- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Jewelry Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Jewelry Market Size, Share & Trends Report]()

U.S. Jewelry Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Necklace, Ring), By Material (Gold, Platinum, Diamond), By Distribution Channel, By End-user (Men, Women, Children), And Segment Forecasts

- Report ID: GVR-4-68040-212-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Jewelry Market Size & Trends

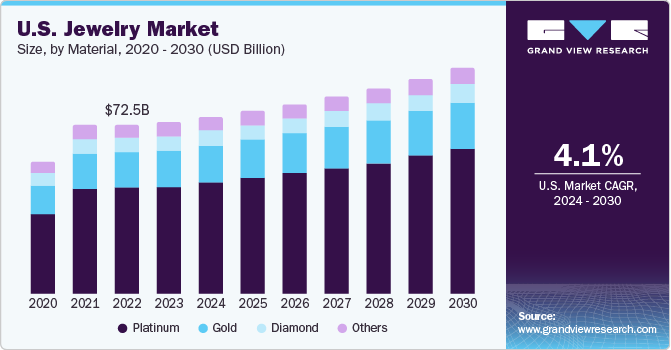

The U.S. jewelry market size was estimated at USD 73.32 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030. The market is driven byinnovative jewelry designs offered by manufacturers and growing disposable income. Furthermore, there’s a distinct shift in consumer behavior, with more people being comfortable buying fine jewelry online. Though this trend was driven by the global pandemic, the jewelry industry may enter a stage of exceptional digital innovation over the forecast period.

U.S. jewelry market accounted for the share of 20.76% of the global jewelry market in 2023. The increasing popularity and acceptable of bling jewelry by celebrities has created a major opportunity for new entrants as well as existing players to expand their product portfolio in the jewelry market. For instance, Zillionaire-an Indian start-up with a large online presence and a store in the city of Jaipur-focuses on the latest trends on bling jewelry, which can be designed and customized specifically for the youth. These are available in gold, silver, and diamond. The company is looking to revolutionize the jewelry market in India by introducing consumers to the “iced-out” trend that is so popular in the U.S.

Like any other industry in the U.S., the luxury jewelry segment is also significantly influenced by the idea of sustainability. Jewelry designers are rigorously undertaking experiments to find a sustainable alternative material for creating luxury jewelry.

The American jewelry design exhibition by Vogue Italia in 2018 showcased unconventional materials like tagua nut as an alternative to ivory. Designers like Ana Katarina, Dana Bronfman, and Yael Sonia are committed to environmental sustainability while also developing fresh styles in jewelry.

Moreover, companies are launching innovative products in the jewelry industry in order to meet consumer demand that further contributing to market growth. For instance, VVS Jewelers introduced its newest feature-totally personalized jewelry-in November 2022. The company sells watches, men’s, and women's jewelry as well as grills, all of which can be personalized.

The trend of personalizing ring designs with gemstones is also gaining popularity in the region. It has been observed that millennials mainly prefer three-stone rings in fancy shapes as well as stackable rings. AS per the jewelry manufacturers rings made with elongated stones, like 3.5mmX2.0mm baguettes, 4.0mmX2.0mm marquise, and 3.0mmX2.0 mm ovals are emerging as a new trend in the U.S.

Market Concentration & Characteristics

The U.S. jewelry market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Manufacturers are also focusing on product innovation by leveraging the demand for cross-cultural jewelry designs. Designs inspired by ethnic communities or Greek or Roman cultures are steadily penetrating the market owing to their popularity. Companies operating in the market are increasingly focusing on the online channel to increase sales and brand internationalization. With the evolution of e-commerce, retailers can source and supply luxury jewelry with shorter lead times and ensure faster delivery.

Leading companies employ key strategies, including mergers, expansions, acquisitions, partnerships, and product development, to enhance brand visibility among consumers.

