- Home

- »

- Organic Chemicals

- »

-

Carbon Monoxide Market Size & Share, Industry Report 2030GVR Report cover

![Carbon Monoxide Market Size, Share & Trends Report]()

Carbon Monoxide Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Chemical, Metal Fabrication, Electronics, Pharma & Biotechnology, Meat & Coloring Preservative), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-527-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Monoxide Market Summary

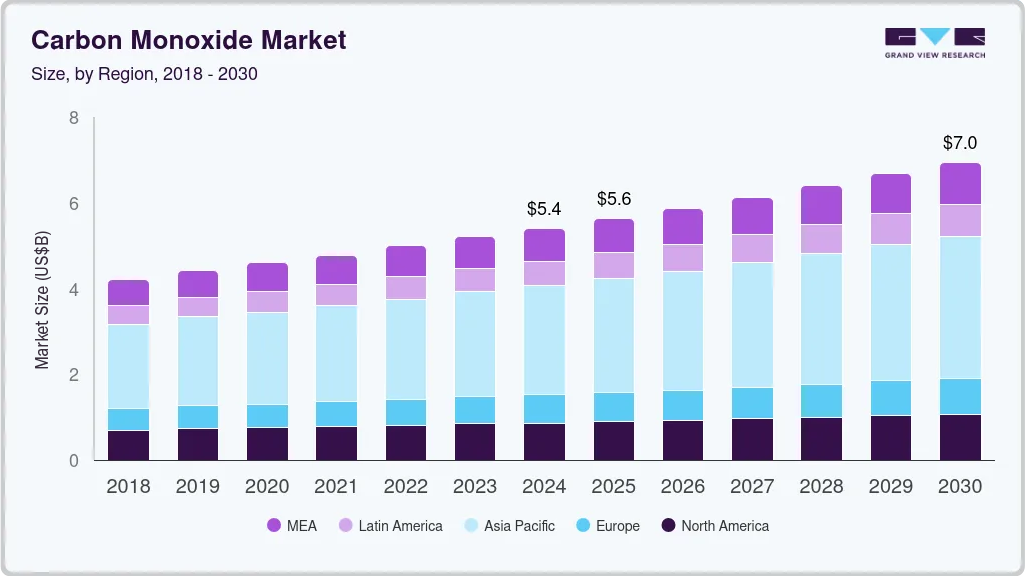

The global carbon monoxide market size was estimated at USD 5.42 billion in 2024 and is projected to reach USD 6.97 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. This growth is attributed to increasing demand for carbon monoxide in chemical manufacturing plants as they are a crucial feedstock in the production of syngas (a mixture of CO and hydrogen), which is widely used to manufacture methanol, acetic acid, and hydrocarbons.

Key Market Trends & Insights

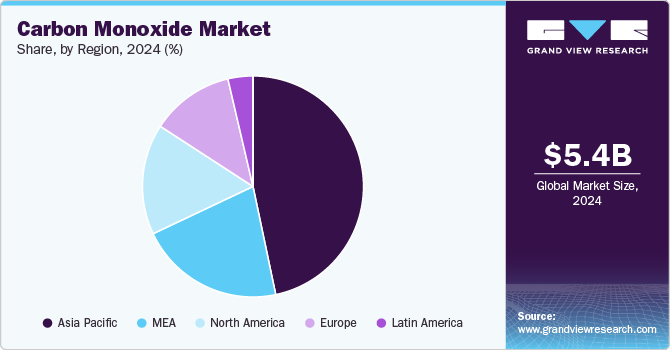

- Asia Pacific carbon monoxide market dominated the global industry with a revenue share of 47.0% in 2024.

- UK is expected to register the highest CAGR from 2025 to 2030.

- By application, the electronics segment dominated the market with a revenue share of 34.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.42 Billion

- 2030 Projected Market Size: USD 6.97 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

Moreover, increasing demand for methanol in fuel applications, plastics, and adhesives is driving CO consumption. Carbon monoxide (CO) is a colorless and odorless gas comprising one carbon atom and one oxygen atom. The incomplete combustion of fossil fuels or gasoline produces it. Because it is odorless and invisible, carbon monoxide is challenging to detect without specialized equipment. Additionally, it is utilized as a reducing agent in various metallurgical processes and many chemical reactions, such as methanol synthesis.

