors such as rising fuel prices, environmental awareness, and government incentives have significantly contributed to the growth of this segment. Major automakers are expanding their EV offerings, enhancing technology, and improving charging infrastructure, further solidifying the e-car segment's leading position in the market. As consumers become more conscious of their carbon footprint, the demand for electric cars is expected to maintain its upward trajectory.

The e-motorcycle segment is expected to grow at the fastest CAGR over the forecast period, driven by advancements in battery technology and increasing demand for energy-efficient two-wheeled transportation. The rise in urbanization and traffic congestion has led consumers to seek alternatives to traditional motorcycles, making electric motorcycles a viable option for short commutes. Companies such as Zero Motorcycles and Harley-Davidson are investing in developing high-performance electric motorcycles that cater to this growing market. The introduction of fast-charging stations and supportive government policies are also expected to contribute to the rapid growth of the e-motorcycle within the U.S. electric mobility market.

Voltage Insights

The 24V segment dominated the market with the highest revenue share in 2024 due to its widespread application in various EV models. This voltage level is commonly used in smaller EVs and e-bikes, making it a popular choice among manufacturers. The versatility of 24V systems allows for efficient power management and compatibility with various components, enhancing their demand in the U.S. electric mobility industry. As manufacturers continue to innovate and improve vehicle designs, the demand for 24V systems is expected to remain strong.

The 48V segment is anticipated to grow at the fastest CAGR over the forecast period as automakers increasingly adopt this voltage level to enhance vehicle performance and efficiency. The 48V architecture supports advanced features such as regenerative braking and improved power delivery for hybrid systems, making it a beneficial option for manufacturers looking to optimize their EV offerings. As more companies focus on integrating 48V systems into their designs, this segment is expected to experience significant growth within the U.S. market.

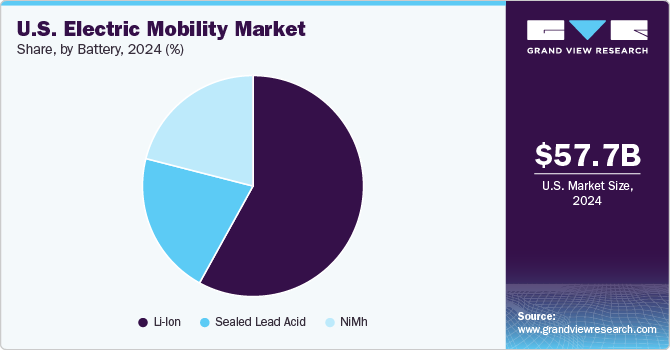

Battery Insights

The Li-Ion segment dominated the market with the highest revenue share in 2024 due to its established reputation for efficiency and performance in EVs. Lithium-ion batteries are known for their high energy density, lightweight design, and longer life cycles than other battery types. As a result, they have become the preferred choice for many EV manufacturers aiming to deliver high-performance vehicles that meet consumer expectations. Continued investments in lithium-ion battery technology will likely drive further advancements and maintain this segment's dominance in the U.S. electric mobility industry.

The NiMh segment is expected to grow at a significant CAGR over the forecast period as advancements in battery technologies enhance their performance and reduce costs. Nickel-Metal Hydride Batteries (NiMh) have been traditionally used in hybrid vehicles due to their reliability and safety features. However, recent innovations are improving their energy density and charging capabilities, making them more competitive against lithium-ion batteries. As automakers explore diverse battery options to meet varying consumer needs, the NiMH segment is anticipated to gain traction within the U.S. electric mobility industry, contributing to a more sustainable transportation landscape.

Key U.S. Electric Mobility Company Insights

The U.S. electric mobility market is characterized by diverse players contributing to its growth and innovation. Some major market players in the country are Harley-Davidson, known for its electric motorcycles, and Honda Motor Co., Ltd. Nissan Motor Co., Ltd. has also made strides with its electric models, including the popular Nissan Leaf, solidifying its presence in the U.S. EV sector. In addition, Accell Group focuses on electric bicycles, catering to the growing demand for eco-friendly transportation options.

