- Home

- »

- Biotechnology

- »

-

U.S. Forensic Genomics Market Size, Industry Report, 2033GVR Report cover

![U.S. Forensic Genomics Market Size, Share & Trends Report]()

U.S. Forensic Genomics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Software, Consumables & Kits), By Method (NGS, PCR Amplification), By Application (Criminal Testing, Paternity & Familial Testing), And Segment Forecasts

- Report ID: GVR-4-68040-690-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Forensic Genomics Market Size & Trends

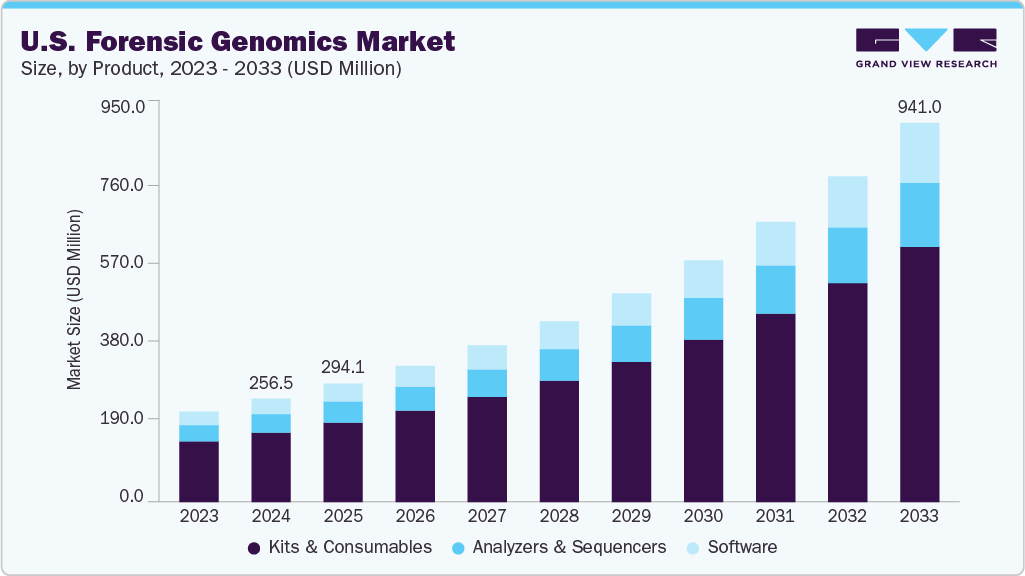

The U.S. forensic genomics market size was estimated at USD 256.5 million in 2024 and is projected to reach USD 941.0 million by 2033, expanding at a CAGR of 15.65% from 2025 to 2033. This growth is driven by advancements in genomic technologies, increasing adoption of forensic DNA analysis in criminal investigations, and rising government funding for forensic research and infrastructure. Moreover, the growing need for accurate and rapid identification methods in law enforcement and legal proceedings will fuel market expansion throughout the forecast period.

Increasing Crime Rates and Complexity of Investigations

Rising incidence of criminal activity, particularly violent crimes, sexual assaults, and homicides, is one of the primary drivers of the growth in the forensic genomics market. As the volume and complexity of criminal cases increases, there is a greater need for advanced tools to provide accurate and reliable evidence. Forensic genomics enables law enforcement agencies to analyze biological samples at a highly detailed genetic level, offering superior accuracy in suspect identification and victim profiling compared to traditional forensic methods.

Moreover, the growing number of unresolved and cold cases has prompted agencies to revisit archived evidence using modern genomic techniques, leading to breakthroughs and case resolutions. The demand for rapid turnaround in investigations and pressure to minimize wrongful convictions further underscores the importance of forensic genomics in the modern criminal justice system. These factors collectively contribute to sustained and increasing demand for genomic solutions in forensic applications across the U.S.

