- Home

- »

- Medical Devices

- »

-

U.S. Invisible Orthodontics Market Size, Industry Report, 2033GVR Report cover

![U.S. Invisible Orthodontics Market Size, Share & Trends Report]()

U.S. Invisible Orthodontics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Clear Aligners, Ceramic Braces, Lingual Braces), By Age (Teens, Adults), By Dentist Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-640-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Invisible Orthodontics Market Summary

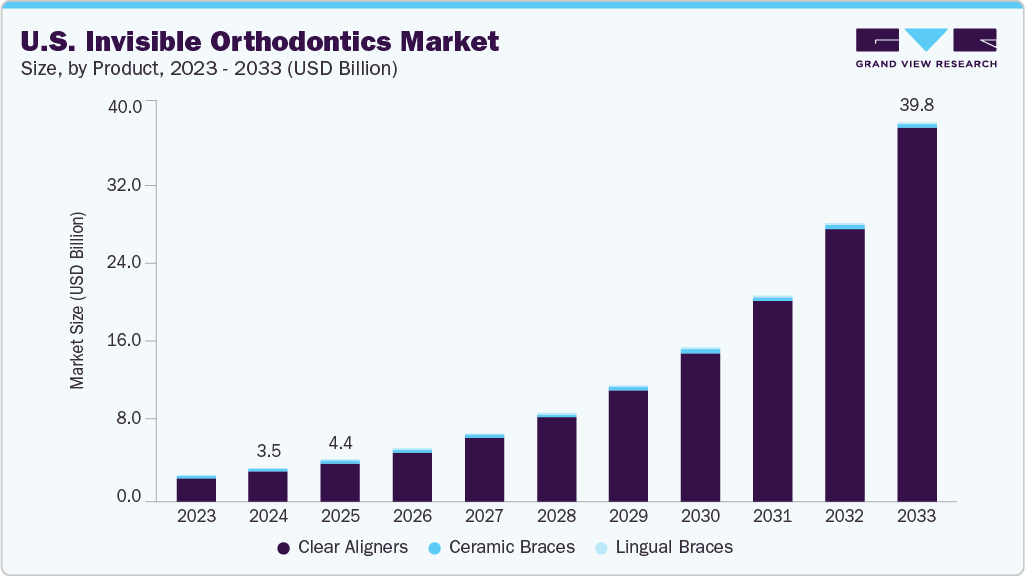

The U.S. invisible orthodontics market size was estimated at USD 3.52 billion in 2024 and is projected to reach USD 39.76 billion by 2033, growing at a CAGR of 31.6% from 2025 to 2033. Invisible orthodontics refers to teeth-straightening treatments that use clear or hidden appliances, such as clear aligners or lingual braces, to improve dental alignment without being visibly noticeable. The rising incidence of malocclusion is one of the factors boosting market growth.

According to an article published by the American Association of Orthodontists in April 2025, nearly 65% of the U.S. population experiences some form of malocclusion, ranging from mild to severe cases. While not all individuals require immediate orthodontic correction, untreated bite irregularities can lead to complications such as difficulty chewing, speech issues, jaw pain, and an increased risk of dental decay over time. This growing awareness of the long-term effects of malocclusion is fueling demand for effective yet discreet treatment options.

Growing adoption of AI-driven treatment planning boosts case acceptance and fuels the market. According to the Overjet article published in April 2025, Overjet, a U.S.-based dental AI company, reported a 10-20% increase in treatment approvals following the adoption of its AI-powered imaging tools. These tools enhance diagnostic clarity by overlaying detailed annotations on dental scans, allowing patients to better understand their oral health and proposed aligner treatments. In a market where aesthetic outcomes and clear communication influence patient decisions, such technology helps build trust and accelerates commitment to treatment. As a result, AI is becoming a vital asset in enhancing patient engagement and supporting the continued expansion of invisible orthodontics adoption nationwide.

