- Home

- »

- Homecare & Decor

- »

-

U.S. Home Bedding Market Size And Share, Report, 2030GVR Report cover

![U.S. Home Bedding Market Size, Share & Trends Report]()

U.S. Home Bedding Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Mattress, Bed Linen, Pillows, Blankets, Mattress Toppers & Pads), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-200-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Home Bedding Market Size & Trends

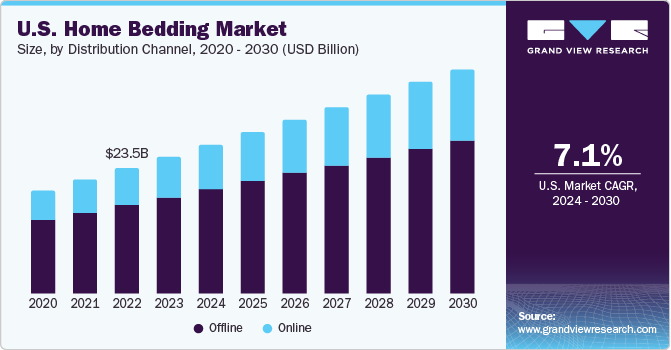

The U.S. home bedding market size was estimated at USD 25.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. Increased consumer spending on bedding products and booming growth in the housing sector in the U.S. have resulted in market growth. Prominent companies are gaining momentum as there is an increased awareness regarding the importance of organic bedding and investing in quality bedding products.

A growing number of individuals are moving into residential areas in cities. The rising per capita income has encouraged consumers to purchase items that make their lives more comfortable and easy. Therefore, the increasing penetration of e-commerce firms, modern residential spaces, and this shift in lifestyle are all responsible for the high sales of home bedding. A large number of people who buy, rent, and renovate homes, use mattresses, bed linens, blankets, and other home bedding products. The fabric and layering of home bedding is the subject of extensive research and development, which is positively changing the dynamics of the market.

Small home accessories that raise the level of living and improve comfort and beauty are becoming more and more popular thanks to e-commerce companies. Sales of home bedding solutions have also been boosted by the new textile revolutions, which include the use of environmentally friendly, biodegradable, and sustainable materials to provide a variety of bedding solutions. In addition, the incorporation of bedding items for the home, such as pillows, bedsheets, and comforters, is generating novel combinations for consumers. The market is expected to increase due to the advantages of home bedding solutions, such as ways linen can control temperature, avoid allergies, maintain hygiene, and ward off bed bugs. The growing number of hotels and resorts is also consuming a significant portion of hospitality apparel. Therefore, it boosts the demand for home bedding. The incorporation of home bedding and furniture that is compatible with each other is one of the renovation ideas that encourages the market growth.

Nonetheless, expensive home bedding, high inflation, and alternative lifestyles are the main factors limiting the market's potential growth. Middle-class people cannot afford to spend as much money on beautifying and renovations due to excessive inflation. Moreover, black marketing and expensive premium home bedding solutions are also hindering the sales of home bedding.

Market Concentration & Characteristics

The surged demand for urban home bedding has pushed numerous players in the industry to concentrate on innovation and new product launches to preserve their brand image and target users. For example, various manufacturers have integrated cooling technology into their products, such as cooling gel-infused memory foam or breathable fabrics. This is in regards to the increasing demand for products that assists with regularization of body temperature while asleep.

The strict regulatory guidelines imposed to avoid the manufacturing and sale of bedding products produced from synthetic materials and toxic chemicals have led to a substantial shift in the industry towards organic and eco-friendly substitutes.

Changing customer preferences and purchasing habits have a substantial effect on the U.S. home bedding market. Moreover, the fast-paced technological progressions has influenced consumer-buying behavior. Smart mattresses with sensors for body and environmental monitoring are projected to be one of the assuring trends in the market in the upcoming years.

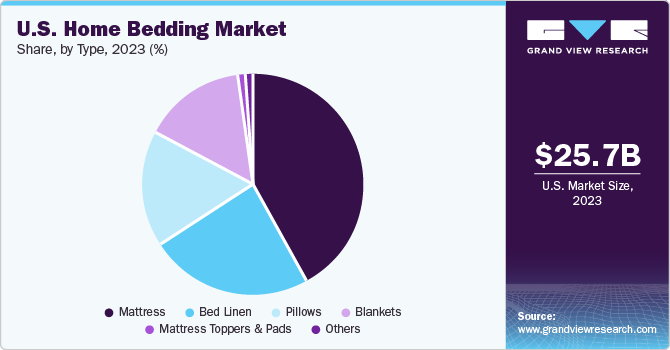

Type Insights

Mattress held the largest share of 41.4% in 2023. A prompt change in consumer preferences regarding high-quality luxury bedding goods such as linens for greater comfort, healthier beds, and durability is a prime factor augmenting the segment growth.

Key players in the bedding industry are generating spin-offs to create brand recognition and rise their share in the market. The luxury bedding products are manufactured from luxurious materials that maintain the greatest standards of quality and workmanship. It also provides linen made from seersucker, silk, and flannel.

The bed linen segment is projected to expand at the fastest CAGR from 2024 to 2030. The segment is driven by the rising demand for luxurious and high quality linens for beddings in the U.S. Furthermore, there is a rising demand for organic bedding that involves bed covers and linen duvets, which are pesticide-free and hypoallergenic, and this is augmenting the segment growth.

Consumers readily invest in great quality, comfortable linens that can augment the aesthetics and coziness of their homes. In addition, the rise of e-commerce has made it easier for consumers to view a wider range of linens, involving premium selections that were earlier only available in high-end stores.

