- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Flexible Polyethylene Market Size & Share Report, 2030GVR Report cover

![U.S. Flexible Polyethylene Market Size, Share & Trends Report]()

U.S. Flexible Polyethylene Market (2023 - 2030) Size, Share & Trends Analysis Report By Grade (Flexible HDPE, Flexible LDPE, Flexible LLDPE), By Product, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-107-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

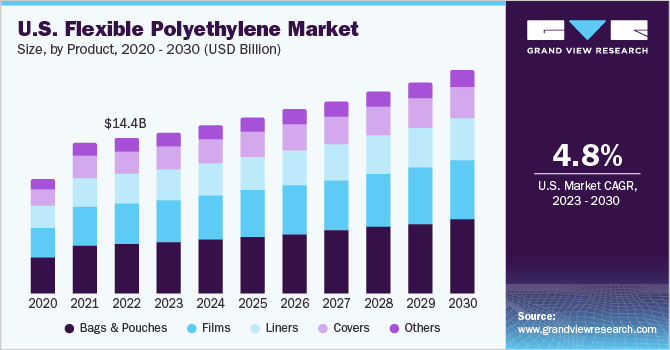

The U.S. flexible polyethylene market size was estimated at USD 14.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The flexible polyethylene (PE) market in the U.S. is witnessing substantial growth, mainly driven by several key factors. The widespread adoption of flexible PE across various industries, such as packaging, construction, automotive, and healthcare, has significantly contributed to its market expansion. Its lightweight, durable, and versatile characteristics make it a preferred choice for a wide range of applications. The increasing awareness and emphasis on sustainability and eco-friendliness have played a pivotal role in driving the market's upward trajectory.

With consumers and market alike prioritizing environmentally responsible solutions, the recyclable nature of flexible PE and its reduced carbon footprint have positioned it as an attractive option. Continuous advancements in manufacturing technologies have led to improved product quality and performance, bolstering the market's appeal further. As the market continue to recognize the value of this eco-friendly material, they are actively leveraging effective communication strategies to highlight the numerous advantages of flexible PE, leading to its sustained growth and solidifying its position as a prominent player in the U.S.

The U.S. flexible polyethylene (PE) market is witnessing remarkable growth, and several key driving factors are propelling this expansion, particularly within the product categories of films, liners, bags & pouches, and covers. One of the primary drivers behind this growth is the widespread utilization of flexible PE in packaging applications, such as films and bags & pouches, across various industries like food and beverage, consumer goods, and pharmaceuticals. The demand for lightweight, durable, and cost-effective packaging materials has led to the increased adoption of flexible PE solutions, providing a practical solution for preserving and protecting products while also offering excellent versatility in design and customization.

Furthermore, the construction industry has been a major catalyst for the market's growth, relying heavily on liners and covers made from flexible PE. These products are extensively used for waterproofing, lining landfills, and providing weather-resistant coverings. The durability and resistance to environmental elements make flexible polyethylene(PE) an ideal choice for construction applications, fueling its demand within this sector. Additionally, the increasing emphasis on sustainability and eco-friendliness has played a pivotal role in driving the market's upward trajectory.

With consumers and the market increasingly seeking environmentally responsible solutions, flexible PE's recyclable nature and reduced carbon footprint have positioned it as an attractive option across all these product categories. These combined factors are contributing to sustained growth and solidifying the position of flexible PE as one of the prominent materials in the U.S. market.

Product Insights

The bags & pouches product segment dominated the U.S. flexible PE market with more than 32% of the revenue share in 2022. This is attributed to their widespread applications and convenience in various industries. These flexible PE products offer versatile packaging solutions, meeting the diverse needs of consumers and businesses alike. From grocery shopping to industrial packaging, bags & pouches provide a lightweight, durable, and cost-effective option for containing and protecting a wide range of goods.

