- Home

- »

- Medical Devices

- »

-

U.S. Hospital Facilities Market Size, Industry Report, 2033GVR Report cover

![U.S. Hospital Facilities Market Size, Share & Trends Report]()

U.S. Hospital Facilities Market (2026 - 2033) Size, Share & Trends Analysis Report By Patient Service, By Facility Type (Private Hospitals, Public/Community Hospitals), By Bed Size, By Service Type, And Segment Forecasts

- Report ID: GVR-4-68039-326-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hospital Facilities Market Summary

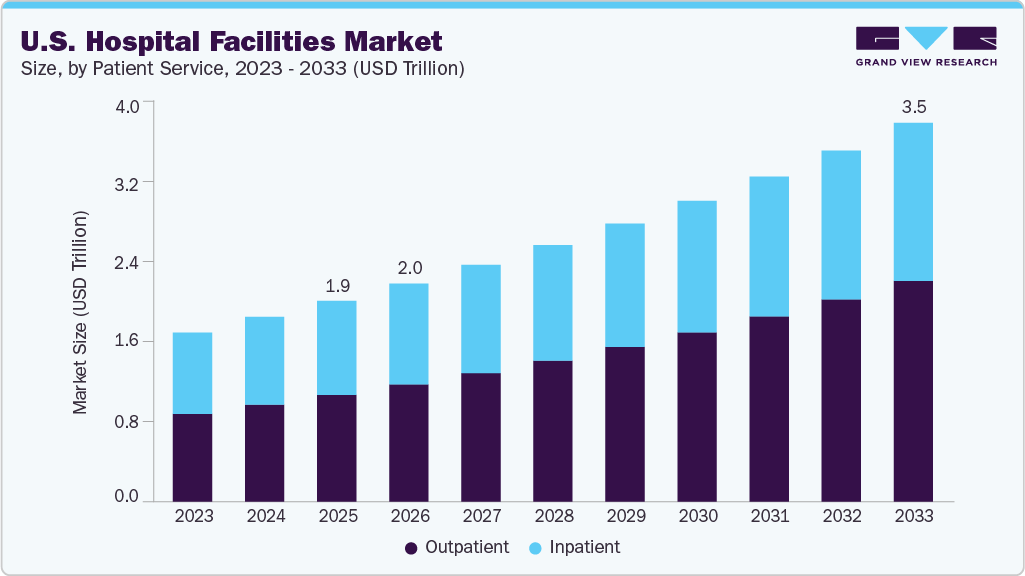

The U.S. hospital facilities market size was estimated at USD 1,875.9 billion in 2025 and is projected to reach USD 3,539.7 billion by 2033, growing at a CAGR of 8.21% from 2026 to 2033. The market is expected to grow significantly due to the increasing demand for better patient care, and the introduction of novel healthcare technologies is anticipated to boost the demand for well-equipped hospitals in the coming years.

Key Market Trends & Insights

- The Southeast region dominated the U.S. hospital facilities market with the largest revenue share of 25.82% in 2025.

- The hospital facilities market in the Northeast region is expected to grow at the fastest CAGR over the forecast period.

- By patient service, the outpatient services segment led the market with the largest revenue share of 53.2% in 2025.

- By facility type, the public/community hospitals segment led the market with the largest revenue share of 52.5% in 2025

- By service type, the cancer segment is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 1,875.9 Billion

- 2033 Projected Market Size: USD 3,539.7 Billion

- CAGR (2026-2033): 8.21%

- Southeast region: Largest market in 2025

- Northeast region: Fastest growing market

According to the CDC, 6 out of 10 adults in the U.S. have a chronic disease, such as cancer, stroke, heart disease, diabetes, and others, with four in ten adults having two or more chronic conditions. These and other non-communicable chronic illnesses are the foremost causes of disability and death in the U.S. They are also a leading driver of healthcare costs and are expected to drive the market during the forecast period.The demand and supply gap in the U.S. healthcare system is growing rapidly. This is mainly due to the growing number of patients and the limited resources available to provide the necessary care. Furthermore, the increase in the average life expectancy of citizens has led to a significant geriatric population in the country, which requires specialized medical care, placing a strain on the medical system. According to the Macrotrends LLC report, Life expectancy rose to 79.25 years in 2024, marking a notable 1.11% increase from 2023, driven largely by improvements in healthcare access, better management of chronic diseases, and a decline in mortality from pandemic-related causes. This upward trend continued into 2025, with life expectancy reaching 79.40 years, representing a further 0.18% increase year over year.

