- Home

- »

- Advanced Interior Materials

- »

-

U.S. Flax Fiber Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Flax Fiber Market Size, Share & Trends Report]()

U.S. Flax Fiber Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Fashion & Textile, Sportswear, Workwear, Smart Textiles & Sensors), And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-639-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flax Fiber Market Summary

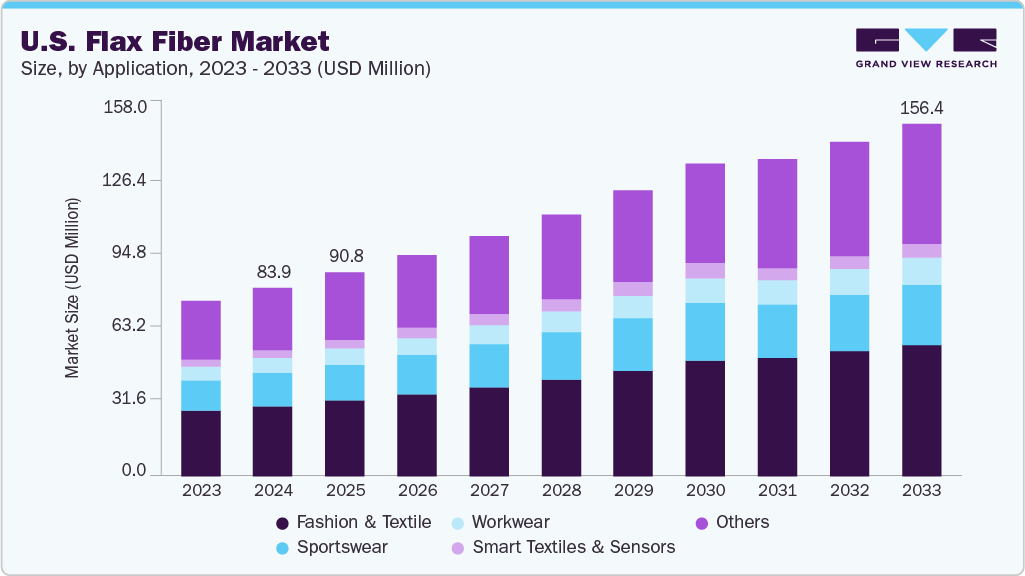

The U.S. flax fiber market size was estimated at USD 83.9 million in 2024, and is projected to reach USD 156.4 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033, driven by a growing shift toward sustainable and biodegradable materials across key industries such as textiles, automotive, construction, and packaging. Consumers and manufacturers alike are showing a preference for natural fibers over synthetic alternatives, largely due to rising environmental concerns, government regulations around plastic use, and increasing awareness of the ecological footprint of conventional materials.

Key Market Trends & Insights

- By application, the fashion & textile segment is expected to grow at the fastest CAGR of 7.1% over the forecast period.

- The workwear segment is expected to grow at the fastest CAGR of 6.9% over the forecast period

Market Size & Forecast

- 2024 Market Size: USD 83.9 Million

- 2033 Projected Market Size: USD 156.4 Million

- CAGR (2025-2033): 7.0%

The demand is also bolstered by the rise of circular economy principles in product design and waste management practices. One of the major drivers fueling the U.S. flax fiber industry is the strong expansion of the eco-friendly fashion and home textiles sectors. Brands are increasingly incorporating flax-based linen and blends into their product lines to meet consumer demand for organic, breathable, and durable fabrics. In addition, the rise of “farm-to-fashion” movements and traceable sourcing practices is favoring the adoption of regionally grown flax. Beyond textiles, the use of flax composites in automotive interiors and bio-based construction materials is expanding rapidly due to their lightweight, durable, and fire-resistant properties.

Innovations in flax fiber processing and applications are also contributing to market momentum. U.S.-based companies and research institutions are exploring enzyme retting techniques, mechanical upgrades in fiber extraction, and nanocellulose production from flax waste, improving efficiency and fiber quality. Moreover, advances in hybrid composites combining flax with other bio-resins or synthetic fibers are enabling their use in high-performance applications across aerospace, marine, and sporting goods industries, widening the scope for market growth.

Market Concentration & Characteristics

The U.S. flax fiber industry is moderately concentrated, with a few key players dominating a significant share of the value chain, particularly in processing and high-performance applications. Companies engaged in flax fiber production often operate through vertically integrated models, managing everything from cultivation to processing and product development. This allows them to maintain consistent quality, traceability, and pricing leverage. However, the limited number of large-scale flax cultivators and processors within the U.S. creates supply constraints, resulting in dependence on imports from countries such as France, Belgium, and the Netherlands, where flax production is more established.

The U.S. flax fiber industry faces competition from several product substitutes, particularly other natural fibers like hemp, jute, cotton, and kenaf, as well as synthetic alternatives such as polyester and polypropylene. Hemp, in particular, poses a strong challenge due to its higher tensile strength, faster growth cycle, and broader applications across textiles, construction, and bioplastics. Cotton remains a preferred choice in apparel due to its softness and widespread availability, while synthetic fibers dominate in cost-sensitive and performance-intensive segments. However, flax continues to maintain its niche appeal due to its superior moisture-wicking properties, biodegradability, and increasing alignment with eco-conscious consumer preferences.

