- Home

- »

- Medical Devices

- »

-

U.S. Independent Diagnostic Testing Facility Market Report 2033GVR Report cover

![U.S. Independent Diagnostic Testing Facility Market Size, Share & Trends Report]()

U.S. Independent Diagnostic Testing Facility Market (2026 - 2033) Size, Share & Trends Analysis Report By Service ((Radiology/Imaging Services, X-Ray, Computed Tomography (CT), Mammography, Ultrasound, Cardiac Monitoring Services, Sleep Studies), And Segment Forecasts

- Report ID: GVR-4-68040-023-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Independent Diagnostic Testing Facility Market Summary

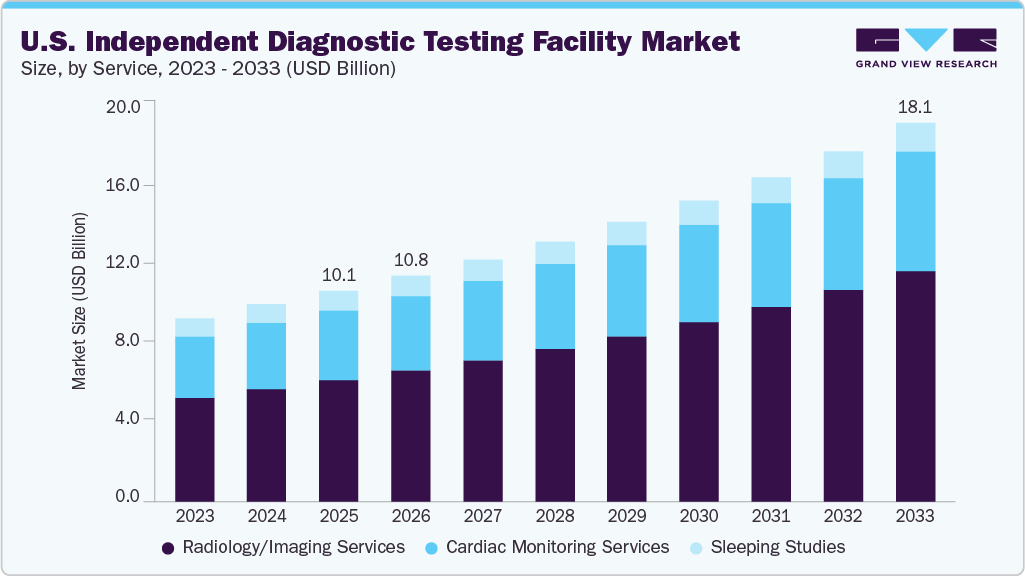

The U.S. independent diagnostic testing facility market size was estimated at USD 10.08 billion in 2025 and is projected to reach USD 18.09 billion by 2033, growing at a CAGR of 7.66% from 2026 to 2033. The growth is driven by the growing burden of chronic and lifestyle-related diseases, rising preference for cost-efficient, accessible, and faster diagnostics, and increasing technological advancements, including digital imaging, AI-enabled diagnostics, portable diagnostics, and improved telehealth integration.