Increasing awareness in the U.S. drives market growth. According to American Association of Orthodontists article published in June 2024, In the 2023-24 fiscal year, the American Association of Orthodontists’ (AAO) Consumer Awareness Program achieved record-breaking engagement over 1.2 billion ad impressions across digital platforms and 10 million unique visitors to aaoinfo.org highlighting significant public interest in bite issues, including malocclusion. This campaign featured targeted efforts like myth-busting videos ("Straight Talk") addressing misaligned bites, partnerships with influencers, and family-focused content (e.g., the Holderness Family video), and a dedicated “Science of Smiles” series emphasizing early diagnosis and orthodontist-led care. Such initiatives underscore growing public understanding that malocclusion isn’t merely cosmetic; it affects oral health, function, and overall well-being, driving more people to seek orthodontic evaluation and treatment.

Number Of Dentists in the U.S.

Year

Total Number of Dentists

Dentists per 100,000 Population

2023

202,304

60.4

2022

202,536

60.8

2021

201,927

60.8

Source: American Dental Association & Grand View Research

A technologically advanced product launched by the key player drives market growth. For instance, in May 2025, Align Technology Inc. introduced a new Invisalign system equipped with mandibular advancement and occlusal blocks in the U.S. and Canadian markets. This latest version addresses Class II malocclusions by promoting lower jaw advancement while simultaneously correcting tooth alignment. Notably, it's the first Invisalign product to incorporate solid occlusal blocks, which enhance the aligner's durability, promote better jaw engagement, and enable earlier treatment of mandibular positioning, according to the company.

Moreover, in May 2024, OrthoFX, established by a group of seasoned experts in the dental industry, unveiled its next-generation clear aligner product, NiTime Clear Aligners. This innovative system stands out as the first and only clear aligner solution specifically developed for reduced daily wear time, and it has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). NiTime is now available across the country for orthodontic professionals to treat all dental malocclusion classes. The company plans to present this cutting-edge material at the upcoming American Association of Orthodontists (AAO) Annual Meeting in New Orleans.

