- Home

- »

- Advanced Interior Materials

- »

-

U.S. Hydraulic Power Unit Market Size, Industry Report 2033GVR Report cover

![U.S. Hydraulic Power Unit Market Size, Share & Trends Report]()

U.S. Hydraulic Power Unit Market (2025 - 2033) Size, Share & Trends Analysis Report By Operating Pressure (<750 psi, 750-2000 psi, 2000-3000 psi, >3000 psi), By Power Source (Diesel, Gasoline, Electric), By Application (Mobile, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-700-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hydraulic Power Unit Market Summary

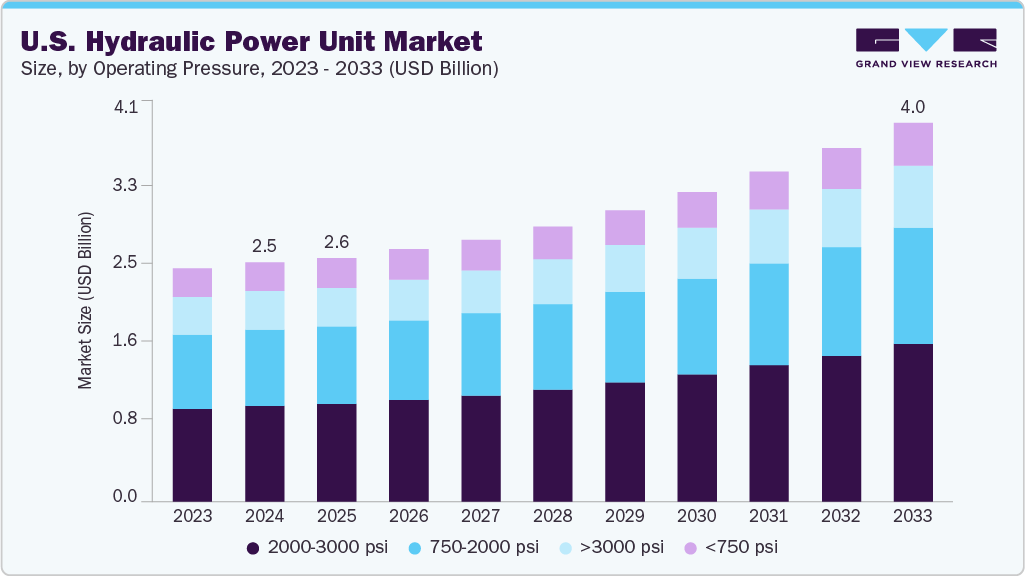

The U.S. hydraulic power unit market size was estimated at USD 2,549.5 million in 2024 and is expected to reach at USD 4,042.3 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is driven by rising demand across construction, manufacturing, aerospace, and energy sectors.

Key Market Trends & Insights

- By operating pressure, 2000-3000 psi dominated the market in 2024, accounting for the largest revenue share of 40.0%.

- By power source, the electric segment dominated the market in 2024, accounting for the largest revenue share of 60.1% driven by demand for energy‑efficient, low‑noise, and eco‑friendly systems suited to indoor and automated environments.

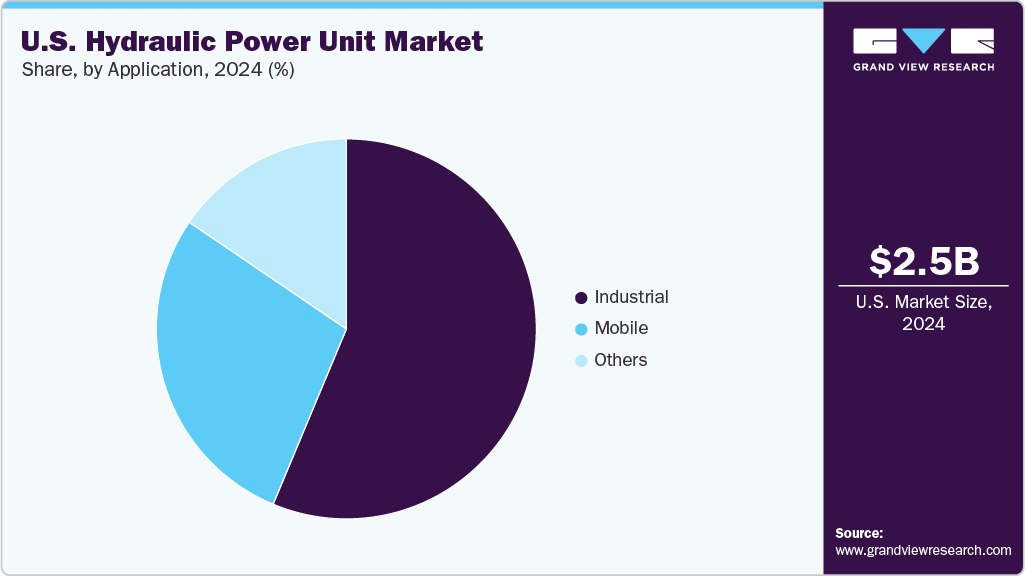

- By application, the industrial segment dominated the hydraulic power unit market in 2024, holding the largest revenue share at 56.3% driven by growing automation in manufacturing, metal processing, and material handling sectors.

