- Home

- »

- Biotechnology

- »

-

U.S. Genotyping Market Size & Share, Report Industry, 2030GVR Report cover

![U.S. Genotyping Market Size, Share & Trends Report]()

U.S. Genotyping Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Kits), By Technology (PCR, Microarrays), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-244-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Genotyping Market Size & Trends

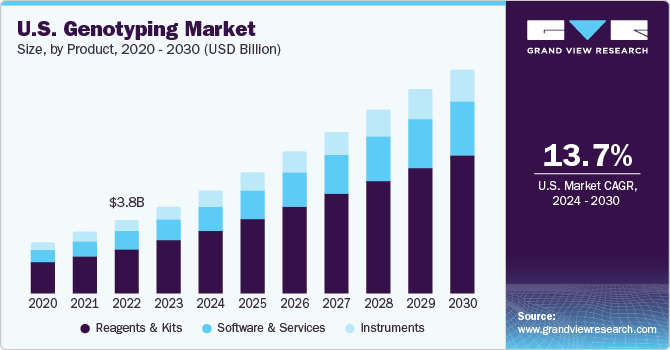

The U.S. genotyping market size was estimated at USD 6.42 billion in 2023 and is expected to grow at a CAGR of 13.7% from 2024 to 2030. Rising prevalence of genetic disorders & cancer, technological advancements, increased focus on developing personalized medicine, and increasing R&D funding for genomics are some of the key factors driving market growth. However, lack of skilled professionals and less awareness about advanced technological solutions in developing regions may hamper market growth.

The U.S. accounted for over 35.8% of the global genotyping market in 2023. The rise in chronic diseases like cancer and genetic disorders is anticipated to fuel the need for diagnostic testing based on genotyping. The World Health Organization reported that there were 19.1 million new cases of cancer worldwide in 2020. Viruses that cause cancer, such as the Human Papilloma Virus (HPV) and Hepatitis B and C Viruses (HBV/HCV), account for approximately 20% of cancer deaths globally. Predictions based on population growth and aging suggest that cancer cases will surge by about 70% in the coming two decades. The American Cancer Society reported that in the year 2023, the U.S. witnessed 1.9 million new instances of cancer and 609,820 fatalities due to the disease. Hence, the escalating cancer incidence is expected to propel the genotyping market significantly.

Genotyping is widely used in the U.S. for a variety of purposes, such as drug discovery, personalized medicine, diagnostic research, and agriculture. In 2018, a new landmark in dairy genetics was achieved, as 2 million individual animal genotypes were recorded in the dairy database. Furthermore, strategic initiatives undertaken by local players are anticipated to contribute to market growth. In February 2021, an example of industry consolidation occurred when VG Acquisition Corp. joined forces with 23andMe, a genetics and research company based in the U.S. that specializes in providing genotypic solutions directly to consumers. This merger was expected to infuse their consumer health genetics business with additional capital funds. These factors are expected to propel market growth.

The local presence of key market players in the country is anticipated to increase the penetration of genotyping products. For instance, Roche provides genotyping products for cervical cancer diagnosis, such as cobas HCV GT. Furthermore, many academic institutes, research centers, and universities are collaborating with key market players to support genomic research programs. For instance, in December 2018, Illumina announced the contribution of its high-density genotyping array, Infinium, to three genome centers in the U.S. to support the “All of Us Research Program.”

The market is anticipated to grow, driven by an upsurge in funding from government entities and pharmaceutical & biotech firms, particularly for genomic studies. An example of this is the USD 28.6 million grant awarded by the National Institutes of Health (NIH) to the “All of Us Research Program” in September 2018. This funding was used to set up three genome centers across the U.S., focusing on precision medicine research. Furthermore, the COVID-19 pandemic has positively influenced the genotyping market by increasing the demand for COVID-19 genotyping kits. SNP genotyping has been utilized to identify genetic variations of COVID-19.

Market Concentration & Characteristics

The U.S. genotyping industry is experiencing a trend towards consolidation, with a significant portion of the industry share concentrated among a few key players. This concentration indicates a mature industry landscape where established companies dominate the industry. Despite this consolidation, the industry is characterized by medium growth, suggesting a stable and steadily expanding industry. The acceleration in the industry's pace signifies a dynamic environment with increasing activities, innovations, and advancements, driving the sector forward toward further development and evolution.

Pharmacogenomics has become increasingly important in drug development, and companies are feeling the pressure to innovate due to FDA recommendations that encourage the inclusion of pharmacogenomics studies and genotyping in the drug discovery process. As a result, many companies are utilizing genotyping to develop new and unique drugs. For instance, Bluebird Bio, Inc. has several gene therapy products in its R&D and clinical phases, such as betibeglogene autotemcel gene therapy and Lentiglobin gene therapy, which are in Phase III clinical trials.