Distribution Channel Insights

The offline distribution channel, which includes supermarkets/hypermarkets, specialty stores, and others, held the largest share in 2023. Customers incline towards the offline channel as it enables the users to have a first-hand look at the items, which assist in an effortless examination of the quality as well as materials. Numerous people choose to feel the bedding products before purchasing, especially when products such as sheets and blankets are involved.

Owing to the huge discounts provided by supermarkets and hypermarkets, rising numbers of consumers are purchasing pillows and pillowcases from these types of stores. These outlets' new product unveilings and product development are also encouraging segment growth. The online segment is expected to grow with the fastest CAGR during the forecast period. This growth is owing to the extensive usage of online platforms used by customers to shop. Online platforms offer ease and several shopping options, while sitting at the comfort of one’s house.

Key U.S. Home Bedding Company Insights

The U.S. home bedding market is characterized by the presence of various well-established players such as Tempur Sealy International, Inc., American Textile Company, Bombay Dyeing and Casper Sleep Inc., in addition to several small and medium players such as Beaumont & Brown, Brooklinen, etc.

Key players operating in the market include, Tempur Sealy International, Inc. and Casper Sleep Inc.

-

Tempur Sealy International, Inc. - Tempur Sealy International, Inc., a global leader in the bedding industry. The company, headquartered in Kentucky, U.S., designs, manufactures, and distributes a wide range of bedding products. The company’s portfolio includes strong brands such as Tempur-Pedic, Sealy featuring Posturepedic Technology, and Stearns & Foster, catering to various price points. In addition to these, it also offers private labels and original equipment manufacturer products.

-

Casper Sleep Inc. - Casper Sleep Inc., originally known as Providence Mattress Company, was founded in October 2013 and rebranded in January 2014. Headquartered in New York, U.S., the company designs, manufactures, and markets a variety of home furnishing products including mattresses, sheets, pillows, duvets, and bed frames.

Some emerging players existing in the market include Crane & Canopy Inc. and Peacock Alley, among others.

-

Crane & Canopy Inc. - Founded in 2012, Crane & Canopy Inc. is a Burlingame, California-based firm that specializes in the manufacture and distribution of premium bedding and bath linens throughout North America. Their extensive product line includes bedding sheets, pillows, pillow covers, comforters, duvets, quilts, mattress pads, towels, bathrobes, bath mats, and shower covers.

-

Peacock Alley - Established in 1973, Peacock Alley is an American enterprise renowned for its production and global distribution of top-tier bedding and bath linens. With its headquarters nestled in Dallas, Texas, the company operates four manufacturing facilities, all situated within the U.S. Peacock Alley’s product portfolio is diverse, encompassing luxury sheets, blankets, throws, coverlets, duvet covers, pillows, pillowcases, shams, bathrobes, bath mats, and shower curtains, among others.

Key U.S. Home Bedding Companies:

- American Textile Company

- Tempur Sealy International, Inc.

- Casper Sleep Inc.

- Pacific Coast Feather Company

- Brooklinen

- Crane & Canopy Inc.

- Peacock Alley

- Purple Innovation, Inc

- Hollander Sleep Products

- Kingsdown Inc.

Recent Developments

-

In March 2023, American Textile Company (ATC) launched its new bedding product AllerEase, with cutting-edge HeiQ Allergen technology. ATC partnered with the Swiss materials innovation company HeiQ to unveil numerous bedding products including mattress pads, pillows, mattress and pillow protectors, comforters, blankets, and throws in the North America.

-

In March 2023, Casper Sleep Inc. entered in a partnership with Bolt to include Bolt’s Fenom Digital technology and API-based checkout experience in its deployment. Bolt’s technology offers a one-click checkout experience without substituting the present user interface, thus offering consumers with a smooth checkout experience.

-

In February 2023, Brooklinen inaugurated a new store in the West Loop neighborhood of West Side of Chicago, Illinois, thus opening its first location in the Midwest part of the U.S. Brooklinen prevailed its partnership with the multidisciplinary design firm, Office of Tangible Space, to establish the Chicago studio.

U.S. Home Bedding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.0 billion

Revenue forecast in 2030

USD 42.2 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

American Textile Company, Tempur Sealy International, Inc., Casper Sleep Inc., Pacific Coast Feather Company, Brooklinen, Crane & Canopy Inc., Peacock Alley, Purple Innovation, Inc., Hollander Sleep Products, Kingsdown Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Home Bedding Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. home bedding market report based on type and distribution channel:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mattress

-

Bed Linen

-

Pillows

-

Blankets

-

Mattress Toppers & Pads

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Supermarket/Hypermarket

-

Specialty Stores

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. home bedding market size was estimated at USD 25.7 billion in 2023 and is expected to reach USD 28.0 billion in 2024.

b. The U.S. home bedding market is expected to grow at a compound annual growth rate of 7.10% from 2024 to 2030 to reach USD 42.20 billion by 2030.

b. Mattress dominated the U.S. home bedding market with a share of more than 42.4% in 2023. A prompt change in consumer preferences regarding high-quality luxury bedding goods such as linens for greater comfort, healthier beds, and durability is a prime factor augmenting the segment's growth.

b. Some key players operating in the U.S. home bedding include American Textile Company, Tempur Sealy International, Inc., Casper Sleep Inc., Pacific Coast Feather Company, Brooklinen, Crane & Canopy Inc., Peacock Alley, Purple Innovation, Inc., Hollander Sleep Products, Kingsdown Inc.

b. Key factors that are driving the U.S. home bedding market growth include the increased consumer spending on bedding products and booming growth in the housing sector in the U.S. has resulted in market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.