Key Market Trends & Insights

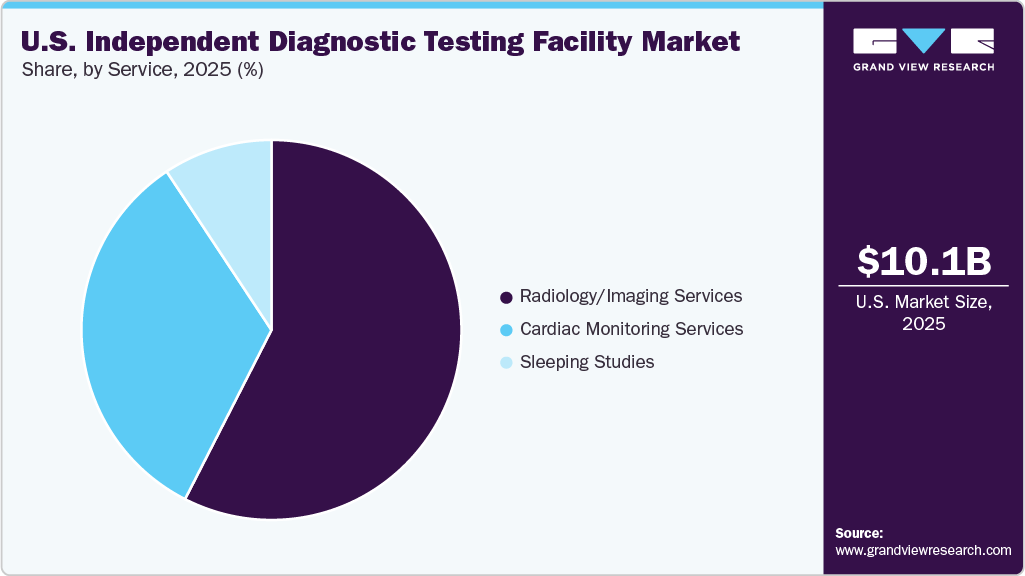

- By service, the radiology/imaging services segment held the largest revenue share of 57.52% in 2025

- By service, the cardiac monitoring services segment is expected to grow at a significant CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 10.08 Billion

- 2033 Projected Market Size: USD 18.09 Billion

- CAGR (2026-2033): 7.66%

In addition, value-based healthcare initiatives and supportive reimbursement structures for certain diagnostic procedures are encouraging providers to shift services to independent diagnostic testing facilities.

Increasing Consumer Awareness and Demand for Preventive Diagnostic Testing

Growing consumer awareness of preventive healthcare is a major driver of the market, as individuals increasingly recognize the importance of early diagnosis in managing health risks, detecting diseases in their initial stages, and avoiding costly complications. Education campaigns by healthcare providers, insurers, and public health bodies, along with widespread access to health information, are encouraging people to proactively seek screening and routine testing for conditions such as cardiovascular disease, diabetes, cancer, respiratory disorders, and sleep-related issues.

The Henry Schein Cares Foundation launched a new multi-year public health awareness initiative, called "Prevention is Power," in February 2024. This initiative is designed to enhance health literacy and encourage individuals to adopt a preventive, integrated approach to healthcare, rather than seeking care only when they are sick. The campaign emphasizes the importance of routine primary care, dental care, and health screenings as a means to reduce the incidence of chronic, non-communicable diseases and lower overall healthcare costs.

Stanley M. Bergman, Chairman of the Board and Chief Executive Officer of Henry Schein, Inc., said:

“By shifting the mindset away from one in which people only go to the doctor when feeling sick, to one in which people regularly access a continuum of preventive health care, we can help reduce health disparities, promote equity, and create healthier communities.”

Preventive diagnostic testing is also strongly supported by value-based healthcare models and employer wellness initiatives, which emphasize early intervention to reduce long-term treatment costs. As a result, independent diagnostic testing facilities benefit from rising patient self-referrals, increased physician referrals for screening tests, and higher test volumes, strengthening their role as accessible, cost-efficient, and convenient centers for preventive diagnostics across the U.S.

New Effective Applications for Diagnostic Imaging Technology

Modern innovations, including high-resolution MRI and CT, PET-CT fusion imaging, advanced ultrasound modalities, 3D and functional imaging, AI-assisted interpretation, and precision diagnostics, enable earlier and more accurate disease detection, leading to better clinical decision-making across various areas, such as oncology, cardiology, neurology, orthopedics, and chronic disease management. These enhanced capabilities improve diagnostic confidence and support personalized and preventive care initiatives, increasing physician reliance on advanced imaging outside hospital settings.

