- Home

- »

- Next Generation Technologies

- »

-

U.S. Environmental Monitoring Market, Industry Report, 2033GVR Report cover

![U.S. Environmental Monitoring Market Size, Share & Trends Report]()

U.S. Environmental Monitoring Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Monitors, Software, Services), By Sampling Method, By Component (Temperature, Moisture, Biological), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-634-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Environmental Monitoring Market Summary

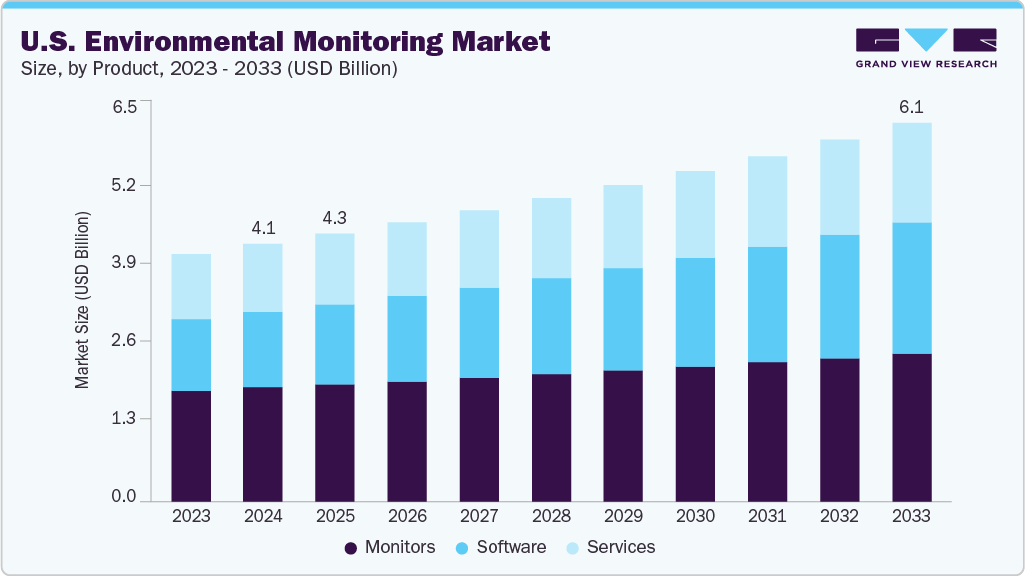

The U.S. environmental monitoring market size was estimated at USD 4,149.8 million in 2024 and is projected to reach USD 6,102.6 million by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The growth is primarily driven by strict regulations, rising pollution concerns, and increased adoption of real-time, IoT-based technologies for effective compliance, sustainability, and industrial risk management.

Key Market Trends & Insights

- By product, the monitors segment led the market and held the largest revenue share of 44.4% in 2024.