Moreover, the U.S. allocates a significant portion of its GDP to healthcare, enabling hospitals to expand capacity, renovate outdated structures, and modernize clinical and administrative environments. Increased public and private funding allows facilities to invest in advanced medical equipment, digital health systems, data infrastructure, and smart technologies that enhance operational efficiency and clinical outcomes. As per the Organisation for Economic Co-operation and Development, a report published in November 2025, the U.S. spent by far the most on health, equivalent to 17.2% in 2024. In addition, according to the American Medical Association, the U.S. spent a total of USD 4,866.5 billion or USD 14,570 per capita on health care in 2023. The ongoing capital investments support the development of specialized care units, improved patient safety systems, and enhanced service delivery capabilities.

As the patient population continues to grow, the country’s healthcare expenditure is expected to increase rapidly, in turn favoring overall market growth. Over the years, there has been a significant rise in the number of surgical procedures performed in the U.S. According to an NCBI study, approximately 40 to 50 million surgical procedures are performed in the country every year. The procedures performed most frequently included surgeries of the digestive, musculoskeletal, cardiovascular, and ophthalmic systems.

Overview of U.S. Surgical Procedure Volumes

Segment

Procedures in 2024 (000s)

Aesthetic, Dermatological, Plastic Procedures

25,660

Cardiothoracic & Interventional Cardiology Procedures

3,613

Ear, Nose, Throat Procedures

4,634

General Surgery Procedures

22,838

Lung Procedures

463

Neurosurgical Procedures

2,817

Obstetrics and Gynecological Procedures

6,853

Ophthalmology Procedures

4,227

Orthopedic Procedures

7,847

Peripheral Vascular Procedures

812

Spine Procedures

1,655

Stereotactic Radiosurgery Procedures

441

Urological Procedures

10,466

Source: Life Science Intelligence, Inc.

Furthermore, technological advancements such as AI, electronic health records, mHealth, telemedicine/telehealth, sensors & wearable technology, wireless communication systems, remote monitoring, robotics, and other notable innovations are expected to drive the market during the forecast period. For instance, Northwestern Memorial Hospital and Caption Health announced a collaboration to bring new AI-powered ultrasound equipment into clinical practice.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The degree of innovation is medium, the level of partnership and collaboration activities is medium, the impact of regulations on the market is high, and the regional expansion of the market is low.

Innovations in medical technologies such as telemedicine, robotic surgery, and electronic health records (EHRs). For instance, telemedicine has expanded access to healthcare services, allowing patients to consult with healthcare providers remotely, which is especially beneficial in rural areas where access to hospitals may be limited. Moreover, the rise in value-based care models has prompted hospitals to innovate their service delivery approaches. Facilities now focus on preventive care and chronic disease management rather than solely on acute treatment. This shift encourages hospitals to invest in outpatient services and community health initiatives that can alleviate pressure on inpatient resources.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, in March 2023, CVS Health stated that it had completed the acquisition of the renowned provider of home healthcare services, Signify Health. The conclusion of this agreement indicates that CVS is prepared to expand its home healthcare services business substantially.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Regulatory bodies such as the Centers for Medicare & Medicaid Services (CMS), the Joint Commission, and state health departments impose standards that hospitals must meet to ensure quality care and patient safety. CMS establishes conditions of participation that hospitals must comply with to receive Medicare and Medicaid funding. For instance, the implementation of the Affordable Care Act (ACA) expanded access to healthcare services and imposed new reporting requirements and quality metrics for hospitals. This has led many facilities to adopt electronic health records (EHR) systems to streamline data collection and improve patient outcomes.

Regional expansion efforts are evident as skilled nursing facilities aim to penetrate underserved markets across the U.S., particularly in rural areas where access to healthcare is limited. Healthcare providers seek to establish a more significant presence in underserved regions. For instance, large health systems such as HCA Healthcare and Tenet Healthcare have expanded their networks by acquiring smaller hospitals or building new facilities in suburban and rural areas. This helps these organizations capture a larger market share and addresses critical gaps in healthcare access for populations that may otherwise face barriers to receiving timely medical attention.