In December 2024, Philips unveiled its CT 5300 system for the North American market, showcasing the company’s integration of in-house AI with advanced hardware and software to enhance computed tomography imaging and workflows. The CT 5300 features Philips’ CT Smart Workflow, a suite of AI‑enabled tools such as Precise Position, Precise Cardiac, Precise Brain, and Precise Image that automate and optimize steps from patient positioning to image reconstruction, reducing routine tasks for technicians and improving consistency, speed, and image quality while lowering radiation dose.

Dan Xu, CT Business Leader at Philips, said:

“The productivity and diagnostic confidence enhancements that AI can deliver to CT imaging empower care teams and ease departmental workflow, helping to mitigate today’s chronic shortage of highly skilled radiologists and technicians.”

As healthcare systems emphasize efficiency, faster turnaround times, and outpatient care, independent diagnostic testing facilities become preferred hubs for deploying these technologies due to their cost-effectiveness, specialized focus, and flexible operational models.

Shift to Outpatient and Value-Based Care

As hospitals and payors increasingly prioritize cost efficiency, early diagnosis, and improved patient outcomes, more diagnostic services are being directed away from expensive inpatient or hospital outpatient settings to lower-cost, high-efficiency outpatient providers. Independent diagnostic testing facilities align well with this transition by offering faster access, shorter appointment wait times, and more affordable testing, while maintaining clinical accuracy and regulatory compliance. Their ability to support preventive care, chronic disease monitoring, and timely diagnostic decision-making helps providers meet value-based care objectives, such as reducing hospital admissions, improving care coordination, and enhancing patient satisfaction. As healthcare policy and reimbursement frameworks continue to support site-neutral payments and the expansion of outpatient care, demand for services from independent diagnostic testing facilities is expected to strengthen further.

According to CMS data published in October 2024, the participation of healthcare providers in value-based care models increased by 25% between 2023 and 2024, reflecting the growing adoption of value-based care models across various care settings. In specialties such as nephrology, CMS-supported value-based programs have demonstrated tangible clinical benefits, including reductions in hospital admissions and readmissions, as well as lower incidences of dialysis crashes, reinforcing confidence in outcome-driven reimbursement models.

Expansion of Telehealth & Remote Diagnostic Services

With the widespread adoption of telemedicine by hospitals, physician groups, and payers, clinicians are increasingly relying on independent diagnostic testing facilities to provide timely diagnostic tests, such as cardiac monitoring, sleep studies, vascular imaging, and mobile imaging that support virtual consultations and remote patient management. Independent diagnostic testing facilities enable cost-effective testing outside of hospital settings, reduce patient travel and wait times, and improve access to diagnostics for rural and underserved populations.

Additionally, the increasing use of remote patient monitoring devices and digital health platforms has strengthened partnerships between telehealth providers and independent diagnostic testing facilities, enabling seamless data transmission and facilitating faster, more informed clinical decision-making. For instance, in March 2025, Eli Lilly expanded its LillyDirect digital healthcare platform to improve access to diagnosis and care for people in the U.S. living with Alzheimer’s disease, aiming to overcome longstanding barriers to timely evaluation and treatment.

David Hyman, MD, Lilly's chief medical officer, said:

"We know that early diagnosis and care can make a big difference for people living with Alzheimer's disease. By expanding this platform, we hope to help patients identify and access additional independent specialty care capacity, which can coordinate with a patient's existing care team," "The addition of Alzheimer's disease to LillyDirect reaffirms our commitment to empower patients to locate the care that is right for them when they need it."

Regulatory & Reimbursement Support

Transparent regulatory frameworks established by the Centers for Medicare & Medicaid Services (CMS) define certification, quality standards, and operational requirements for independent diagnostic testing facilities, thereby enhancing the credibility of providers and encouraging physician referrals. At the same time, consistent reimbursement coverage under Medicare, Medicaid, and commercial insurance plans for imaging and diagnostic procedures such as MRI, CT, ultrasound, and nuclear imaging ensures predictable revenue streams for independent diagnostic testing facility operators. Favorable payment policies, including coverage for outpatient and non-hospital-based diagnostic testing, make independent diagnostic testing facilities a cost-effective alternative to hospital imaging departments.