End-user concentration is a significant factor in the U.S. jewelry market. Growing consumer awareness about the validity of rose gold, platinum, mixed metals, and stones used in jewelry pieces. Manufacturers educate consumers through marketing campaigns, in addition to upholding authenticity and quality standards. The rising sales of rings worldwide are principally driven by the increasing demand for wedding rings and minimalistic rings as part of corporate dressing is expected to boost market growth. Younger generations with a less-traditional viewpoint on marriages, tend to build a strong connection between love and rings, be it commitment rings, engagement rings, or promise rings. Furthermore, jewelers now integrate expression and personalization more frequently. The lettering on rings is elegant and subtle. In the near future, jewelers are expected to increasingly target younger consumers worldwide owing to their growing affinity for rings.

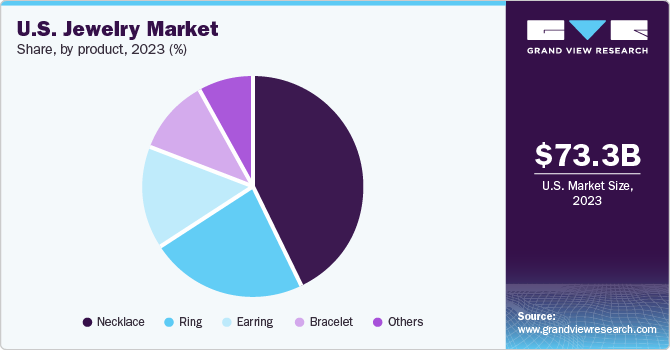

Product Insights

Based on product, the rings accounted for a revenue share of 42.95% in 2023. Rings are one of the most popular accessories among the American population. U.S.-based designers like Kylie Nakao, Moorea Seal, Agatha Waszczyk, Page Neal, Anna Bario, Hikaru Furuhashi, Vanessa Stofenmacher, and T. Ngu excel in creating new ring designs, which is expected to have a positive influence on the segment growth during the forecast period.The demand for earing is expected to grow at a CAGR of 4.2% over the forecast period. Earrings are a statement and standalone piece of jewelry, they are often also worn to complement other accessories such as necklaces and bracelets. Thus, the rising demand for these jewelry items could translate into increased sales of earrings. Earrings are some of the most commonly worn pieces of jewelry owing to their simplistic designs and ease of use.

Material Insights

The diamond jewelry accounted for a revenue share of 62.86% in 2023,the availability of new designs and shapes in the product category has been spurring the demand for diamond jewelry among millennials in the country.According to a report by Bain & Co. and Antwerp World Diamond Centre, the global recovery of the diamond industry beginning in 2020 had a positive impact on the U.S. market. Diamond jewelry sales in the country registered a 3% rise in 2018, compared to 2017.

The gold jewelry is projected to grow at a CAGR of 3.9% during the forecast period. The increase in the sales of gold jewelry in the country has also contributed to the growth of the market over the forecast period. According to figures from the World Gold Council, sales of gold jewelry in the U.S. rose by 26.1% in 2022 to a record 149.1 tons. Sales in the U.S. reached a total of 26.4 tons in the first quarter of 2022, virtually matching the record achieved in the same time of 2021.

Distribution Channel Insights

Sales through offline distribution channels accounted for 84% share in 2023. Presence of luxury stores in the region coupled with consumer preferences for purchasing jewelry in the stores is expected to boost segment’s growth. Luxury brands have their own stores where they offer wide range of jewelry for the customers to try. Jewelry stores conduct detailed consumer sentiment analyses to understand customer preferences for products and choices.

The online sales is expected to grow at a significant CAGR over the forecast period. With major players focused on using their websites to announce new releases, sales, and other pertinent information, the jewelry market is also anticipated to experience substantial growth online.

End-use Insights

Women accounted for the market share of 72% in 2023. Women's jewelry accounts for a sizable portion of the market. Significant gains in women’s financial independence due to the growing female employment rate in recent years, which has led to an increased purchasing power of women. According to a blog published by the Jeweller magazine, more than 80% of all purchases were made by women in 2020. In addition, female home ownership increased significantly, which demonstrates the rising wealth and prosperity of women.