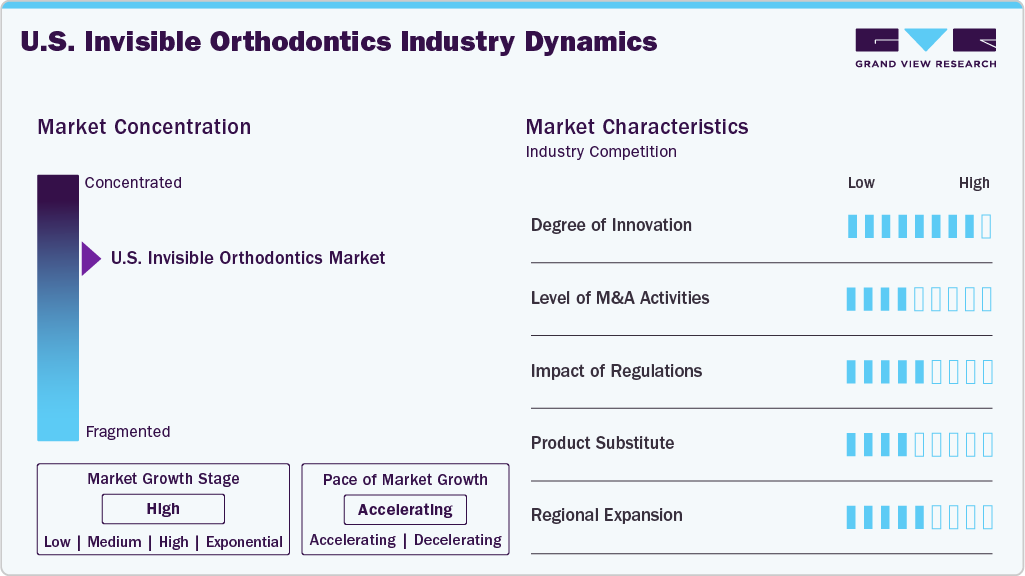

Market Concentration & Characteristics

The U.S. invisible orthodontics industry is experiencing a high degree of innovation, driven by the integration of cutting-edge technologies, smart materials, and patient-centric treatment approaches. Notable advancements include AI-enhanced treatment planning platforms, 3D printing for custom aligner fabrication, and the development of accelerated tooth movement systems. These innovations enhance treatment precision, reduce chair time, and improve patient comfort, ultimately making orthodontic care more efficient and accessible. As a result, orthodontic providers are increasingly adopting these advanced solutions to deliver faster, more predictable, and aesthetically appealing outcomes.

Several key players in the U.S. invisible orthodontics industry, including Align Technology, Inc., SmileDirectClub, Ormco Corporation (Envista), and Henry Schein, Inc., actively pursue strategic initiatives such as product innovation, technology integration, and global expansion. For instance, in June 2024, Align acquired Cubicure to scale its capacity for 3D-printed tooling and appliances, enhancing its ability to produce customized orthodontic devices at large volumes.

Regulatory oversight from agencies like the FDA plays a vital role in the U.S. invisible orthodontics industry by ensuring products meet strict safety and effectiveness standards before they reach patients. While approval processes can be lengthy, efforts to modernize and streamline regulatory pathways are helping accelerate access to advanced orthodontic technologies. These measures support the introduction of safer, more innovative aligner systems, ultimately enhancing treatment quality and patient outcomes.

There are no direct substitutes for invisible orthodontics regarding discreet and effective teeth alignment. While traditional braces and removable appliances offer alternatives, clear aligners provide a unique combination of aesthetics, comfort, and convenience. These systems have become essential in modern orthodontic care, offering personalized, noninvasive treatment options that meet the growing demand for subtle and lifestyle-friendly solutions in the U.S. market.

Key players in the U.S. invisible orthodontics industry are broadening their reach by focusing on underserved regions, collaborating with local dental professionals, and offering customized treatment solutions. These strategies are improving access to advanced orthodontic care and addressing the increasing demand for discreet, effective teeth alignment across the country.

Product Insights

The clear aligners segment held the largest share of over 89.3% in 2024. Clear aligners are transparent, removable dental trays designed to gradually shift teeth into proper alignment. They offer a discreet alternative to traditional braces and are custom-made for each patient using digital scans or impressions. Increased cases of malocclusion and strategic initiatives by the key players drive market growth. For instance, in March 2025, Angel Aligner announced its first U.S.-based clear aligner production center in Oak Creek, Wisconsin. The 52,000 sq ft facility, using automated proprietary 3D printing, will create nearly 200 jobs and bolster North American manufacturing and supply chain capabilities.

Ceramic braces is growing significantly during the forecast period. Ceramic braces are orthodontic devices made from tooth-toned or translucent ceramic materials that blend with natural teeth. They offer a discreet alternative to traditional metal braces while effectively addressing alignment issues. Rising cases of malocclusion and the technologically advanced products offered by the manufacturer drive market growth. For instance, Ormco Corporation (Envista) offers multiple ceramic brackets, including Symetri Clear, a high aesthetics polycrystalline ceramic twin-stock bracket known for strength, translucency, and easy debonding. Moreover, Henry Schein, Inc. offers NeoLucent Plus Ceramic Brackets and Tooth-colored polycrystalline ceramic brackets.

Age Insights

The adults segment held the largest share of over 59.2% in 2024. A growing number of adults opt for orthodontic treatment, increasing the demand for dental equipment with aesthetic appeal. Clear Aligner Therapy (CAT), a dynamic appliance system, includes a wide spectrum of applications with differing modes of applicability, methods of construction, and actions for various malocclusion treatments.

