- Home

- »

- Organic Chemicals

- »

-

U.S. Industrial Lubricants Market Size, Industry Report, 2030GVR Report cover

![U.S. Industrial Lubricants Market Size, Share & Trends Report]()

U.S. Industrial Lubricants Market Size, Share & Trends Analysis Report By Product (Process Oils, General Industrial Oils, Metalworking Fluids, Industrial Engine Oils, Greases), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-273-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Industrial Lubricants Market Trends

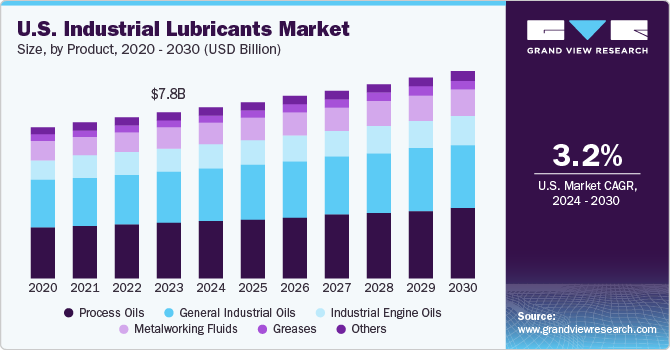

The U.S. industrial lubricants market size was valued at USD 7.82 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. The increased pace of industrial activities across various manufacturing and production sectors such as automotive, aerospace, textile, and energy have fueled the country's demand for special-purpose industrial lubricants. Developing high-performance lubricants with enhanced properties such as improved viscosity, thermal stability, and corrosion resistance meets the evolving needs of industries seeking to optimize efficiency and reduce downtime and maintenance costs. Furthermore, anticipating the market growth potential, lubricant manufacturers invest strategically to expand their operations and production capacity. These factors have led to a steady market growth rate in the economy.

The growing trend of industrial automation and the adoption of Industry 4.0 technologies are driving the need for advanced lubricants that can withstand the demands of high-temperature and high-pressure applications. Additionally, an increasing focus on predictive maintenance and equipment reliability is driving the adoption of lubricants with advanced condition monitoring capabilities. The growing importance of environmental sustainability across industries has popularized the concept of recyclable packaging solutions for lubricants. For instance, in March 2024, the National Lubricant Container Recycling Coalition (NLCRC), which works towards developing sustainable and recyclable packaging solutions for petroleum-based oils and lubricants, announced Lucas Oil as its new member.

The expansion of industrial applications in the economy, such as renewable energy and advanced manufacturing processes, is creating new market opportunities for specialized lubricants. Additionally, substantial investments in infrastructure projects, including transportation and energy grids, contribute to the increased demand for lubricants to support the operation and maintenance of heavy machinery. For instance, in August 2024, Klüber Lubrication announced the launch of its new specialty lubricants, the Klübersynth BEM 48-1501 Rescue Grease and a Gear Oil Booster, for extending maintenance intervals and minimizing downtimes for wind turbines, at the WindEnergy 2024 event. As industries strive to reduce their environmental footprint and energy consumption, lubricants that enhance energy efficiency and reduce friction are witnessing a substantial growth in their demand.

Product Insights

The process oils segment dominated the market with the largest revenue share of 34.1% in 2023. This is owing to their widespread application across various industries in the country, including chemicals, plastics, textiles, and rubber manufacturing. Process oils play a crucial role in facilitating the production process, enhancing product quality, and ensuring equipment reliability. The demand for process oils is driven by their ability to improve process efficiency, reduce downtime, and minimize waste. Additionally, the growing trend of industrial automation and the increasing focus on productivity and efficiency across organizations in the U.S. have further boosted the demand for process oils.

Meanwhile, the industrial engine oils segment is expected to register the fastest CAGR over the forecast period. This is attributed to the increasing demand for high-performance lubricants that can meet the evolving needs of industrial equipment. The growing trend of industrialization in the U.S. has led to an increase in the number of industrial engines in operation, driving the demand for advanced engine oils. Additionally, a shift towards more efficient and environment-friendly technologies has resulted in the development of new industrial engine oil formulations, such as bio-based and synthetic oils, which offer improved performance and reduce environmental impact. Furthermore, an increasing focus on equipment reliability and maintenance, as well as the need to extend their lifespan, has also driven the demand for premium industrial engine oils in the country.

Application Insights

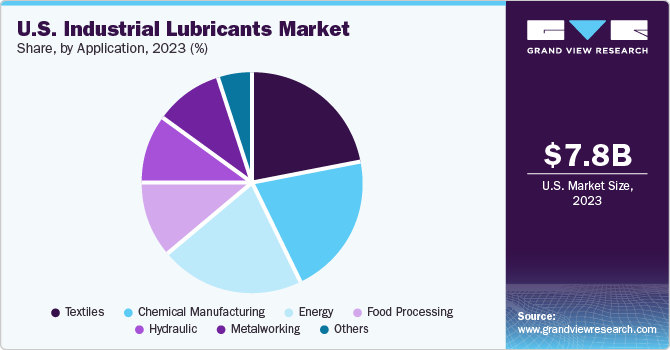

The textiles segment accounted for the largest market share in 2023. This sector is a significant consumer of industrial lubricants, utilizing these products in spinning, weaving, knitting, and finishing processes to reduce friction, prevent wear and tear, and improve equipment efficiency. The industry’s reliance on high-speed machinery and equipment, such as looms and spinning frames, necessitates the use of specialized lubricants that can withstand high temperatures, pressures, and speeds. Additionally, a constant focus on product quality and consistency drives the demand for lubricants that can minimize fiber breakage, reduce yarn defects, and improve fabric quality. These factors have led to a steady demand for innovative lubrication solutions in the textile sector of the economy.