Patient Service Insights

The outpatient services segment led the market with the largest revenue share of 53.2% in 2025 and is expected to grow at the fastest CAGR over the forecast period. The development of new technologies, such as telemedicine, telemonitoring, and diagnostic techniques, has led to shorter patient stays, as physicians can provide treatment remotely, which in turn reduces overhead costs and patient fees. Furthermore, there has been a gradual shift to outpatient or daycare surgeries among patients in recent years. Minimally invasive surgeries have made it possible for daycare surgeries to flourish. This is expected to boost the growth of the outpatient service segment. In terms of patient services, the U.S. hospital facilities industry is segmented into outpatient services and inpatient services. Meanwhile, the inpatient services segment is expected to expand owing to the rising number of hospitalizations and the high cost of care for inpatients.

The inpatient services segment is expected to grow at a significant CAGR over the forecast period. Inpatient services are the primary source of revenue for hospitals. However, due to the introduction of novel techniques, such as better diagnostics and interventional surgeries, the recovery time for patients is being reduced. Thus, the average time for an inpatient is reduced, which, in turn, is expected to decrease the share of the inpatient services segment in the near future.

Facility Type Insights

The public/community hospitals segment led the market with the largest revenue share of 52.5% in 2025, driven primarily by their essential role in providing accessible, affordable, and localized care. Community hospitals support primary and secondary care, emergency services, maternal care, and chronic disease management, thereby helping to reduce the patient burden on larger academic medical centers. The increasing prevalence of chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders has strengthened the need for community-based continuous care infrastructures.

The state-owned & federal hospitals segment is expected to grow at the fastest CAGR over the forecast period. State-owned hospitals primarily aim to target patients who require acute care, including infection control and accident/trauma cases. Federal hospitals play a crucial role in providing healthcare services to patients who have limited access to quality care. Increasing access to public healthcare is expected to drive segment expansion. Dr. Reddy's Laboratories Ltd. launched the Regadenoson injection, a substance used in imaging the heart muscle to check blood flow and approved by the U.S. FDA, in the U.S. market in May 2023. The injection serves as a pharmacologic stress agent for radionuclide myocardial perfusion imaging (MPI) in patients who are unable to undergo adequate exercise stress.

Service Type Insights

The cardiovascular segment led the market with the largest revenue share of 20.8% in 2025. Its dominance is attributed to the growing adoption of sedentary lifestyle practices is leading to a rise in the incidence of obesity in the U.S., thus increasing the risk of heart diseases. Thus, an increasing number of patients suffering from CVDs is expected to propel segment growth. As per the CDC, Heart disease continues to represent the most serious public health challenge in the U.S., remaining the leading cause of death among men, women, and most racial and ethnic groups. The burden of cardiovascular disease is extremely high, with one person dying every 34 seconds due to heart-related conditions, highlighting both the widespread prevalence and severity of the disease. In 2023 alone, cardiovascular disease accounted for 919,032 deaths, representing approximately one in every three deaths nationwide.

The cancer segment is expected to grow at the fastest CAGR over the forecast period. Cancer is the second leading cause of death in the U.S. after CVDs. According to an American Cancer Society study published in January 2024, approximately 2,001,140 new cancer cases and 611,720 cancer-related deaths were projected in 2024 in the U.S., highlighting the persistent and significant public health burden of cancer. The increasing costs of cancer treatment, the rising number of specialized oncology departments & oncologists, and the supportive reimbursement framework are among the key factors expected to propel segment growth.

Bed Size Insights

The 0-99 segment led the market with the largest revenue share of 53.4% in 2025. This segment comprises small hospitals that primarily serve rural or remote areas with low population density. These hospitals play a crucial role in providing access to basic healthcare services to communities, although some hospitals in this segment fulfill the specialized needs of the local population. Their primary focus is on delivering essential medical care.

The 100-199 segment is expected to register at the fastest CAGR over the forecast period. These hospitals are better equipped to offer a wider range of services and specialties. With a higher bed capacity, they can accommodate more patients and address a broader spectrum of medical needs.

Region Insights

Southeast region dominated the U.S. hospital facilities market with the largest revenue share of 25.8% in 2025. Its dominance is driven by strong demographic and healthcare utilization trends. Rapid population growth, fueled by in-migration from other U.S. regions and an aging population, is increasing demand for inpatient and outpatient hospital services across states such as Florida, Georgia, Texas, North Carolina, and Tennessee. The region also has a high prevalence of chronic diseases, including cardiovascular disorders, diabetes, obesity, and respiratory conditions, which necessitate sustained hospital care, emergency services, and specialized treatment facilities.

