- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Essential Oils Market Size, Industry Report, 2033GVR Report cover

![U.S. Essential Oils Market Size, Share & Trends Report]()

U.S. Essential Oils Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Acorus Calamus, Ajowan, Basil, Black pepper, Cardamom, Carrot Seed, Cassia, Cedarwood, Citronella, Clove, Cornmint), By Application, By Sales Channel, And Segment Forecasts

- Report ID: GVR-1-68038-405-5

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Essential Oils Market Summary

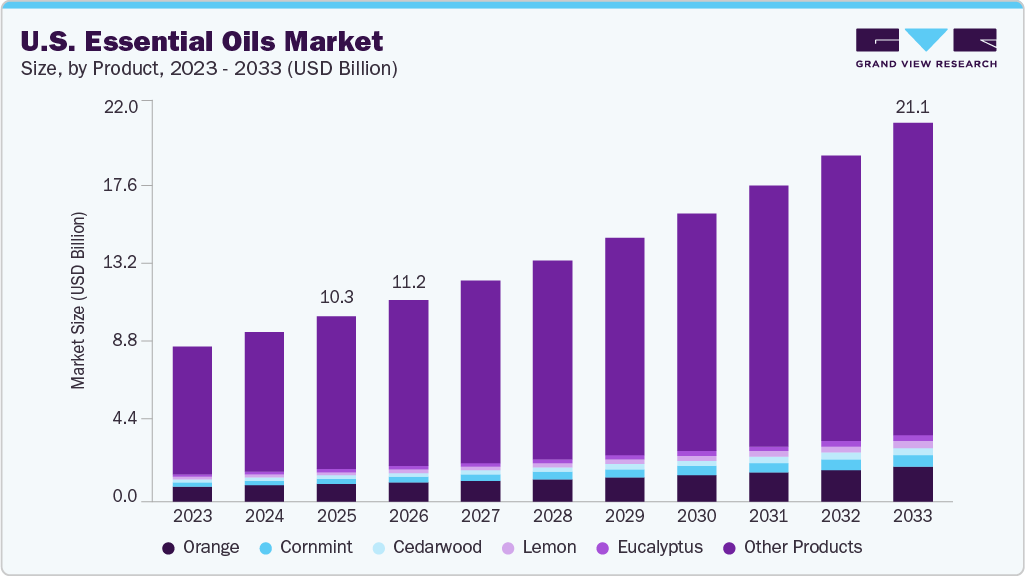

The U.S. essential oils market size was estimated at USD 10,280.8 million in 2025 and is expected to reach USD 21,085.8 million by 2033, growing at a CAGR of 9.4% from 2026 to 2033. The increasing demand for natural and plant-based ingredients across aromatherapy, personal care, food & beverages, and pharmaceuticals is driving market growth.

Key Market Trends & Insights

- By product, the orange oil segment accounted for a significant revenue share of 9.3% in 2025.