The energy sector is expected to register a significant growth rate from 2024 to 2030. This is owing to the increasing demand for lubricants in the exploration, production, and transmission of energy resources. The resurgence of the U.S. energy industry, driven by advances in extraction technologies and the growing energy demand, has led to an increase in the number of operational oil and gas wells, power generation facilities, and renewable energy installations. For instance, the U.S. Energy Information Administration released the 2023 energy consumption data for the country, which showed an upward trajectory for energy production and consumption in the economy. This, in turn, has driven the demand for specialized industrial lubricants that can withstand extreme operating conditions and temperatures experienced in the energy industry.

Key U.S. Industrial Lubricants Company Insights:

Some key companies involved in the industrial lubricants market in the U.S. include Valvoline, CASTROL LIMITED, and Quaker Houghton, among others.

-

Valvoline is a manufacturer and marketer of lubricants, anti-freeze and coolants, transmission fluids, grease, and automotive chemicals for passenger vehicle motor oil and offers automotive services in over 140 countries and regions. The company operates through a network of service centers in company-owned and franchised locations. In its industrial and hydraulic oil portfolio, Valvoline offers a wide range of lubricants such as Valvoline 101S, AGMA EP Gear Oil 150/220/320/460, AW EHVI, anti-wear hydraulic oils, and Borilo Plus, among others.

-

Quaker Houghton is a U.S.-based industrial process fluids manufacturing company with operations in more than 25 countries worldwide. The company caters to sectors such as aerospace, metal finishing, mining, transportation, steel, metal containers, and others. The company’s product portfolio includes can-making lubricants, casting lubricants, forging fluids, greases, hydraulic fluids, and industrial lubricants. To contribute towards environmental sustainability, in July 2022, the company collaborated with SKF to provide circular use of industrial oils to reduce C02 emissions.

Key U.S. Industrial Lubricants Companies:

- Exxon Mobil Corporation

- FUCHS

- The Lubrizol Corporation

- Shell plc

- Phillips 66 Company

- Lucas Oil Products, Inc.

- AMSOIL INC.

- TotalEnergies

- Klüber Lubrication

- Valvoline

- Chevron Corporation

- Quaker Chemical Corporation d/b/a Quaker Houghton

- CASTROL LIMITED

- Petroliam Nasional Berhad (PETRONAS)

Recent Developments

-

In June 2024, Lucas Oil announced the expansion of its grease manufacturing operations at its production plant in Indiana. The expanded facility is expected to cater to the growing demand for industrial and commercial lubrication solutions that would ensure equipment efficiency and longevity, thus optimizing operations and reducing downtime of the company’s customers.

-

In December 2023, FUCHS announced that three of its recently launched lubricants, ECOCOOL 7085, ECOCOOL 7978, and ECOCOOL 7990, had received DMG MORI approval for the North American region. These solutions have been designed for lubrication during grinding, cutting, milling, drilling, and sawing operations. This development comes after FUCHS LUBRICANTS announced a technology partnership with DMG MORI in 2022 to introduce high-performance lubricants for machine tool applications.

U.S. Industrial Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.05 billion

Revenue Forecast in 2030

USD 9.74 billion

Growth Rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application

Key companies profiled

Exxon Mobil Corporation; FUCHS; The Lubrizol Corporation; Shell plc; Phillips 66 Company; Lucas Oil Products, Inc.; AMSOIL INC.; TotalEnergies; Klüber Lubrication; Valvoline; Chevron Corporation; Quaker Chemical Corporation d/b/a Quaker Houghton; CASTROL LIMITED; Petroliam Nasional Berhad (PETRONAS)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Lubricants Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial lubricants market report based on product and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Process oils

-

General industrial oils

-

Metalworking fluids

-

Industrial engine oils

-

Greases

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metalworking

-

Metal forming

-

Metal cutting

-

Metal joining

-

Electronics

-

Industrial heat exchangers

-

Others

-

-

Textiles

-

Textile weaving

-

Non-woven textiles

-

Textile finishing

-

Composites

-

Others

-

-

Energy

-

Transformer oil

-

Pipelines

-

Liquefied natural gas

-

Ocean energy

-

Others

-

-

Chemical manufacturing

-

Industrial gases

-

Fertilizers

-

Polymers

-

Others

-

-

Food processing

-

Beverages

-

Frozen food

-

Canned food

-

Processed potatoes

-

Bakery

-

Cocoa & chocolate

-

Others

-

-

Hydraulic

-

Compressors

-

Bearings

-

Others

-

-

Other industrial applications

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."