The hospital facilities market in the Northeast region is expected to grow at the fastest CAGR over the forecast period. This is driven by a combination of high population density, an aging demographic profile, and a strong concentration of academic and tertiary care hospitals. States such as New York, Massachusetts, Pennsylvania, and New Jersey have a large elderly population with a higher prevalence of chronic diseases, including cardiovascular disorders, cancer, and neurological conditions, which continues to drive sustained demand for inpatient and specialized hospital services.

Key U.S. Hospital Facilities Company Insights

Some of the major companies in the market are The Johns Hopkins Hospital, Mayo Clinic, Cleveland Clinic, Cedars-Sinai, Massachusetts General Hospital, UCSF Health, New York-Presbyterian Hospital, and others. The strategies of key players to strengthen their market presence include new product launches, partnerships & collaborations, mergers & acquisitions, and geographical expansion.

For instance, in July 2023, Google Cloud and Mayo Clinic announced a strategic partnership aimed at leveraging generative artificial intelligence (AI) to enhance healthcare delivery. This collaboration focuses on utilizing advanced AI technologies to improve patient care, streamline operations, and facilitate research initiatives within the healthcare sector.

Key C-Reactive Protein Testing Companies:

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars-Sinai

- Massachusetts General Hospital

- UCSF Health

- NewYork-Presbyterian Hospital

- Brigham and Women's Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

Recent Developments

-

In October 2024, Cleveland Clinic and Angeles Health System announced the establishment of a Joint Advisory Council aimed at enhancing healthcare collaboration between the two institutions. This partnership is designed to leverage the strengths of both organizations to improve patient care, share best practices, and foster innovation in medical services.

-

In December 2023 , Mayo Clinic announced an ambitious USD 5 billion plan to revamp its flagship campus in downtown Rochester, Minnesota. This initiative, titled “Bold. Forward. Unbound,” aims to transform the healthcare delivery model by creating a more integrated and patient-centered environment. The expansion will include five new buildings totaling 2.4 million square feet, designed with future-oriented elements and advanced digital capabilities.

-

In September 2023, Mayo Clinic announced a strategic collaboration with GE HealthCare aimed at advancing innovation in medical imaging and theranostics. This partnership is designed to leverage the strengths of both organizations to enhance patient care through improved diagnostic capabilities and treatment options.

U.S. Hospital Facilities Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2,037.4 billion

Revenue forecast in 2033

USD 3, 539.7 billion

Growth rate

CAGR of 8.21% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Patient service, facility type, service type, bed size, region

Country scope

U.S.

Key companies profiled

The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hospital Facilities Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. hospital facilities market report based on patient service, facility type, service type, bed size, and region:

-

Patient Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inpatient Services

-

Outpatient Services

-

-

Facility Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Private Hospitals

-

State-owned & Federal Hospitals

-

Public/Community Hospitals

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Acute Care

-

Cardiovascular

-

Cancer Care

-

Neurorehabilitation & Psychiatry Services

-

Pathology Lab, Diagnostics, and Imaging

-

Obstetrics & Gynecology

-

Others

-

-

Bed Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

0 - 99

-

100 - 199

-

200 - 299

-

300 - more

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

Southeast

-

Midwest

-

West

-

Northeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. hospital facilities market size was valued at USD 1,875.9 billion in 2025 and is expected to reach USD 2,037.4 billion in 2026.

b. The U.S. hospital facilities market is expected to grow at a compound annual growth rate of 8.21% from 2026 to 2033 to reach USD 3,539.7 billion by 2033.

b. The outpatient services segment held the largest revenue share of 53.15% in 2025. The development of new technologies, such as telemedicine, telemonitoring, and diagnostic techniques, has led to shorter patient stays, as physicians can provide treatment remotely, which, in turn, reduces overhead costs and patient fees.

b. Some key players operating in the U.S. hospital facilities market include The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital

b. Key factors driving the U.S. hospital facilities market growth include the growing impetus for better patient care and the entry of novel healthcare technology. Furthermore, technological advancements such as AI, electronic health records, mHealth, telemedicine/telehealth, sensors & wearable technology, wireless communication systems, remote monitoring, robotics, and other notable innovations are expected to drive the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.