- Home

- »

- Clinical Diagnostics

- »

-

U.S. Ferritin Testing Market Size, Industry Report, 2033GVR Report cover

![U.S. Ferritin Testing Market Size, Share & Trends Report]()

U.S. Ferritin Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Kits & Reagents, Lateral Flow Readers), By Application, By Technique, By Test Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-662-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ferritin Testing Market Size & Trends

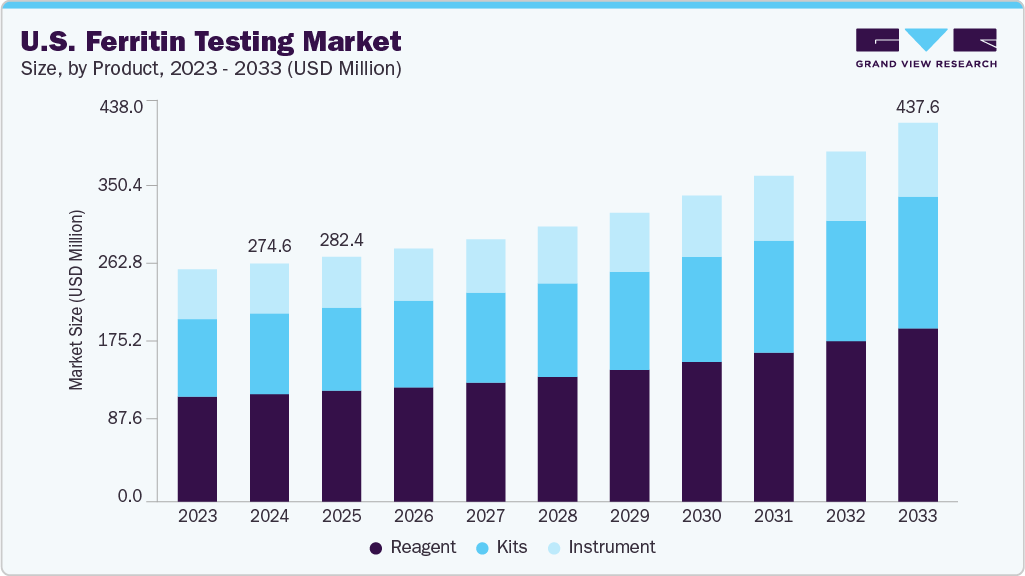

The U.S. ferritin testing market size was estimated at USD 274.60 million in 2024 and is projected to grow at a CAGR of 5.63% from 2025 to 2033. The market is driven by the rising prevalence of iron deficiency anemia and related chronic conditions such as inflammatory diseases, chronic kidney disease, and cancer.

Increasing awareness among healthcare professionals about the importance of ferritin as a biomarker for iron storage and inflammation has led to its growing adoption in both routine health screenings and specialized diagnostic protocols. In addition, the expanding geriatric population is more susceptible to anemia and nutritional deficiencies has amplified the demand for ferritin testing in clinical settings.

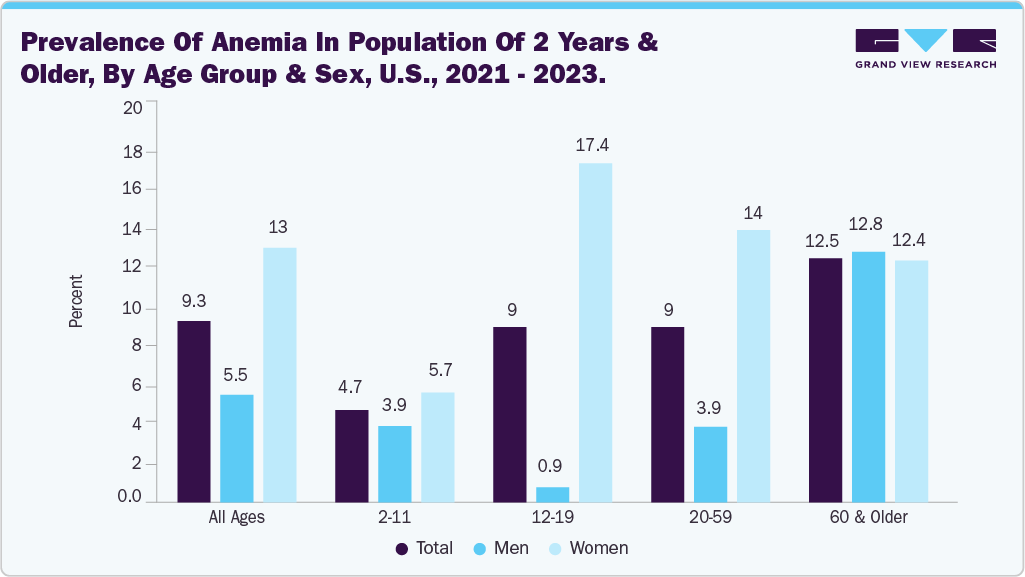

Millions of women of childbearing age and young children under five are likely suffering from anemia, experiencing symptoms like fatigue, weakness, and shortness of breath. These debilitating effects not only diminish their health and productivity but also have a broader impact on families, communities, and the development of nations. The chart below illustrates the incidence of anemia in the U.S. from 2021 to 2023.