Advancements in Genomic Technologies

Technological innovations in genomics, particularly next-generation sequencing (NGS), microarray analysis, and enhanced DNA extraction methods, have significantly transformed the landscape of forensic science. These tools enable highly detailed, accurate, and rapid analysis of genetic material, even when samples are degraded, scarce, or mixed. Unlike traditional short tandem repeat (STR) profiling, NGS can sequence entire genomes or targeted regions more precisely, allowing forensic scientists to uncover previously inaccessible genetic information. This has proven invaluable in criminal investigations, where clear and reliable DNA evidence can solve complex cases.

Moreover, integrating bioinformatics and artificial intelligence in genomic analysis has streamlined the interpretation of large-scale genetic data, improved turnaround times and reducing human error. These technological improvements have not only expanded the capabilities of forensic labs but have also increased confidence in the use of forensic genomics as legally admissible evidence. As the cost of these advanced technologies continues to decline, more state and local forensic laboratories are incorporating them into their workflows, contributing to the growing demand and wider adoption of forensic genomics solutions across the U.S.

Market Concentration & Characteristics

The U.S. forensic genomics industry demonstrates high innovation, driven by rapid advancements in next-generation sequencing (NGS), bioinformatics, and data analytics. These innovations have significantly improved DNA analysis's sensitivity, accuracy, and speed, enabling the resolution of complex cases involving degraded or mixed samples. Emerging capabilities such as phenotypic prediction, ancestry inference, and familial searching are expanding the scope of forensic applications beyond traditional identification methods. For instance, in July 2025, Florida implemented an advanced DNA testing method to resolve cold cases more efficiently. This approach utilizes forensic genetic genealogy, combining DNA analysis with genealogical research to identify suspects in unsolved crimes. The technique has already led to breakthroughs in cases dating back decades. Continued investment in research and the development of portable and real-time genomic tools further underscores the dynamic and evolving nature of innovation in this market.

The U.S. forensic genomics industry has witnessed moderate to increasing mergers and acquisitions (M&A) activity as companies aim to strengthen their technological capabilities and expand their market presence. Leading players are acquiring innovative startups and niche biotech firms specializing in advanced genomic sequencing, bioinformatics, and forensic software solutions to enhance their product portfolios. For instance, in April 2025, LGC Group (UK) and Dynamic Devices (USA) formed a strategic partnership to strengthen genomic workflows. By integrating Dynamic Devices' Lynx Robotic Liquid Handler with LGC's SNPline automation platform, sbeadex Lightning chemistry, and Amp-Seq targeted genotyping workflows, the collaboration aims to provide comprehensive solutions for DNA extraction, purification, and genotyping. This partnership seeks to deliver efficient, automated, and scalable tools to laboratories, breeders, and researchers globally, reducing manual intervention and ensuring reproducible results. This consolidation trend is driven by the need to integrate complementary technologies, accelerate R&D efforts, and gain a competitive advantage in a rapidly evolving market.

The U.S. forensic genomics market is significantly influenced by stringent regulatory frameworks and quality standards that govern genetic evidence collection, analysis, and use. Regulations set by agencies such as the FBI, the Department of Justice, and the Scientific Working Group on DNA Analysis Methods (SWGDAM) ensure forensic genomic data's accuracy, reliability, and legal admissibility. Compliance with these regulations requires continuous validation of testing methods, adherence to chain-of-custody protocols, and rigorous laboratory accreditation processes, which can increase operational costs and drive market growth by fostering trust in forensic results. Moreover, evolving privacy laws and ethical considerations surrounding genetic information are shaping the development and deployment of forensic genomics technologies, compelling companies to innovate responsibly and maintain high data security and confidentiality standards.

The U.S. forensic genomics industry is witnessing significant product expansion as forensic laboratories and service providers broaden their offerings to meet diverse investigative needs. Beyond traditional DNA profiling, services include advanced genomic sequencing, phenotypic prediction, ancestry analysis, and rapid on-site testing. For instance, in September 2024, Promega Corporation introduced a novel enzyme designed to reduce stutter artifacts in forensic DNA analysis significantly. This genetically engineered polymerase, a modified version of Taq polymerase incorporating features from T7 DNA polymerase, enhances the accuracy and reliability of Short Tandem Repeat (STR) profiling by minimizing errors that complicate the interpretation of complex or mixed DNA samples. The enzyme's application is expected to improve the deconvolution of mixed samples, thereby aiding in identifying low-level contributors and enhancing the overall efficiency of forensic investigations. This expansion is fueled by growing demand from law enforcement agencies, legal institutions, and disaster response teams seeking more comprehensive and timely forensic solutions.