Their popularity in the retail sector, especially in the food and beverage industry, owes to their ability to maintain freshness, prevent spillage, and ensure easy handling for customers. Additionally, bags & pouches' adaptability in industrial applications, such as for chemical or pharmaceutical products, further cements their dominant position in the U.S. market, reflecting their integral role in modern packaging solutions.

The economic advantages of Bags & Pouches have significantly contributed to their market penetration. These packaging solutions often prove to be more cost-effective than traditional alternatives, both in terms of production and transportation costs. Their lightweight construction minimizes shipping expenses while also reducing the carbon footprint, aligning with evolving sustainability concerns. As businesses seek efficient and budget-friendly packaging options, Bags & Pouches emerge as a logical choice.

Moreover, continuous innovation and technological advancements in materials and manufacturing techniques have further propelled the growth of Bags & Pouches. With the development of eco-friendly materials, improved sealants, and customized printing options, these packaging solutions have become increasingly attractive for branding and consumer engagement. Additionally, the convenience offered by resealable and easy-to-carry pouches resonates with modern lifestyles, adding to their appeal among consumers.

Grade Insights

Flexible High-Density Polyethylene (HDPE) grade type dominated the U.S. flexible polyethylene (PE) market with a revenue share of over 38% in 2022. The market is experiencing significant growth, influenced by several driving factors, particularly among the different grades, including flexible HDPE, flexible LDPE, and flexible LLDPE. The primary factor driving the market's expansion is the increasing demand for sustainable and eco-friendly packaging solutions across various industries.

The Flexible HDPE segment is witnessing growth due to its excellent strength and barrier properties, making it an ideal choice for packaging applications in industries such as food and beverage, retail, and e-commerce. On the other hand, flexible Low-Density Polyethylene (LDPE) is finding widespread use in industries like healthcare and pharmaceuticals, where its flexibility and ease of sealing are crucial for medical packaging and other specialized applications. Flexible Linear Low-Density Polyethylene (LLDPE) is also driving growth in the market due to its enhanced puncture resistance and flexibility, making it suitable for use in heavy-duty bags and industrial liners.

Moreover, the shift in consumer preferences toward sustainable and recyclable materials has significantly influenced the market's growth. The growing awareness of environmental concerns has prompted industries to opt for more eco-friendly packaging solutions, which has boosted the adoption of flexible PE grades. Additionally, advancements in manufacturing technologies have improved the production process and the quality of flexible PE products, making them more cost-effective and accessible for businesses across various sectors.

As a result, companies are actively adopting flexible PE materials to meet the demands of environmentally-conscious consumers and align their practices with sustainable business models. This combination of increasing demand, technological advancements, and a focus on sustainability is driving the growth of the U.S. flexible PE market.

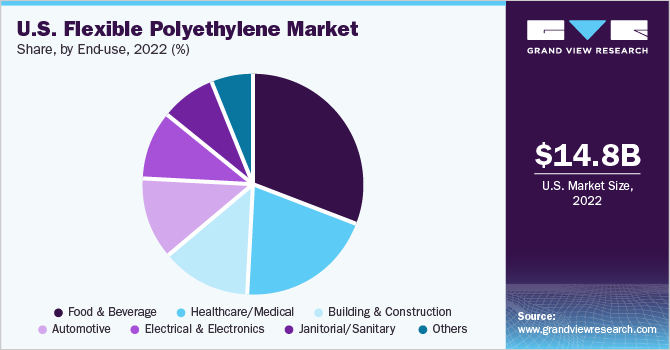

End-use Insights

The dominance of the food & beverage end-use industry in the U.S. flexible polyethylene (PE) market in 2022, with over 30% of the revenue share, is primarily fueled by the high demand for PE packaging in preserving and conveniently delivering food and beverage products, catering to consumer preferences for sustainable, cost-effective, and innovative packaging solutions, while also aligning with the growth of e-commerce and regulatory compliance requirements.