According to a CDC report published in December 2024, from 2021 to 2023, anemia affected 9.3% of individuals aged 2 years and above. The condition was more common in females, with a prevalence of 13.0%, compared to 5.5% in males. Among age groups, the lowest anemia rates were observed in children aged 2 to 11 years (4.7%), while the highest rates were found in adults aged 60 and older (12.5%). Factors such as poor dietary intake, chronic blood loss, pregnancy, poverty level, and certain medical conditions contribute to the increasing incidence of IDA. Early and accurate diagnosis is crucial for effective management, making ferritin testing an indicator of the body’s iron stores a vital tool for healthcare providers.

Technological advancements in immunoassay platforms and the integration of ferritin testing into comprehensive anemia panels are further supporting market growth. Moreover, the growing emphasis on preventive healthcare, coupled with improved access to diagnostic services through hospital laboratories, physician offices, and point-of-care settings, continues to enhance the market’s expansion across the U.S.

Technological innovations offer further opportunities. The development of rapid, cost-effective, and minimally invasive point-of-care (POC) testing devices enables ferritin assessments outside traditional laboratories, improving accessibility in remote and underserved areas. For example, in March 2023, the smartphone-based point-of-care ferritin biosensor was launched. This innovative device enables rapid, on-site assessment of iron deficiency by measuring ferritin levels using a simple, portable biosensor connected to a smartphone. It offers an accessible, cost-effective solution for early diagnosis and monitoring in diverse healthcare settings.

Integration of ferritin testing with multiplex panels and digital health platforms also allows comprehensive iron status evaluation alongside other biomarkers, enhancing diagnostic efficiency and personalized care. In addition, growing government initiatives and public health programs focused on maternal and child health, nutrition, and anemia prevention support increased ferritin screening and monitoring. Emerging markets, with expanding healthcare infrastructure and rising healthcare expenditure, present untapped potential for market players to introduce affordable and scalable ferritin testing solutions

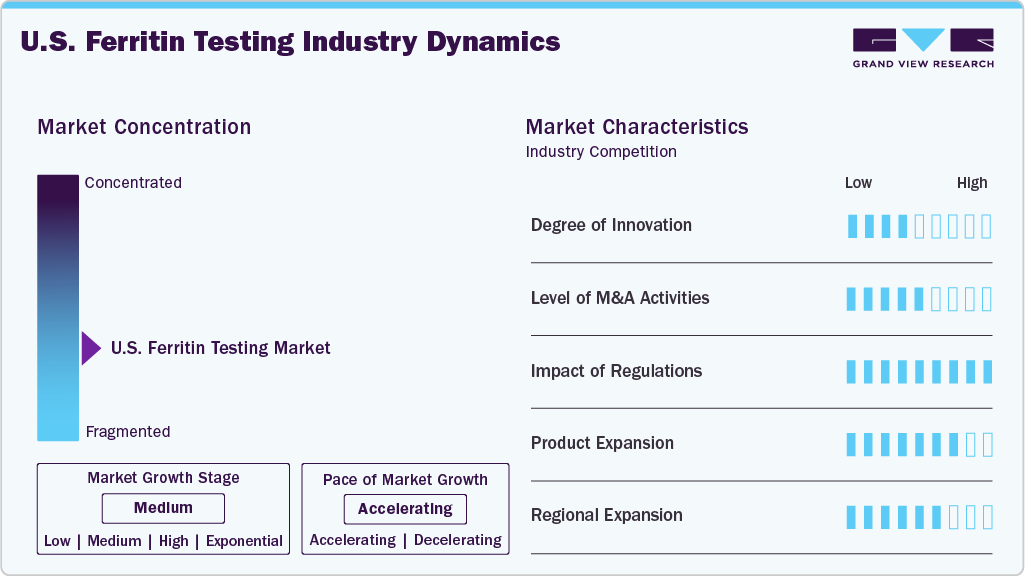

Market Concentration & Characteristics

The U.S. ferritin testing industry is experiencing continuous technological advancements, particularly in the areas of assay sensitivity, automation, and integration into multiplex platforms. High-sensitivity immunoassays, chemiluminescent detection methods, and advanced ELISA technologies are improving the accuracy and turnaround times of ferritin measurements. Moreover, integration with digital platforms and electronic health records (EHRs) is enabling real-time diagnostic decision-making, contributing to improved patient outcomes and more efficient anemia management protocols.