Players like Roche leverage partnership strategy to increase their capabilities and promote product offerings. For instance, in January 2020, Illumina and Roche partnered to improve patient access to oncology genomic testing by assay development. Similarly, in October 2019, QIAGEN N.V. and Illumina, Inc. partnered for 15 years to expand the availability and use of NGS-based IVD kits.

Regulations significantly affect the industry, influencing everything from product development to commercialization. Regulatory guidelines are pivotal in forming strategic implications, new business models, and launching innovative products. These rules impact industry dynamics, technological trends, and the strategic direction of pharmaceutical companies. The regulatory climate affects the industry's willingness to embrace personalized medicine strategies and can pose challenges or opportunities for industry participants. For companies operating in the genotyping industry, understanding and adhering to these regulations is crucial to navigating the pharmaceutical industry's intricate terrain.

Increased funding and investment to conduct R&D in genomic testing is expected to drive the industry. Funding and investments play a significant role in the drug development process. For instance, key biopharmaceutical players invest substantially in R&D for new drug development, and pharmacogenomics is involved in most of this research. In 2020, AstraZeneca announced it will invest USD 500 million over the next five years for several R&D projects in France.

Key players in this industry also adopt expansion strategies to increase their geographical presence and product reach. For instance, in July 2021, 23andMe, a genomic diagnostic company, announced the addition of its services in eight new North American regions.

Product Insights

Reagents & kits dominated the market and held the largest revenue share of 61.2% in 2023. This segment is also expected to grow at the fastest CAGR during the forecast period. These products facilitate the creation of standardized workflows, aiding researchers in diverse areas such as food testing, cancer and genetic disease detection, and forensics. The significant market share of this segment can be attributed to technological advancements, substantial healthcare spending by various research organizations, growing demand for genetic testing, and an increase in genotyping testing volumes. In addition, direct PCR necessitates certain specialized reagents that enable efficient and precise results without requiring extraction and purification processes. Factors such as standardized outcomes, enhanced efficiency, and cost-effectiveness are expected to drive market growth.

Services are also anticipated to grow at a significant CAGR of 13.6% during the forecast period. This growth is primarily attributed to the rising adoption of software-based services by research labs and academic institutions. Specifically, bioinformatics solutions play a crucial role in this expansion by improving sequencing techniques and minimizing errors prevalent in conventional methods. These bioinformatics solutions are instrumental across diverse sectors such as agrigenomics, human diseases, animal livestock, and microbial studies. By enhancing sequencing methodologies and reducing errors, these services contribute significantly to advancements in various fields, fostering innovation and efficiency. Overall, the increased utilization of software-based services, particularly bioinformatics solutions, is expected to drive market growth by addressing critical needs in research and academic settings, ultimately propelling progress, and development in multiple scientific domains.

Technology Insights

Sequencing dominated this market and held the largest revenue market share of 21.5% in 2023 and is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to an increase in genome profiling initiatives, research and development for new drugs, and a decrease in the cost and size of DNA sequencers. For instance, MinION, a product of Oxford Nanopore Technologies, is the only portable device for RNA & DNA sequencing, and it weighs less than 100g. Sequencing technologies encompass DNA sequencing processes and emerging Next Generation Sequencing (NGS) technologies like sequencing platforms & RNA sequencing. This sector is expected to see substantial growth due to its enhanced specificity and superior ability to detect genes with low expression & differential expression compared to other methods. Genotyping by sequencing also facilitates comparative analysis across samples without requiring a reference genome.

Polymerase Chain Reaction (PCR) held the second-largest market revenue share in 2023. PCR is the most basic and initial step taken before conducting any genetic material-related tests. The growing use of genotyping in areas such as pharmacogenomics, drug discovery & development, AIDS, and cancer research directly boosts the demand for PCR technologies. The increasing need for advanced diagnostic methods, the rising number of Contract Research Organizations (CROs), forensic & research labs, and the growing incidence of diseases like chronic diseases & genetic disorders are key factors anticipated to propel market growth.

Application Insights

Diagnostics and personalized medicine dominated the market and accounted for the largest revenue share of 33.8% in 2023. This is owing to the rising adoption of genotyping products for research and the increasing need to diagnose genetic diseases. Genotyping allows researchers to discover genetic variants, such as significant structural changes in DNA and Single Nucleotide Polymorphism (SNP). High-throughput genomic technologies such as microarray and next-generation sequencing allow a more profound knowledge of disease etiology at a molecular level. Technological advancements and increased demand for genotype testing can account for the segment’s high market share. The growing prevalence of infectious diseases is also anticipated to drive the market. There is a high demand for automated and efficient products in the market, which is expected to increase diagnostic research.

Pharmacogenomics is expected to grow at the fastest CAGR of 14.5% during the forecast period. Using genotyping techniques in pharmacogenomics involves extensive testing of new chemical entities (NCEs) that are viable for developing novel drugs tailored to specific genetic profiles. By analyzing individual drug responses, insights can be gained into the connection between nucleotide polymorphism and drug metabolism. This helps identify subsets of the population that are responsive or non-responsive, enabling the delivery of personalized treatment to individuals with different genetic makeups. This also facilitates the creation of medications specific to a subset of the population suffering from a particular disease, paving the way for personalized medicine. Ongoing research in pharmacogenomics and genotyping can also help reduce the attrition of products in clinical development.