Market Size & Forecast

- 2024 Market Size: USD 2,549.5 Million

- 2033 Projected Market Size: USD 4,042.3 Million

- CAGR (2025-2033): 5.7%

Growth in automation, industrial modernization, and infrastructure development alongside the push for compact, energy-efficient systems is fueling the adoption of advanced hydraulic solutions nationwide. In the U.S., the growing shift toward electrification and renewable energy projects is boosting demand for reliable and efficient hydraulic systems. OEMs are increasingly offering modular and customizable hydraulic power units to cater to diverse industrial needs, improve productivity, minimize downtime, and support long-term operational cost savings for end users.

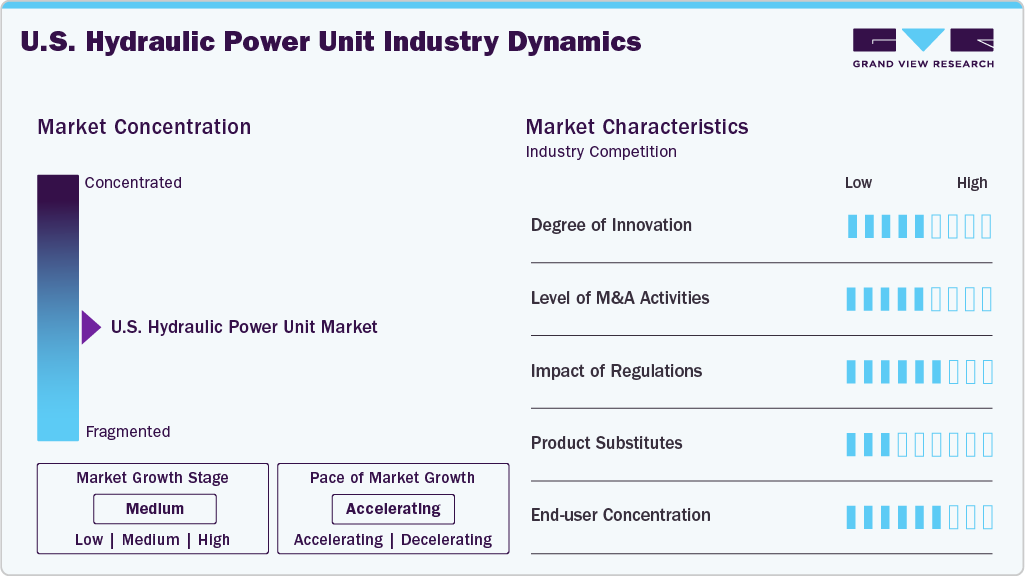

Market Concentration & Characteristics

The hydraulic power unit market in the U.S. is moderately fragmented. While a few large companies, such as Bosch Rexroth, Parker Hannifin, and Eaton, hold significant market share, numerous regional players and specialized manufacturers also contribute. These smaller companies focus on niche markets or customized solutions. The presence of both large, established players and smaller, specialized firms leads to moderate competition, with innovation and customer service acting as key differentiators.

U.S. hydraulic power unit market demonstrates a strong focus on innovation, which is largely driven by advancements in energy efficiency, automation, and smart technologies. Companies are integrating IoT and AI to enable real-time monitoring, predictive maintenance, and enhanced performance. The focus on compact, durable, and energy-saving hydraulic systems is pushing innovation, addressing modern industrial demands.

Mergers and acquisitions in the U.S. hydraulic power unit market are growing as companies seek to expand their product portfolios and technological capabilities. Larger firms are acquiring specialized players to strengthen their presence in niche markets, streamline operations, and enhance R&D efforts for advanced hydraulic solutions, creating a more consolidated and competitive market.

Stringent environmental standards on energy consumption, emissions, and safety are pushing manufacturers to adopt eco-friendly, energy-efficient technologies. Compliance with industry standards, such as ISO certifications, also encourages the development of safer, more reliable hydraulic systems for various applications.

Drivers, Opportunities & Restraints

The growing demand for automation in industries such as construction, manufacturing, and aerospace is driving the U.S. hydraulic power unit market. The need for efficient, high-performance systems to support advanced machinery and automation technologies boosts the market, with hydraulic power units playing a vital role in powering heavy-duty equipment.

An opportunity in the market lies in the integration of IoT and smart technologies within hydraulic power units. These systems allow for real-time monitoring, predictive maintenance, and enhanced operational efficiency, allowing manufacturers to provide value-added solutions for industries seeking increased productivity and reduced downtime.

A major challenge in the market is the need for high capital investment and maintenance costs linked to advanced hydraulic systems. Smaller companies may struggle to adopt new technologies, while ensuring consistent performance and meeting environmental regulations can increase operational costs, slowing down adoption in price-sensitive sectors.

Operating Pressure Insights

2000-3000 psi dominated the market in 2024, accounting for the largest revenue share of 40.0% due to its widespread use across industrial machinery, mobile equipment, and construction applications. Its optimal balance of power, efficiency, and moderate complexity makes it ideal for mid-range operational needs, fueling its dominance in the domestic market.

