- Home

- »

- Consumer F&B

- »

-

U.S. Ice Cream Trucks Market Size And Share Report, 2030GVR Report cover

![U.S. Ice Cream Trucks Market Size, Share & Trends Report]()

U.S. Ice Cream Trucks Market Size, Share & Trends Analysis Report By Product Type (Dairy & Water-based, Non-dairy/Vegan), By Product, By Type (Conventional, Artisanal), By Flavor, By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-055-0

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

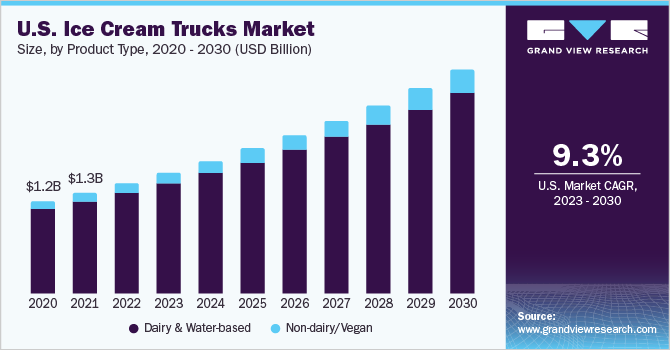

The U.S. ice cream trucks market size was valued at USD 1,480.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The rising number of concerts, festivals, and other large-scale events in the U.S. is accelerating market growth. The increasing popularity of ice cream trucks at public and private events has heightened the demand for ice cream trucks. Moreover, the consumer demand for ice creams is constantly evolving, and manufacturers are expanding their offerings with products that include exotic, organic, herbal, and functional ingredients. The preference for reduced or no-fat dairy-based desserts and ice creams is also rising. These factors are propelling the market growth.

The COVID-19 pandemic increased consumer concerns regarding food safety and the adoption of protocols to prevent the spread of coronavirus. The pandemic led to changes in the consumption patterns of consumers and encouraged them to eat more nutritious food, which further decreased the demand and purchase of ice creams from various types, including ice cream trucks. Furthermore, government initiatives such as social distancing further restrained consumers from social activities and eating outside, which further hindered the growth of the market during the pandemic. Thus, these factors negatively impacted the market.

Ice cream trucks have been popular in the U.S. for a while now, and these are seen parked near beaches, parks, and other public areas with high footfall. In recent years, however, ice cream trucks have become common at various public events, such as music and food festivals and sporting games. The rising number of concerts, festivals, games, and other large-scale events in the U.S. is a key factor contributing to the growth of the ice cream truck market.

Artisanal ice creams are free from stabilizers, emulsifiers, artificial flavors, and preservatives and are made in smaller batches as they have a shorter shelf life than conventional ice creams. This makes them a perfect fit for ice cream trucks as they can be quick without them going bad. There is also a rising demand for artisanal ice creams among health-conscious consumers as they are made with natural ingredients. This is a major opportunity for ice cream truck businesses in the U.S.

The rising popularity of rolled ice creams in the country is another trend players can capitalize on. Rolled ice creams are highly customizable and allow customers to personalize their ice cream with a choice of flavors and ingredients. This trend has been made increasingly popular because of Instagram and other social media apps. Some players offering rolled ice cream in the country are Rolled 4 Ever, Kobschie's Ice Rolls, Udderly Fresh, and Rollin Frozen.

Ice cream trucks are mobile and often move from one location to another. This results in wear and tear. Regular changes in weather and constant movement of the vehicle mandate frequent maintenance, unlike traditional ice cream shops. This limits the market growth. Moreover, the continuously rising prices of trucks, mechanical parts, and fuel are restraining the growth of the ice cream truck market in the U.S.

Product Type Insights

Dairy & water-based dominated the product type category with a share of more than 90% in 2022. Ice creams are dairy-based frozen delicacies that are typically eaten as sweets or snacks. According to federal laws or standards of identity, ice cream must contain 20% milk solids by weight and a minimum of 10% milk fat. Furthermore, consumers are on the lookout for functional food consumption that helps to reduce inflammation, and dietary fiber consumption lowers the risk of gastrointestinal disorders. This is expected to propel the market growth over the forecast period.