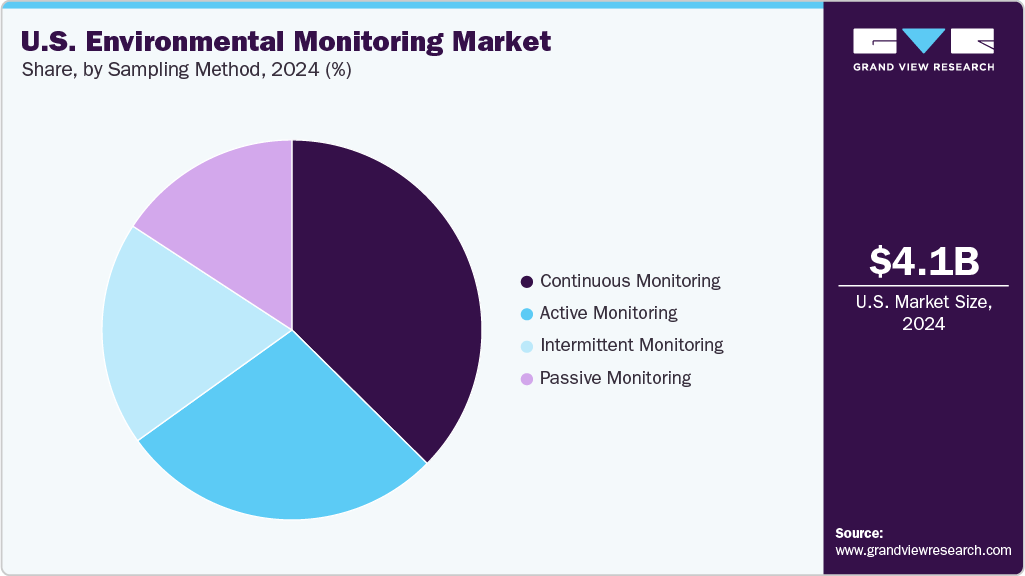

- By sampling method, the continuous monitoring segment accounted for the largest share of the U.S. environmental monitoring market in 2024.

- By component, particulate matter segment led the market and held the largest revenue share of 32.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,149.8 million

- 2033 Projected Market Size: USD 6,102.6 million

- CAGR (2025-2033): 4.4%

The increasing demand for accurate, real-time environmental data is accelerating the growth of the U.S. environmental monitoring industry. Environmental monitoring solutions now utilize IoT sensors, remote sensing, cloud-based platforms, and automated data analytics to monitor air and water quality, detect hazardous emissions, and ensure regulatory compliance. This technology-driven efficiency is particularly valuable in the face of tightening environmental regulations, public health concerns, and the urgent need for rapid response to climate-related events, prompting a shift toward smarter, scalable monitoring solutions.

The rapid evolution and deployment of sensor technologies and data analytics tools are fundamentally transforming the U.S. environmental monitoring industry. Advanced systems such as real-time air and water quality sensors, satellite-based remote sensing, and IoT-enabled monitoring networks enable authorities and organizations to detect pollution levels and respond swiftly. The demand for intelligent monitoring solutions continues to grow, accelerating the expansion of the U.S. environmental monitoring industry.

Additionally, increased environmental regulations and heightened public awareness of climate change and pollution are driving demand for robust monitoring systems. The Environmental Protection Agency (EPA) has imposed stricter emissions and water quality standards across industries such as manufacturing, energy, and agriculture. The growing necessity to achieve compliance goals without sacrificing operational efficiency positions environmental monitoring as a crucial investment, propelling market growth.

Furthermore, the rising adoption of environmental monitoring in smart city development and infrastructure modernization projects is significantly contributing to market expansion. The integration of monitoring technologies into transportation, construction, and utility networks enables municipalities to reduce environmental impact and enhance citizen well-being. Federal and local government initiatives to promote sustainable urban living through infrastructure grants and technology investments are encouraging the widespread deployment of monitoring solutions. This collaborative momentum between public agencies and private solution providers is fostering long-term growth and innovation in the U.S. environmental monitoring industry.

Product Insights

The monitors segment dominated the U.S. environmental monitoring market, accounting for a share of over 44% in 2024. The emergence of next-generation products, such as water-resistant, dustproof, data-logging sensors equipped with wireless technology, has influenced the growth of this segment. Increasing use of these monitors in industries such as transportation for consignment temperature monitoring, retail for warehouse environment monitoring, and other businesses for compliance adherence applications is expected to drive the segment growth.

The software segment is expected to witness the fastest CAGR of over 6% from 2025 to 2033. This growth is driven by the rising adoption of cloud-based environmental data platforms, real-time analytics, and AI-powered insights for pollution tracking, regulatory compliance, and risk mitigation. Increasing mandates for automated reporting, along with the need for centralized monitoring across air, water, and soil parameters, are fueling demand. Growing integration of IoT devices with software platforms enhances operational efficiency and decision-making, further propelling the segment's expansion.

