- Home

- »

- Medical Devices

- »

-

U.S. Laparoscopic Devices Market, Industry Report, 2030GVR Report cover

![U.S. Laparoscopic Devices Market Size, Share & Trends Report]()

U.S. Laparoscopic Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Laparoscopes, Energy Systems, Trocars), By Application (Bariatric Surgery, Other Surgery), By End User (Hospital, Clinic), And Segment Forecasts

- Report ID: GVR-4-68040-238-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laparoscopic Devices Market Trends

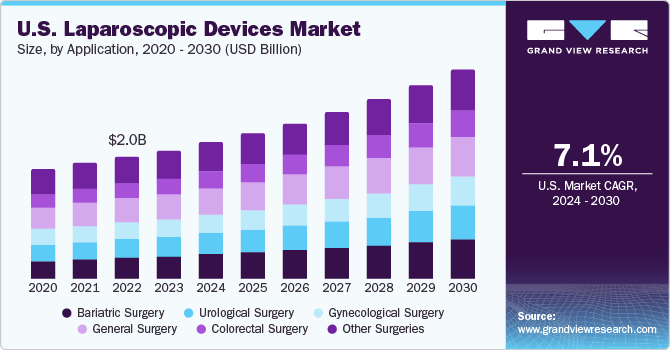

The U.S. laparoscopic devices market was valued at USD 2.26 billion in 2023 and is projected to grow significantly at a CAGR of 7.13% from 2024 to 2030. Key drivers include an increase in the number of surgical procedures, an aging population, and a high prevalence of chronic diseases along with a rising number of preventive surgeries performed to curb the prevalence of chronic diseases. In addition, an increase in the number of surgical procedures due to accidents, burns, and trauma cases is one of the major factors driving the market in this country.

In 2023, the U.S. held a significant 29.0% share of the global laparoscopic devices market. The reasons for this can be attributed to the rising incidence of chronic diseases like diabetes and cancer, favorable government policies, and increasing awareness among people. Laparoscopy is now being recommended by surgeons over traditional surgeries as it allows for faster healing and better outcomes. This growing awareness about the benefits of minimally invasive surgeries and laparoscopic procedures is expected to drive market growth.

Additionally, increasing healthcare investments in the U.S. may attract new players to the market. The increasing number of conventional surgeries has created a huge demand for modern surgical tools and techniques. Major companies are focusing more on introducing technologically advanced surgical instruments. For example, powered surgical instruments, such as battery-powered and electric-powered, are becoming more popular among surgeons due to their ease of use and effectiveness.

Furthermore, electrosurgeries reduce blood loss by cauterizing tissue using an electric current. With the emergence of advanced surgical tools, there is an increasing demand for these products as surgical efficiency gains momentum. Additionally, several government and non-governmental organizations have increased their funding in healthcare sectors to support innovations and technological advancements in surgeries and other fields.

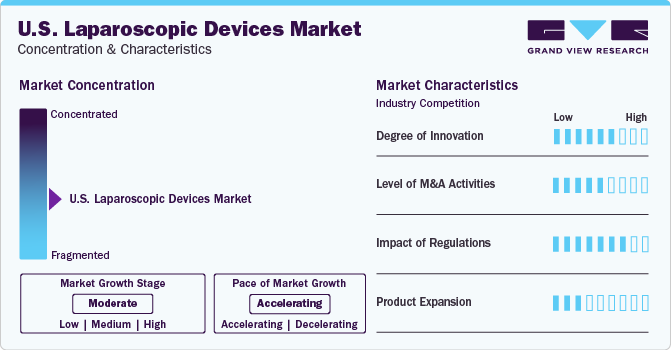

Market Concentration & Characteristics

Technological advancements in laparoscopy devices are one of the major drivers of this industry. These advancements include HD imaging, portability, and micro laparoscopy, which enable accurate diagnoses & treatment. Moreover, various key industry players are investing in R&D for developing innovative minimally invasive surgical instruments. For instance, introducing medical robots to assist surgeons in procedures is a key development in the field. Many component manufacturers in the laparoscopy devices industry are focused on ensuring ergonomic and modular designs. Some companies also focus on innovations in hand access instruments, slide-lock graspers & trocars, and closure devices used in these surgeries. In addition, competition among prominent players related to product innovation will also impact the industry.