Non-dairy/vegan segment is forecasted to grow at the fastest CAGR of 12.8% in the forecast period. Ice cream manufacturers use a range of plant-based alternatives to milk, such as oat, almond, soy, and pea milk, depending on their functional requirements. Plant-based innovations are rapidly gaining popularity in the ice cream industry. The demand for non-dairy/vegan ice cream is on the rise owing to the growing prevalence of lactose intolerance and dairy-related allergies across the globe, particularly across the U.S.

Product Insights

In terms of product, cups & tubs dominated the market with a share of around 65% in 2022. The size of the cup or tub influences a customer’s purchase decision. A smaller product, such as ice cream in a cup, is easier to eat without spilling or making a mess than a cone or a bar, which is more likely to melt. This factor is resulting in the higher usage of cups or tubs as container formats for ice cream.

Bars, sticks & pops segment is posed to register the fastest CAGR of 10.3% during the forecast period. Ice cream sticks and cones can be enjoyed throughout the day and are becoming more popular among consumers than tubs and bricks, which are often considered an end-of-the-day treat. The demographic trend is the primary cause of this sudden rise in smaller packs. One-person and two-person homes are becoming more and more prevalent, and this trend will continue. According to the U.S. Census Bureau, there were 37.9 million one-person households in the U.S., or 29% of all households, in November 2022.

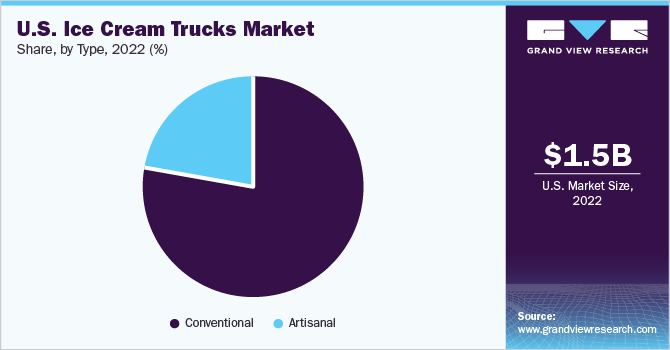

Type Insights

The conventional segment accounted for majority of the sales in 2022, with a share of more than 77%. Ice cream is a perennial favorite and a popular mood booster for both kids and adults. The conventional scoop has remained popular across the globe and has changed in terms of flavor & taste over time. Several ice cream trucks are adding more extravagant ice creams to their menus in the form of shakes to draw in more customers. This is propelling the market growth.

The artisanal segment is forecasted to grow at a CAGR of 10.3% during the forecast period. The increasing demand for fat-free, dairy-free, and GMO (genetically modified organisms)-free ice cream is boosting the market growth over the forecast period. Moreover, popsicles are a popular artisan ice cream trend in the country and are sold at ice cream shops, food stands, and street food trucks throughout the country.

Flavor Insights

The vanilla segment accounted for the majority of the sales in 2022, with a share of more than 25%. Vanilla is widely used in desserts, cookies, ice creams, savory meals, and beverages. In 2022, YouGov surveyed 1,000 U.S. adults to study their preferred flavors of ice cream and found that a majority of American consumers, that is 59%, liked vanilla ice cream. Ice cream trucks in the U.S. provide vanilla-flavored bars, sticks, sandwiches, cups, and popsicles with different toppings. For instance, Neighborhood Ice Cream Truck sells dairy- & gluten-free Vanilla Bean Bar at USD 5.00 through its mobile vending cart and even through online portals.

The chocolate segment is forecasted to grow at a CAGR of 10.7% during the forecast period. The increasing demand for chocolate-flavored ice cream among children and millennials across the U.S. is propelling market growth. For instance, a candy maker named Harry Burt invented the chocolate-dipped vanilla ice cream bar in Youngstown, Ohio, who first called it the Good Humor Sucker before changing its name to the Good Humor Bar. Chocolate ice cream grabbed the attention of consumers and, since then, made one of the most popular and preferred flavors.