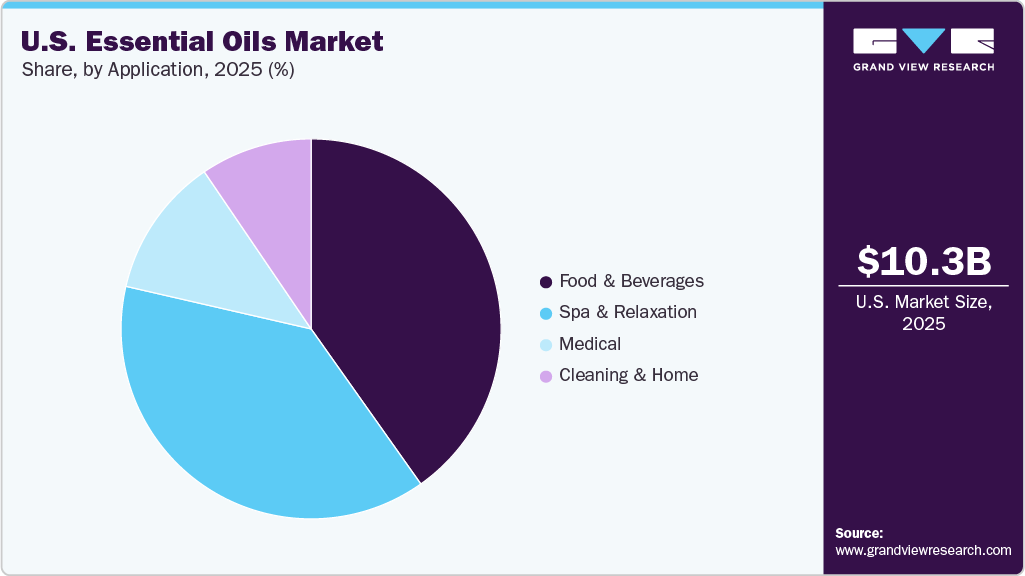

- By application, the food and beverage segment held the largest revenue share of 40.2% in 2025.

- By sales channel, the indirect segment held the largest revenue share of 68.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10,280.8 Million

- 2033 Projected Market Size: USD 21,085.8 Million

- CAGR (2026-2033): 9.4%

Rising consumer preference for clean-label and wellness-oriented products, expanding use of essential oils in cosmetics and functional foods, growing adoption in alternative therapies, and continuous product innovation in organic and sustainably sourced oils are contributing to the market’s steady expansion. Essential oils are concentrated natural extracts obtained from plants and are used for their aromatic, therapeutic, flavoring, and functional properties. Essential oils are primarily derived through distillation, cold pressing, or solvent extraction and are widely used across aromatherapy, personal care & cosmetics, food & beverages, pharmaceuticals, and home care applications. The rising demand for essential oils is largely driven by growing consumer awareness of natural wellness solutions, increasing preference for clean-label and plant-based ingredients, and expanding applications across health, beauty, and lifestyle products, along with advancements in extraction technologies that enhance purity, consistency, and product quality.

According to industry and wellness-focused sources, the increasing adoption of holistic health practices and natural ingredients across consumer-oriented industries in the U.S. is supporting essential oils consumption. Rising demand for aromatherapy and stress-relief products, coupled with growing focus on ingredient transparency, product safety, and compliance with regulatory standards, continues to encourage the use of high-quality and sustainably sourced essential oils, further strengthening demand across the U.S. market.

