- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare API Market Size, Industry Report, 2033GVR Report cover

![U.S. Healthcare API Market Size, Share & Trends Report]()

U.S. Healthcare API Market (2025 - 2033) Size, Share & Trends Analysis Report By Services (EHR Access, Appointments, Remote Patient Monitoring, Payment, Wearable medical device), By Deployment Model, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-744-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Healthcare API Market Summary

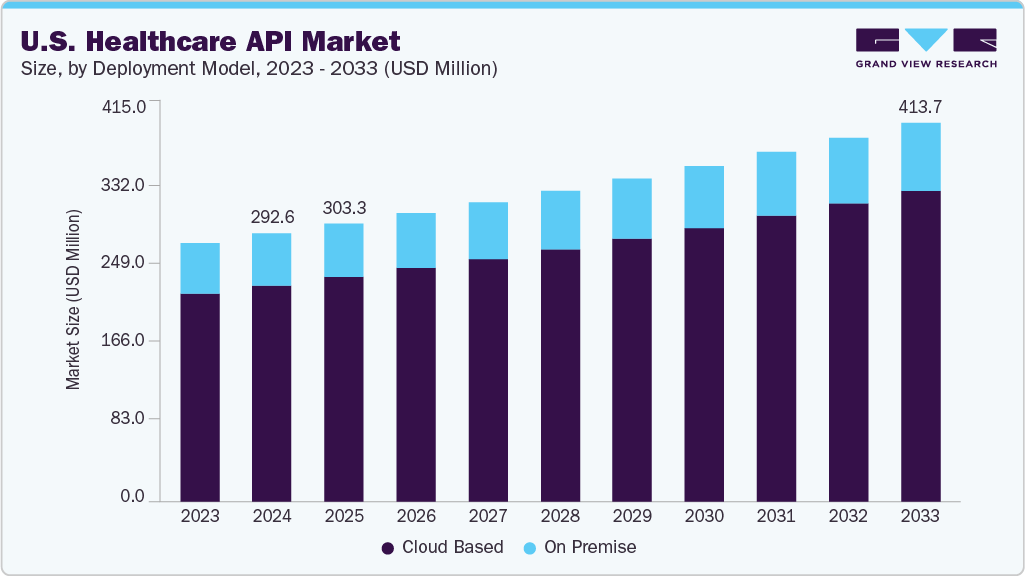

The U.S. healthcare API market size was estimated at USD 292.6 million in 2024 and is projected to reach USD 413.7 million by 2033, growing at a CAGR of 4.0% from 2025 to 2033. Healthcare APIs allow the integration of electronic health records (EHRs), diagnostic tools, and patient management systems.

Key Market Trends & Insights

- By services, the EHR access segment led the market with a share of 29.76% in 2024.

- By deployment model, the cloud based segment was the leading deployment model segment in 2024 and accounted for the largest market share.