The >3000 psi segment is expected to witness a significant growth during the forecast period, particularly in heavy-duty applications such as mining, defense, and aerospace. Technological improvements and enhanced material durability support the adoption of ultra‑high‑pressure systems that provide superior power and precision in demanding conditions.

Power Source Insights

Electric segment dominated the market in 2024, accounting for the largest revenue share of 60.1% driven by demand for energy‑efficient, low‑noise, and eco‑friendly systems suited to indoor and automated environments. Industrial electrification, robotics, and stricter emission norms are accelerating adoption in manufacturing, logistics, and smart factory settings.

The diesel segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue due to off‑road and remote applications where electric power is limited. Its high mobility, reliability, and suitability for construction, mining, and agricultural machinery continue to support sustained demand despite environmental concerns.

Application Insights

The industrial segment dominated the hydraulic power unit market in 2024, holding the largest revenue share at 56.3% driven by growing automation in manufacturing, metal processing, and material handling sectors. Hydraulic power units are essential for powering machinery such as presses, lifts, and CNC systems, thanks to their precision, reliability, and energy efficiency.

The mobile segment is expected to grow at the fastest in the hydraulic power unit market driven by booming infrastructure, construction, agriculture, and mining activities, mobile HPUs are favored for their portability, compact form, and high power density in equipment such as loaders and excavators.

U.S. Hydraulic Power Unit Market Company Insights

Some of the key players operating in the market include Bosch Rexroth AG, Danfoss, Parker Hannifin Corporation and HAWE Hydraulik SE.

-

Bosch Rexroth AG, headquartered in Germany, manufactures hydraulic power units used across industrial, mobile, and automation sectors. The company focuses on modular system designs and energy efficiency, developing components that support both standard and custom applications. Its units are used in sectors such as manufacturing, construction, and marine. Bosch Rexroth emphasizes digitalization, integrating smart monitoring and predictive maintenance technologies into its systems.

-

Parker Hannifin Corporation is a U.S.-based manufacturer specializing in motion and control technologies, including hydraulic power units. Its systems are widely used in construction, manufacturing, and heavy machinery. Parker designs both standard and custom power units, often integrating advanced controls and energy-saving features. The company supports a broad customer base through localized production and service facilities. Its focus includes improving reliability, minimizing downtime, and meeting various regulatory and application-specific needs across different industries.

Key U.S. Hydraulic Power Unit Companies:

- Bosch Rexroth AG

- Parker Hannifin Corporation

- Danfoss

- HAWE Hydraulik SE

- Energy Manufacturing Co. Inc.

- Hydac International GmbH

- Bailey International LLC

- Oilgear Company

- Hydrotech Inc.

- Delta Power Company

Recent Developments

-

In June 2023, KTI Hydraulics Inc., based in Santa Ana, California, launched a submerged DC hydraulic power unit designed to enhance the reliability of recycling equipment. This innovative HPU offers improved performance, reduced maintenance needs, and increased durability, making it suitable for demanding commercial and industrial recycling applications.

-

In August 2021, Danfoss completed the acquisition of Eaton’s hydraulics business, significantly expanding its product portfolio and market reach. This strategic move strengthens Danfoss’s position in mobile and industrial hydraulics, enhancing its capabilities to deliver more comprehensive solutions across global applications.

U.S. Hydraulic Power Unit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,594.6 million

Revenue forecast in 2033

USD 4,042.3 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product type, service, application

Country Scope

U.S.

Key companies profiled

Bosch Rexroth AG; Parker Hannifin Corporation; Danfoss; HAWE Hydraulik SE; Energy Manufacturing Co. Inc.; Hydac International GmbH; Bailey International LLC; Oilgear Company; Hydrotech Inc.; Delta Power Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hydraulic Power Unit Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the U.S. hydraulic power unit market report based on operating pressure, power source, application:

-

Operating Pressure Outlook (Revenue, USD Million, 2021 - 2033)

-

<750 psi

-

750-2000 psi

-

2000-3000 psi

-

>3000 psi

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Diesel

-

Gasoline

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hydraulic power unit market size was estimated at USD 2,549.5 million in 2024 and is expected to reach USD 2,594.6 million in 2025.

b. The U.S. hydraulic power unit market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 4,042.3 million by 2033.

b. 2000-3000 psi dominated the market in 2024, accounting for the highest revenue share at 40.0% due to its widespread use across industrial machinery, mobile equipment, and construction applications. Its optimal balance of power, efficiency, and moderate complexity makes it ideal for mid-range operational needs, fueling its dominance in the domestic market.

b. Some of the key players operating in the U.S. hydraulic power unit market include Bosch Rexroth AG, Parker Hannifin Corporation, Danfoss, HAWE Hydraulik SE, Energy Manufacturing Co. Inc., Hydac International GmbH, Bailey International LLC, Oilgear Company, Hydrotech Inc., Delta Power Company

b. U.S. hydraulic power unit market is driven by rising demand in construction, manufacturing, and aerospace industries, increased automation, expanding infrastructure projects, and the need for compact, energy-efficient systems offering high performance, reliability, and compliance with environmental regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.