U.S. High Speed Blower Market Summary

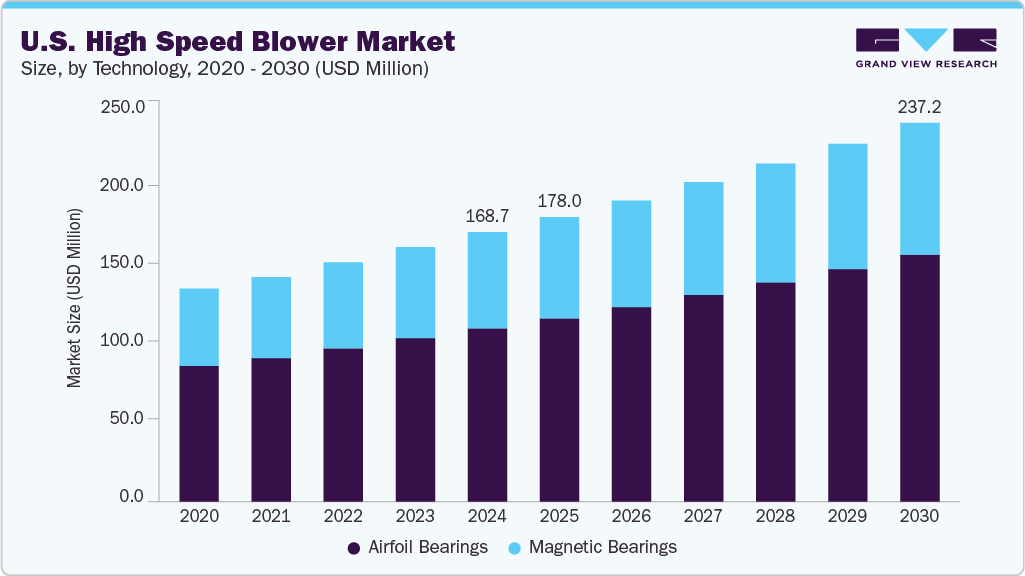

The U.S. high-speed blower market size was valued at USD 168.7 million in 2024 and is projected to reach USD 237.2 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The primary drivers for the U.S. high speed blower industry include significant energy efficiency, as high speed blowers utilize advanced technologies such as variable frequency drives and magnetic bearings to reduce energy consumption and operating costs.

Key Market Trends & Insights

- By technology, the airfoil bearings segment held the highest market share of 64.3% in 2024.

- Based on technology, the magnetic bearings segment is expected to experience a significant CAGR of 5.5% in 2024.

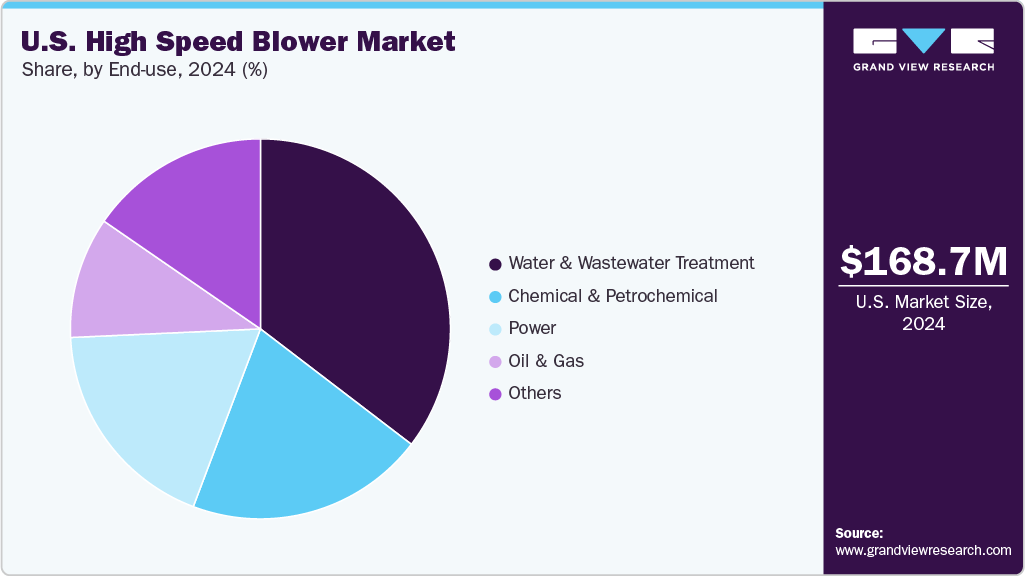

- Based on end use, the water & wastewater treatment segment held the highest market share of 35.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 168.7 Million