-

Honda Motor Co. Ltd. is known for its commitment to sustainability and innovation in transportation. The company has been expanding its electric vehicle lineup, including hybrids and fully electric models, to meet the growing consumer demand for eco-friendly options. Honda's strategic initiatives focus on enhancing battery technology and increasing the production of electric vehicles, with plans to introduce several new models in the coming years. By investing in research and development, Honda aims to strengthen its position in the electric mobility sector and contribute to reducing overall carbon emissions.

-

BMW AG is known for strongly emphasizing the electrification of its vehicle portfolio. The BMW Group is dedicated to expanding its range of Battery Electric Vehicles(BEVs) and plug-in hybrids, offering innovative models that combine performance with sustainability. The company is committed to achieving ambitious goals for electric mobility while enhancing its sustainable transportation solutions.

Key U.S. Electric Mobility Companies:

- Accell Group

- Airwheel Technology Holding (USA) Co., Ltd.

- Derby Bicycle

- HARLEY-DAVIDSON

- Honda Motor Co. Ltd.

- Invacare Holdings Corporation

- SEGWAY INC.

- Lightning Motorcycles

- Nissan Motor Co., Ltd

- BMW AG

Recent Development

-

In January 2024, Tesla announced plans to produce an affordable robotaxi and a low-cost electric vehicle priced at USD 25,000, which will be based on the same vehicle architecture. Their production would begin toward the end of 2025. This strategic move aims to position Tesla competitively against more affordable gasoline-powered cars and an increasing number of low-cost electric vehicles, such as those manufactured by China's BYD.

-

In October 2023, Toyota Motor announced a supply agreement with LG Energy Solution to produce lithium-ion battery modules for the automaker's BEVs manufactured in the U.S. Under this agreement, LG Energy Solution will deliver 20 GWh of high-nickel NCMA battery modules to the company starting in 2025. To facilitate this initiative, LG Energy Solution aims to invest around USD 3 billion in its facility in Holland, Michigan, where production lines for modules and battery cells will be established specifically for Toyota.

U.S. Electric Mobility Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 68.51 billion

Revenue forecast in 2030

USD 171.87 billion

Growth Rate

CAGR of 20.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, voltage, battery

Key companies profiled

Accell Group; Airwheel Technology Holding (USA) Co., Ltd.; Derby Bicycle; HARLEY-DAVIDSON; Honda Motor Co. Ltd.; Invacare Holdings Corporation; SEGWAY INC.; Lightning Motorcycles; Nissan Motor Co., Ltd; BMW AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Mobility Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electric mobility market report based on product, voltage, and battery.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

E-Scooter

-

E-Bicycle

-

E-Skateboard

-

E-Motorcycle

-

E-Car

-

E-Wheelchair

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

24V

-

36V

-

48V

-

Greater than 48V

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Sealed Lead Acid

-

NiMh

-

Li-Ion

-

Frequently Asked Questions About This Report

b. The global U.S. electric mobility market size was estimated at USD 28.8 billion in 2020 and is expected to reach USD 33.8 billion in 2021.

b. The global U.S. electric mobility market is expected to grow at a compound annual growth rate of 19.8% from 2021 to 2028 to reach USD 119.8 billion by 2028.

b. Electric Car segment dominated the U.S. electric mobility market with a share of 80.8% in 2020. The segment growth can be attributed to the increasing adoption rate of electric cars compared to skateboards, bicycles, and wheelchairs.

b. Some key players operating in the U.S. electric mobility market include Accell Group, Airwheel Holding Limited, Derby Cycle, HARLEY-DAVIDSON, Honda Motor Co. Ltd., Invacare Corporation, Lohia Auto Industries, and Ninebot Ltd.

b. Key factors that are driving the market growth include the sustainability move toward smart cities is one of the key factors responsible for the adoption of eco-friendly and cost-effective transportation. Since electric scooters run on batteries, there are no carbon or gaseous emissions from these vehicles. This mode of transportation is gaining penetration amongst environmentally conscious commuters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.