- Home

- »

- Advanced Interior Materials

- »

-

U.S. Fuelwood Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Fuelwood Market Size, Share & Trends Report]()

U.S. Fuelwood Market (2025 - 2030) Size, Share & Trends Analysis Report By Source Type (Natural Forests, Plantation Forests, Agroforestry), By End-use (Residential Heating & Cooking, Industrial heating), And Segment Forecasts

- Report ID: GVR-4-68040-669-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Fuelwood Market Summary

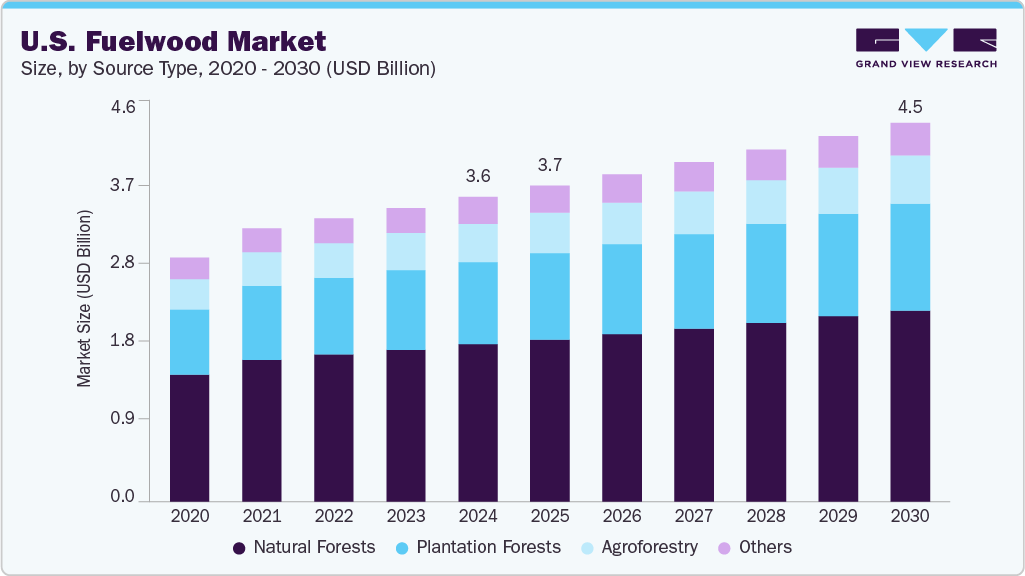

The U.S fuelwood market size was estimated at USD 3.62 billion in 2024 and is projected to reach USD 4.50 billion by 2030, growing at a CAGR of 3.7% from 2025 to 2030. Fuelwood remains a popular choice in rural households for residential heating and cooking due to its cost-effectiveness and accessibility.

Key Market Trends & Insights

- In terms of source type, natural forests segment dominated the market with a revenue share of 51.5% in 2024.

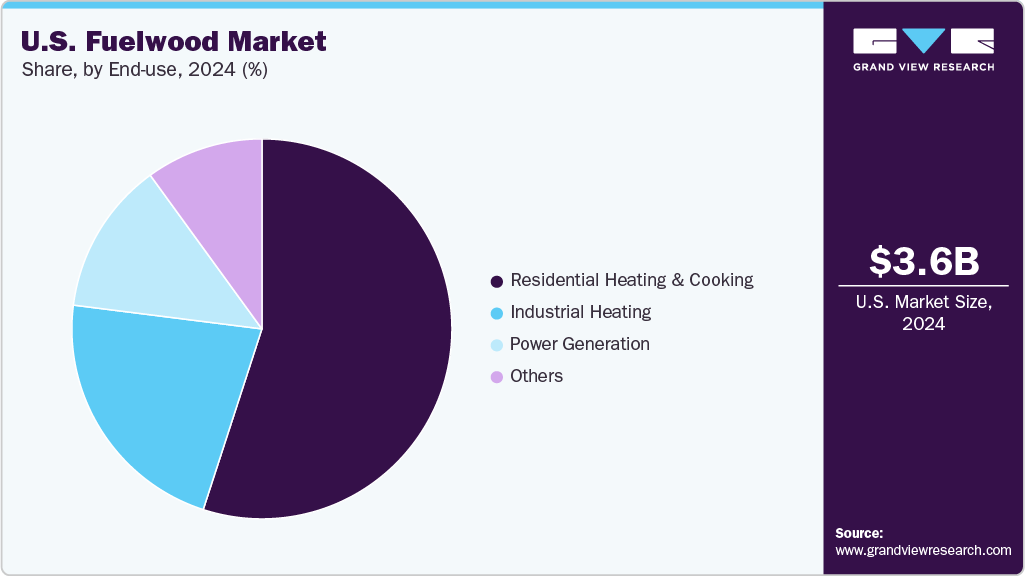

- By end use, the residential heating & cooking segment dominated the U.S fuelwood market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.62 Billion

- 2030 Projected Market Size: USD 4.50 Billion

- CAGR (2025-2030): 3.7%

Rising demand for renewable and carbon-neutral energy sources is driving demand for greater use of wood for heating. Agroforestry is rising, as more farmers are integrating trees into their farmland to supply wood and maintain agricultural productivity.The growing demand for fuelwood is rising due to increasing environmental concerns owing to increasing popularity of firewood as a renewable heating source. With increasing popularity of recreational activities such as camping and bonfires leading to greater consumption of firewood, generating steady demand.