Product Insights

The kits & consumables segment dominated the forensic genomics industry, accounting for 67.19% of the total revenue in 2024, driven by the continuous demand for high-quality reagents, DNA extraction kits, and sequencing consumables essential for forensic genomic analysis. For instance, in February 2020, Verogen introduced a comprehensive next-generation sequencing (NGS) workflow tailored for severely degraded forensic DNA samples. This approach integrates the Dental Forensic Extraction Kit (DFK), the InnoQuant HY DNA Quantification Kit, and the MiSeq FGx Forensic Genomics System, collectively enhancing the recovery and analysis of nuclear DNA from challenging samples such as bones and teeth. The DFK optimizes DNA extraction without compromising the sample's integrity, while the InnoQuant HY kit enables precise assessment of DNA quality and quantity. The recurring need to replenish these supplies in forensic laboratories, combined with advancements in kit technology that enhance accuracy and efficiency, has sustained the strong revenue contribution from this segment.

The software segment is expected to grow with the fastest CAGR throughout the forecast period. The need for accurate and reliable forensic analysis drives investment in software solutions that improve the efficiency and accuracy of DNA profiling and other forensic techniques. Integrating artificial intelligence and machine learning in forensic software also revolutionizes case investigations by providing predictive analytics and pattern recognition capabilities. Moreover, regulatory requirements and the push for standardized processes in forensic labs lead to increased adoption of software solutions that ensure compliance and quality control. These trends collectively contribute to the robust growth of the segment.

Method Insights

The capillary electrophoresis (CE) segment dominated the market with a revenue share of 36.98% in 2024 due to its widespread adoption as a reliable and cost-effective method for DNA fragment analysis in forensic genomics. CE technology offers high resolution, rapid processing times, and compatibility with existing forensic workflows, making it a preferred choice among forensic laboratories. Moreover, its proven track record in generating legally admissible evidence has reinforced its dominance in the market during the forecast period.

The next-generation sequencing (NGS) segment is expected to experience the fastest growth rate during the forecast period, driven by its ability to provide comprehensive, high-resolution genetic data that surpasses traditional forensic methods. NGS technology enables detailed analysis of complex and degraded DNA samples, supports phenotypic and ancestry predictions, and offers greater accuracy in mixture interpretation. For instance, in May 2025, researchers published a comprehensive review in BMC Genomics, evaluating the integration of Next-Generation Sequencing (NGS) and Single Nucleotide Polymorphism (SNP) microarrays into routine forensic DNA analysis. NGS was noted for its enhanced discriminatory power, improved performance with degraded DNA, and better mixture deconvolution. Increasing adoption of NGS in forensic laboratories, coupled with ongoing advancements that reduce costs and improve workflow efficiency, is fueling the rapid expansion of this segment in the forensic genomics industry.

Application Insights

The criminal testing application segment held the largest revenue share of over 66.15% in 2024, driven by the increasing use of forensic genomics in solving crimes such as homicides, sexual assaults, and violent offenses. The demand for accurate and rapid DNA profiling to identify suspects and exonerate innocents has led to law enforcement agencies' widespread adoption of genomic technologies. Moreover, the growing number of cold case investigations and the expansion of national DNA databases have further fueled the need for advanced forensic testing in criminal applications.

For instance, in June 2025, Othram, a U.S.-based forensic genomics laboratory, achieved a significant milestone by identifying a previously unknown individual from a 1978 cold case in Batavia, Illinois. Utilizing advanced DNA sequencing techniques, Othram identified the remains as those of 17-year-old Esther Ann Granger, who had been deceased since 1866. This case exemplifies the transformative impact of forensic genomic analysis in resolving long-unresolved cases. The company's efforts have led to over 500 identifications, including collaborations with the Bureau of Indian Affairs to address missing and murdered Indigenous persons cases.