In November 2023, the CMS issued the Calendar Year (CY) 2024 Medicare Physician Fee Schedule (PFS) final rule, which finalizes a range of policy changes for Medicare payments under the Physician Fee Schedule and other Medicare Part B provisions, effective from January 2024. This rule is part of a broader, Administration-wide effort to promote more equitable, accessible, high-quality, innovative, and affordable healthcare for Medicare beneficiaries by refining how physicians and other practitioners are paid for their services. Key components of the rule include updates to the overall payment conversion factor with a modest reduction from the previous year’s rate, as well as targeted increases in payment for primary care and direct patient care services.

This combination of regulatory clarity and reimbursement assurance lowers entry barriers, supports expansion of standalone diagnostic centers, and drives greater utilization of independent diagnostic testing facility services across the U.S. healthcare system.

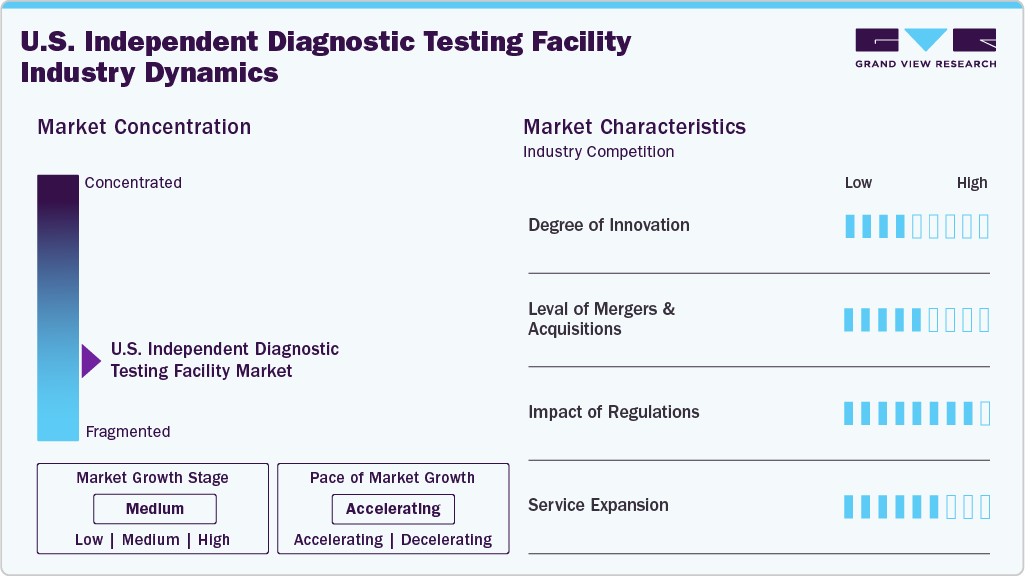

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The degree of innovation is medium, the level of merger & acquisitionactivities is medium, the impact of regulations on the market is high, and the service expansion of the U.S. independent diagnostic testing facility market is medium.

The degree of innovation in the U.S. independent diagnostic testing facility industry is moderate. The independent diagnostic testing facilities offer a broad range of imaging and testing services, including MRI, CT scans, cardiac monitoring, and sleep studies, with faster turnaround times and lower costs than many hospital-based options. This makes them valuable partners for physicians and patients. Innovations also include the adoption of digital pathology and point-of-care technologies that extend diagnostic reach beyond traditional labs. At the same time, interoperability with electronic records and data analytics platforms enhances continuity of care and patient outcomes.

The U.S. independent diagnostic testing facility market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, in May 2025, Labcorp entered into an agreement to acquire select assets of Incyte Diagnostics’ clinical and anatomic pathology testing businesses. This strategic move expands its laboratory services footprint in the Pacific Northwest.