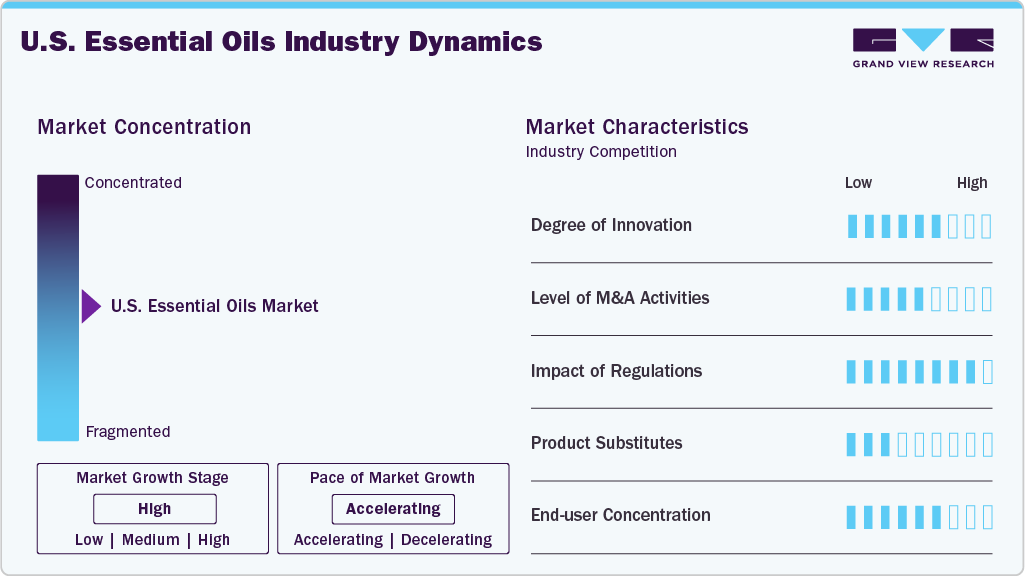

Market Concentration & Characteristics

The industry is moderately fragmented, with the presence of a mix of multinational essential oil producers, fragrance and flavor companies, and regional distillers shaping the competitive landscape. These companies benefit from established sourcing networks, strong relationships with consumer goods and wellness brands, and diversified product portfolios. Key participants are increasingly focusing on expanding production and sourcing capacities, investing in advanced extraction and purification technologies, and developing organic, traceable, and sustainably sourced essential oils to strengthen their competitive positioning in the U.S. essential oils industry.

Leading players in the industry are adopting a mix of capacity expansion, product innovation, strategic collaborations, and sustainability-focused initiatives to enhance their market presence. Companies operating across essential oil extraction, processing, and downstream formulation are investing in advanced distillation and extraction technologies, quality standardization, and product differentiation to improve purity, consistency, and functional performance across end-use applications. To address rising domestic demand across aromatherapy, personal care, food & beverages, and pharmaceutical applications, several market participants are expanding their production and sourcing capabilities, strengthening distribution and private-label partnerships, and collaborating with consumer goods manufacturers and wellness brands to support application-specific and regulatory requirements.

Product Insights

The orange oil segment accounted for a significant revenue share of 9.3% in 2025 and is expected to witness steady growth during the forecast period. Demand for orange oil is driven by its wide availability, cost competitiveness, and versatile functional properties across multiple end-use industries. Orange oil is extensively used in food & beverages, personal care & cosmetics, aromatherapy, and household cleaning products, supporting its strong adoption across both branded and private-label product segments. Other product types, including lavender, peppermint, eucalyptus, tea tree, and lemon oils, are also gaining traction due to their therapeutic benefits, aromatic profiles, and expanding application scope, and are analyzed in the report. Rising consumer demand for natural ingredients, clean-label formulations, and plant-based wellness products is further boosting essential oil consumption across the U.S. market.

Orange oil is valued for its pleasant citrus aroma, solvent properties, and broad functional versatility, making it suitable for diverse consumer and industrial applications. Lavender and peppermint oils are preferred in aromatherapy and personal care due to their calming and therapeutic attributes, while eucalyptus and tea tree oils are increasingly adopted for pharmaceutical, hygiene, and wellness applications. Continued product innovation, growing focus on natural and sustainable ingredient sourcing, expanding use in functional foods and cosmetics, and sustained demand from cost-sensitive applications are expected to support the continued growth of essential oil product segments over the forecast period.

Sales Channel Insights

The indirect selling channel dominated the market with a share of 68.8% in 2025. The channel is witnessing robust growth as distributors, wholesalers, and third-party suppliers play a critical role in connecting essential oil manufacturers with a wide range of end-use industries, including food & beverages, personal care, aromatherapy, wellness, and home care applications. These intermediaries facilitate product availability, ensure consistent supply, and support bulk procurement, enabling manufacturers and brands to focus on product innovation and market expansion. Rising demand for natural and sustainably sourced ingredients, increasing reliance on efficient distribution networks, and growing adoption of private-label and branded products are driving strong growth through indirect channels, while direct sales and e-commerce platforms are also analyzed in the report.

Essential oils distributed through indirect channels are required to meet strict quality, safety, and regulatory standards while ensuring timely delivery and consistent supply. Increasing focus on streamlined logistics, supplier partnerships, and inventory management, along with sustained demand from diverse end-use industries, is expected to support continued growth of the indirect sales channel and overall U.S. essential oils market.

Application Insights

The food & beverages segment dominated the industry with a revenue share of 40.2% in 2025. The segment is witnessing robust growth as essential oils are extensively used as natural flavoring agents across a wide range of food and beverage products, including bakery items, confectionery, beverages, dairy products, and savory formulations. These oils play a critical role in enhancing flavor profiles, aroma, and sensory appeal while supporting clean-label and natural ingredient positioning. Rising consumer preference for natural flavors, increasing demand for minimally processed foods, and growing use of plant-based ingredients are driving strong demand for essential oils within this segment, while other applications such as personal care & cosmetics, aromatherapy, pharmaceuticals, home care, and other industrial uses are also analyzed in the report.

