- Home

- »

- Electronic & Electrical

- »

-

U.S. Household Kitchen Appliances Market Size Report, 2033GVR Report cover

![U.S. Household Kitchen Appliances Market Size, Share & Trends Report]()

U.S. Household Kitchen Appliances Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Refrigerator, Cooking Appliances, Dishwasher, Range Hood), By Technology (Conventional, Smart Appliances), And Segment Forecasts

- Report ID: GVR-4-68040-683-0

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Household Kitchen Appliances Market Summary

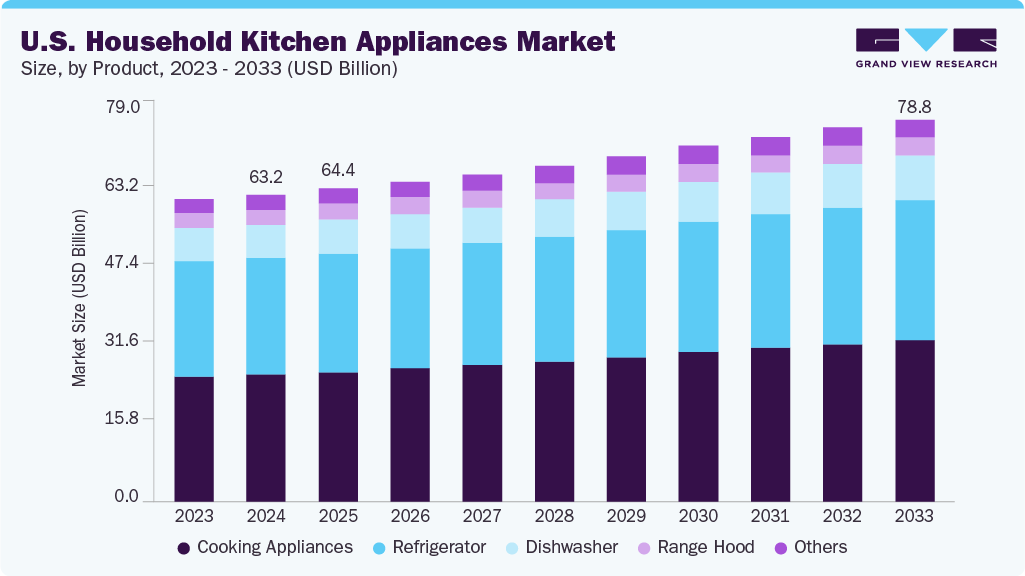

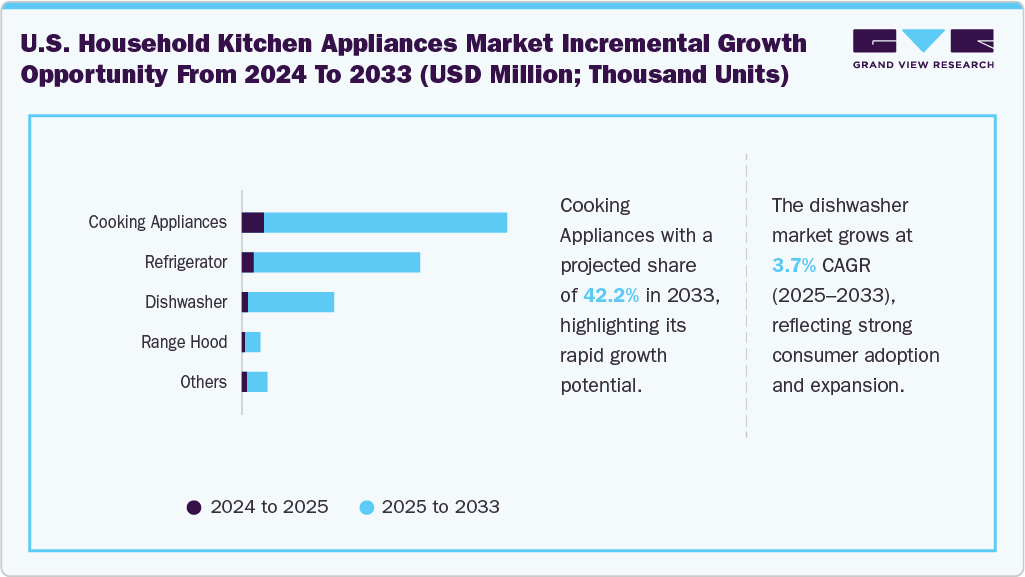

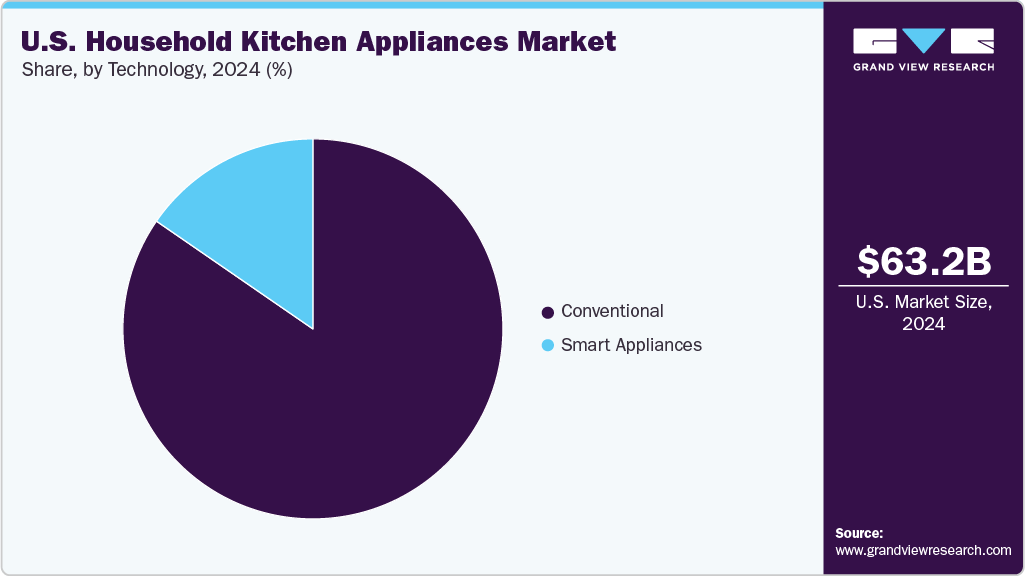

The U.S. household kitchen appliances market size was valued at USD 63.21 billion in 2024 and is expected to reach USD 78.76 billion by 2033, growing at a CAGR of 2.5% from 2025 to 2033. Consumer demand is driven by a preference for automation, cost efficiency, and sustainability.

Key Market Trends & Insights

- By product, the cooking appliances segment held the largest market share, accounting for 41.3% in 2024.

- By technology, the conventional technology segment held the largest share of 84.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 63.21 Billion

- 2033 Projected Market Size: USD 78.76 Billion

- CAGR (2025-2033): 2.5%

Trends in home renovation and remodeling, coupled with a growing shift toward premium, high-performance products, are further fueling market expansion. The industry is experiencing strong growth, driven in part by the rapid expansion of e-commerce platforms that offer consumers convenient access to a broad selection of products and brands. Increasing brand awareness and a growing preference for stylish, design-forward appliances are playing a key role in shaping consumer choices. Additionally, government incentives and regulatory measures promoting energy efficiency and environmental sustainability are supporting the adoption of eco-friendly and compliant appliances across the country. For instance, the Inflation Reduction Act of 2022 is a law signed by the Federal government to combat climate change and bolster clean energy adoption.

Moreover, evolving consumer lifestyles and a focus on convenience are driving demand for smart kitchen appliances with advanced features and connectivity. Accoridng to the YouGov data published in October 2023, about 7% Americans planned to remodel the kitchens. Urbanization and smaller living spaces are also influencing product innovation, with compact and multifunctional appliances gaining popularity. The rise in home cooking and entertaining has boosted sales of premium and specialty kitchen equipment. Additionally, manufacturers are investing in local production and supply chain resilience to meet changing consumer expectations and reduce lead times.