Key players are trying to carve out their niche through various business strategies such as mergers and acquisitions, collaborations, and partnerships. For instance, in February 2020, Medtronic announced the acquisition of Digital Surgery to enhance its robotic-assisted surgery platform and provide AI & data analytics within laparoscopic procedures. Various companies are also shifting their focus toward electrosurgical surgical instruments through acquisitions of niche players which is expected to boost the industry growth.

Medical malpractices lead to surgical errors, which result in nearly 100,000 injuries in the U.S. every year. However, rising health insurance coverage is expected to increase the number of surgeries performed and the demand for surgical instruments. The U.S. industry is expected to grow during the forecast period due to increasing government initiatives, supportive regulations and laws, and increasing awareness in the community. The high cost of switching accessory suppliers due to changing regulatory compliance contributes to high supplier power.

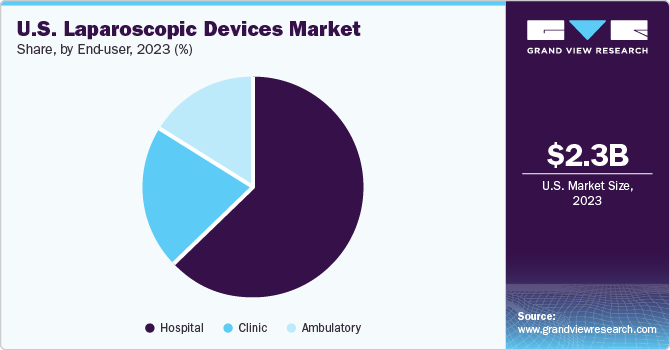

End-Use Insights

In 2023, the hospital segment held the largest share of 62.88%, which can be attributed to an increase in patients suffering from chronic ailments leading to a rise in surgical procedures. Hospitals are the primary healthcare system in many countries, so the number of laparoscopic surgeries performed in hospitals is relatively high. Additionally, hospitals are using advanced technology and devices extensively to provide better treatment, resulting in a comparatively higher demand for laparoscopic devices in hospitals. On the other hand, the ambulatory segment is expected to witness the fastest CAGR during the forecast period. This growth can be attributed to the high preference for outpatient surgeries, an increase in the adoption of minimally invasive surgeries, and the cost-effectiveness of ambulatory surgery center-based laparoscopic procedures. Furthermore, the demand to curb surgical and postsurgical expenses and the increasing prevalence of chronic ailments are expected to drive the growth of this segment.

Product Insights

The robot-assisted system segment accounted for the largest share of 22.96% in 2023 due to increasing investments in R&D, availability of technologically advanced products, and high product adoption. In addition, collaborations, and partnerships for developing innovative medical robotic platforms are expected to propel market growth during the forecast period. Furthermore, the rising number of product launches and increasing prevalence of conditions such as cardiovascular disorders, cancers, & neurological disorders are expected to boost segment growth during the forecast period.

The hand-access instruments segment is expected to witness the fastest CAGR over the forecast period. The segment is driven by technological innovations and their growing adoption in minimally invasive surgeries. These handheld devices can be either mechanical, robotic, or semi-automated. Handheld devices ensure easier access during surgery with instrument triangulation, thereby reducing the risk of potential errors.

Application Insights

The general surgery segment accounted for the largest share of 19.31% in 2023. The application of trocars in general surgery, especially in laparoscopic surgery, has increased largely in recent times. Most surgeons prefer trocars as they allow a clear view of tissues without cameras. In addition, there is a low risk of developing postoperative infection, with lesser healing time, compared to traditional open surgeries. This factor is expected to propel segment growth during the forecast period.

The bariatric surgery segment is expected to witness the fastest CAGR over the forecast period. The increasing incidence of obesity in adults due to changing lifestyle habits and excessive intake of calories is the major driver for segment growth. Furthermore, the American Heart Association has estimated the total medical cost for bariatric surgery to reach USD 957.0 billion from USD 861.0 billion by 2030. Moreover, government support and increased awareness about unhealthy food/drinks available in the market & their impact on BMI are expected to increase the demand for bariatric surgeries during the forecast period.