State Insights

California State dominated the U.S. ice cream trucks market with a share of 8.40% in 2022. An increased consumption of ice creams has been witnessed in California over the past few years. Therefore, several ice cream manufacturers also offer ice creams through their company-oriented ice cream trucks. For instance, Mister Softee of Southern California is a manufacturer of ice creams and shakes and other frozen treats, and also owns five ice cream trucks.

Florida is posed to register the fastest CAGR of about 11.4%. Ice cream distributors adopting the mobile vending strategy to sell frozen novelties to consumers for immediate consumption. For instance, Ice Cream Distributors of Florida LLC is one of the largest vending distributors in Florida. Its product line reaches more than 800 ice cream trucks and ice cream pushcarts in Florida per day.

Key Companies & Market Share Insights

The U.S. ice cream trucks market is highly competitive, with a range of companies offering various products with different flavors across the U.S. Many big players are increasing their focus toward new product launches, partnerships, and expansion into new markets to compete effectively.

-

For instance, In December 2022, Momma P’s Ice Cream Truck partnered with WCTV, a Tallahassee news channel, for a fundraising campaign. WCTV scheduled a kids’ hour from 4-5 pm where kids who brought donations got complimentary ice cream from Momma P’s Ice Cream Truck.

-

For instance, In May 2022, Cold Stone Creamery Truck celebrated the anniversary of OREO by launching All Things OREO. Various flavors were made available in stores such as OREO Crème Ice Cream, OREO Crème Ice Cream, OREO Cookies, Golden OREO® Cookies and Caramel. The new items were available across all stores and trucks of the company.

Some of the prominent players in the U.S. ice cream trucks market include:

-

Cold Stone Creamery Truck

-

Parfait Organic Artisan Ice Cream

-

Big Spoon Creamery

-

Karmic Ice Cream

-

The Vintage Ice Cream Guys

-

Sticks and Cones Ice Cream

-

HipPOPs

-

Momma P’s Ice Cream Truck

-

Twirl and Dip Ice Cream

-

Cosmos Ice Cream

U.S. Ice Cream Trucks Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3,004.6 million

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, product, type, flavor, state

Country scope

U.S.

Key companies profiled

Cold Stone Creamery Truck; Parfait Organic Artisan Ice Cream; Big Spoon Creamery; Karmic Ice Cream; The Vintage Ice Cream Guys; Sticks and Cones Ice Cream; HipPOPs; Momma P’s Ice Cream Truck; Twirl and Dip Ice Cream; Cosmos Ice Cream

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ice Cream Trucks Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. ice cream trucks market report based on product type, product, type, flavor, and state.

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dairy & Water-based

-

Non-dairy/Vegan

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bars, Sticks & Pops

-

Cups & Tubs

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional

-

Artisanal

-

-

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

-

Vanilla

-

Chocolate

-

Cookies & Cream

-

Mint Chocolate Chip

-

Chocolate Chip Cookie Dough

-

Dulce de Leche

-

Strawberry

-

Passion Fruit

-

Lemon Pie

-

Pistacchio

-

Others

-

-

State Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Florida

-

California

-

Oregon

-

New York

-

Texas

-

Tennessee

-

Indiana

-

Colorado

-

Pennsylvania

-

North Carolina

-

-

Frequently Asked Questions About This Report

b. The U.S. ice cream trucks market was estimated at USD 1,480.0 million in 2022 and is expected to reach USD 1,621.6 million in 2023.

b. The U.S. ice cream trucks market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 3,004.6 million by 2030.

b. California dominated the U.S. ice cream trucks market with a share of over 8% in 2022. This is owing to the growing consumer living standards and increased consumption of ice creams that have been witnessed in the state over the past few years.

b. Some key players operating in the U.S. ice cream trucks market include Cold Stone Creamery Truck, Parfait Organic Artisan Ice Cream, Big Spoon Creamery, Karmic Ice Cream, The Vintage Ice Cream Guys, Sticks and Cones Ice Cream, HipPOPs, Momma P’s Ice Cream Truck, Twirl and Dip Ice Cream, and Cosmos Ice Cream.

b. Key factors that are driving the U.S. ice cream trucks market growth include high production and consumption of dairy & water-based ice cream, the increasing popularity of ice cream trucks at public and private events have heightened the demand for ice cream trucks, and the high preference for and consumption of vanilla ice cream in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."