- Home

- »

- Next Generation Technologies

- »

-

U.S. Energy Management Systems Market, Industry Report, 2030GVR Report cover

![U.S. Energy Management Systems Market Size, Share & Trends Report]()

U.S. Energy Management Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By System Type, By Component, By Deployment, By Vertical, And Segment Forecasts

- Report ID: GVR-1-68038-033-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

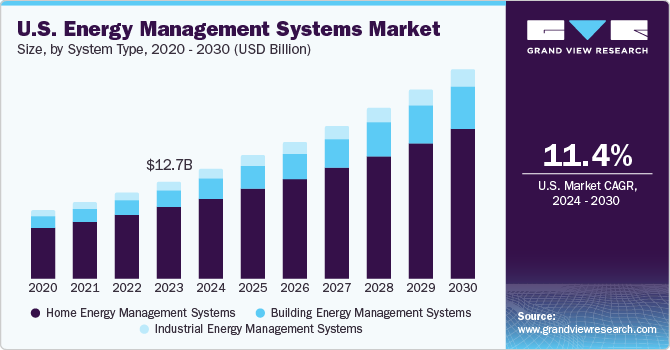

The U.S. energy management systems market size was valued at USD 12.70 billion in 2023 and is projected to grow at a CAGR of 11.4% from 2024 to 2030. The demand for proactive control, monitoring, and optimization of energy consumption across industrial, commercial, and public institutions and organizations has spurred the penetration of energy management systems (EMS). Besides, the decarbonization trend has prompted American stakeholders to inject funds into advanced EMS. Incumbent manufacturers have exhibited a profound interest in smart meter installation, auguring well for stakeholders vying to bolster their footprint in the region.

The U.S. government has augmented investments in energy management and clean energy. For instance, in January 2024, the Biden-Harris Administration announced an infusion of USD 207 million in clean energy and domestic fertilizer projects to minimize energy bills and bolster competition for U.S. farmers, agricultural producers, and ranchers. The USDA has also poured over USD 1.6 billion through REAP in 5,457 renewable energy and energy efficiency improvements.

Advanced technologies, including cloud, are likely to be sought for real-time monitoring of energy consumption. EMS solutions and services are poised to gain traction as the demand for industrial EMS, home EMS, and building EMS continues to receive an impetus across the North American region. Moreover, an uptick in R&D investments to commercialize EMS products will bode well for the business outlook.

Market Concentration & Characteristics

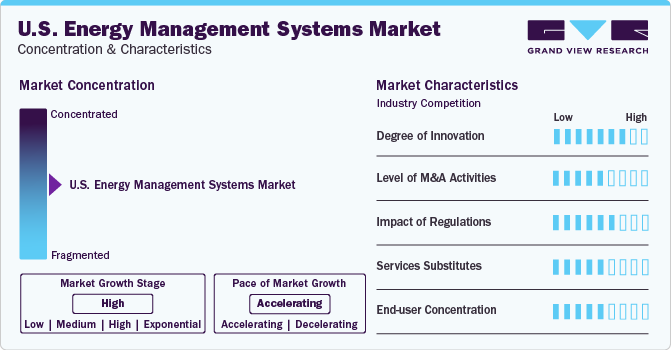

Innovations have become pronounced in the U.S. as stakeholders emphasize investments in state-of-the-art technologies. Predominantly, smart technologies and real-time EMS have garnered immense popularity across the region. For instance, the NYS Energy Research and Development Authority (NYSERDA) provides Real Time Energy Management (RTEM) and underpins up to 30% of the RTEM project’s cost.

The level of mergers & acquisitions activities has gained traction as market companies strive to gain a competitive edge. Notably, the trend for smart metering systems and advanced energy management has encouraged stakeholders to boost their strategies. For instance, in September 2023, DNV announced the acquisition of Houston-based ANB Systems to expedite energy transition and underscore digital energy management capabilities.

