- Home

- »

- Petrochemicals

- »

-

Metalworking Fluids Market Size, Share, Growth Report 2030GVR Report cover

![Metalworking Fluids Market Size, Share & Trends Report]()

Metalworking Fluids Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mineral, Synthetic), By End-use (Machinery, Transportation Equipment), By Industrial End-use, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-744-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metalworking Fluids Market Summary

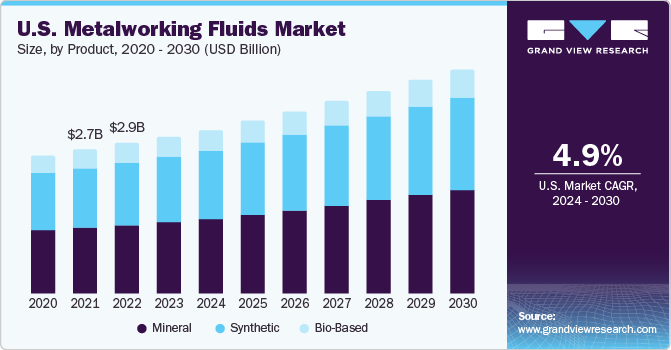

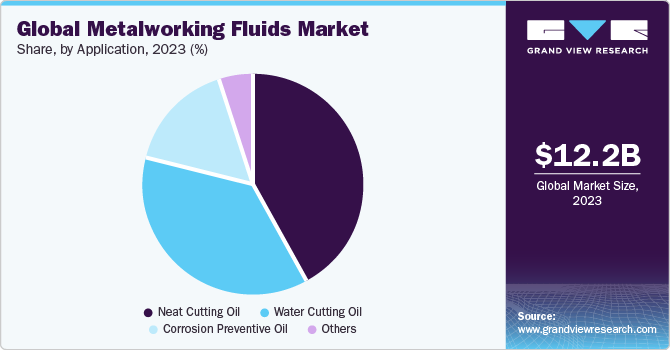

The global metalworking fluids market size was estimated at USD 12.17 billion in 2023 and is projected to reach USD 17.45 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The product demand is anticipated to be driven by increased demand for automotive and heavy industry machinery.

Key Market Trends & Insights

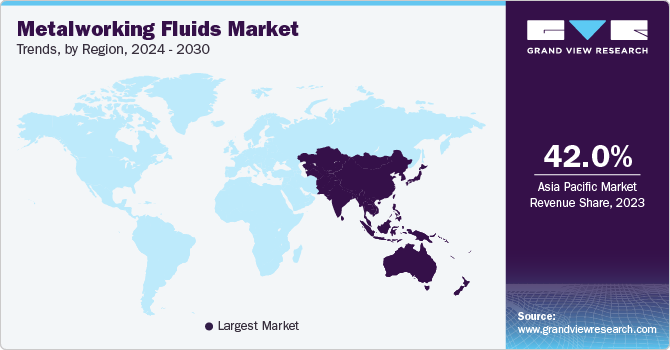

- Asia Pacific dominated the market and held a revenue share of over 42.0% in 2023.

- By product, the mineral segment held the largest share of over 48.06% in 2023.

- By end-use, machinery segment accounted for a revenue share of more than 41.61% in 2023.

- By industrial end-use, the construction segment dominated the market with the largest revenue share of 26.98% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.17 Billion

- 2030 Projected Market Size: USD 17.45 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

Individual end-use sectors, such as machinery, metal fabrication, and transportation equipment, are driving the expansion of the Metalworking Fluids (MWFs) market. The most basic raw source utilized to make the product is crude oil. The crude oil is refined, treated, and blended to create the neat cutting oils, soluble oils, and corrosion-preventive oils that are sought. Base oil, derived from crude oil, is a primary raw material that accounts for approximately 40% of the total MWF cost.

Base oil is manufactured from the refining and heating process of crude oil. It is used to manufacture motor oils, lubricants, and MWFs. The growth of the automobile industry is expected to be one of the key drivers of product demand. The product is used in the automobile industry because it can reduce friction between the workpiece and the tool, eliminate metal chips, offer good surface quality, and extend tool life. Metalworking fluids help improve the efficiency of machining processes, resulting in higher machine production volumes. As a result, the demand for metalworking fluids is likely to be stable over the forecast period.

Manufacturing is one of the core industries in North America and Europe. Advances in the manufacturing methods for producing sophisticated end-use products, coupled with increased exports of construction machinery and power, agricultural, and automotive equipment, have fueled the metalworking fluid market growth. The market growth in North America and Europe is also attributed to the robust growth of end-use industries in Asia Pacific. In Asia Pacific, more consumers prefer advanced machinery and equipment in the agriculture, automotive, and construction industries.

This has led to increased market penetration of MWFs in machinery and transportation equipment end-use industries. The growth of the heavy machinery industry in developing economies of the Asia Pacific and Central & South America is anticipated to drive the market. Increasing exploration & production activities of oil & gas in these regions, especially from Chinese petroleum companies, have been a significant factor in influencing the demand for MWFs in the oilfield equipment industry.