Paternity and familial testing are expected to grow fastest over the forecast period, driven by increasing demand for accurate biological relationship verification in legal and personal contexts. Advances in genomic technologies have made these tests more accessible, reliable, and affordable, encouraging their adoption in immigration cases, inheritance disputes, child custody battles, and family reunification efforts. Moreover, growing awareness about the importance of genetic confirmation in forensic and civil cases is further driving the growth of this segment within the forensic genomics market.

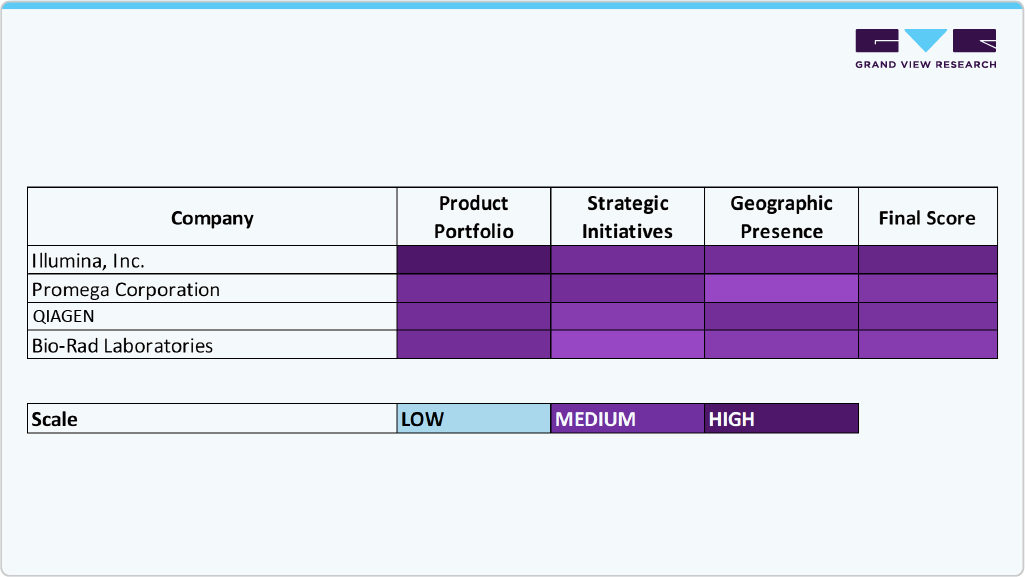

Key U.S. Forensic Genomics Company Insights

The U.S. forensic genomics industry is characterized by several well-established players who dominate through robust product portfolios, strategic collaborations, and continuous investment in research and development. Leading companies such as Illumina, Inc., Thermo Fisher Scientific, Inc., Merck KGaA, Agilent Technologies, Promega Corporation, QIAGEN, Bio-Rad Laboratories, LGC Limited, Tri Tech Forensics, and Verogen maintain significant market share by offering comprehensive solutions that span advanced genomic sequencing, sample processing, forensic software, and bioinformatics tools. These organizations leverage cutting-edge technologies to meet the growing demand for highly accurate, reliable, and rapid forensic DNA analysis in criminal investigations, legal proceedings, and disaster victim identification.

Key players continue to consolidate their market leadership by combining technological innovation with end-to-end service offerings tailored to forensic laboratories, law enforcement agencies, and governmental bodies. Through strategic growth initiatives, including mergers and acquisitions, partnerships, and continuous product development, these companies address the evolving complexities of forensic genomics-from traditional DNA profiling to next-generation sequencing and phenotypic prediction. Companies such as Illumina, Thermo Fisher Scientific, and Verogen are at the forefront of integrating genomics with advanced data analytics, enabling forensic casework with higher resolution and speed.

The U.S. forensic genomics market is also witnessing a dynamic interplay between established industry leaders and emerging innovators, fueling competition and accelerating technological breakthroughs. Increasing collaborations between biotechnology firms and forensic service providers and investments in AI-powered analytics and portable sequencing platforms are shaping the future landscape. As demand for precise and timely forensic evidence intensifies, these companies focus on enhancing accessibility, accuracy, and ethical data handling to support justice systems nationwide, positioning themselves for sustained growth in this rapidly evolving sector.