The janitorial/sanitary industry has embraced flexible PE products for various purposes, such as trash bags and liners, catering to the growing need for waste management solutions. In the building & construction sector, flexible PE liners and covers have become essential components for waterproofing, insulation, and protective applications. The automotive industry has also witnessed growth, utilizing flexible PE materials for automotive parts, interior trim, and protective coatings, taking advantage of its durability and low cost

Additionally, the electrical & electronics industry has adopted flexible PE as a valuable material for wire and cable insulation, ensuring safety and efficiency in electrical applications. The increasing demand from these diverse end-use industries, coupled with continuous advancements in manufacturing technologies, is driving the growth of the U.S. flexible PE market, making it a versatile and sought-after material across various industries.

Key Companies & Market Share Insights

The U.S. flexible polyethylene (PE) industry is fragmented with the presence of various key players. Major players, in particular, compete based on production capacity expansions, product portfolio developments, and methods to implement new technologies in the manufacturing of flexible polyethylene.

The raw materials used in the manufacture of flexible polyethylene along with their affiliated costs play a significant role in determining the price of the product. As a result, the prices of raw materials such as ethylene is expected to play a vital role in the market over the forecast period. Many established and emerging players are engaged in the capacity expansion of their manufacturing facilities, so as to consolidate their fixed costs by catering to increased demand from end-use applications.

For Instance, In May 2023, Gelpac one of the leading high-performance packaging solutions company in North America is planning to acquire the Standard Multiwall Bag Mfg. Co. manufacturing facility located in Beaverton, Oregon, and Lubbock, Texas. Some prominent players in the U.S. flexible polyethylene market include:

-

Dow Inc.

-

ExxonMobil Chemical

-

Chevron Phillips Chemical Company

-

LyondellBasell Industries

-

Formosa Plastics Corporation

-

NOVA Chemicals

-

Westlake Chemical Corporation

-

Pinnacle Polymers LLC

-

INEOS Olefins & Polymers USA

-

Sasol North America Inc.

-

Braskem America

-

Total Petrochemicals & Refining USA, Inc.

U.S. Flexible Polyethylene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.9 billion

Revenue forecast in 2030

USD 20.8 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, product, end-use

Key companies profiled

Dow Inc.; ExxonMobil Chemical; Chevron Phillips Chemical Company; LyondellBasell Industries; Formosa Plastics Corporation; NOVA Chemicals; Westlake Chemical Corporation; Pinnacle Polymers LLC; INEOS Olefins & Polymers USA; Sasol North America Inc.; Braskem America; Total Petrochemicals & Refining USA, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flexible Polyethylene Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flexible polyethylene market report based on grade, product, and end-use:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible HDPE

-

Flexible LDPE

-

Flexible LLDPE

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Films

-

Liners

-

Bags & Pouches

-

Covers

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Healthcare/Medical

-

Janitorial/Sanitary

-

Building & Construction

-

Automotive

-

Electrical & Electronics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. flexible polyethylene market size was estimated at USD 10,095.5 kilotons in 2022 and is expected to reach USD 10,428.6 kilotons in 2023.

b. The U.S. flexible polyethylene market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 13,815.3 kilotons by 2030.

b. Flexible HDPE grade type dominated the U.S. flexible polyethylene market with a revenue share of over 41.0% in 2022. This is primarily driven by increasing demand for sustainable and eco-friendly packaging solutions across various end-use industries such as food & beverage, healthcare/medical, janitorial/sanitary, building & construction, automotive, electrical & electronics. Moreover, its excellent strength and barrier properties, make it an ideal choice for packaging applications in industries such as food and beverage, retail, and e-commerce.

b. Some key players operating in the U.S. flexible polyethylene market include Dow Inc., ExxonMobil Chemical, Chevron Phillips Chemical Company, LyondellBasell Industries, Formosa Plastics Corporation, NOVA Chemicals, Westlake Chemical Corporation, Pinnacle Polymers LLC, INEOS Olefins & Polymers USA, Sasol North America Inc., Braskem America, Total Petrochemicals & Refining USA, Inc.

b. Key factors that are driving the U.S. flexible polyethylene market growth include increasing demand from various end-use industries and rising concern toward sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.