Essential oils used in food and beverage applications are required to meet strict quality, safety, and regulatory standards while delivering consistent flavor and aroma performance. Increasing adoption of natural flavor solutions, growing focus on ingredient transparency and regulatory compliance, and sustained product innovation by food manufacturers are expected to drive continued growth of the food & beverages segment and other end-use industries across the U.S. market.

The spa & relaxation segment is expected to emerge as one of the fastest-growing end uses in the U.S. essential oils industry, registering a CAGR of 9.4% during the forecast period. Growth is driven by the increasing use of essential oils across spa therapies, massage treatments, aromatherapy sessions, and wellness centers, where these oils are valued for their therapeutic, calming, and mood-enhancing properties. Expanding consumer focus on stress management, mental well-being, and holistic health practices, along with rising demand for premium wellness experiences, is contributing to increased essential oil consumption within the segment.

Rising investments in wellness infrastructure, coupled with the growing popularity of self-care routines and professional spa services, are further accelerating adoption across the U.S. market. Ongoing product innovation, including the development of customized blends, organic and sustainably sourced oils, and enhanced aromatherapy formulations, is expected to support the sustained growth of the spa & relaxation segment over the forecast period.

U.S. Essential Oils Market Trends

The U.S. essential oils market represents a well-established and steadily evolving landscape, supported by strong consumer awareness and widespread adoption of natural and plant-based ingredients. Demand for essential oils across food & beverages, personal care & cosmetics, aromatherapy, pharmaceuticals, and wellness applications is contributing to sustained market activity. Increasing preference for clean-label products, growing interest in holistic health solutions, and expanding use of essential oils in functional foods and natural personal care formulations are shaping market dynamics in the U.S.

The presence of established domestic producers, advanced extraction and processing capabilities, and extensive distribution and private-label networks further supports market development. Ongoing investments in sustainable sourcing, organic and non-GMO certifications, and product innovation, along with rising consumer spending on wellness and self-care products, are expected to drive continued growth of the U.S. essential oils market over the forecast period.

Key U.S. Essential Oils Company Insights

Key players operating in the U.S. essential oils market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Key players, such as Shell PLC, Exxonmobil Corporation, and Chevron Corporation, are dominating the market.

- Aura Cacia is emerging as a key player in the U.S. essential oils market, focusing on the sourcing, production, and distribution of high-quality natural and organic essential oils for food, personal care, aromatherapy, and wellness applications. The company leverages its extensive supplier network, rigorous quality control measures, and strong technical expertise to develop pure, sustainably sourced, and innovative oil solutions. Aura Cacia’s commitment to sustainability, product integrity, and continuous innovation supports its growing presence across the domestic U.S. essential oils market.

Key U.S. Essential Oils Companies:

- Nature’s Truth

- NOW Foods

- doTERRA

- Rocky Mountain Oils, LLC

- Lebermuth, Inc.

- Givaudan (Ungerer & Company).

- Young Living Essential Oils, LC

- BIOLANDES

- The Essential Oil Company

- Eden Botanicals

- Edens Garden

- International Flavors & Fragrances

- MANE

- Symrise

- Firmenich SA

- Takasago International Corporation

- Sensient Technologies Corporation

- Robertet

Recent Developments

- DSM-Firmenich has introduced its AROMActive well-being rituals, a new skin-care line powered by natural fragrances and essential oil blends. The range uses over 95% natural-origin ingredients and combines clinically backed actives with aromatherapy-based scents designed to support mood and wellness. With “Sunrise” (energizing) and “Sunset” (relaxing) formats, the launch strengthens the role of essential oils in daily beauty routines and reflects growing demand for holistic, nature-driven wellness solutions.

