- Home

- »

- Electronic & Electrical

- »

-

U.S. Household Appliances Market, Industry Report, 2030GVR Report cover

![U.S. Household Appliances Market Size, Share & Trends Report]()

U.S. Household Appliances Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-146-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Household Appliances Market Trends

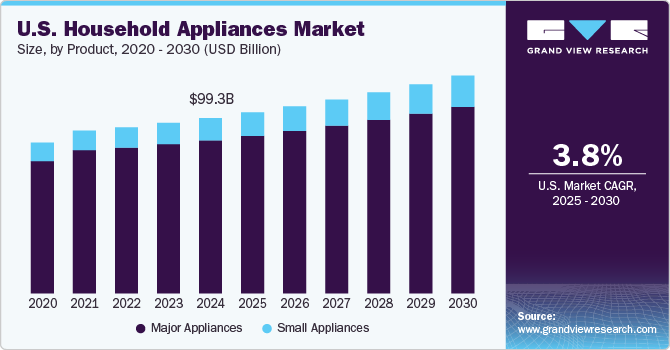

The U.S. household appliances market size was estimated at USD 99.34 billion in 2024 and is expected to grow at a CAGR of 3.8% from 2025 to 2030. Consumer preference for automation, cost savings, and sustainability. Home renovation and remodeling trends, along with a shift toward premium, high-performance product, further boost market growth. The rise of e-commerce and Omni channel retailing, led by platforms like Amazon and Best Buy, is influencing purchasing behavior through competitive pricing and convenience. Additionally, growing environmental awareness and government incentives, such as ENERGY STAR certifications, are pushing manufacturers to develop eco-friendly appliances. Changing lifestyles, urbanization, and the need for compact, multifunctional devices are also shaping innovation, while brands like Samsung and LG enhance in-store experiences with interactive displays and experiential retailing.

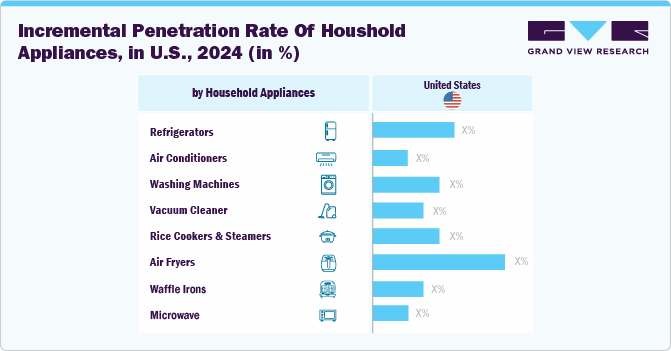

The consumer penetration of household appliances is increasing in the U.S., driven by rising disposable income, technological advancements, and growing demand for energy-efficient and smart appliances. The integration of IoT and AI in appliances, enabling remote control and automation, has boosted adoption among tech-savvy consumers. Additionally, increased urbanization, smaller living spaces, and busy lifestyles have fueled demand for compact, multifunctional appliances. Retail expansion, including omnichannel strategies by major players like Best Buy, Home Depot, and Walmart, has made appliances more accessible. Government incentives promoting energy-efficient models and financing options have further accelerated market growth, making household appliances a necessity in modern U.S. homes.

The rise in household appliance ownership in the U.S. has been driven by changing consumer lifestyles, particularly the increasing number of dual-income households and busy work schedules. This has fueled the demand for time-saving appliances such as robotic vacuums, smart washing machines, and dishwashers that offer convenience and efficiency. Additionally, the growing trend of home renovation and remodeling has encouraged consumers to upgrade and replace old appliances, boosting sales in the U.S. household appliances industry.

Another significant factor is the increased focus on health and hygiene, especially following the pandemic. Consumers are now prioritizing air purifiers, water purifiers, and self-cleaning appliances to enhance cleanliness and safety in their homes. Moreover, the availability of flexible payment and financing options, including buy now pay later (BNPL) schemes and zero-interest financing, has made high-end appliances more accessible to a wider range of consumers.