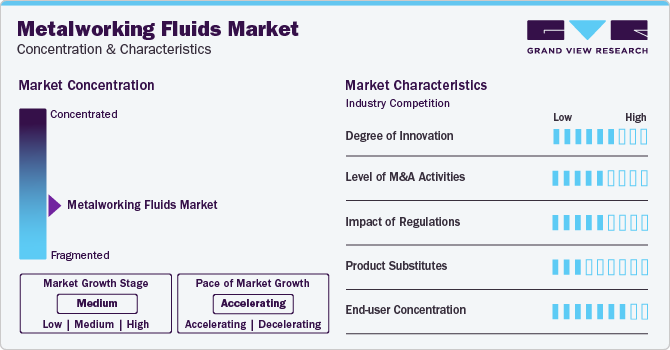

Market Concentration & Characteristics

The global market is highly competitive, with the big international brands focusing on developing long-term relationships with end-users. With a rise in the manufacturing, automotive, and transportation sectors, the competition is also anticipated to increase in the coming years. Companies such as Houghton International Inc., BP plc, Exxon Mobil Corporation, and Total SA have a high degree of integration across the value chain as they are also engaged in producing various MWFs. These companies have established themselves as key manufacturers and focus on R&D for novel product uses.

The metalworking fluid market trend is being driven by increased demand for automotive and heavy industry, as well as the growing preference for lightweight components in high performance applications such as heavy machinery, transportation equipment, automotive and construction.

The global metalworking fluids market is witnessing significant growth, driven by various end-use sectors and regional demand, with the Asia-Pacific region playing a pivotal role in the market expansion.

Product Insights

The mineral segment held the largest share of over 48.06% in 2023. The high share has been attributed to the consumption of mineral-based oils owing to their low cost. Due to price-conscious consumers, small- and medium-scale manufacturers typically use mineral oil-based MWFs. Over the forecast period, this is expected to impact the market growth. Mineral-based fluids are also used in machining processes, such as turning, grinding, broaching, drilling, and milling. Synthetic MWFs are anticipated to witness the fastest CAGR over the forecast period.

The growth is anticipated due to the characteristics imparted by MWFs, such as enhanced tool life and excellent surface finish. Synthetic oils are in high demand due to their ability to reduce friction between work pieces, eliminate waste, and extend sump life. Large-scale manufacturers in many countries have embraced semi-synthetic MWFs, resulting in increased synthetic MWF penetration over the last few years, which is expected to continue during the projected period. Growing concern regarding using petroleum products has resulted in strict environmental restrictions and government measures to promote environmentally friendly products. As a result, the manufacturing of bio-based MWFs has increased.

End-use Insights

Machinery segment accounted for a revenue share of more than 41.61% in 2023 and is likely to dominate the market over the forecast period. The demand is attributed to a rise in the consumption of MWFs in agriculture equipment, earth-moving equipment, and automotive components. Significant growth of the MWFs market is projected to be aided by the rising demand from construction equipment makers. Metalworking fluids are used in machining operations to extend the life of the sump, which saves manufacturers money in the long run. Small-scale enterprises have increased the usage of MWFs owing to their limited procurement budgets.

The transportation equipment segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. The growth is attributed to the high product demand for transportation equipment along with the development of infrastructure. Metalworking fluids are used in operations where heat dissipation is critical for effective machining and producing high-quality products. They are found in various transportation equipment, including high-performance railway engines, ships, and planes. The main areas where these oils are employed to improve engine performance are Maintenance, Repair, & Overhauling (MRO).

Industrial End-use Insights

The construction segment dominated the market with the largest revenue share of 26.98% in 2023 due to increased demand for construction machinery and related parts required for industrial, residential, and commercial construction. The construction industry manufactures various types of equipment, such as excavators, loaders, forklifts, cranes, dozers, and others. Along with this, the industry uses various ferrous and non-ferrous components in interior and exterior applications, such as garage doors, gates, sealing angles, shutters, balconies, window frames, staircase grills, shades for parking spaces, and others. Rapid urbanization, along with a rise in investments in building & construction activities, is likely to fuel the segment growth over the forecast period.

The automobile industry is anticipated to witness the fastest CAGR over the forecast period owing to a rising spending capacity on luxurious cars globally. Different metals, such as steel, aluminum, and others, need the machine shop to use particular metalworking processes to increase productivity and optimize cost. The machine shops need different MWFs during various product processing operations, which is expected to fuel the segment growth during the forecast period. Increasing awareness about using advanced equipment in farming for enhanced productivity will support the demand for agricultural equipment and tools, thereby boosting the demand for MWFs. Low per capita land holding is a primary reason leading to the high demand for and rapid modernization of farm machinery, which, in turn, will drive the segment.