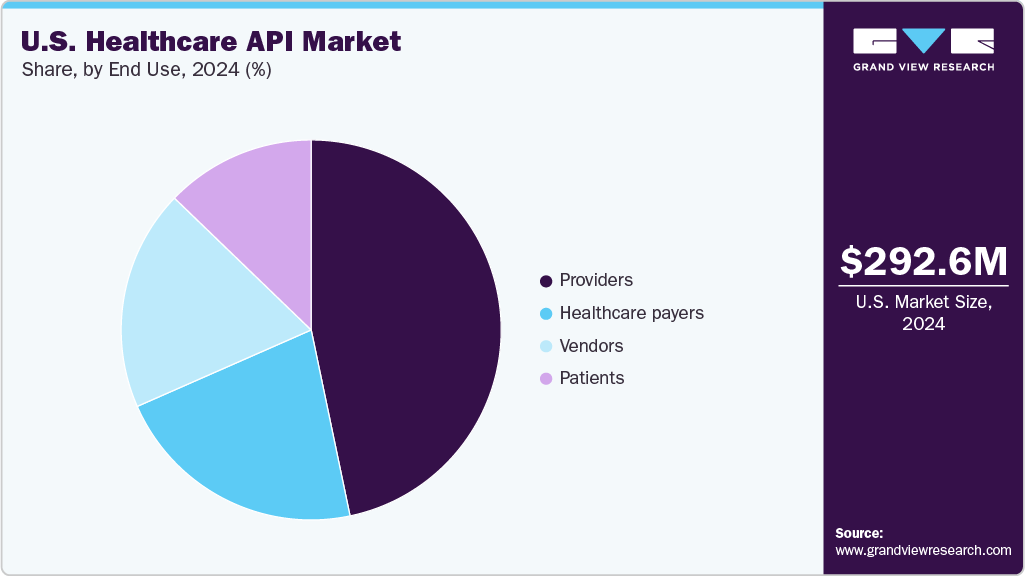

- By end use, the provider segment led the market with a share of 46.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 292.6 Million

- 2033 Projected Market Size: USD 413.7 Million

- CAGR (2025-2033): 4.0%

This can provide simplicity and accessibility to healthcare data, which is expected to drive market growth. Healthcare providers are accelerating their digital transformation initiatives, creating strong demand for the U.S. healthcare API market. As hospitals and outpatient facilities modernize infrastructure to support electronic health records (EHRs), telehealth, remote patient monitoring, and AI-powered diagnostics, APIs serve as the essential backbone enabling system integration and real-time data exchange. From enhancing patient portals to automating clinical workflows and improving care coordination, APIs help providers bridge siloed systems. Initiatives such as cloud migration, interoperability mandates, and digital front-door strategies further amplify this demand. Providers are increasingly seeking standards-based, scalable APIs to integrate third-party apps, ensure compliance, and deliver connected, patient-centered care.

Advanced healthcare IT infrastructure, growing strategies and initiatives by key market players, investments supporting telemedicine's growth, and a growing emphasis on data interoperability. For instance, in March 2025, Alphabet Inc. launched global FHIR-compliant Medical Records APIs in Health Connect, enabling apps to securely read and write clinical data such as allergies, medications, immunizations, and lab results, now supporting over 50 health data types on-device. Hospitals, clinics, insurers, and digital health platforms across the country increasingly rely on APIs to streamline data exchange, enhance care coordination, and improve patient engagement through integrated digital services. Some of the APIs used by healthcare providers in the U.S. include:

-

Human API is a consumer-centric health data platform that integrates with 90% of US hospitals and over 300 wearable devices and fitness apps.

-

Doximity has emerged as the largest network of healthcare professionals in the U.S., connecting over 70% of physicians, nurse practitioners, physician assistants, and pharmacists. Its Dialer feature has proven effective, with 83% of physicians reporting improved patient response rates.

Moreover, the shift toward patient-centric healthcare and government initiatives such as the 21st Century Cures Act in the U.S., which requires open API access to patient data, also adds to the key factors driving the market growth. APIs empower patients by enabling them to access and manage their health data through mobile apps and wearable devices. This increasing emphasis on using APIs likely to drive the demand for APIs and market growth.

Integration of AI in Healthcare API Market

The integration of Artificial Intelligence (AI) and advanced analytics is significantly reshaping the healthcare API market, driving a paradigm shift from static data exchanges to intelligent, real-time decision-making ecosystems. As healthcare organizations confront increasing pressure to modernize infrastructure, improve patient outcomes, and streamline operational workflows, the demand for AI-enhanced APIs has surged. These next-generation APIs, powered by autonomous agents and predictive analytics, enable systems to do more than just facilitate interoperability-they actively interpret, monitor, and optimize data flows across disparate healthcare IT environments.

Companies are increasingly integrating their AI enables solutions with APIs to enhance the efficiencies of a task. For instance, in May 2023, Suki, an innovator in voice-based artificial intelligence (AI) for healthcare, announced the integration of its AI-powered voice assistant with Epic’s electronic health record (EHR) system through Epic’s ambient APIs. This collaboration enhances clinical workflow efficiency by enabling Suki Assistant to capture and process patient-clinician conversations in real time, automatically generating clinical notes. With this integration, the notes are seamlessly transmitted back into Epic, populating the appropriate sections of the patient record-reducing administrative burden and streamlining documentation for providers.