Sampling Method Insights

The continuous monitoring segment accounted for the largest share of the U.S. environmental monitoring market in 2024, owing to features such as real-time data analysis and insights sharing, assurance of effective compliance adherence, use of advanced technology for enhanced outcomes, and focus of multiple organizations on enhancing facility comfort by adopting continuous monitoring technologies. Tools for continuous environmental monitoring are equipped with advanced sensors, intelligent system support, and abilities to identify and record even the slightest changes in elements such as temperature and amount of pollution.

The active monitoring segment is expected to witness a significant CAGR from 2025 to 2033. Active monitoring lacks the ability to record changes or contaminations after the sample is collected. Active environmental monitoring is preferred in large or medium-sized enterprises to ensure air quality maintenance. It is widely used to identify potential environmental issues and prevent them from furthering. As a result, demand for active monitoring systems is expected to rise in the coming years.

Component Insights

The particulate matter segment dominated the U.S. environmental monitoring industry with the largest share in 2024, driven by rising health concerns related to airborne pollutants and increased regulatory scrutiny across industries. The harmful effects of microscopic solids and liquid droplets, which can be inhaled and impact respiratory health, have prompted organizations to adopt advanced monitoring systems. These systems are designed to detect, analyze, and report real-time particulate concentrations. Equipped with high-precision sensors and automated alert mechanisms, particulate matter monitoring tools are becoming essential in safeguarding industrial workers and improving overall environmental quality.

The biological segment is expected to witness a significant CAGR from 2025 to 2033, owing to increasing awareness regarding the benefits associated with biomonitoring and its increasing application in areas such as freshwater ecosystem management, occupational health, and public health monitoring. Characteristics such as targeted assessment abilities and community engagements are likely to fuel the growth of this market during the forecast period.

Application Insights

The air pollution segment accounted for the largest market share in 2024. The growing number of motor vehicles, industrial emissions, and household combustion sources has significantly contributed to deteriorating air quality. Advanced environmental monitoring technologies are being deployed to measure pollutants such as particulate matter, nitrogen dioxide, sulfur dioxide, and carbon monoxide in real time. These systems support compliance efforts, enhance public awareness, and drive environmental policy reform. Increasing government investments in clean air initiatives and the integration of smart monitoring devices into urban infrastructure are reinforcing the segment's continued growth.

The noise pollution segment of the U.S. environmental monitoring industry is expected to witness a significant CAGR from 2025 to 2033. This growth is driven by rising urbanization, expansion of transportation networks, and stricter noise regulation frameworks. Increased adoption of real-time noise monitoring solutions by municipalities, airports, and industrial facilities is further fueling demand.

End-use Insights

The corporate segment accounted for the largest share of the U.S. environmental monitoring market in 2024. Stringent regulatory compliance requirements, indoor air quality management, employee well-being, and operational efficiencies are some of the key growth drivers for this segment. Sustainability initiatives embraced by the corporate industry, the significance of environmental monitoring in the pharmaceutical or food production sector, and measures regarding crisis management are projected to drive demand.

The government segment is expected to witness a significant CAGR from 2025 to 2033. This growth is driven by increasing regulatory enforcement, rising public health concerns, and federal investments in climate change mitigation. Government agencies are adopting advanced sensors and real-time data systems to ensure compliance and enhance environmental protection.

Key U.S. Environmental Monitoring Company Insights

Some of the key players operating in the market include Thermo Fisher Scientific Inc. and Agilent Technologies Inc.

-

Thermo Fisher Scientific Inc. delivers a wide range of environmental monitoring solutions, including air and water quality testing instruments, emissions analyzers, and real-time sensor platforms. The company supports U.S. regulatory compliance and public health initiatives by enabling accurate detection of pollutants, heavy metals, and pathogens across industrial, municipal, and research environments.

-

Agilent Technologies Inc. specializes in laboratory instruments and analytical technologies for environmental applications. Agilent’s chromatography, spectroscopy, and mass spectrometry systems are widely used in U.S. environmental testing labs to identify contaminants in soil, air, and water. The company continues to lead in precision analytics and method development for environmental protection.