Application Insights

The neat-cutting oil segment accounted for the largest share of more than 42.0% of the global revenue in 2023. The growth is attributed to increased demand from the automobile, aerospace, marine, and construction sectors. They are utilized in a wide range of machining processes, as well as in a variety of cutting operations. Because of their capacity to supply cost-effective solutions, they have significant demand from the high-volume manufacturing industry in Asia Pacific’s emerging economies. The use of high-alloy steels in the heavy equipment manufacturing sector is also likely to drive the demand for neat-cutting oils over the forecast period. The water-cutting oil segment accounted for the second-largest market share in 2023.

The growth is credited to the increase in the consumption of these fluids in various complex machining operations. These fluids are utilized in various procedures where heat dissipation is critical for successful machining and high-quality products. They are diluted in water before using in the machine shop and are used for various cutting activities, such as drilling, milling, and grinding. These fluids are used in heavy equipment production to keep the temperature of the machining operation under control. The semi-synthetic cutting oil segment in water-cutting oil is anticipated to grow at a considerable CAGR from 2022 to 2030.

The growth is credited to its application in cast iron, aluminum components, and machining operations, such as sawing, drilling, turning, and milling. The rising use of these oils in the aforementioned applications is expected to boost segment growth over the forecast period. Corrosion preventive fluids are also expected to grow steadily over the forecast period. These oils are utilized in machining processes where the risk of harming the tool is significant; as a result, these oils are responsible for extending the sump life, resulting in lower overhead expenses for manufacturers. Due to their low production quantities and limited cost structures, small-scale enterprises have increased their usage of corrosion-preventative oils.

Regional Insights

Based on geographies, the global market has been divided into Asia Pacific, North America, Europe, Middle East & Africa, and Central & South America.

Asia Pacific Metalworking Fluids market: Asia Pacific dominated the market and held a revenue share of over 42.0% in 2023. The regional market is estimated to expand further at the fastest CAGR from 2024 to 2030. The high product demand is attributed to a rise in manufacturing units in the Asia Pacific region. China and India, in particular, are projected to dominate the demand for mineral and synthetic MWFs. The market for synthetic MWFs is expected to grow in this region.This is due to the increased requirement for superior lubrication performance in automotive grinding and machining operations.

North America Metalworking Fluids market: The market in the North American region is also anticipated to witness significant growth, in terms of value, during the forecast period. Mineral, synthetic, and water-soluble oils are available from MWF producers in North America and are suited for machining and grinding operations on ferrous and non-ferrous metals. Metalworking fluids can be used with ferrous metals and alloys, including cast iron, steel, and stainless steel, as well as non-ferrous metals and alloys, such as aluminum, nickel, copper, and magnesium.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

On January 2023, Univar Solutions B.V. entered a distribution agreement with Graphics Services Ltd. for their products such as inks, rust preventive oils, coatings, lubricants, and metalworking fluids in Europe.

-

On September 2022, Clariant announced the extension of support for metalworking fluid manufacturers globally by offering their additives to develop high lubricity and fully-synthetic metalworking fluids.

Key Metalworking Fluid Companies:

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Metalworking Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.71 billion

Revenue forecast in 2030

USD 17.45 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, industrial end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Spain; Italy; U.K.; Switzerland; Denmark; Norway; Belgium; Poland; Czech Republic; Turkey; Sweden; Finland; China; India; Japan; South Korea; Singapore; Malaysia; Thailand; Australia; New Zealand; Brazil

Key companies profiled

Houghton International Inc.; Blaser Swisslube AG; BP plc; Exxon Mobil Corp.; Total S.A.; FUCHS; Chevron Corp.; China Petroleum & Chemical Corp.; Kuwait Petroleum Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metalworking Fluids Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metalworking fluid market report based on product, application, end-use, industrial end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral

-

Synthetic

-

Bio-Based

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Neat Cutting Oil

-

Water Cutting Oil

-

Corrosion Preventive Oil

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal Fabrication

-

Transportation Equipment

-

Machinery

-

Others

-

-

Industrial End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Electric & Power

-

Agriculture

-

Automobile

-

Aerospace

-

Rail

-

Marine

-

Telecommunications

-

Health Care

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Russia

-

Italy

-

Spain

-

Turkey

-

Switzerland

-

Denmark

-

Norway

-

Belgium

-

Poland

-

Czech Republic

-

Sweden

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

Malayasia

-

Thailand

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metalworking fluids market size was estimated at USD 10.8 billion in 2021 and is expected to reach USD 11.49 billion in 2022.

b. The global metalworking fluids market is expected to grow at a compound annual growth rate of 3.8% from 2022 to 2030 to reach USD 15.16 billion by 2030.

b. The Asia Pacific dominated the metalworking fluids market with a share of 41.31% in 2021. This is attributable to rising demand from the manufacturing sector in India, China, and other emerging economies.

b. Some key players operating in the metalworking fluids market include FUCHS, Blaser Swisslube AG, CIMCOOL Fluid Technology LLC, Kuwait Petroleum Corporation, and MORESCO Corporation.

b. Key factors that are driving the metalworking fluids market growth include the growth of the heavy machinery industry in the developing economies of Asia Pacific and Central and South America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.