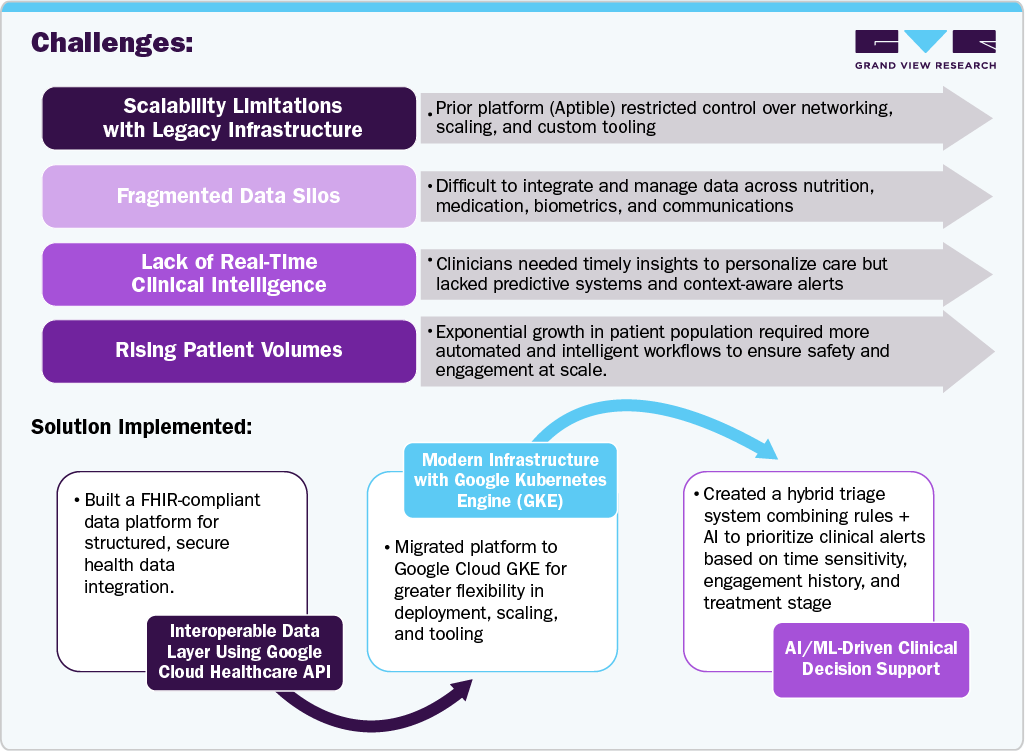

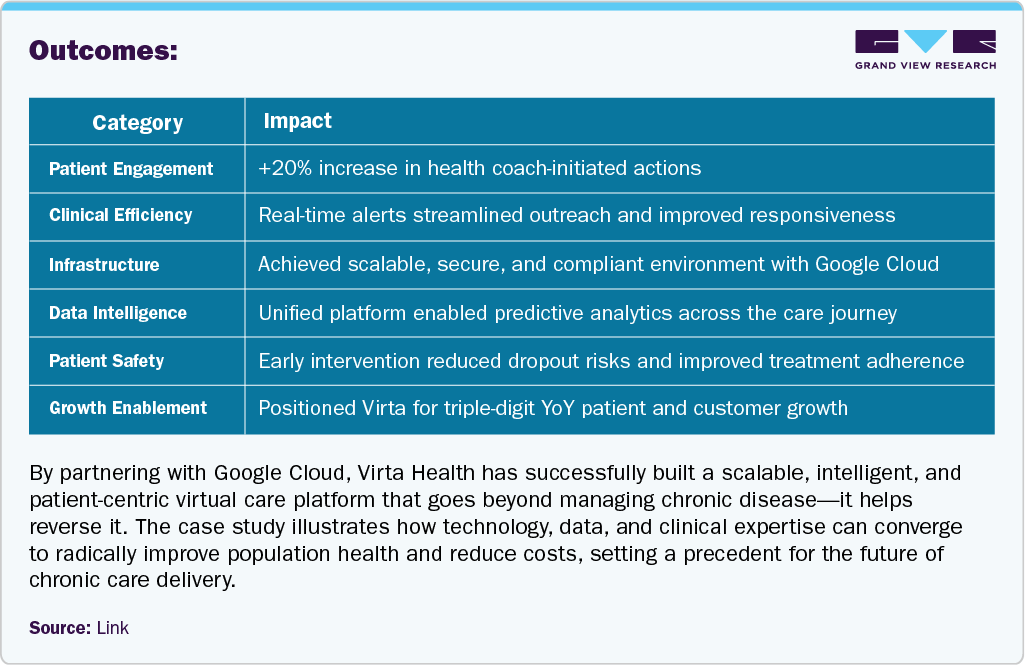

Case Study: Virta Health Transforms Type 2 Diabetes Care with Google Cloud API

Type 2 diabetes is one of the most pressing health crises in the U.S., affecting over 11.3% of the population (~37M) with an additional 8.5 million undiagnosed individuals. The economic burden exceeds $400 billion annually, and those with diabetes faced heightened risk during the COVID-19 pandemic-accounting for 40% of COVID-related deaths. Virta Health offers a medication-free, non-surgical approach to sustainably reverse Type 2 diabetes. As Virta scaled, its tech infrastructure andcare intelligence systems needed to evolve to support tens of thousands of patients-and its goal to help 100 million people by 2025.

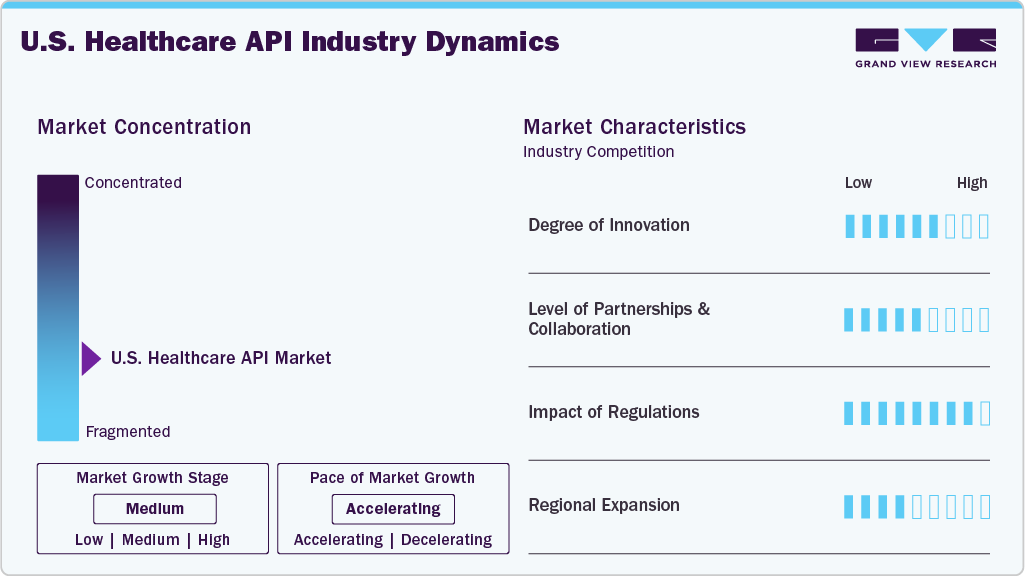

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants of U.S healthcare API market. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. healthcare API market is slightly moderately fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the U.S. healthcare API market is moderate to high, fueled by the growing demand for interoperability, seamless data exchange, and patient-centric care. Healthcare providers and payers are increasingly leveraging APIs to enable integration across EHRs, digital health platforms, wearables, and telehealth solutions, thereby improving care coordination and patient engagement. For instance, in March 2025, Google introduced enhanced AI-powered health search features, including a "What People Suggest" tool aggregating user experiences, a global medical record API for Android's Health Connect app, and FDA-cleared pulse detection on its smartwatch for emergency alerts.