Key U.S. Laparoscopic Company Insights

Some of the prominent U.S. laparoscopic devices market companies operating include Medtronic, Stryker Corporation, Microline Surgical, BD, Karl Storz SE & CO. Kg, Johnson and Johnson, Olympus Corporation, CONMED Corporation, B. Braun Melsungen AG, The Cooper Companies Inc., and Richard Wolf GmbH. In addition, increasing healthcare expenditure in the U.S. may also favor the entry of both new and old players.

Key players are strategically expanding their businesses and building more warehouses at various locations to run their operations through different channels in the worst-hit regions. Companies are adopting various strategies to tackle supply chain disruption, including rerouting logistics, sourcing from additional partners, and quick delivery with air freight.

Key U.S. Laparoscopic Devices Companies:

- Karl Storz SE & CO. Kg

- Medtronic

- Johnson and Johnson

- Olympus Corporation

- CONMED Corporation

- B. Braun Melsungen AG

- The Cooper Companies Inc.

- Richard Wolf GmbH

- Microline Surgical

- BD

- Welfare Medical Ltd.

- DEAM

- Intuitive Surgical

- Shenzen Mindray Bio Medical Electronics Co., Ltd & Others

Recent Developments

-

In February 2024, Virtual Incision Corporation received the FDA approval in marketing authorization of the MIRA™ Surgical System (MIRA). It is the world’s first miniaturized robotic-assisted surgery (miniRAS) device, for use in adults undergoing colectomy procedures

-

In November 2023, Ethicon (Johnson & Johnson) announced the launch of an AI-powered laparoscopic surgical simulation platform which is a first-of-its-kind device that integrates augmented reality, AI-guided assessment, and tactile feedback. It aims to enhance the surgical skills and training experiences for general, gynecological, and laparoscopic surgeons

U.S. Laparoscopic Devices Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 2.36 billion

The revenue forecast in 2030

USD 3.60 billion

Growth Rate

CAGR of 7.13% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Medtronic, Stryker Corporation, Karl Storz SE & CO. Kg, Johnson and Johnson, Olympus Corporation, CONMED Corporation, B. Braun Melsungen AG, The Cooper Companies Inc., Richard Wolf GmbH, Microline Surgical, BD, Welfare Medical Ltd., DEAM, Intuitive Surgical, Shenzen Mindray Bio Medical Electronics Co., Ltd. & Others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laparoscopic Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the U.S. laparoscopic devices report based on product, application, and end-use:

-

Laparoscopic Devices Market, Product Outlook (Revenue USD Million; 2018 - 2030)

-

Laparoscopes

-

Energy Systems

-

Trocars

-

Closure Devices

-

Suction/ Irrigation Device

-

Insufflation Device

-

Robot Assisted Systems

-

Hand Access Instruments

-

-

Laparoscopic Devices Market, Application Outlook (Revenue USD Million; 2018 - 2030)

-

Bariatric Surgery

-

Urological Surgery

-

Gynecological Surgery

-

General Surgery

-

Colorectal Surgery

-

Other Surgeries

-

-

Laparoscopic Devices Market, End User Outlook (Revenue USD Million; 2018 - 2030)

-

Hospital

-

Clinic

-

Ambulatory

-

Frequently Asked Questions About This Report

b. The U.S. laparoscopic devices market size was valued at USD 2.26 billion in 2023 and is expected to reach USD 2.36 billion in 2024.

b. The U.S. laparoscopic devices market is expected to grow at a compound annual growth rate of 7.30% from 2024 to 2030 to reach USD 3.6 billion by 2030.

b. Based on product, the robot assisted systems segment held the largest market share with 22.% market share in 2023 owing to technological advancements, wide availability associated with robot assisted systems.

b. Key companies operating in the U.S. laparoscopic devices market are Medtronic PLC; Karl Storz GmbH; Stryker Corp.; Cooper Surgical; Intuitive Surgical; Richard Wolf; Johnson and Johnson Services, Inc.; CONMED Corp.; and Olympus Corp.

b. Key factors that are driving the U.S. laparoscopic devices market growth include the increasing number of patients suffering from gallstones, obesity, rectal prolapse, and severe gastroesophageal reflux disease syndrome.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.