Sustainability and energy efficiency have also played a key role in driving appliance sales. With rising awareness of environmental concerns and government incentives for energy-efficient products, consumers are actively seeking ENERGY STAR-certified appliances to reduce electricity consumption and lower utility bills. Finally, the strong retail and distribution network in the U.S., including major big-box retailers like Best Buy, Walmart, and Costco, along with direct brand stores and online marketplaces, has made it easier for consumers to access a variety of household appliances at competitive prices.

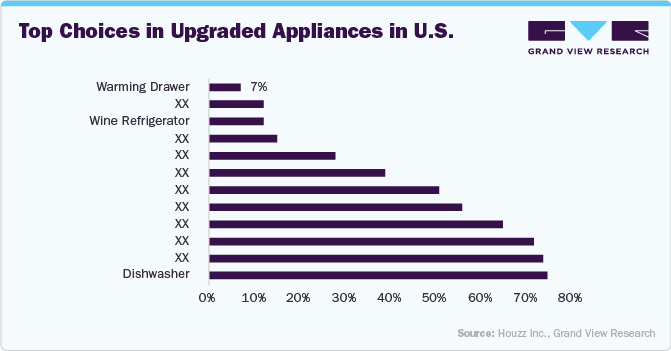

Consumer Insights

In the U.S. household appliances industry, consumer preferences are shifting toward upgraded, energy-efficient, and smart home-compatible products. Dishwashers are the top choice for appliance upgrades, driven by features like advanced cleaning technology, water and energy efficiency, and smart connectivity. Consumers prioritize convenience, durability, and high performance, with brands offering innovations such as customizable cycles, noise reduction, and eco-friendly options gaining traction. While most purchases still occur in physical stores, online channels continue to grow due to competitive pricing, customer reviews, and home delivery services. Additionally, experiential retail spaces and interactive product demonstrations are influencing buying decisions, enhancing consumer confidence in premium appliance investments.

Energy efficiency and sustainability are also key factors driving the market. U.S. consumers are becoming more environmentally conscious and are seeking appliances that reduce energy consumption and carbon footprints. Energy-efficient cooking appliances with certifications such as ENERGY STAR are increasingly preferred, as they help lower utility bills while promoting sustainability. Manufacturers are responding to this demand by introducing products with advanced energy-saving features, such as induction cooktops and ovens with improved insulation and rapid preheating capabilities. In March 2024, BSH Hausgeräte GmbH opened its flagship Experience & Design Center in Miami's Design District, offering an 8,000-square-foot space atop the Design 41 building. This center showcases premium home appliances from Thermador, Bosch, and Gaggenau, allowing visitors to engage in hands-on experiences and explore the latest innovations in home appliance technology. The showroom features full kitchen setups that highlight both new and classic design trends, providing a comprehensive look at the brands' offerings.

Product Insights

Major appliances accounted for a revenue share of 87.31% in 2024. essential appliances such as refrigerators, washing machines, and ovens are fundamental to daily life, driving consistent demand. The trend toward smart home integration has further fueled sales, as consumers invest in IoT-enabled appliances for enhanced convenience, energy efficiency, and remote-control features. Additionally, a strong housing market, home renovations, and rising disposable incomes have encouraged consumers to upgrade to premium and high-tech appliances. Extended financing options and promotional discounts offered by major retailers have also played a role in boosting sales.

The small appliances market is expected to grow at a CAGR of 5.9% from 2025 to 2030. increasing consumer demand for convenience and time-saving products, such as coffee makers, blenders, and robotic vacuums, has led to a surge in their popularity. As lifestyles become busier, consumers are looking for ways to simplify daily tasks, which has boosted the adoption of small appliances. Additionally, small appliances tend to have lower price points, making them more accessible to a wider range of consumers. Technological advancements in small appliances, such as smart features and improved performance, have also contributed to their growth.