The U.S. regulations on energy management systems have reshaped the industry outlook. For instance, in 2022, the U.S. Department of Energy (DOE) issued a baseline energy efficiency standards update for new federal commercial and multi-family high-rise residential buildings. Moreover, the Energy Policy Act (EPA) addresses, including but not limited to, energy efficiency, tribal energy, renewable energy, energy tax incentives, and climate change technology.

The level of substitutes may be moderate as technological advancements and innovations continue to dominate the industry. Amidst surging installation costs, the installation of smart meters could provide a silver lining to identify discrepancies and consumption patterns. Soaring Greenhouse Gas (GHG) emissions have compelled stakeholders to bank on EMS components and services. The U.S. EPA asserts that the energy industry accounts for 25% of the GHG emissions. Stakeholders are expected to inject funds into EMS to overcome the current environmental challenges.

End-users, including energy & power, telecom & IT, manufacturing, healthcare and retail, are slated to invest in the management of energy use. The expansion of AI, machine learning and 5G networks will encourage end-users to invest in EMS hardware, software and services. End-users are likely to rethink their energy usage through advanced energy management systems.

System Type Insights

The Industrial energy management system (IEMS) segment led the U.S. energy management systems market, contributing 74.5% revenue share in 2023. The growth outlook is partly attributed to an increasing footprint of IoT devices, big data, and cloud computing. The emergence of Industry 4.0 and the trend for real-time data analytics have prompted American market companies to prioritize industrial energy management systems.

The Building energy management system (BEMS) segment has exhibited a notable uptick on the back of the demand for smart buildings. Of late, the rising penetration of smart metering devices and electrification of space heating and cooling has encouraged stakeholders to inject funds into BEMS cloud-based software platforms. BEMS is expected to be sought to control energy demands in buildings and minimize energy costs and consumption.

Component Insights

The hardware segment is expected to gain ground on the back of the rising footfall of sensor networks. End-users have depicted an increased inclination for real-time data tracking with improved sensor efficiency. Predominantly, the rising footfall of home automated systems has boded well for the market growth. Stakeholders have also furthered investments in hardware components following the uptake in the demand for controlling and monitoring building operations.

The software segment will observe an uptake during the forecast period, largely due to the component’s innate ability to minimize energy costs, provide actionable insights, and streamline workflow. EMS software has gained prominence as it provides accurate consumption and expenditure data. In addition, EMS suppliers and service providers are using software to streamline energy allocation and provide in-depth energy information.

Deployment Insights

The On-premises segment is slated to showcase stellar growth in light of heightened demand for edge controllers. For instance, On-premises equipment, as well as smart devices, has gained prominence to foster building energy management systems. While the migration to the cloud is expected to be pronounced, considerable capital expenditure could work in favor of On-premises EMS.

The cloud-based segment could unlock new opportunities against the backdrop of scalability, reduced costs, and flexibility. Of late, the U.S. has witnessed a profound demand for real-time visibility of energy. End-users could count on IIoT devices to reduce energy usage amidst a global push to minimize carbon emissions. Cloud-based EMS will provide a fillip to the U.S. market share with increased interoperability, streamlined operations, agility and faster deployment.

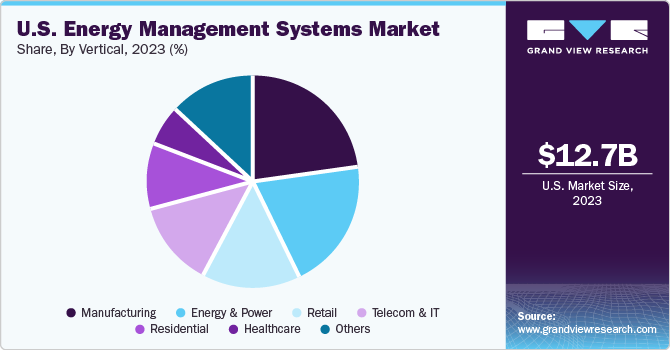

Vertical Insights

The manufacturing segment accounted for the largest revenue share in 2023, and it is forecast to witness a similar trend in the ensuing period. The growth potentials emanate from America’s robust roadmap towards a sustainable future. To illustrate, in October 2022, the U.S. Treasury held meetings with utilities, clean power groups, labor unions, and others to “jump-start green energy investments.” The manufacturing industry will rely on EMS to provide visibility of energy usage and add value to smart building systems.