The U.S ferritin testing industry has seen notable M&A activity, with companies acquiring cutting-edge technologies to expand their portfolios. Strategic acquisitions are being driven by the need to incorporate ferritin testing within comprehensive anemia and inflammation diagnostic panels. These deals also enable companies to access proprietary platforms, expand their R&D pipelines, and enhance distribution across hospital laboratories and outpatient testing centers. This consolidation is helping to streamline product offerings and improve service reach across the U.S. healthcare landscape.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and Clinical Laboratory Improvement Amendments (CLIA) have a significant influence on the ferritin testing market. While laboratory-developed tests (LDTs) remain a key component of the market, increasing regulatory scrutiny is pushing for higher validation standards. At the same time, clear approval pathways for in vitro diagnostic (IVD) assays and point-of-care devices support innovation and market entry. Compliance with regulatory frameworks ensures test reliability and fosters trust among healthcare providers, thereby supporting long-term market stability.

Diagnostic manufacturers are actively expanding their product lines to include ferritin testing as part of broader anemia and iron panel solutions. Ferritin assays are increasingly being bundled with iron, transferrin saturation, and C-reactive protein (CRP) tests to provide clinicians with a more holistic view of a patient’s iron status and inflammatory condition. Most notably, Roche’s Elecsys automated immunoassay systems have recently gained widespread clinical adoption in U.S. hospitals and labs, offering precise measurements with minimal sample volume. In addition, the launch of rapid and point-of-care ferritin tests is enabling earlier diagnosis and monitoring, especially in resource-limited or outpatient settings. This expansion is also aligned with the growing trend toward personalized medicine and preventive care.

Companies are intensifying their regional outreach within the U.S., targeting underserved areas and broadening access to ferritin testing in non-hospital settings such as physician offices, urgent care clinics, and independent laboratories. Growth is particularly strong in regions with higher incidences of anemia-related conditions, such as the elderly and populations with chronic disease burdens. Efforts to decentralize testing services, combined with favorable reimbursement policies and increased healthcare funding, are supporting widespread regional adoption and driving consistent demand across urban and rural healthcare markets.

Product Insights

The reagents segment led the market with the largest revenue share of 45.34% in 2024. The reagent segment includes essential assay components required for the detection and quantification of ferritin concentrations in human serum or plasma. These reagents are used across a range of immunoassay-based methodologies, including enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay (CLIA), electrochemiluminescence (ECL), immunoturbidimetry, and nephelometry. Core reagents include monoclonal or polyclonal anti-human ferritin antibodies (for capture and detection), enzyme-labeled conjugates (e.g., HRP, alkaline phosphatase), signal substrates (such as TMB for ELISA or chemiluminescent agents for CLIA/ECL), buffers, wash solutions, and calibrators and controls.

The kits segment is projected to experience at the fastest CAGR over the forecast period, driven by the rising demand for rapid, point-of-care diagnostics and the increased availability of user-friendly test kits for both clinical and at-home use. This growth is further supported by technological advancements such as latex-enhanced immunoturbidimetric assays, improved sensitivity and specificity of ELISA kits, and the integration of ferritin tests into multiplex panels used in primary care and hospital settings. In addition, growing awareness around iron deficiency-related disorders, including anemia in women and chronic inflammation in elderly populations, has led to increased screening, reinforcing demand for test kits. Major companies like Abbott, Roche, Siemens Healthineers, and Diazyme Laboratories are actively expanding their test kit portfolios, launching CLIA-waived and FDA-approved products that enable quick turnaround times and support routine wellness testing across various healthcare settings.

Application Insights

The anemia application segment led the market with the largest revenue share of 44.10% in 2024. This growth is fueled by the escalating prevalence of iron deficiency anemia, particularly among women of childbearing age (approximately 12% affected) and elderly populations. This segment's growth is underpinned by robust clinical demand. For instance, in December 2024, the National Center for Health Statistics reported that between August 2021 and August 2023, the prevalence of anemia among individuals aged 2 years and older was 9.3%. The overall prevalence was significantly higher in females (13.0%) than in males (5.5%), with notable differences across specific age groups. Among adolescents aged 12–19, anemia affected 17.4% of females and only 0.9% of males, while in adults aged 20–59, the prevalence was 14.0% in females and 3.9% in males. The rise of point-of-care and home-use ferritin kits that deliver faster results aligns perfectly with clinicians' need for rapid anemia diagnostics in primary care and outpatient settings. Altogether, these trends signal a well-anchored and expanding role for anemia applications in the U.S. ferritin testing landscape.