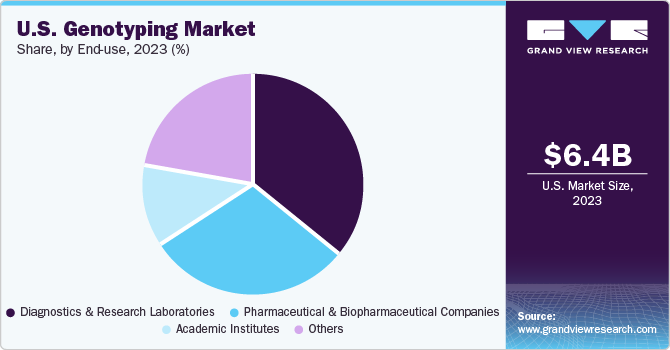

End-use Insights

Diagnostics and research laboratories dominated this market and held the largest revenue share of 36.3% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Genotyping studies enable researchers to identify genetic variations, including DNA structural changes and SNP. Advanced genomic technologies like genotyping, microarray, and Next Generation Sequencing (NGS) provide a deeper understanding of disease origins at a molecular level. Factors such as increased awareness of personalized medicine, a surge in demand for cost-effective services, and technological advancements are expected to stimulate segment growth. The rising incidence of cancer also escalates the demand for diagnostic tests, like cancer genotyping assays, which are anticipated to propel the market.

The pharmaceutical and biopharmaceutical companies segment is expected to grow at the second fastest CAGR of 14.02% during the forecast period. Increasing demand for pharmacogenomics in the creation of drugs and the FDA’s advice to incorporate pharmacogenomics studies and genotyping in the drug discovery process are anticipated to propel market expansion. Companies are proactively employing pharmacogenomics to create innovative medications. For example, Pfizer is undertaking a clinical trial based on genotyping to examine the effectiveness of Talazoparib in patients with somatic BRCA mutant-resistant metastatic breast cancer. Therefore, the growing number of pharmacogenomics-based clinical trials is expected to stimulate growth in this sector.

Key U.S. Genotyping Company Insights

Companies in the U.S. genotyping market are actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to fortify their position. Some of the key players in the market include F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, and Agilent Technologies. Key players are adopting different strategies, such as partnerships, to increase product capabilities and market share. For instance, in January 2020, Illumina and Roche partnered to improve patient access to oncology genomic testing.

Key U.S. Genotyping Companies:

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Danaher Corporation

- Agilent Technologies

- Eurofins Scientific Inc.

- GE Healthcare Inc.

- Bio-Rad Laboratories Inc.

Recent Developments

-

In March 2024, Bio-Rad Laboratories, Inc. announced that the dd-Check STEC Solution received approval from AOAC INTERNATIONAL. This is the first Droplet Digital PCR method to be approved by AOAC.

-

In March 2024, Thermo Fisher Scientific and Bayer declared their intention to jointly create companion diagnostic assays based on next-generation sequencing (NGS). These assays will facilitate the identification of patients who could potentially benefit from Bayer’s expanding range of precision cancer treatments. This will be achieved by providing decentralized genomic testing and ensuring a quick response time.

-

In January 2024, QIAGEN announced their plan to open a regional headquarters in Riyadh, Saudi Arabia, at the beginning of 2024 to expand their presence in the Middle East region. They signed a memorandum of Understanding with the Ministry of Health of Saudi Arabia to support their public health initiatives.

U.S. Genotyping Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.36 billion

Growth rate

CAGR of 13.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use

Country scope

U.S.

Key companies profiled

Illumina Inc.; Thermo Fisher Scientific Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Fluidigm Corporation; Danaher Corporation; Agilent Technologies; Eurofins Scientific Inc.; GE Healthcare Inc.; Bio-Rad Laboratories Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Genotyping Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. genotyping market based on product, technology, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Kits

-

Software and Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

Capillary Electrophoresis

-

Microarrays

-

Sequencing

-

Mass Spectrometry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacogenomics

-

Diagnostics and Personalized Medicine

-

Agricultural Biotechnology

-

Animal Genetics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Diagnostics and Research Laboratories

-

Academic Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. genotyping market size was estimated at USD 6.42 billion in 2023.

b. The U.S. genotyping market is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2024 to 2030 to reach USD 16.36 billion by 2030.

b. Reagents & kits dominated the market and held the largest revenue share of 61.2% in 2023. This segment is also expected to grow at the fastest CAGR during the forecast period.

b. Some of the key players in the market include F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, and Agilent Technologies.

b. Rising prevalence of genetic disorders & cancer, technological advancements, increased focus on developing personalized medicine, and increasing R&D funding for genomics are some of the key factors driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.