The energy & power segment is likely to exhibit significant traction for EMS to foster efficiency and maximize energy availability with real-time controls. American companies are emphasizing advanced automation systems to manage electrical power availability by leveraging a permanent load balancing between the energy consumed and the energy produced. Energy and power companies will potentially use EMS to create financial projections and inject funds into advanced connectivity, big data and IoT.

Key U.S. Energy Management Systems Company Insights

Some of the leading players operating in the market include Honeywell, General Electric, Siemens AG, and Emerson. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.

- In February 2024, Siemens Energy announced an infusion of USD 150 million in a new factory in Charlotte, North Carolina. It will help the company address the lack of power transformers in the U.S.

-

In March 2023, Honeywell announced an investment in Redaptive to get access to the latter’s data technology and energy platform.

-

In November 2023, Emerson announced an infusion of funds into Frugal Technologies, a company that helps minimize energy use and emissions in shipping fleets. The latter’s cloud-based propulsion optimization software reportedly uses AI technology to collate data on cargo load, weather, and propulsion.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In August 2023, Verdigris raised USD 10 million in funding to expedite the adoption of an AI-fueled energy management platform.

-

In June 2022, Ubicquia and RealTerm Energy announced that the completion of 25 smart street lighting projects across the U.S. and Canada. The cities have reportedly implemented smart lighting controls and converted their streetlights to LED.

Key U.S. Energy Management Systems Companies:

- Schneider Electric SE

- Honeywell International Inc.

- Siemens AG

- Johnson Controls, Inc.

- C3.ai, Inc.

- GridPoint

- General Electric

- International Business Machines Corporation

- Cisco Systems, Inc.

Recent Developments

-

In August 2023, C3 AI asserted that the U.S. Air Force adopted its air logistics optimization application to boost flight efficiency and conserve fuel use.

-

In November 2022, IBM launched an initiative, IBM Sustainability Accelerator, to expedite clean energy transition. The program will reportedly apply AI and hybrid cloud to ramp up projects emphasizing vulnerable populations.

U.S. Energy Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.29 Billion

Revenue Forecast in 2030

USD 27.36 Billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

System type, Component, Deployment, Vertical

Key Companies Profiled

Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai, Inc.; GridPoint; General Electric; International Business Machines Corporation; Cisco Systems, Inc.

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Energy Management Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. energy management systems market based on system type, component, deployment, and vertical:

-

System Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial energy management systems (IEMS)

-

Building energy management systems (BEMS)

-

Home energy management systems (HEMS)

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Energy & Power

-

Telecom & IT

-

Manufacturing

-

Retail

-

Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. energy management systems market size was estimated at USD 12.70 billion in 2023 and is expected to reach USD 14.29 billion in 2024.

b. The U.S. energy management systems market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 27.36 billion by 2030.

b. Industrial energy management systems (IEMS) dominated the U.S. energy management systems market with a share of 74.5% in 2023. The growth outlook is partly attributed to an increasing footprint of IoT devices, big data, and cloud computing. The emergence of Industry 4.0 and the trend for real-time data analytics have prompted American market companies to prioritize industrial energy management systems.

b. Some key players operating in the U.S. energy management systems market include Schneider Electric SE, Honeywell International Inc., Siemens AG, Johnson Controls, Inc., C3.ai, Inc., GridPoint, General Electric, International Business Machines Corporation, and Cisco Systems, Inc.

b. Key factors that are driving the market growth include the influence of government on energy management, price escalation and fluctuations in energy consumption and grid and meter smart installation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.