The carbon monoxide industry is fragmented, featuring several key players such as Air Liquide, Air Products and Chemicals, Inc. and Chemicals, Inc., American Gas Products, Celanese Corporation, Axcel Gases, Messer, Linde plc, and Sipchem Company.

Drivers, Opportunities & Restraints

The increasing demand for syngas in the carbon monoxide (CO) industry is driven by its versatility and efficiency in producing key chemicals and fuels. As industries seek sustainable and cost-effective alternatives, syngas, which are primarily composed of hydrogen and carbon monoxide, are gaining traction. Its ability to serve as a precursor in various processes, including methanol synthesis and Fischer-Tropsch synthesis, makes it integral to modern chemical manufacturing. Additionally, the push towards cleaner energy sources further propels the demand for syngas in CO production.

CO is a toxic gas with significant safety concerns, which may impede its market growth. The harmful effects of exposure, including potential health risks and fatalities, can lead to stricter regulations and decreased acceptance in various industries. Public awareness of these dangers may also drive demand for safer alternatives, further limiting the market potential for carbon monoxide applications. As a result, companies may face challenges in both production and consumer confidence.

The increasing demand for organic and inorganic chemicals will substantially grow the carbon monoxide market. As carbon monoxide is a key ingredient in the production of various chemicals, its utilization in manufacturing processes is becoming more critical. This uptick in chemical production, including methods like methanol synthesis and acetic acid production, will likely boost carbon monoxide consumption. Consequently, this trend points towards a significant expansion in the market size for carbon monoxide in the coming years.

Application Insights

The electronics segment dominated the market with a revenue share of 34.1% in 2024. This growth is attributed to CO’s significant role in producing essential chemicals. CO is a key feedstock for various processes, such as synthesizing methanol and acetic acid, which are fundamental in manufacturing plastics, solvents, and other industrial chemicals. As industries increasingly focus on chemical production to meet rising global demand, the reliance on carbon monoxide is expected to grow, positioning this segment for significant market expansion. This trend underscores the importance of carbon monoxide in sustaining and enhancing chemical manufacturing processes.

The metal fabrication segment of the carbon monoxide market plays a crucial role in various applications, including the production of steel and other alloys. Carbon monoxide directly reduces iron ore, facilitating iron extraction more cleanly and efficiently. One key market driver for this segment is the increasing demand for high-quality steel, driven by infrastructure development and construction activities. As industries strive for enhanced production efficiency and reduced emissions, the reliance on carbon monoxide in metal fabrication processes is expected to rise, fostering growth in this sector.

Regional Insights

Asia Pacific carbon monoxide market dominated the global industry with a revenue share of 47.0% in 2024. The high demand from companies involved in metal extraction and processing is expected to drive growth in the Asia Pacific carbon monoxide market. Additionally, the significant manufacturing presence of end-user industries, such as chemicals and pharmaceuticals, is likely to enhance the development of the CO market in the Asia-Pacific region further. Furthermore, the increasing demand for electronic-grade, high-purity carbon monoxide from Japan and China, particularly for producing integrated circuits and other sensitive components, is expected to positively impact industry growth.

North America Carbon Monoxide Market Trends

North America carbon monoxide market is anticipated to experience significant growth during the forecast period, primarily due to the presence of numerous manufacturers in the U.S. The expansion of mining activities and increased exploration of metal ores drive this market growth. For instance, according to the U.S. Geological Survey (USGS), in January 2025, the overall value of U.S. mineral production increased from USD 1 billion in 2024 to USD 106 billion.

In the carbon monoxide market in the U.S., the demand for the CO is expected to increase significantly due to increasing production of iron ore in the region. For instance, in October 2024, according to the U.S. Geological Survey (USGS) iron ore production was recorded at around 44,000 tons and 39,000 tons in 2023 and 2022 respectively, highlights a 13% increase in production in 2023 compared to 2022. This further leads to increased demand for CO which is used in the iron ore extraction process.

Europe Carbon Monoxide Market Trends

The carbon monoxide market in Europe is expected to grow. This growth is due to rising demand for CO from sectors such as metal fabrication and pharmaceuticals, which is a primary driver of market growth. Carbon monoxide is crucial in processes like iron extraction and as a reducing agent in various chemical reactions.