Montrose Environmental Group Inc. and Teledyne Technologies Incorporated are some of the emerging participants in the U.S. environmental monitoring market.

-

Montrose Environmental Group Inc. offers innovative environmental solutions focused on measurement, laboratory analysis, and remediation. As a growing U.S.-based firm, Montrose delivers mobile air testing labs, water quality assessments, and compliance services for government and industrial clients, helping address real-time environmental challenges with rapid-response capabilities.

-

Teledyne Technologies Incorporated emerged as a key player through its expansion of advanced sensor platforms and analytical instruments. The company provides U.S. environmental agencies and industries with air, water, and soil monitoring solutions that integrate satellite and remote sensing capabilities, enhancing environmental data collection and decision-making accuracy.

Key U.S. Environmental Monitoring Companies:

- Emerson Electric Co.

- 3M

- Honeywell International Inc.

- Agilent Technologies Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Teledyne Technologies Incorporated

- PerkinElmer

- Montrose Environmental Group, Inc.

Recent Developments

-

In May 2025, PerkinElmer introduced a system with enhanced interference removal capabilities to support environmental laboratories across the U.S. This new technology enables precise, trace-level detection of heavy metals and pollutants in drinking water, strengthening municipal efforts to meet federal regulatory standards and improve real-time water quality monitoring.

-

In February 2025, Thermo Fisher Scientific launched its VVS Environmental Gas Analyzer platform in the U.S. environmental monitoring market. The system delivers high-precision, multi-gas detection, including VOCs and greenhouse gases, for industrial emissions monitoring. With automated calibration and cloud-based data reporting, the platform enhances regulatory compliance and streamlines environmental oversight for U.S. industrial facilities.

-

In February 2025, Teledyne Technologies (Teledyne e2v) introduced the Lince5M NIR high-speed CMOS sensor, designed for visible and near-infrared detection at 250 fps with a high dynamic range. This innovation supports the U.S. market for environmental monitoring by enabling advanced imaging applications for air and water quality assessment, industrial emissions tracking, and smart urban monitoring systems.

U.S. Environmental Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,320.2 million

Revenue forecast in 2033

USD 6,102.6 million

Growth rate

CAGR of 4.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sampling method, component, application, end-use

Country scope

U.S.

Key companies profiled

Emerson Electric Co.; 3M; Honeywell International Inc.; Agilent Technologies Inc.; Danaher Corporation; General Electric Company; Thermo Fisher Scientific Inc.; Teledyne Technologies Incorporated; PerkinElmer; Montrose Environmental Group, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Environmental Monitoring Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. environmental monitoring market report based on product, sampling method, component, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Monitors

-

Indoor

-

Outdoor

-

Portable

-

-

Software

-

Services

-

-

Sampling Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Monitoring

-

Continuous Monitoring

-

Intermittent Monitoring

-

Passive Monitoring

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Temperature

-

Moisture

-

Biological

-

Chemical

-

Particulate Matter

-

Noise

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Pollution

-

Water Pollution

-

Soil Pollution

-

Noise Pollution

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Corporate

-

Energy & Utilities

-

Healthcare

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. environmental monitoring market size was estimated at USD 4.14 billion in 2024 and is expected to reach USD 4.32 Billion in 2025.

b. The U.S. environmental monitoring market is expected to grow at a compound annual growth rate of 4.4 % from 2025 to 2033 to reach USD 6.10 Billion by 2033.

b. Continuous monitoring segment held the dominant position in the market and accounted for the leading revenue share of over 37% in 2024.

b. The key players in the U.S. environmental monitoring market include Emerson Electric Co., 3M, Honeywell International Inc., Agilent Technologies Inc., Danaher Corporation, General Electric Company, Thermo Fisher Scientific Inc., Teledyne Technologies Incorporated, PerkinElmer, Montrose Environmental Group, Inc.

b. Key factors driving market growth in the U.S. environmental monitoring market include strict regulations, pollution concerns, and real-time data needs, supported by technological advancements, sustainability initiatives, and increased investments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.