- 2030 Projected Market Size: USD 237.2 Million

- CAGR (2025-2030): 5.9%

High-speed blowers are advanced air-moving devices that use high-speed motors, single-stage centrifugal compressors, and frictionless air foil or magnetic bearings to deliver highly efficient, oil-free airflow. In the U.S., they are increasingly used across sectors such as municipal wastewater treatment, power generation, chemical processing, and others. Their compact and lightweight design allows for easier installation and requires less space. Additionally, turbo blowers are known for their quiet operation and lower maintenance requirements due to fewer moving parts, resulting in longer lifespan and reduced replacement costs. Some high-speed blowers offer several advantages, including intelligent motion controls that enable autonomous operation and enhance system responsiveness. Their long-term reliability ensures consistent performance without frequent maintenance, reducing operational disruptions.

Designed for rugged performance, these blowers can withstand challenging conditions, making them suitable for demanding industrial environments. The government’s energy rules encourage companies to use machines that save electricity, and rising electricity costs make businesses look for more efficient equipment, such as high-speed blowers. Government investments in improving wastewater treatment plants increase the need for high speed blowers, which help clean water. Industries are using more automated and easy-to-maintain machines, so smart high-speed blowers are in demand. Companies in the U.S. want to be more environmentally friendly, so they choose oil-free and efficient blowers to reduce pollution and save energy.

Technology Insights

The airfoil bearings segment has the largest share of 64.3% in 2024, as airfoil bearings are increasingly used in high-speed blowers, especially in industries that demand oil-free, energy-efficient, and low-maintenance solutions. Companies are integrating airfoil bearing technology into their high-speed turbo blowers, which are widely adopted in applications such as wastewater treatment, pharmaceutical manufacturing, and semiconductor clean rooms. The result is a quiet, reliable, and long-life system ideal for environments where contamination and downtime are unacceptable. The trend reflects a growing shift in the U.S. toward sustainable, oil-free air systems in both public infrastructure and advanced manufacturing sectors.

The magnetic bearing segment is expected to experience a significant CAGR of 5.5% for the forecast period. Magnetic bearings in high-speed blowers are highlighted for their precision and durability. These systems suspend the shaft using magnetic fields, resulting in no mechanical contact and minimal wear.

End-use Insights

The water & wastewater treatment segment dominated the market with revenue share in 2024. In the U.S., high-speed blowers are widely used in the water and wastewater treatment sector because they deliver efficient, oil-free air for aeration processes. These blowers play a crucial role in biological treatment systems by providing the precise airflow required to support microbial activity that breaks down organic matter. Using airfoil bearing technology further enhances reliability by eliminating the need for lubrication and reducing mechanical wear, supporting continuous and long-term operation in demanding treatment environments.

The chemical & petrochemical segment is anticipated to register the fastest CAGR over the forecast period. In the U.S., the chemical and petrochemical industries increasingly rely on high-speed blower systems, particularly turbo blowers, to supply high-purity, pressurized air or process gases essential for operations like gas compression, drying, vapor recovery, and process air delivery. These blowers are favored for their compact footprint and high rotational speeds, which translate into enhanced energy efficiency and reduced space requirements

Key U.S. High Speed Blower Company Insights

Some of the key companies in the U.S. high speed blower industry include AERZEN Maschinenfabrik GmbH, Fuji Electric Co. Ltd., and APG-Neuros, and Atlas Copco.

-

Spencer Turbine Company is a global leader in industrial gas handling solutions and a pioneer in blower technology. The company specializes in engineered air and gas handling systems for critical applications across environmental, industrial, and energy markets.

-

United Blowers Inc. is a leading American manufacturer of high-performance blower systems, specializing in engineered solutions for industrial and environmental applications.

Key U.S. High Speed Blower Companies:

- AERZEN Maschinenfabrik GmbH

- APG-Neuros

- Atlas Copco

- Fuji Electric Co. Ltd.

- Gardner Denver

- Howden Group

- United Blowers Inc.

- Ingersoll Rand

- Xylem Inc.

- Spencer Turbine Company

Recent Developments

U.S. High Speed Blower Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 178.0 million

|

|

Revenue forecast in 2030

|

USD 237.2 million

|

|

Growth rate

|

CAGR of 5.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

|

|

Segments covered

|

Technology, end-use

|

|

Key companies profiled

|

AERZEN Maschinenfabrik GmbH, APG-Neuros, Atlas Copco, Fuji Electric Co. Ltd., Gardner Denver, Howden Group, United Blowers Inc., Ingersoll Rand, Xylem Inc., Spencer Turbine Company

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. High Speed Blower Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. high-speed blower market report based on technology, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Airfoil Bearings

-

Magnetic Bearings

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)