- Home

- »

- IT Services & Applications

- »

-

U.S. Factoring Services Market Size And Share Report, 2030GVR Report cover

![U.S. Factoring Services Market Size, Share & Trends Report]()

U.S. Factoring Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Domestic, International), By Type (Recourse, Non-recourse), By Financial Institution (Banks, Non-banking Financial Institutions), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-924-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Factoring Services Market Trends

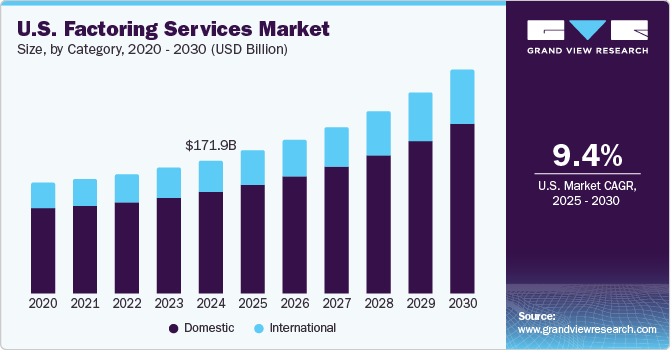

The U.S. factoring services market size was valued at USD 171.98 billion in 2024 and is projected to grow at a CAGR of 9.4% from 2025 to 2030. The current growth can be attributed to the increasing requirement for alternative sources of financing for Small and Medium Enterprises (SMEs) and the advent of blockchain technology and cryptocurrency in factoring services. Several fintech businesses are offering factoring services to SMEs and freelancers to ease their financial pressure owing to delayed payments. Furthermore, there is growing interest among enterprise owners in seeking new and non-conventional means of financing the companies. Organizations, such as Factors Chain International (FCI) are offering a unique network for cooperation in cross-border factoring, which has been adopted by several organizations.

The increased implementation of Machine Learning (ML), Natural Language Processing (NLP), and Artificial Intelligence (AI) is expected to generate profitable growth prospects for the U.S. factoring services market in the near future. For instance, in July 2021, RTS Financial Service, a U.S.-based factoring company, announced a partnership with PCS Software, an AI-driven transportation management platform leader, to provide better factoring capabilities and fuel savings to PCS Software’s marketplace of API-connected applications. This partnership will drive disruptive innovation for medium to large-sized enterprise brokers, carriers, and shippers in Canada and the U.S. These benefits will supplement the growth of the market during the forecast period.

Several fintech service providers in the region such as PayPal, JP Morgan, Morgan Stanley, and Wells Fargo, offer factoring services to SMEs and freelancers to ease the financial pressure caused due to delayed payments. This alternative form of financing is likely to be adopted and accepted for factoring receivables. However, new technologies are helping these companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts. Additionally, benefits such as cost-effectiveness, powerful insights and reporting, and thorough credit evaluation are expected to push the demand for factoring services.

Account receivable financing is becoming more secure owing to several laws. The governments of various states have developed legal frameworks for the use of electronic invoices. This has helped governments collect taxes efficiently, provide efficient factoring tools, and reduce fraud. Moreover, banks and financial services companies are constantly trying to upgrade their technological and operational expertise to provide cost-effective services to their customers and boost the demand for their services. For instance, in November 2020, Nav, a U.S.-based financial services company, launched a next-generation emended finance platform for small businesses. Features of the new platform included dynamic financing profiles and a full-service funding manager team, which would be used to improve predictions, deliver new products, and boost customer engagement and retention.

The rise in the adoption of Distributed Ledger Technology (DLT) among various SMEs and large enterprises, and increased awareness of blockchain DLT applications among various industries, are driving the growth of the regional market. The technology provides several benefits, such as sending and receiving product information transparently and storing customers’ detailed information securely for the next purpose. For instance, Walmart Inc., one of the leading retail corporations in the U.S., has been using blockchain DLT to track and record its product information. These benefits will supplement the growth of the regional market during the forecast period.

Category Insights

The domestic segment accounted for the largest share of 76.8% in 2024. The segment growth can be attributed to the rapid adoption of the factoring receivable methods in major industries due to their effectiveness. Furthermore, the increasing effectiveness of electronic invoices and the results of the government’s efforts in several states in the region, such as creating a competitive marketplace and creating high-quality jobs to boost private consumption (to measure the money spent by the consumers in the country to buy goods and services), is the key driving factor for the growth of the segment.

The international segment is expected to grow at the highest CAGR during the forecast period owing to the rise in open trade accounts, especially from suppliers in emerging economies. The major importers or suppliers in developed countries are considering factoring as a suitable alternative to conventional forms of trade finance, which is further expected to drive the demand for factoring services in the U.S. and other North American countries. Additionally, a growing number of Chinese manufacturers are moving production to countries in North and South America to avoid ongoing trade wars, which is further expected to boost the growth of the market.

Type Insights

The recourse segment held the largest market share in 2024. This factoring is extensively used in U.S. organizations. It helps the client raise funds in one go rather than waiting for each debtor to come up with the payment. The recourse factoring offers all facilities except debt protection. Furthermore, the recourse factoring services are used by firms who have creditworthy invoice clients and when they want to sell their invoices at the lowest discounts. The fact that firms pay smaller factor fees and receive the maximum money possible for invoices is what makes this segment used widely among businesses.

The non-recourse segment is expected to register a significant CAGR during the forecast period. The growth of the segment can be attributed to the advantages offered by factoring services, such as full credit cover offered by the financing companies and debt security. Non-recourse factoring can be a good option for businesses with a large customer base, as businesses may want to clean up their balance sheet by offloading their accounts receivable. Moreover, small and medium-sized businesses are expected to be leading buyers of this service. These capabilities will supplement the growth of the segment during the forecast period.

