- Home

- »

- Advanced Interior Materials

- »

-

U.S. Insulation Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Insulation Market Size, Share & Trends Report]()

U.S. Insulation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glass Wool, Mineral Wool, EPS, XPS, CMS Fibers, Others), By Application (Infrastructure, Industrial, HVAC & OEM, Others), And Segment Forecasts

- Report ID: GVR-4-68040-219-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Insulation Market Size & Trends

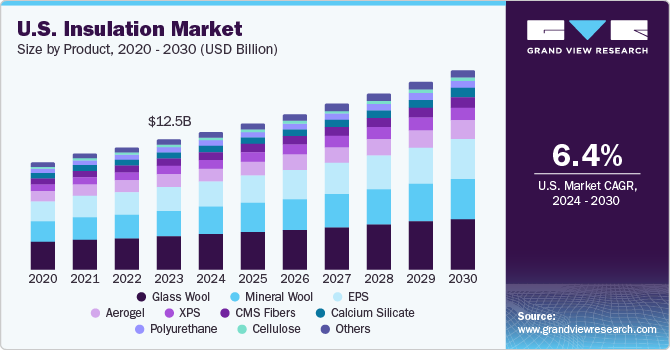

The U.S. insulation market size was estimated at USD 12.51 billion in 2023 and is expected to grow at a CAGR of 6.4% from 2024 to 2030. Rising regulations for energy conservation across the country are propelling the market growth. Insulating residential properties can help save up to 20% of the routine energy consumption and cost. Thus, the U.S. population is preferring re-insulating the houses further boosting the market growth.

Another factor driving the growth of the market is an upward trend in the real estate sector of U.S. due to increasing number of single-family residences. In the recent years, 17-20 major cities in U.S. are experiencing a rise in property rates. However, this rise is seen in both commercial and residential properties, further showing positive impacts on the market for insulation in the U.S. The application of foamed plastic insulation (a type of insulation product) in the residential properties is expected to rise. This is due to stringent building regulations that call for dwellings to be tightly sealed to prevent air leakage.

Surge in the demand for fire resistant houses, offices, hospitals, and other high-rise buildings is expected to increase the demand for mineral wool (a type of insulation product.) Since fire safety is topmost priority in these buildings, the U.S. market for insulation is expected to witness a positive impact. Mineral wool also finds its applications in the production of industrial and HVAC equipment.

Market Concentration & Characteristics

Rising consumer awareness pertaining to energy conservation is likely to remain a crucial driving factor for the U.S. insulation market. Favourable regulations in a majority of regions are also expected to have a positive impact on the market growth. Furthermore, with an aim of serving a large consumer base the market players are investing in product innovations to expand their product portfolio. This is expected to increase the competition in the market.

The industry is going through rigorous R&D activities to come up with innovative products. Technological advancements in thermal insulation resulted into Vacuum Insulation Panels (VIPs). Since air is absent in vacuum, no thermal conductivity can take place making VIPs an excellent thermal insulation option. Development in pigment technologies is also giving the industry opportunity to expand color options beyond white. Thus, the degree of innovation in the market is moderate to high.

The market is highly regulated by the U.S. government due to increasing need for energy conservation around the world. The Energy Policy Act (EPA) in the U.S. focuses on renewable energy sources, energy conservation, and other such factors. Under these regulations, insulation of properties, both commercial and residential, focuses on reducing the impact on power usage by up to 20%. Effective insulation reduces carbon footprint of the building, thus, of the city.

Plastic foam and wool insulation materials are the most preferred choice across U.S. owing to their comparatively affordable cost, superior performance, and easy availability. Perlite and wood fiber are used for numerous applications despite their high costs. Lack of skilled manpower and low R&D investments are some of the obstacles to the development of alternatives. The threat of substitute in the insulation market is moderate owing to the reasons above.

End-user of the market are mostly real estate builders, HVAC & OEM appliance manufacturers, and building renovation contractors. Insulation in the U.S. is highly used in hospitals, schools, offices, movie theatres, auditoriums, and more.

Product Insights

The glass wool segment dominated the market with a revenue share of over 25% in 2023. Glass wool has acoustic and thermal insulation properties such as high tensile strength and low weight and is made up of sand. It comprises of glass fibers bound systematically into a texture similar to wool and is relatively lighter than rock wool. The product also encompasses various features, such as, ability to insulate flat surfaces, reduced energy consumption, protection of personnel vulnerable to heat and fire threats, easy installation, low moisture absorption, ability to hold up the original shape despite the surrounding high temperatures and good recovery from packaged compression. Glass wool’s features makes it ideal for vast applications across industries, thus, making it the leading segment of the market.

The expanded polystyrene (EPS) segment is expected to witness the fastest CAGR of 7.2% in the U.S. market for insulation during the forecast period. Expanded polystyrene is a lightweight and high-tensile plastic foam insulation made from rigid pellets of polystyrene. It is further expanded by integrating minor amounts of pentane gas dissolved into the base polystyrene during production. Considering the environmental hazards and adverse carbon footprint left behind by most of the insulation materials the current trends in the building and construction industry is led by employing environmentally cautious insulation material. For this reason, EPS is being preferred amongst other products since it is recyclable and safe to be used in landfills as a stabilizing material.