“Labcorp’s strong technical expertise combined with Incyte’s deep professional expertise will help advance laboratory precision medicine in the Pacific Northwest,” said Rajat Mehta, Senior Vice President of Labcorp’s West Division. “We look forward to building on the deep-rooted tradition of high-quality laboratory and healthcare services that Incyte Diagnostics patients and physicians have come to expect and deserve.”

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. The Centers for Medicare & Medicaid Services (CMS) sets specific performance standards that all independent diagnostic testing facilities must meet to participate in the Medicare program. Facilities must comply with 17 CMS independent diagnostic testing facilities performance standards covering areas such as staff credentialing, documentation, medical supervision, proper equipment maintenance, and quality control. Independent diagnostic testing facilities must enroll through the Medicare Provider Enrolment, Chain, and Ownership System (PECOS), undergo site inspections, and meet accreditation requirements where applicable, especially for advanced imaging services such as MRI, CT, and PET, typically accredited by bodies such as ACR, IAC, or The Joint Commission.

In April 2024, Medicalgorithmics accelerated its expansion in the U.S. independent diagnostic testing facility industry by adding five new clients, including First-Call Medical, its fifth partner in the country. The Massachusetts-based partner will use Medicalgorithmics’ AI-powered diagnostic platform to analyze EKG signals for arrhythmia and other heart disorders, leveraging data collected by third-party devices.

Service Insights

The radiology/imaging services segment held the largest revenue share of 57.52% in 2025 and is expected to grow at the fastest CAGR over the forecast period. Its dominance is attributed to the healthcare systems and payers shifting imaging volumes away from high-cost hospital settings toward lower-cost outpatient and independent facilities to control expenses, making independent diagnostic testing facilities an attractive alternative due to their cost efficiency, shorter wait times, and operational flexibility. Moreover, technological advancements such as AI-assisted image interpretation, digital workflows, and high-throughput imaging equipment are further enhancing the diagnostic accuracy and productivity of independent diagnostic testing facilities, supporting higher patient volumes.

The cardiac monitoring services segment is expected to grow at a significant CAGR over the forecast period. Its growth is attributed to the advances in wearable and remote cardiac monitoring technologies offered by independent diagnostic testing facilities, enabling earlier diagnosis, improved patient compliance, and cost-effective monitoring outside hospital settings. In addition, favorable reimbursement policies for ambulatory cardiac monitoring, growing physician preference for outsourcing diagnostic services, and the need to reduce hospital burden are accelerating referrals to independent diagnostic testing facilities.

Key U.S. Independent Diagnostic Testing Facility Company Insights

The U.S. independent diagnostic testing facility market is highly fragmented, comprising a mix of national leaders, regional imaging centers, specialty diagnostic providers, and health system-affiliated players. RadNet, Inc. is one of the leading independent diagnostic testing facilities due to its extensive nationwide imaging network. Meanwhile, regional operators such as Texas MRI, Houston MRI & Diagnostic Imaging, Vestavia Diagnostic Center, and Brookwood Diagnostic Center are strengthening their local market presence. Academic and integrated providers, such as Duke University Health System and Covenant Health Diagnostics, benefit from strong referral networks. Companies like AliveCor, Advanced Cardio Services, Vitalistics, and ACS Diagnostics add niche strengths in cardiac and specialized diagnostics. Overall, market share is dispersed, with growth driven by increasing demand for outpatient imaging, technology adoption, and regional expansion.

Key U.S. Independent Diagnostic Testing Facility Companies:

- RadNet, Inc.

- Vitalistics

- Breathe

- Texas MRI

- The Brookwood Diagnostic Center

- ACS Diagnostics, Inc.

- Houston MRI & Diagnostic Imaging

- TestSmarter Inc.

- Duke University and Duke University Health System

- Covenant Health Diagnostics

- AliveCor, Inc.