Latin America Carbon Monoxide Market Trends

The carbon monoxide market in Latin America is projected to grow steadily over the forecast period, mainly due to increasing regional iron ore production. Latin America is rich in non-ferrous metals, such as copper, which will likely boost demand for these products by reducing agents in the extraction process.

Middle East & Africa Carbon Monoxide Market Trends

The Middle East and Africa carbon monoxide market is expected to witness steady growth over the forecast period due to increasing end use applications. As CO is used in electronic product production, more over chemical production in the region is also increasing during the forecast period leading to the increased demand for the carbon monoxide market.

Key Carbon Monoxide Company Insights

Some key players operating in the market include Air Liquide and Messer.

-

The company’s business divisions include healthcare, electronics, and engineering & construction. The company operates in over 75 countries across the globe, with an employee count of 66,400. It carries out various processes such as carbonation, oxy-combustion, industrial cryogenics, and a few others. Airgas is a subsidiary of Air Liquide which supplies carbon dioxide and dry ice in the U.S. The company operates in over 75 countries across the globe. The company has a global presence serving the markets in the Americas, Europe, Asia Pacific, and the Middle East & Africa.

-

The Messer company is involved in the manufacturing and supply of oxygen, nitrogen, argon, carbon dioxide, and others for medicinal purposes. In addition, it also serves various industries, including food & beverage, electronics, rubber & plastics, paper & pulp, and others. The company operates in 30 European and Asian countries.

Key Carbon Monoxide Companies:

The following are the leading companies in the carbon monoxide market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Linde plc

- Celanese Corporation

- Messer

- MESA Specialty Gases & Equipment

- Sipchem Company

- Axcel Gases

- Praxair Inc.

- Air Products and Chemicals, Inc.

- American Gas Products

Recent Developments

-

In January 2024, Linde started supplying captured carbon dioxide and clean hydrogen to Celanese Corporation from their global chemical and specialty materials company's carbon monoxide and hydrogen production facility. Celanese uses other CO₂ sources and clean hydrogen as feedstock for producing low-carbon methanol at its joint venture Mitsui & Co., Ltd with Fairway Methanol LLC. This partnership builds an existing agreement in which Linde supplies Celanese with oxygen, carbon monoxide, and nitrogen. Both companies are dedicated to reducing their carbon footprints and advancing decarbonization efforts.

-

In May 2023, Air Products announced its plans to construct and operate two new carbon monoxide (CO) production facilities in Texas, one in La Porte and the other in Texas City, collectively producing over 70 million standard cubic feet per day (MMSCFD) of CO. The La Porte facility, set to be operational in 2024, will supply more than 30 MMSCFD to LyondellBasell, while the Texas City facility will come online in 2026, producing over 40 MMSCFD for Eastman Chemical Company. These facilities will integrate with Air Products' Gulf Coast CO pipeline network, enhancing supply reliability for regional customers.

Carbon Monoxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.64 billion

Revenue forecast in 2030

USD 6.97 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Air Liquide; Linde plc; Air Products and Chemicals, Inc.; Celanese Corporation; Messer; Air Products and Chemicals, Inc.; Sipchem Company; Axcel Gases; Praxair Inc.; American Gas Products

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Monoxide Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon monoxide market report based on the application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Metal Fabrication

-

Electronics

-

Pharma & Biotechnology

-

Meat & Coloring Preservative

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carbon monoxide market size was estimated at USD 5.42 billion in 2024 and is expected to reach USD 5.64 billion in 2025.

b. The global carbon monoxide market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 6.97 billion.

b. Asia Pacific dominated the carbon monoxide market with a share of 53.8% in 2024. This growth is attributed to the significant manufacturing presence of end-user industries, such as chemicals and pharmaceuticals, is likely to enhance the development of the CO market in the Asia-Pacific region further

b. Some key players operating in the carbon monoxide market include Air Liquide, Linde plc, Air Products and Chemicals, Inc., Celanese Corporation, Messer, Air Products and Chemicals, Inc., Sipchem Company, Axcel Gases, Praxair Inc., and American Gas Products.

b. This growth is attributed to increasing demand for carbon monoxide in chemical manufacturing plants. Carbon monoxide is crucial feedstock in the production of syngas (a mixture of CO and hydrogen), which is widely used to manufacture methanol, acetic acid, and hydrocarbons.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.