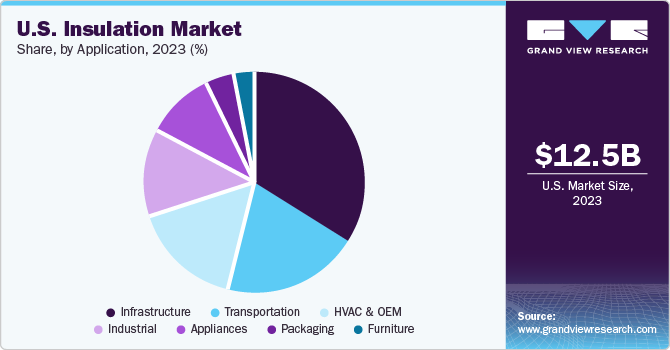

Application Insights

The infrastructure segment dominated the market with a revenue share of 34% in 2023.The reason for wide usage of insulation in construction is due to the benefits it brings for the user. An insulated residential establishment is both, cost-efficient and an energy-efficient choice, as it brings down the costs generated by a heating or cooling system. An insulated building saves wastage and conserves heat energy. For institutional and commercial buildings, sustainability has turned out to be a comprehensive and important project driver. The features affiliated with high performance green building – including comfort of the inhabitant, increased values of property, high energy efficiency, and material durability– have ushered the espousal of best practices in construction methods and materials. The use of air barriers, efficient insulation systems, and seamless monolithic roofing systems top the list of these best practices.

The transportation segment is anticipated to be the fastest growing segment during the forecast period. Automotive industry is constantly developing methods to enhance the safety and comfort of vehicles. This is the major factor driving the demand for insulation in the transportation segment. Exhaust pipes, diesel particulate filters, selective catalytic reduction system, compensators, flexible hoses, and cast manifolds are some of the most prominent areas in automotive that require insulation. Growing shipping along with the development and expansion of new trade route for maritime industry globally, is projected to propel the marine application segment in the U.S. market for insulation over the forecast period.

Key U.S. Insulation Company Insights

Operational strategies implemented by market participants stress on optimizing efficiency by using improved manufacturing techniques. The key players such as Owens Corning and Huntsman Corporation LLC have ventured into acquisitions aimed at increasing performance of the combined ventures thus boosting the overall market revenue.

Key U.S. Insulation Companies:

- GAF Materials Corporation

- Huntsman International LLC

- Johns Manville

- Cellofoam North America, Inc.

- DuPont

- Owens Corning

- Atlas Roofing Corporation

- Knauf Insulation

Recent Development

-

In February 2023, GAF launched its Timberline® Ultra HDZ™ shingles for efficient insulation, waterproofing, and faster installation.

-

In September 2022, GAF announced its insulation and roofing operations expansion in Savannah, Cumming, and Statesboro in Georgia. This expansion was aimed to expand the GAF’s thermoplastic polyolefin (TPO) roofing manufacturing capabilities.

-

In August 2022, Owens Corning acquired Natural Polymers, LLC, which is a Cortland, Illinois-based manufacturer of spray polyurethane foam insulation for building and construction applications.

U.S. Insulation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12,517 million

Revenue forecast in 2030

USD 19.25 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key Companies

GAF Materials Corporation; Huntsman International LLC; Johns Manville; Cellofoam North America, Inc.; DuPont; Owens Corning; Atlas Roofing Corporation; Knauf Insulation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Insulation Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. insulation market report based on product, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

CMS Fibers

-

Calcium Silicate

-

Aerogel

-

Cellulose

-

PIR

-

Phenolic Foam

-

Polyurethane

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Infrastructure

-

Residential construction

-

Non-residential & commercial construction

-

-

Industrial

-

HVAC & OEM

-

Transportation

-

Automotive

-

Marine

-

Aerospace

-

-

Appliances

-

Furniture

-

Packaging

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global insulation market include GAF Materials Corp., Huntsman International LLC, Johns Manville, Cellofoam North America, Inc., DuPont, Owens Corning, Atlas Roofing Corporation, Kingspan Group, Carlisle Companies, Inc., Bridgestone Corporation, Fletcher Building, 3M.

b. The key factors that are driving the global insulation market include, increasing regulatory support and rising demand for residential and industrial insulation are the factors estimated to fuel market demand over the projected period.

b. The U.S. insulation market size was estimated at USD 12.51 billion in 2023 and is expected to reach USD 13.26 billion in 2024.

b. The U.S. insulation market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 19.25 billion by 2030.

b. Glass Wool led the market and accounted for about 25% share of the revenue in 2023. Glass wool’s features makes it ideal for vast applications across industries, thus, making it the leading segment of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.