Demand for Men’s jewelry is expected to grow at a CAGR of 5% from 2024 to 2030. Increased acceptance of jewelry among men is anticipated to boost segment’s growth. Products such as cufflinks, plain gold chains, tie bars, cartography necklaces, and signet rings are some of the products commonly in demand among men.

Key U.S. Jewelry Company Insights

Some of the key players operating in the market includeTiffany & Co, Signet Jewelers, and Vrai & Oro, LLC

-

Tiffany & Co. is involved in designing, manufacturing, and selling luxury goods, leather items, and jewelry, including bracelets, earrings, necklaces, charms, and engagement rings for men and women. The company also offers home décor products such as tableware, bar and drinkware, designer coffee and tea sets, desk accessories, and baby gifts.

-

Signet Jewelers involved in the design and sale of diamond jewelry such as bracelets, earrings, necklaces, charms, and rings for men and women. The majority of the company's diamond purchases are made in the form of finished jewelry, however some are made in the form of loose polished diamonds and rough diamonds that are later polished in Signet's plant in Botswana for the final delivery. The company has a number of reportable sectors, including the Sterling Jewelers, Zale, Piercing Pagoda, and UK Jewelry divisions.

Aether Diamonds, Brilliant Earth, LLC, and HSternare some of the other participants in the U.S. jewelry market,

- Brilliant Earth, LLC is digitally native, multichannel fine jewelry company is a global leader in fine jewelry made from ethically sourced materials. It offers a variety of products, including gifts, gemstone rings, diamond and gold rings, diamond earrings, and diamond necklaces.

- Aether Diamonds generates the first and only diamonds in the world created entirely from captured carbon. The company is a certified B-Corporation and an award-winning startup in climate technology. The company is laying the foundation for a more attractive and long-lasting products for both people and the environment by pushing the boundaries of product design, manufacturing technology, and artisanship.

Key U.S. Jewelry Companies:

- Tiffany & Co

- Signet Jewelers

- Vrai & Oro, LLC

- Aether Diamonds

- Brilliant Earth, LLC

- HSternare

- Swarovski AG

- Harry Winston

- CHANEL

- Richemont

Recent Developments

-

In January 2023, Vrai & Oro, LLC launched the brides fine jewelry collection VRAI x Brides. The collection includes engagement rings, wedding bands, earrings, necklaces, and bracelets.

-

In September 2022, Tiffany & Co. launched a new campaign collaborating with music superstar Beyoncé to showcase the company's most iconic designs, including Tiffany Lock. Tiffany Lock consists of an avant-garde clasp and diamonds that were hand set by Tiffany master craftsmen.

U.S. Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 75.75 billion

Revenue forecast in 2030

USD 96.61 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end-user

Country scope

U.S.

Key companies profiled

Tiffany & Co; Signet Jewelers; Vrai & Oro, LLC; Aether Diamonds; Brilliant Earth, LLC; HSternare; Swarovski AG; Harry Winston; CHANEL; Richemont

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Jewelry Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. jewelry market report based on product, material, distribution channel, and end-user :

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry Stores

-

Others

-

-

Online Retail Stores

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

Frequently Asked Questions About This Report

b. The U.S. jewelry market size was estimated at USD 73.32 billion in 2023 and is expected to reach USD 75.75 million in 2024.

b. The U.S. jewelry market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 96.61 billion by 2030.

b. Rings dominated the U.S. jewelry market with a share of 43% in 2023. The rising sales of rings in the U.S. and worldwide are principally driven by the increasing demand for wedding rings, coupled with the growing preference for corporate dressing.

b. Some key players operating in the U.S. jewelry include Tiffany & Co; Signet Jewelers; Vrai & Oro, LLC; Aether Diamonds; Brilliant Earth, LLC; HSternare; Swarovski AG; Harry Winston; CHANEL; Richemont

b. The market is driven by innovative jewelry designs offered by manufacturers and growing disposable income. Furthermore, there’s a distinct shift in consumer behavior, with more people being comfortable buying fine jewelry online.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.