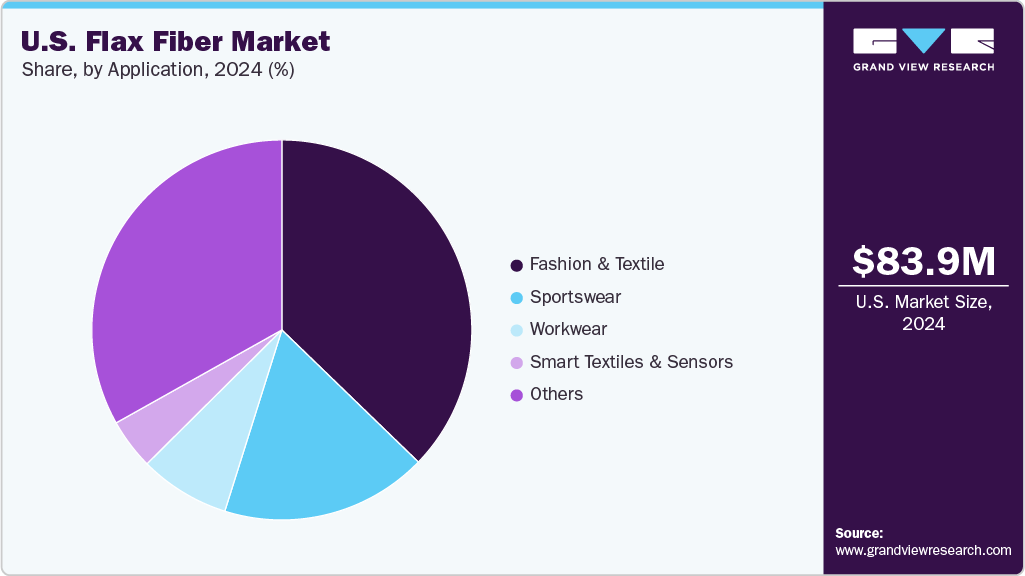

Application Insights

The fashion & textile segment led the market with the largest revenue share of 37.2% in 2024, due to rising consumer demand for sustainable, breathable, and natural fabrics. Flax-based linen is increasingly favored in apparel, home textiles, and lifestyle products for its durability, low environmental impact, and premium texture. Many fashion brands, both luxury and fast fashion, are incorporating flax fibers into their collections to align with circular economy goals and ESG commitments. The growth of conscious consumerism, combined with increased availability of organically certified flax, is reinforcing its stronghold in this sector.

The workwear segment is expected to grow at the fastest CAGR of 6.9% over the forecast period, driven by a rising preference for durable, lightweight, and eco-friendly materials in protective and industrial clothing. Flax fiber's natural flame resistance, moisture management, and thermal regulation properties make it well-suited for uniforms used in construction, agriculture, logistics, and manufacturing. In addition, as regulations tighten around sustainability in procurement and corporate responsibility, more employers are sourcing workwear made from renewable and biodegradable materials, further accelerating demand for flax-based textiles in this category.

Key U.S. Flax Fibers Company Insights

Some of the key players operating in the U.S. market include Fibrevolution, Coast Fibers

-

Founded in 2016 in Oregon by Shannon Welsh and Angela Wartes‑Kahl, Fibrevolution is pioneering the revival of fiber flax cultivation and processing in the Pacific Northwest,marking the first efforts in the region in over 60 years. They operate an organic-focused farming network and are actively developing a regional mill infrastructure to produce long-line linen locally

-

Launched in April 2025 as an offshoot of Fibrevolution, Coast Fibers in Oregon represents the next phase of the flax-to-linen value chain. It’s the first step toward establishing a domestic flax fiber mill born from eight years of R&D and community-driven efforts on the West Coast.

Meridian Specialty Yarn Group, Dillon Yarn Corporation are some of the emerging market participants in the U.S. flax fiber industry.

-

Based in North Carolina, Meridian specializes in novelty and dyed yarns, including flax blends. It operates full-spectrum spinning and dyeing facilities-covering package, space, top dyeing, twisting, and more-and supplies yarns for upholstery, apparel, industrial, and automotive markets, often incorporating flax fibers.

-

Headquartered in South Carolina (with distribution operations in Florida), Dillon Yarn offers a broad range of spun, flat, and industrial yarns, including linen and flax blends. With around a century in the textile business, it serves sectors spanning textiles, apparel, industrial, and specialty fabrics.

Key U.S. Flax Fibers Companies:

- Fibrevolution

- Coast Fibers

- Kropna Fibers

- Hemptique

- Meridian Specialty Yarn Group

- Ludlow Textiles

- Dillon Yarn Corporation

- American Falcon, Inc.

- Brahms Mount

- Tuscarora Yarns

U.S. Flax Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 90.8 million

Revenue forecast in 2033

USD 156.4 million

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S

Key companies profiled

Fibrevolution; Coast Fibers; Kropna Fibers; Hemptique; Meridian Specialty Yarn Group; Ludlow Textiles; Dillon Yarn Corporation; American Falcon, Inc.; Brahms Mount; Tuscarora Yarns

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flax Fiber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. flax fiber market report based on application.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Fashion & Textile

-

Sportswear

-

Workwear

-

Smart Textiles and Sensors

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. flax fiber market size was estimated at USD 83.9 million in 2024 and is expected to reach USD 90.8 million in 2025.

b. The U.S. flax fiber market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 156.4 million by 2033.

b. The fashion & textile segment in the U.S. market accounted for the largest revenue share of 37.2% in 2024, due to the fiber's favorable properties and alignment with the growing demand for sustainable apparel.

b. Some of the prominent companies in the flax fiber market include Fibrevolution, Coast Fibers, Kropna Fibers, Hemptique, Meridian Specialty Yarn Group, Ludlow Textiles, Dillon Yarn Corporation, American Falcon, Inc., Brahms Mount, Tuscarora Yarns.

b. Key factors driving the U.S. flax fiber market include rising sustainability awareness, growth in eco-friendly textiles, and increasing use in bio-based composites across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.