Distribution Channel Insights

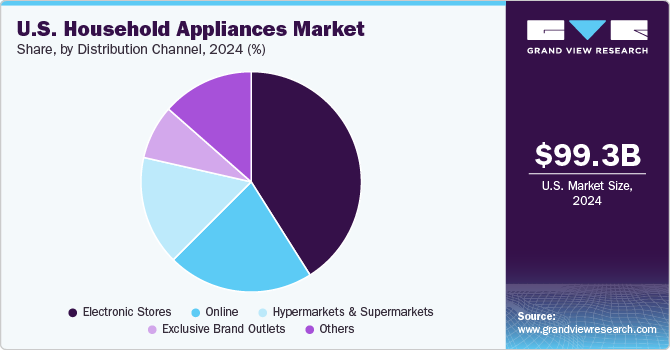

Sales through electronic stores accounted for a revenue share of 41.03% in 2024. Sales through electronic stores dominate the U.S. household appliances market due to their ability to offer a wide product selection, hands-on experience, and immediate availability. Consumers prefer in-store shopping for high-ticket appliances like refrigerators and washing machines, as they can physically examine products, compare features, and receive expert guidance. Leading retailers such as Best Buy, Walmart, and Home Depot integrate omnichannel strategies, allowing customers to research online before finalizing purchases in-store. Additionally, electronic stores provide instant purchases, installation services, warranties, and better after-sales support, making them more reliable than online-only retailers. Exclusive brand partnerships, promotional deals, and financing options further attract consumers, reinforcing trust and preference for physical retail over e-commerce in the U.S. household appliances industry.

Sales of household appliances through online channels are expected to grow with a CAGR of 5.1% from 2025 to 2030. The U.S. household appliances market is experiencing strong growth in online sales as consumer behavior shifts toward digital shopping. According to Adtaxi's 2024 Ecommerce Survey, 78% of Americans are now comfortable buying major appliances online, up from 73% the previous year. This rising preference aligns with broader e-commerce trends, where convenience and easy product and price comparisons are key drivers. With 93% of American adults shopping online and a growing number making daily purchases, the online channel has become an essential platform for major appliances, enabling brands to reach a wider audience efficiently.

Country Insights

The Southeast U.S. household appliances market accounted for a revenue share of 34.61% in 2024, driven by its large population, rapid urbanization, and strong housing market. States like Florida, Georgia, and Texas contribute significantly due to high homeownership rates and frequent home renovations. The region's warm climate also increases demand for appliances like air conditioners, refrigerators, and washers. Additionally, the presence of major retail chains and distribution hubs enhances accessibility and affordability, further solidifying the Southeast’s leadership in the market.

The Western U.S. household appliances market is expected to grow at a CAGR of 3.9% from 2025 to 2030. States like California, Washington, and Oregon are at the forefront of this growth due to progressive environmental policies, government incentives for energy-efficient appliances, and a highly tech-savvy consumer base. The region’s emphasis on reducing carbon footprints has led to a surge in demand for eco-friendly refrigerators, dishwashers, and smart HVAC systems. Additionally, the high concentration of urban developments and luxury real estate in cities like Los Angeles, San Francisco, and Seattle fuels interest in premium, high-performance appliances. The expansion of e-commerce and omnichannel retailing in the West further accelerates market growth, making it a key hub for innovation and new product adoption.

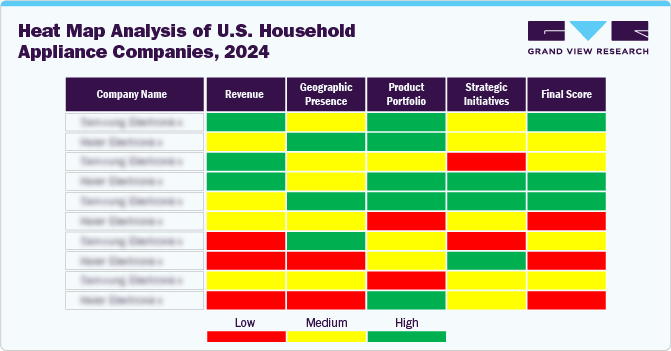

Key U.S. Household Appliances Company Insights

In the U.S. household appliances market, manufacturers are using brand share analysis and production data of household appliances to refine their strategies, focusing on smart technology and customizable designs. With the growing adoption of IoT-enabled appliances, consumers can now remotely control their devices, track energy consumption, and receive predictive maintenance alerts through mobile apps and virtual assistants like Amazon Alexa and Google Assistant. At the same time, brands are catering to style-conscious buyers by offering interchangeable panels, bold color choices, and modular components that allow easy upgrades without replacing entire units. This shift reflects an industry-wide push toward personalization, efficiency, and sustainability in modern homes.