The level of partnerships and collaborations in the U.S. healthcare API market is increasing, driven by the need for interoperability, workflow automation, and digital transformation across healthcare ecosystems. Technology vendors, EHR providers, and digital health platforms are forming alliances to enhance data connectivity and deliver integrated care experiences. For instance, in November 2024, HealthArc joined athenahealth's Marketplace program, integrating its unified remote care management platform with athenahealth's EHR to automate clinical documentation, improve patient engagement, and optimize billing and reimbursements for healthcare providers.

The U.S. healthcare API market operates within a regulatory framework to ensure data security, patient privacy, and interoperability. Key regulations include the Health Insurance Portability and Accountability Act (HIPAA), which mandates stringent safeguards for patient data; the 21st Century Cures Act, which prohibits information blocking and promotes the use of Fast Healthcare Interoperability Resources (FHIR) APIs; and the Centers for Medicare & Medicaid Services (CMS) Interoperability and Patient Access Rule, which require health insurers to provide patients with secure access to their health information via APIs. These regulations aim to enhance data exchange, reduce administrative burdens, and improve patient care outcomes.

The level of regional expansion in industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Services Insights

EHR access accounted for the largest share of 29.0% in 2024, owing to its ability to facilitate interoperability and streamlined clinical workflows. The increasing adoption of EHR systems by healthcare providers to enhance patient engagement, improve care coordination, and integrate advanced technologies such as AI and data analytics is a major driver for segment growth. According to a 2022 AHA Annual Survey Information Technology Supplement, around four in five of hospitals in the U.S. use APIs not just to read but also to write patient-generated data back into EHR systems. Use of software in EHR access enables seamless integration and interoperability across electronic health record systems, and APIs are a key component for keeping access to electronic health records open.

The wearable devices segment is expected to register a significant CAGR of 4.45% during the forecast period. The growing use of wearable medical devices generated a demand for APIs that can seamlessly capture, transmit, and integrate real-time health data into clinical and consumer health platforms. These APIs enable connectivity between devices such as smartwatches, ECG monitors, fitness trackers, and biosensors with electronic health records (EHRs), remote monitoring platforms, and wellness apps.

Deployment Model Insights

The cloud-based segment accounted for the largest market share in 2024 and is expected to grow at the fastest CAGR of 4.2% over the forecast period. The growing preference for cloud solutions due to their scalability, cost-efficiency, and ease of deployment is likely to drive the demand for cloud-based APIs. In addition, cloud-based APIs enable seamless integration of healthcare systems and facilitate real-time data access for providers and patients, supporting interoperability and enhancing care delivery. For instance, Google Cloud APIs provide a scalable infrastructure solution managing essential healthcare data formats, such as HL7, FHIR, and DICOM.

The on-premise segment is expected to grow significantly from 2025 to 2033. Its ability to offer enhanced data security and greater control over healthcare data storage and management is likely to add to its market growth. In addition, healthcare organizations prefer on-premise solutions to comply with stringent data protection regulations and to mitigate risks associated with third-party data access, which is further likely to add to the segment growth.

End Use Insights

Providers accounted for the largest market share of 46.72% in 2024, owing to the increasing prevalence of the disease. This significant share can be attributed to the rising reliance on digital solutions to streamline operations, enhance patient care, and ensure compliance with evolving healthcare regulations. Providers are increasingly adopting APIs to integrate electronic health records(EHRs), telemedicine platforms, and other digital health tools to improve clinical workflows and enhance patient engagement.

The healthcare payers segment is projected to grow at the fastest CAGR over the forecast period from 2025 to 2033. The increasing adoption of digital technologies to improve claims processing, enhance fraud detection, and streamline administrative functions is driving the demand for healthcare APIs in the market. Healthcare payers, such as insurance companies and government programs, are also leveraging APIs to integrate with healthcare providers, manage patient data, and offer more efficient services. This is further expected to add to the market demand.

Key U.S. Healthcare API Company Insights

The market is moderately fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key U.S. Healthcare API Companies:

- Apple, Inc.

- Athenahealth

- Cerner Corporation (Oracle)

- Microsoft

- Epic Systems Corporation

- eClinicalWorks

- Veradigm LLC

- Greenway Health, LLC

- Practice Fusion, Inc.