Key U.S. Forensic Genomics Companies:

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Agilent Technologies

- Promega Corporation

- QIAGEN

- Bio-Rad Laboratories

- LGC Limited

- Tri Tech Forensics

- Verogen

Recent Developments

-

In May 2025, QIAGEN, headquartered in the Netherlands, acquired Genoox, an Israeli provider of AI-powered software, for USD 70 million plus potential milestone payments of up to USD 10 million. This acquisition enhances QIAGEN's Digital Insights portfolio by integrating Genoox's Franklin platform. This cloud-based solution supports clinical decision-making through real-time, AI-driven next-generation sequencing (NGS) data analysis. Franklin is utilized by over 4,000 healthcare organizations across more than 50 countries, facilitating over 750,000 case interpretations. The integration aims to improve diagnostic yield, turnaround time, and scalability for clinical labs, complementing QIAGEN's existing tools like QCI Interpret and QCI Precision Insights.

-

In September 2024, Promega Corporation introduced a novel DNA polymerase designed to reduce stutter artifacts in forensic DNA analysis significantly. This breakthrough enzyme enhances the accuracy and efficiency of DNA profiling by minimizing errors during the amplification of short tandem repeats (STRs). The new polymerase, which integrates features from T7 DNA polymerase, has been shown to reduce stutter by an order of magnitude compared to current systems, rendering it undetectable against instrument baseline noise. Promega plans to incorporate this enzyme into future 8-color STR analysis kits, aiming to improve the reliability of DNA analysis in forensic laboratories.

-

In May 2024, QIAGEN announced a Cooperative Research and Development Agreement (CRADA) with the U.S. Federal Bureau of Investigation (FBI) to develop a novel digital PCR assay for its QIAcuity platform. This collaboration aims to enhance forensic DNA analysis by enabling absolute quantification of nuclear and mitochondrial DNA, male DNA, and quality markers for degradation and inhibition. The QIAcuity system's nanoplate-based digital PCR technology offers improved tolerance to inhibitors and greater sensitivity, facilitating the analysis of challenging forensic samples such as aged bones, teeth, and trace evidence. Accurate DNA quantification is crucial for optimizing next generation sequencing workflows, minimizing errors, and ensuring reliable forensic investigations.

U.S. Forensic Genomics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 294.1 million

Revenue forecast in 2033

USD 941.0 million

Growth rate

CAGR of 15.65% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, application

Key companies profiled

Illumina, Inc.; Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies; Promega Corporation; QIAGEN; Bio-Rad Laboratories; LGC Limited; Tri Tech Forensics; Verogen

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Forensic Genomics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. forensic genomics market report based on product, method, and application:

-

U.S. Forensic Genomics Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Analyzers & Sequencers

-

Software

-

Kits & Consumables

-

-

U.S. Forensic Genomics Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Capillary Electrophoresis

-

Next-generation Sequencing

-

PCR Amplification

-

Others

-

-

U.S. Forensic Genomics Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Criminal Testing

-

Paternity & Familial Testing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. forensic genomics market size was estimated at USD 256.5 million in 2024 and is expected to reach USD 294.1 million in 2025.

b. The U.S. forensic genomics market is expected to grow at a compound annual growth rate of 15.65% from 2025 to 2033 to reach USD 941.0 million by 2033.

b. Kits & consumables dominated the U.S. forensic genomics market with a share of 67.19% in 2024. This is attributable to rising crime rates and increasing technological advancements, fueling the adoption of forensic technologies.

b. Some key players operating in the U.S. forensic genomics market include Illumina, Inc.; Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies; Promega Corporation; QIAGEN; Bio-Rad Laboratories; LGC Limited; Tri Tech Forensics; Verogen

b. Key factors driving the market growth include advancements in next‑generation sequencing, AI‑driven interpretation, increased government investment, rising crime and cold‑case resolution needs, and forensic genealogy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.