U.S. Essential Oils Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11224.7 million

Revenue forecast in 2033

USD 21,085.8 million

Growth rate

CAGR of 9.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sales channel, application

Key companies profiled

Shell Aura Cacia; Nature’s Truth; NOW Foods; doTERRA; Rocky Mountain Oils, LLC; Lebermuth, Inc.; Givaudan (Ungerer & Company); Young Living Essential Oils, LC; BIOLANDES; The Essential Oil Company; Eden Botanicals; Edens Garden; International Flavors & Fragrances; MANE; Symrise; Firmenich SA; Takasago International Corporation; Sensient Technologies Corporation; Robertet

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Essential Oils Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. essential oils market report based on product, sales channel, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Acorus Calamus

-

Ajowan

-

Basil

-

Black pepper

-

Cardamom

-

Carrot Seed

-

Cassia

-

Cedarwood

-

Celery

-

Cinnamon

-

Citronella

-

Clove

-

Cornmint

-

Cumin Seed

-

Curry Leaf

-

Cypriol

-

Davana

-

Dill Seed

-

Eucalyptus

-

Fennel

-

Frankincense

-

Garlic

-

Ginger

-

Holy Basil

-

Juniper Berry

-

Lemon

-

Lemongrass

-

Lime

-

Mace

-

Mustard

-

Neem

-

Nutmeg

-

Orange

-

Palmarosa

-

Pepper Mint

-

DMO

-

Rosemary

-

Spearmint

-

Turmeric

-

Vetiver

-

Ciz-3 Hexanol

-

Tea Tree

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Medical

-

Pharmaceutical

-

Nutraceuticals

-

-

Food & Beverages

-

Bakery

-

Confectionery

-

Dairy

-

RTE meals

-

Beverages

-

Meat, Poultry & Seafood

-

Snacks & Nutritional Bars

-

-

Spa & Relaxation

-

Aromatherapy

-

Massage Oil

-

Personal Care

-

Cosmetics

-

Hair Care

-

Skin Care

-

Sun Care

-

Makeup and color cosmetics

-

-

Toiletries

-

Soaps

-

Shampoos

-

Men's Grooming

-

Oral Care

-

Baby Care

-

-

Fragrances

-

Perfumes

-

Body Sprays

-

Air fresheners

-

-

-

-

Cleaning & Home

-

Kitchen Cleaners

-

Floor Cleaners

-

Bathroom Cleaners

-

Fabric Care

-

-

-

Sales Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Direct Selling

-

Indirect Selling

-

Frequently Asked Questions About This Report

b. The U.S. essential oils market size was estimated at USD 10,280.8 million in 2025 and is expected to reach USD 11,224.7 million in 2026

b. Some of the key players operating in the U.S. essential oils market include Aura Cacia, Nature’s Truth, NOW Foods, doTERRA, Rocky Mountain Oils, LLC, Lebermuth, Inc., Givaudan (Ungerer & Company), Young Living Essential Oils, LC, BIOLANDES, The Essential Oil Company, Eden Botanicals, Edens Garden, International Flavors & Fragrances, MANE, Symrise, Firmenich SA, Takasago International Corporation, Sensient Technologies Corporation, and Robertet.

b. The U.S. essential oils market is expected to grow at a compound annual growth rate of 9.4% from 2026 to 2033 to reach USD 21,085.8 million by 2033

b. The orange oil segment dominated the U.S. essential oils market by product type in 2025, accounting for a significant share of 9.3% of overall consumption, driven by its versatility, cost-effectiveness, and wide applicability across food, personal care, and wellness products. Orange oil is extensively used in bakery items, beverages, confectionery, aromatherapy, and household care applications due to its appealing aroma, flavor-enhancing properties, and functional versatility

b. The U.S. essential oils market is primarily driven by rising demand from food & beverages, personal care, aromatherapy, and wellness sectors, supported by increasing consumer preference for natural and plant-based ingredients. Growing adoption of clean-label products, continuous product innovation, and expanding use of organic and sustainably sourced oils are accelerating market growth. The deployment of essential oils across functional foods, cosmetics, spa treatments, and household applications, driven by the need for quality, efficacy, and regulatory compliance, continues to support steady U.S. market expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.