Key U.S. Household Appliances Companies:

- Whirlpool Corporation

- Electrolux AB Group

- Fisher & Paykel Appliances Holdings Ltd.

- GE Appliances

- Haier Group

- LG Electronics

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SMEG S.p.A.

- Miele & Cie. KG

- iRobot Corporation

Recent Developments

-

In March 2024, Miele announced the latest enhancements to its G7000 Dishwashers, emphasizing convenience and sustainability. Showcased at the Kitchen & Bath Industry Show (KBIS) from February 27-29, 2024, the updated G7000 models feature an upgraded AutoDos with PowerDisk system, ensuring precise detergent dispensing for optimal results with each load. The new models boast even quieter operations and an improved dishwasher basket design, catering to the accommodation of reusable bottles, straws, and smaller items.

-

In February 2024, LG Electronics Inc. unveiled the 14-person LG Dios Objet Collection Dishwasher, aimed at optimizing space efficiency and convenience. This new product is offered in three variations: built-in models with product heights of 10 cm and 15 cm from the kitchen floor, as well as a freestanding option. Its design eliminates the need for separate installation work, providing customers with customizable choices to suit their kitchen interior requirements.

-

In January 2024, Whirlpool Corporation disclosed its collaboration with One Energy to integrate onsite wind and solar power systems into its operations in Findlay and Clyde, Ohio. Presently, the company boasts nine onsite wind turbines across four Ohio plants located in Findlay, Marion, Greenville, and Ottawa. Together, these turbines cater to 22 percent of the electrical requirements for these facilities. The newly announced projects are among the most substantial behind-the-meter renewable energy endeavors in the U.S. Upon completion, they will guarantee that the Clyde and Findlay plants derive a minimum of 70 percent of their energy needs from onsite renewable sources.

U.S. Household Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 102.54 billion

Revenue forecast in 2030

USD 123.33 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

Northeast; Southeast; Southwest; Midwest; West

Key companies profiled

Whirlpool Corporation; Electrolux AB Group; Fisher & Paykel Appliances Holdings Ltd.; GE Appliances; Haier Group; LG Electronics; Panasonic Corporation; Robert Bosch GmbH; Samsung Electronics Co., Ltd.; SMEG S.p.A.; Miele & Cie. KG; iRobot Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Household Appliances Market Report Segmentation

This report forecasts revenue & volume growth at the country level and regional levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. household appliances market report based on product, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S household appliances market size was estimated at USD 99.34 billion in 2024 and is expected to reach USD 102.54 billion in 2025.

b. The U.S household appliances market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 123.33 billion by 2030.

b. Cooktops, cooking ranges, microwaves, and ovens dominated the U.S. household appliances market with a share of 31.6% in 2024. This is attributable to the swift pace of urbanization. rising income levels and spending power of consumers

b. Some of the key market players in the U.S household appliances market are Whirlpool Corporation; Electrolux AB Group; Fisher & Paykel Appliances Holdings Ltd.; GE Appliances; Haier Group; LG Electronics; Panasonic Corporation; Robert Bosch GmbH; Samsung Electronics Co., Ltd.; SMEG S.p.A.; Miele & Cie. KG; and iRobot Corporation

b. Key factors such as Home renovation and remodeling trends, along with a shift toward premium, high-performance products, drive the market growth. The rise of e-commerce and omnichannel retailing, led by platforms like Amazon and Best Buy, is influencing purchasing behavior through competitive pricing and convenience. Additionally, growing environmental awareness and government incentives, such as ENERGY STAR certifications, are pushing manufacturers to develop eco-friendly appliances. Changing lifestyles, urbanization, and the need for compact, multifunctional devices are also shaping innovation, while brands like Samsung and LG enhance in-store experiences with interactive displays and experiential retailing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.