Consumer Insights for U.S. Household Kitchen Appliances

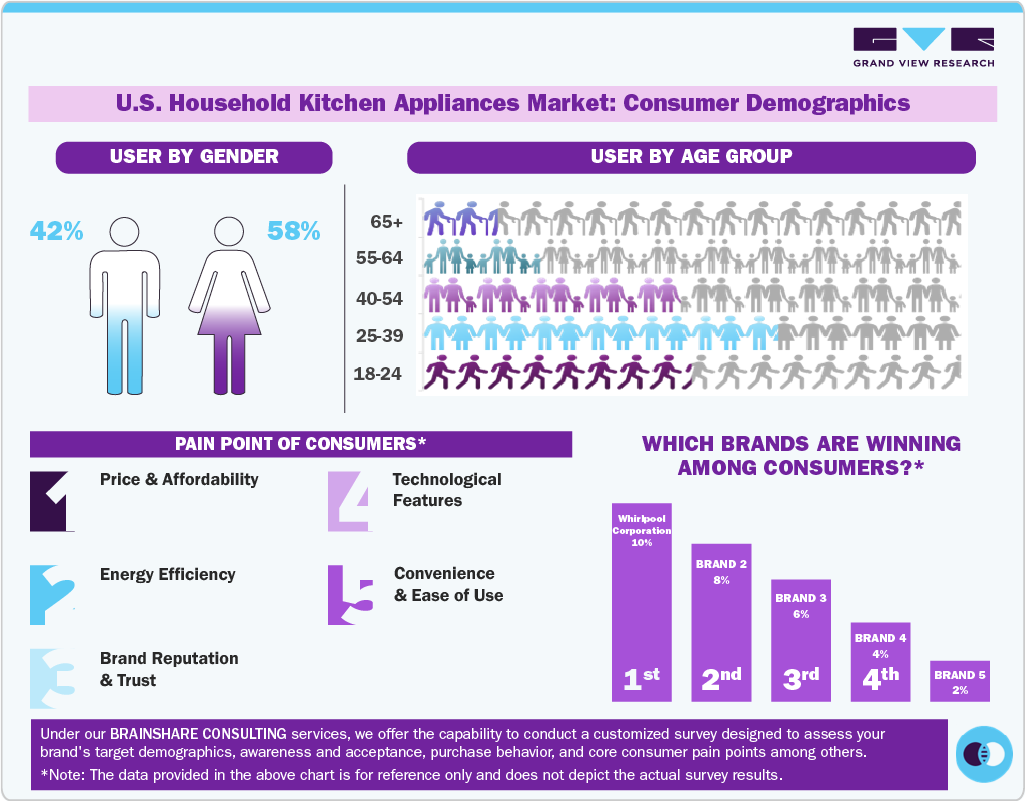

U.S. consumers remain highly price‑sensitive and value‑driven amid persistent inflation and new tariffs. Despite concerns over rising appliance costs, many still plan to move forward with big‑ticket purchases, particularly for home improvements and appliance replacements. Multifunctional, compact appliances are thriving-especially countertop items like air fryers, toaster ovens, blenders, food processors, and rice cookers. The “three‑in‑one economy” resonates strongly-consumers seek products that save space, money, and time. Air fryers, for instance, are among the most considered purchases in 2025 (over 29%), and usage of coffee makers and kettles remains high weekly.

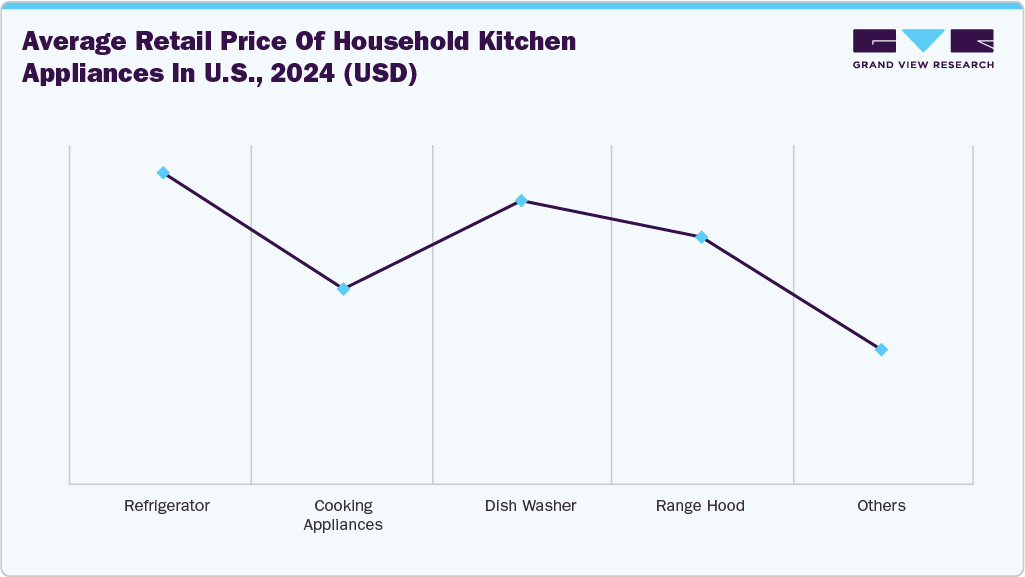

Pricing Analysis:

Pricing analysis of the industry highlights a highly competitive environment shaped by brand reputation, energy efficiency standards, and the adoption of smart technologies. Premium brands maintain higher price points due to their advanced features, quality materials, and innovative designs. The mid-range segment is expanding as value-driven consumers look for a balance between performance and affordability. Entry-level products continue to face price sensitivity, influenced by factors such as inflation and fluctuations in raw material costs. Overall, flexible pricing strategies and frequent promotions play a crucial role in guiding consumer purchasing decisions in this mature and evolving market.

Product Insights

Cooking appliances accounted for the largest share of 41.3% in 2024, driven by increased interest in home cooking, fueled by lifestyle shifts and health-conscious eating habits. Technological advancements, such as smart features and voice control, are enhancing user convenience and appeal. For instance, in April 2025, UNOX launched a combi oven, CHEFTOP-X, an innovative and advanced combi oven, designed to deliver efficiency, precision and ease of use. Demand for energy-efficient and faster cooking solutions is also on the rise. Moreover, aesthetic integration with modern kitchen designs is influencing consumer preferences and purchase decisions.

The dishwashers segment is projected to grow at the fastest CAGR of 3.7% from 2025 to 2033. Dishwashers are gaining popularity due to increased emphasis on convenience and time-saving solutions in busy households. Rising awareness around water and energy conservation is driving demand for EPA-certified, ultra-efficient models. Smart features, such as Wi‑Fi connectivity, voice control, and adaptive wash cycles, are enhancing user experience and appeal. Companies such as LG Electronics, offer technologically advanced Wi-Fi-enabled dishwashers with QuadWash technology for efficient cleaning. Additionally, sleek, built-in designs that seamlessly blend into modern kitchen aesthetics are significantly influencing purchasing decisions.

Technology Insights

The conventional technology segment accounted for the largest market share of 84.6% in 2024, driven by the affordability and proven reliability of conventional kitchen appliances, making them a preferred choice for many households. Ease of use and minimal maintenance requirements appeal to a wide range of consumers, especially those in rural and budget-conscious segments. Replacement demand for older appliances also supports steady sales. Additionally, strong brand loyalty and widespread availability further bolster the market for conventional technology. For instance, in June 2024, Dacor, a SAMSUNG company, launched a new 24-inch Dishwasher, enhancing its luxury kitchen appliance offerings. This innovative dishwasher, showcased during the A&D Building’s Market Days from June 26-27, 2024, combines sophisticated design with powerful cleaning capabilities.

The smart appliances segment is projected to grow at the fastest CAGR of 4.2% from 2025 to 2033. The market is driven by growing consumer interest in connectivity and automation, with smart appliances offering enhanced convenience and control through mobile apps and voice assistants. Energy efficiency and remote monitoring capabilities are increasingly valued for reducing utility costs and environmental impact. Innovative features such as personalized cooking programs and integration with smart home ecosystems are attracting tech-savvy buyers. Continuous advancements and expanding product availability are also accelerating adoption in U.S. households.

Regional Insights

The U.S. household kitchen appliances market is driven by advancements in materials and design that enhance durability and user experience. Growing awareness of health and hygiene is boosting demand for appliances with easy-to-clean and antimicrobial features. Seasonal promotions and financing options are also encouraging consumers to make timely purchases. Furthermore, collaborations between appliance manufacturers and technology companies are fostering innovation and expanding product capabilities.