The pregnancy segment is projected to grow at the fastest CAGR over the forecast period, due to rising awareness of maternal health and advancements in prenatal care. Factors such as increasing birth rates, greater access to healthcare, and the growing focus on maternal and fetal well-being drive this trend. Expectant mothers are increasingly seeking early and accurate detection of pregnancy-related conditions, including anemia, gestational diabetes, and preeclampsia, which is fueling the demand for specialized testing services. The market for pregnancy-related testing, particularly for conditions like anemia and gestational diabetes, is expanding with innovations in home testing and point-of-care devices. These advancements are making pregnancy-related health monitoring more accessible, convenient, and affordable, further driving the growth of the pregnancy testing market.

End Use Insights

The hospitals & clinics segment led the market with the largest revenue share of 56.39% in 2024, driven by factors such as increasing patient volumes, advancements in medical technology, and rising demand for specialized treatments. The expansion of healthcare infrastructure, particularly in emerging economies, also contributes to this growth. Hospitals are increasingly adopting advanced diagnostic tools, including rapid testing devices, to improve patient outcomes and streamline operations.

The diagnostic laboratories segment is expected to grow at the fastest CAGR during the forecast period. In 2022, U.S. diagnostic labs processed ferritin assays as part of broader micronutrient and anemia panels, reflecting the ongoing shift toward centralized high-volume testing Major national lab networks like Labcorp, with over 2,000 patient service centers and more than 6,000 in-office phlebotomists, and Quest Diagnostics, offering ferritin testing at over 2,200 locations and reaching 85% of U.S. physicians and hospitals, are key players Their recent innovation includes Quest’s 2024 launch of consumer-initiated micronutrient deficiency panels, which include ferritin tests available via QuestHealth.com, enhancing accessibility for both clinicians and consumers.

Key U.S. Ferritin Testing Company Insights

Leading companies in the U.S. ferritin testing industry including Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Thermo Fisher Scientific, Bio-Rad Laboratories, bioMérieux, and Diazyme Labs, are intensifying efforts to innovate and expand their test offerings. Abbott launched an advanced Ferritin ELISA test kit in September 2023, enabling dual-analyte measurement for more comprehensive iron metabolism profiling and improved diagnostic accuracy in at-risk populations. Roche gained FDA approval in June 2023 for its high-sensitivity Ferritin ELISA test, enhancing both sensitivity and specificity and facilitating broader adoption in clinical labs. Siemens Healthineers continues to build momentum by integrating ferritin assays into its Atellica platform, supporting high-throughput analysis in major hospitals.

Key U.S. Ferritin Testing Companies:

- Eurolyser Diagnostica GmbH

- Cortez Diagnostics Inc

- Pointe Scientific, Inc

- bioMrieux

- Aviva Systems Biology Corporation

- Abnova Corporation

- CTK Biotech, Inc

- Thermo Fisher Scientific Inc.

U.S. Ferritin Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 282.42 million

Revenue forecast in 2033

USD 437.64 million

Growth rate

CAGR of 5.63% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Country scope

U.S.

Key companies profiled

Eurolyser Diagnostica GmbH; Cortez Diagnostics Inc.; Pointe Scientific, Inc.; bioMrieux; Aviva Systems Biology Corporation; Abnova Corporation; CTK Biotech, Inc.; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ferritin Testing Market Report Segmentation

This report forecasts revenue growth at, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. ferritin testing market report based on product, application, technique, test type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instrument

-

Reagent

-

Kits

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Anemia

-

Hemochromatosis

-

Lead Poisoning

-

Pregnancy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. ferritin testing market size was valued at USD 274.60 million in 2024 and is expected to reach USD 282.42 million in 2025.

b. The U.S. ferritin testing market is expected to expand at a compound annual growth rate (CAGR) of 5.63% from 2025 to 2033.

b. The reagents segment dominated the U.S. ferritin testing market accounting for 45.34% of the market share in 2024. The reagent segment of the ferritin testing market includes essential assay components required for the detection and quantification of ferritin concentrations in human serum or plasma

b. Eurolyser Diagnostica GmbH; Cortez Diagnostics Inc.; Pointe Scientific, Inc.; bioMrieux; Aviva Systems Biology Corporation; Abnova Corporation; CTK Biotech, Inc.; Thermo Fisher Scientific Inc.

b. The market is driven by the rising prevalence of iron deficiency anemia and related chronic conditions such as inflammatory diseases, chronic kidney disease, and cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.