Teens is estimated to register the fastest CAGR over the forecast period. The invisible nature of ceramic, lingual braces, & clear aligners, and the comfort & control they provide patients have made them highly popular among teens who are more aware and want to avoid traditional treatments, such as metal braces. According to Becher & Gil Orthodontics, 80% of teenagers in the U.S. are currently undergoing orthodontic treatment. Recent advancements in the clear aligner systems, such as the introduction of Invisalign Teen with Mandibular Advancement for treating Class II dental conditions in teenagers, are helping dentists improve patients’ profiles by advancing the lower jaw. The 3D scans allow orthodontists to create trays based on their calculations of the teeth’s position.

End Use Insights

The standalone practices segment accounted for the largest revenue share of 53.0% in 2024. An orthodontist has a better treatment plan, training, & expertise in case of providing invisible orthodontics therapy as they rely on their clinical experience, expert opinions, and limited published evidence-based results. Several orthodontists recommend invisible orthodontics as it provides healthy periodontal tissue and reduces the risk of enamel decalcification compared to metal brackets. Most private orthodontists have one practicing location. All these factors are expected to boost invisible orthodontics recommendations through standalone practice. These aspects are boosting the market.

Hospital is estimated to register a significant CAGR over the forecast period. According to the Dental Elf, although there are declarations that the clear aligners are effective, evidence for the same is generally lacking. Reduced treatment and chair time is currently the only significant proof of the effectiveness of clear aligners in mild-to-moderate malocclusion cases compared to conventional systems, backed by strong evidence in treating all classes of malocclusion. Due to these factors, the adoption of clear aligners is low in hospitals. However, ceramic braces function like conventional metal braces and are used for various complex dental treatments, supporting their adoption in hospital facilities.

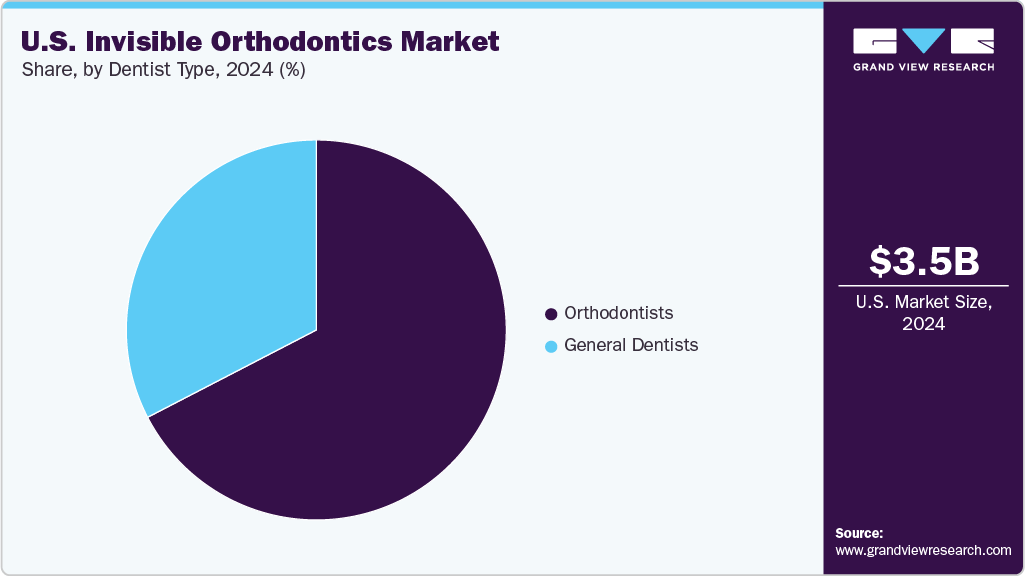

Dentist Type Insights

Orthodontists accounted for the largest revenue share of 67.4% in 2024, since most patients are referred to specialists for treatments like invisible orthodontic therapy. As per Canalyst, a data analytics site, GD prescribes Invisalign at an extremely lower rate than orthodontists. Moreover, according to the Dillehay orthodontics article, technological advancements and new technologies such as digital scanning and self-ligating bracket systems, 3D printing, and clear aligner therapy make orthodontic treatment more efficient, accurate, and comfortable than ever are boosting the market.