Financial Institution Insights

Banks dominated the market in 2024 owing to the growing adoption of blockchain technology platforms by several banks in the U.S. Several banks provide factoring services, such as Wells Fargo and Morgan Stanley, which perform an important trade finance service by helping to convert the user’s receivables into cash, thus helping tide over constraints of cash flow and working capital. Moreover, banks and financial services companies are constantly trying to upgrade their expertise on the technological and operational levels to provide cost-effective services to their customers and boost the demand for their services.

Non-Banking Financial Institutions (NBFIs) are expected to grow at the highest CAGR during the forecast period. The growth in the fintech companies and non-banking financial startup companies, such as Coinbase, Ripple, and Toast, Inc., among others, is the major factor propelling the growth of the market in the U.S. For instance, Ripple, an enterprise blockchain company, is using the Integrated Ledger Protocol (ILP), an open-source ledger that connects different banks’ proprietary ledgers through connectors for peer-to-peer transactions. This inter-ledger allows any financial institution to connect its core system to transact within the network. These developments in the region are expected to boost the growth of the segment.

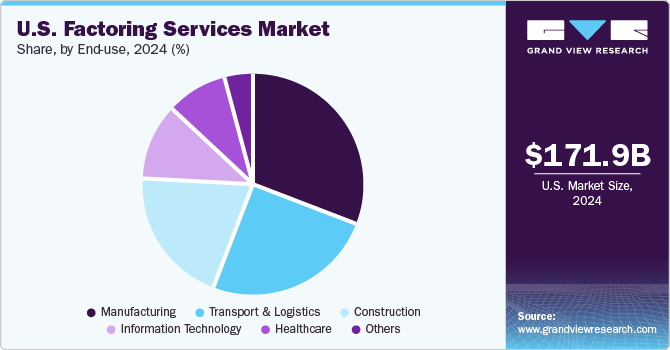

End-use Insights

The manufacturing segment dominated the market in 2024. The growth can be attributed to the increased funding options for micro and small & medium-sized manufacturing units, improved inventory management, and effective working capital management. Moreover, the growing regulatory scrutiny coupled with enhanced customer satisfaction, as well as enhancing production processes, and the creation of innovative products, which facilitate employees for streamlining work while retaining precision, are some of the factors responsible for the growth of the segment during the forecast period.

The transport & logistics segment is anticipated to register a moderate growth rate during the forecast period. The segment growth can be attributed to the benefits offered by freight factoring companies, such as paying drivers, buying fuel, fast funding, and value-added support services, which produce the ideal funding solutions for new and growing transportation companies in the U.S. Furthermore, these features continue to propel invoice factoring in the transportation industry even further forward, as a viable cash flow solution increasing its popularity as a form of business financing. Due to this, invoice factoring remains a primary source of funding for the transportation & logistics industry.

Key U.S. Factoring Services Company Insights

Some of the key companies in the U.S. factoring services market include HSBC Group; BNP Paribas; Barclays Plc; CIT Group Inc.; and the Southern Bank Company, among others. These players are undergoing several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

HSBC Group is a multinational investment bank and financial services holding company that provides personal and commercial loans, deposit services, mortgages, card products, insurance solutions, asset management, working capital and term loans, payment services, international trade facilitation, merger and acquisition advisory, transaction banking, capital markets, risk management, investment management, and trusts and estate planning, among others.

-

Barclays Plc is a multinational universal bank that is engaged in retail banking, credit cards, corporate and investment banking, and wealth management. The bank emphasizes strategic partnerships and collaborations as its key growth strategies to sustain in the factoring services market.

Key U.S. Factoring Services Companies:

- HSBC Group

- BNP Paribas

- Barclays Plc

- RTS Financial Services, Inc.

- TCI Business Capital

- Riviera Finance of Texas, Inc.

- CIT Group Inc.

- Triumph Business Capital

- Breakout Capital, LLC

- Charter Capital Holdings LP

Recent Developments

-

In September 2024, 1st Commercial Credit LLC announced the development of its services with the introduction of international invoice factoring for inbound sales. Furthermore, this new offering provides financial assistance to foreign businesses by factoring invoices from U.S.-based buyers importing goods from Latin America, Asia, and select European countries. With this development, foreign companies involved in international trade can enhance their cash flow by obtaining immediate financing on invoices supported by credit-insurable U.S. buyers.

U.S. Factoring Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 183.90 billion

Revenue forecast in 2030

USD 287.61 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institution, and end use

Key companies profiled

HSBC Group; BNP Paribas; Barclays Plc; RTS Financial Services, Inc.; TCI Business Capital; Riviera Finances of Texas, Inc.; CIT Group Inc.; Triumph Business Capital; Breakout Capital, LLC; and Charter Capital Holdings LP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Factoring Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. factoring services market report based on category, type, financial institution, and end-use:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recourse

-

Non-recourse

-

-

Financial Institutions Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banks

-

Non-banking Financial Institutions (NBFIs)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. factoring services market size was estimated at USD 171.98 billion in 2024 and is expected to reach USD 183.90 billion in 2025.

b. The global U.S. factoring services market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 287.61 billion by 2030.

b. The bank's segment accounted for the largest market share of 84.3% in 2024 owing to the growing adoption of blockchain technology platforms by several banks in the U.S.

b. Some key players operating in the U.S. factoring services market include HSBC Group; BNP Paribas; Barclays Plc; RTS Financial Services, Inc.; and TCI Business Capital, Riviera Finance of Texas, Inc.; CIT Group Inc.; Triumph Business Capital; Breakout Capital, LLC; and Charter Capital Holdings LP

b. The current growth of the regional market can be attributed to the increasing requirement for alternative sources of financing for Small and Medium Enterprises (SMEs) and the advent of blockchain technology and cryptocurrency in factoring services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.