- Advanced Cardio Services

- Diagnostic Medical Testing Inc.

- K & T Diagnostic, Inc.

- Vestavia Diagnostic Center (VDC)

- Advanced Imaging Center

Recent Developments

-

In June 2025, Amazon officially entered India by launching Amazon Diagnostics. This new at-home testing service lets users book laboratory tests, schedule home sample collection, and receive digital reports directly through the Amazon app. The platform offers access to over 800 diagnostic tests, featuring doorstep sample collection within approximately one hour.

-

In May 2025, ResMed acquired independent diagnostic testing facility VirtuOx to strengthen its diagnostic and virtual care capabilities across sleep, respiratory, and cardiac health.

ResMed chief product officer Justin Leong said: “By integrating VirtuOx’s diagnostic capabilities into our ecosystem, we can help accelerate the time between evaluation and treatment, reduce drop-off, and help more people access the life-changing benefits of therapy for sleep apnoea and related conditions.”

-

In September 2024, Sentara Health Plans and Quest Diagnostics entered a multi-year strategic collaboration aimed at expanding access to high-quality, affordable laboratory testing for health plan members in parts of the Southeast, particularly in Virginia and Florida.

Leah D. Timmerman, Senior Vice President of Health Plans at Quest Diagnostics, said: "We look forward to helping Sentara Health Plans improve access and affordability for its members as we extend into parts of the southeastern U.S., particularly Virginia, where our presence has been limited."

U.S. Independent Diagnostic Testing Facility Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 18.09 billion

Growth rate

CAGR of 7.66% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service

Country scope

U.S.

Key service provider profiled

RadNet, Inc.; Vitalistics; Breathe; Texas MRI; The Brookwood Diagnostic Center; ACS Diagnostics, Inc.; Houston MRI & Diagnostic Imaging; TestSmarter Inc.; Duke University and Duke University Health System; Covenant Health Diagnostics; AliveCor, Inc.; Advanced Cardio Services; Diagnostic Medical Testing Inc.; K & T Diagnostic, Inc.; Vestavia Diagnostic Center (VDC); Advanced Imaging Center

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Independent Diagnostic Testing Facility Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. independent diagnostic testing facility market report based on service:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiology/Imaging Services

-

X-Ray

-

Computed Tomography (CT)

-

Magnetic Resonance Angiography (MRA)

-

Magnetic Resonance Imaging (MRI)

-

Mammography

-

Ultrasound

-

Positron Emission Tomography (PET) Scan

-

-

Sleep Studies

-

Cardiac Monitoring Services

-

Frequently Asked Questions About This Report

b. The U.S. independent diagnostic testing facility market size was valued at USD 10.08 billion in 2025.

b. The U.S. independent diagnostic testing facility market is expected to grow at a compound annual growth rate of 7.66% from 2026 to 2033 to reach USD 18.09 billion by 2033.

b. The radiology/imaging service segment dominated the U.S. independent diagnostic testing facility market with a share of 57.52% in 2025. This is attributable to the availability of services available to reduced cost compared to hospitals.

b. Some key players operating in the U.S. independent diagnostic testing facility market include RadNet, Inc.; Equimed Corporation; Vitalistics; Breathe; Texas MRI; The Brookwood Diagnostic Center; ACS Diagnostics, Inc.; Houston MRI & Diagnostic Imaging; TestSmarter Inc.; Duke University and Duke University Health System; Covenant Health Diagnostics; AliveCor, Inc.; Advanced Cardio Services; Diagnostic Medical Testing Inc.; K & T Diagnostic, Inc.; Vestavia Diagnostic Center (VDC); Advanced Imaging Center

b. Key factors that are driving the market growth include the growing burden of chronic and lifestyle-related diseases, rising preference for cost-efficient, accessible, and faster diagnostics, and increasing technological advancements including digital imaging, AI-enabled diagnostics, portable diagnostics, and improved telehealth integration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.