General dentists is anticipated to grow significantly during the forecast period. With the rising demand for invisible orthodontic therapy and cosmetic restoration treatments, the adoption of invisible orthodontic services has considerably increased among general dentists (GD). Several manufacturers are now partnering with GDs and are providing them with training & assistance to use invisible orthodontics in their practices. Companies like Invisalign offer a certification program on dental aligners to teach the GDs the use of clear aligners as a tool to improve treatment outcomes. The Invisalign Assist treatment program also gives procedural and technical support throughout treatment to help patients obtain effective results.

Key U.S. Invisible Orthodontics Company Insights

Dentsply Sirona, Angel Aligner, and Institut Straumann AG are major contributors to the U.S. market. Angelalign Technology, known internationally as Angel Aligner, develops advanced clear aligner systems and holds over 150 patents related to 3D printing, manufacturing processes, and aligner design. Dentsply Sirona, a key industry participant, offers a comprehensive portfolio of dental products and consumables widely used in clinical dental procedures.

Key U.S. Invisible Orthodontics Companies:

- Angel Aligner

- SmarTee

- Dentsply Sirona

- Institut Straumann AG

- SCHEU DENTAL GmbH

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- SmileDirectClub

- Align Technology, Inc.

- TP Orthodontics, Inc.

Recent Developments

-

In April 2023, Henry Schein, Inc., took a controlling interest in Biotech Dental, a firm developing clear aligners, dental implant solutions, and digital dentistry software.

-

In July 2023, Angel Aligner launched custom-made, clear aligners and aligner technology into the U.S. market.

-

In October 2022, Align Technology introduced the latest iteration of its iTero-exocad Connector, which seamlessly integrates NIRI images and an iTero intraoral camera into exocad DentalCAD 3.1 Rijeka software.

U.S. Invisible Orthodontics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.42 billion

Revenue forecast in 2033

USD 39.76 billion

Growth rate

CAGR of 31.6% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age, end use, dentist type

Country scope

U.S.

Key companies profiled

Angel Aligner; SmarTee; Dentsply Sirona; Institut Straumann AG; SCHEU DENTAL GmbH; Ormco Corporation (Envista); Henry Schein, Inc.; SmileDirectClub; Align Technology, Inc.; TP Orthodontics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Invisible Orthodontics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global U.S. invisible orthodontics market report based on product, age, end use, and dentist type:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Clear Aligners

-

Ceramic Braces

-

Lingual Braces

-

-

Age Outlook (Revenue, USD Million, 2021 - 2033)

-

Teens

-

Adults

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Stand Alone Practices

-

Group Practices

-

Others

-

-

Dentist Type Outlook (Revenue, USD Million, 2021 - 2033)

-

General Dentists

-

Orthodontists

-

Frequently Asked Questions About This Report

b. The U.S. invisible orthodontics market size was estimated at USD 3.52 billion in 2024 and is expected to reach USD 4.42 billion in 2025.

b. The U.S. invisible orthodontics market is expected to grow at a compound annual growth rate of 31.6% from 2025 to 2033 to reach USD 39.76 billion by 2033.

b. The clear aligners segment held the largest share of over 89.3% in 2024. Clear aligners are transparent, removable dental trays designed to gradually shift teeth into proper alignment.

b. The following are the leading companies in the U.S. invisible orthodontics market. Angel Aligner, SmarTee, Dentsply Sirona, Institut Straumann AG, SCHEU DENTAL GmbH, Ormco Corporation (Envista), Henry Schein, Inc., SmileDirectClub, Align Technology, Inc., and TP Orthodontics, Inc.

b. The rising incidence of malocclusion is one of the factors boosting market growth. According to an American Association of Orthodontists article published in April 2025, in the U.S., it is estimated that nearly 65% of the population experiences some form of malocclusion, ranging from mild to severe cases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.