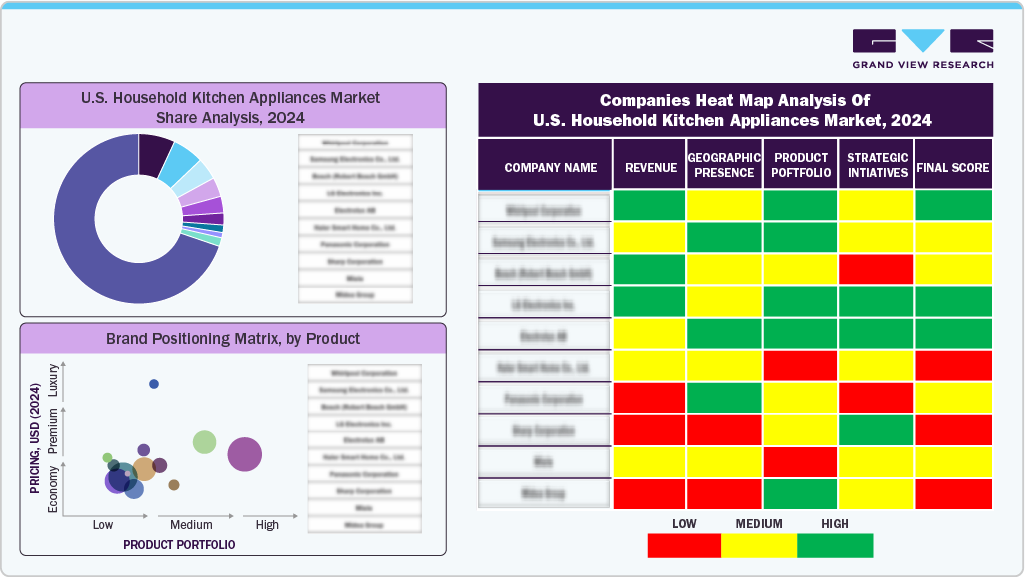

Key U.S. Household Kitchen Appliances Companies Insights

Key players operating in the U.S. household kitchen appliances market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Household Kitchen Appliances Companies:

- Whirlpool Corporation

- General Electric

- Samsung Electronics

- LG Electronics

- Bosch Home Appliances

- Electrolux

- Miele & Cie. KG

- Haier

- Panasonic

- JennAir.

Recent Developments

-

In March 2024, Miele, Inc., the world leader in commercial-grade products, launched the MasterLine series of new dishwashers designed to meet the changing needs of home and commercial customers. MasterLine redefines standards in safety, efficiency, and convenience by offering powerful cleaning capabilities on two decks, fast delivery times, and a wide range of optional accessories.

-

In August 2023, Whirlpool Corporation introduced a brand-new 153,000-square-foot technology center in St. Joseph, Michigan. This USD 60+ million endeavor marks the expansion and replacement of a significant portion of the existing St. Joseph Technology Center. It signifies the initial phase of a three-part strategy to revamp an iconic research and development facility renowned for hosting decades of appliance innovations.

U.S. Household Kitchen Appliances Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 64.43 billion

Revenue Forecast in 2033

USD 78.76 billion

Growth rate (revenue)

CAGR of 2.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in thousand units; revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology

Country scope

U.S.

Key companies profiled

Whirlpool Corporation; General Electric; Samsung Electronics; LG Electronics; Bosch Home Appliances; Electrolux; Miele & Cie. KG; Haier; Panasonic; JennAir

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Household Kitchen Appliances Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. household kitchen appliances market report on the basis of product and technology:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Refrigerator

-

Cooking Appliances

-

Cooktops & cooking range

-

Ovens

-

Others

-

-

Dishwasher

-

Range Hood

-

Others

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Smart Appliances

-

Frequently Asked Questions About This Report

b. The U.S. household kitchen appliances market size was estimated at USD 63.21 million in 2024 and is expected to reach USD 64.43 million in 2025.

b. The U.S. household kitchen appliances market is expected to grow at a compound annual growth rate (CAGR) of 2.5 % from 2025 to 2033 to reach USD 78.76 million by 2033.

b. Cooking appliances accounted for a revenue share of 41.4% in 2024, driven by busy lifestyles, rising interest in home cooking, and demand for smart, energy-efficient solutions.

b. Some key players operating in the U.S. household kitchen appliances market include Whirlpool Corporation, General Electric, Samsung Electronics, LG Electronics, Bosch Home Appliances, Electrolux, and Miele & Cie. KG.

b. Key factors driving growth in the U.S. household kitchen appliances market include increasing demand for smart, connected appliances, a strong focus on energy efficiency, and rising interest in home cooking and healthy lifestyles. Technological advancements, growing renovation activities, and wide product availability through both offline and e-commerce channels further contribute to market expansion across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.