- Salesforce, Inc.

- IBM

- Alphabet Inc.

Recent Developments

- In October 2024, Salesforce announced that MuleSoft was named a leader in the 2024 Gartner Magic Quadrant for API Management.

“At MuleSoft, we continue to advance our vision to make API Management universal and through that effort, bring our customers the benefits of greater visibility, consistent governance, flexible control, and improved engagement across all their API initiatives.”

-Param Kahlon, EVP, Automation and Integration

- In February 2024, Salesforce, Inc. launched MuleSoft Anypoint Flex Gateway Policy Development Kit (PDK), empowering developers to build, test, and deploy custom API security policies within their IDE and CI/CD workflows.

“With Flex Gateway PDK, we extended functionality to allow developers and partners to create powerful custom policies to address their unique API security needs, offering both protection and control.”

-Gerry Egan, VP, Product Management

- April 2023, Epic Systems Corporation expanded its collaboration with Microsoft to integrate Microsoft's Azure OpenAI Service into its electronic health record (EHR) software, leveraging generative AI to improve productivity, enhance patient care, and streamline healthcare workflows.

“Our expanded partnership builds on a long history of collaboration between Microsoft, Nuance and Epic, including our work to help healthcare organizations migrate their Epic environments to Azure. Together, we can help providers deliver significant clinical and business outcomes leveraging the power of the Microsoft Cloud and Epic.

-Eric Boyd, corporate vice president, AI Platform, Microsoft.

- In February 2023, Google Cloud partnered with Redox to accelerate healthcare data interoperability, offering Redox’s HL7-to-FHIR integration platform via the Google Cloud Marketplace to simplify EHR connectivity for providers, payers, and digital health organizations.

“Healthcare organizations are transforming using new applications and analytics tools driven by cloud technology. Redox was designed to support these new tools with enterprise-scale data exchange with hospitals, clinics, health plans, Healthcare Information Exchanges, networks and other sources that provide the foundation of healthcare data.”

-Redox CEO Luke Bonney.

U.S. Healthcare API Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 303.3 million

Revenue forecast in 2033

USD 413.7 million

Growth rate

CAGR of 4.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, deployment model, end use

Key companies profiled

Apple, Inc.; Athenahealth; Cerner Corporation (Oracle); Microsoft; Epic Systems Corporation; eClinicalWorks; Veradigm LLC; Greenway Health LLC; Practice Fusion, Inc.; Salesforce, Inc.; IBM; Alphabet Inc..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare API Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. healthcare API market report based on services, deployment model, and end use.

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

EHR access

-

Appointments

-

Remote Patient Monitoring

-

Payment

-

Wearable medical device

-

-

Deployment Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud Based

-

On Premise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare payers

-

Providers

-

Patients

-

Vendors

-

Frequently Asked Questions About This Report

b. The U.S. healthcare API market size was estimated at USD 292.6 million in 2024 and is expected to reach USD 303.3 million in 2025.

b. The U.S. healthcare API market is expected to grow at a compound annual growth rate of 3.96% from 2025 to 2033 to reach USD 413.7 million by 2033.

b. The EHR access segment accounted for the largest market share of 29.76% in 2024. This growth is attributed to the increasing adoption of EHR systems by healthcare providers to enhance patient engagement, improve care coordination, and integrate advanced technologies such as AI and data analytics is a major driver for segment growth

b. Some of the key players in U.S. healthcare API market include Apple, Inc., Athenahealth, Cerner Corporation (Oracle), Microsoft, Epic Systems Corporation, eClinicalWorks, Veradigm LLC, Greenway Health, LLC, Practice Fusion, Inc., Salesforce, Inc., IBM, and Alphabet Inc..

b. Key factors that are driving the market growth include the rising demand for interoperability, increasing adoption of API-based Electronic Health Records, the shift to Service-Oriented Architecture (SOA), technological advancements, and integration of Artificial Intelligence and analytics. In addition, rising reliance on digital solutions to streamline operations, enhance patient care, and ensure compliance with evolving healthcare regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.