Fuelwood is a popular choice of energy generation due to its recreational uses and serves as a cost-effective alternative to traditional heating. This is especially true in rural and off-grid areas where access to electricity or natural gas can be limited or costly. The affordability of firewood and its availability from local sources make it an appealing option for homeowners looking to reduce their heating expenses while adopting sustainable practice.

Regulations have a high impact on the U.S. fuelwood market. The Environment Protection Agency enforces air quality regulations, including strict emission standards for wood burning appliances. This influences the market by gradually eliminating older, high-emission stoves and promoting new, cleaner and more efficient models. Sustainable harvesting practices are gaining popularity, especially among environmentally conscious producers. Use of digital platforms for ordering fuelwood is also emerging.

Source Type Insights

The natural forests segment dominated the market and accounted for the largest revenue share, 51.5%, in 2024. As consumers seek renewable and locally sourced energy options, fuelwood from natural forests is considered a preferred choice. Its carbon-neutral profile and perception as a traditional and reliable heating source contribute to its popularity. This trend aligns with broader environmental responsibility and energy independence movements, especially in rural and off-grid areas. The use of locally harvested wood further supports regional economies and reduces reliance on imported fossil-based fuels.

The plantation forests segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. These forests are characterized by shorter harvest cycles and provide a reliable and consistent supply of high-quality wood. Intensive management practices such as soil preparation, weed control, and fertilization promote rapid growth and yield high biomass. Adoption of shorter rotation cycles- where trees are harvested at a relatively young age supports rapid generation and ensures a steady supply of fuelwood to meet rising demand. As a result, plantation forests are becoming an increasingly vital component of the US renewable energy landscape.

End Use Insights

The residential heating & cooking segment dominated the U.S fuelwood market and accounted for the largest revenue share in 2024. Increasing electricity and gas prices have led many households to choose fuelwood as a cost-effective and accessible energy alternative. Many consumers are motivated by the desire for energy independence, environmental sustainability, and reliability of wood-based heating during power outages or extreme weather conditions. Social factors such as cultural preference for wood-fire cooking using traditional cooking options and reliance of poor people on fuelwood due to lack of access to clean energy have sustained demand.

The power generation segment is expected to grow at a significant CAGR of 4.5% over the forecast period. Many of the population is seeking renewable and low-carbon-emitting alternatives to fossil fuels. Using wood pellets and forestry residues for electricity generation has emerged as a popular and sustainable energy solution.

Key U.S. Fuelwood Company Insights

Some of the key companies in industry include Weyerhaeuser Company, RAYONIER Inc., and others.

-

Westervelt Renewable Energy (part of The Westervelt Company) is explicitly involved in wood fuel pellets for heating and power generation. They are listed as a company in the wood fuel pellets market.

-

F&W Forestry Services offers services related to "Wood to Energy," including project scoping, planning and supervision of harvesting for wood fuel, marketing of timber and biomass products, and woodchip and log production.

Key U.S. Fuelwood Companies:

- Weyerhaeuser Company

- Rayonier Inc.

- PotlatchDeltic Corporation

- Sierra Pacific Industries.

- Green Diamond Resource Company

- F&W Forestry Services

- Westervelt Renewable Energy

- Domtar Corporation

- The Timber Company

- Southern Fuelwood

Recent Developments

-

In November 2024, Weyerhaeuser announced plans to invest approximately USD 500 million to construct a new TimberStrand facility near Monticello and Warren, Arkansas. This state-of-the-art plant aims to expand the company's engineered wood products capacity in the U.S., with construction expected to begin in 2025 and operations commencing in 2027.

U.S. Fuelwood Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.50 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source type, end use

Country Scope

U.S.

Key companies profiled

Weyerhaeuser Company, Rayonier Inc., PotlatchDeltic Corporation, Sierra Pacific Industries, Green Diamond Resource Company, F&W Forestry Services, Westervelt Renewable Energy, Domtar Corporation, The Timber Company, Southern Fuelwood

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fuelwood Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fuelwood market report based on source type, and end use:

-

Source Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Forests

-

Plantation Forests

-

Agroforestry

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential Heating & Cooking

-

Industrial Heating

-

Power Generation

-

Others

-

Frequently Asked Questions About This Report

b. The natural forest segment led the market and accounted for the largest revenue share, 51.5%, in 2024, driven by their widespread availability and ease of access, especially in rural and remote regions.

b. Enviva Inc., Drax Group plc, Pinnacle Renewable Energy, Lignetics, Inc., Energex, Green Energy Biofuel, Pacific BioEnergy, Fram Renewable Fuels, West Oregon Wood Products, and The Westervelt Company are prominent companies in the U.S. fuelwood market.

b. Key factors driving the U.S. fuelwood market include rising energy demand in rural areas, limited access to modern fuels, affordability, cultural preferences, and increasing focus on sustainable biomass alternatives.

b. The global U.S. fuelwood market size was estimated at USD 3.62 billion in 2024 and is expected to reach USD 3.49 billion in 2025.

b. The U.S. fuelwood market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030 to reach USD 4.50 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.