- Home

- »

- Advanced Interior Materials

- »

-

U.S. LCD Glass Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. LCD Glass Market Size, Share & Trends Report]()

U.S. LCD Glass Market (2025 - 2033) Size, Share & Trends Analysis Report By Substrate Material (Alkali-free Glass, Borosilicate Glass), By Application, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-701-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. LCD Glass Market Summary

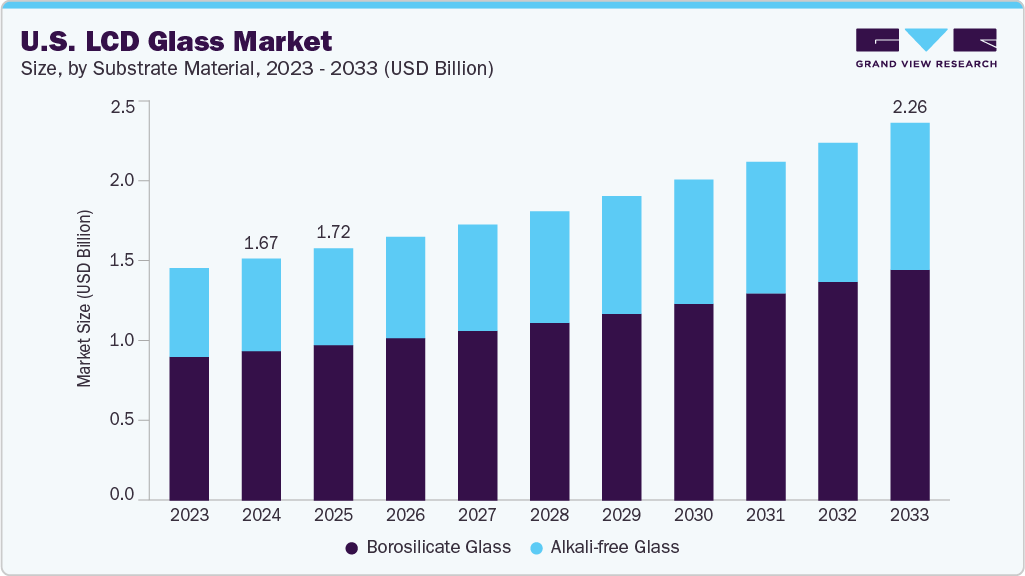

The U.S. LCD glass market size was estimated at USD 1,679.1 million in 2024 and is projected to reach USD 2,260.0 million by 2033, growing at a CAGR of 3.5% from 2025 to 2033. The U.S. LCD glass industry is experiencing robust growth primarily due to rising demand for high-performance display panels across consumer electronics.

Key Market Trends & Insights

- By substrate material, the borosilicate glass segment accounted for the largest revenue share of over 61.0% in 2024.

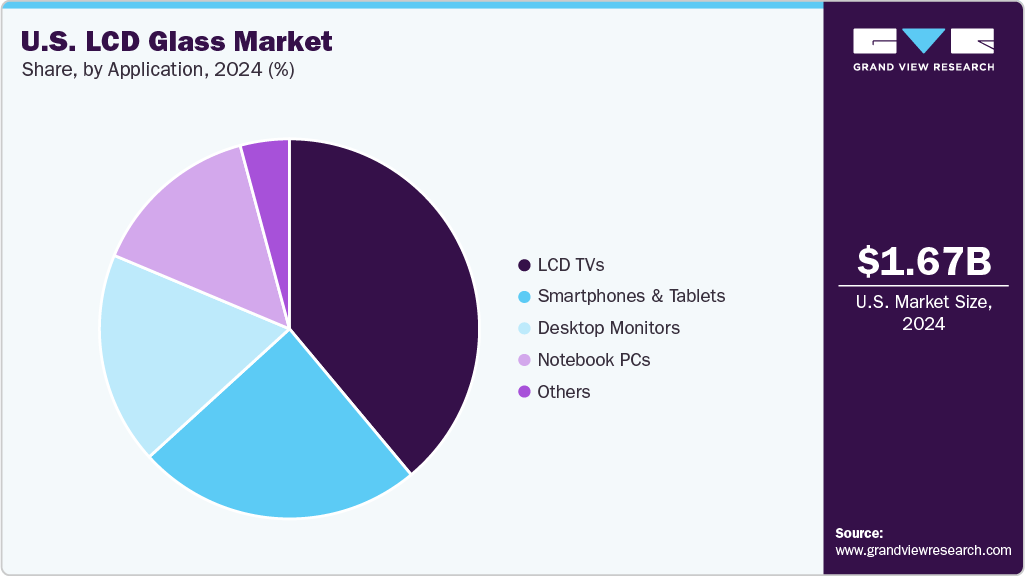

- By application, the smartphones and tablets segment is anticipated to register the fastest CAGR of 3.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,679.1 Million

- 2033 Projected Market Size: USD 2,260.0 Million

- CAGR (2025-2033): 3.5%

The proliferation of smartphones, tablets, laptops, and televisions with larger screens and enhanced resolution pushes manufacturers to adopt advanced LCD technologies. With consumer preferences shifting toward ultra-slim, energy-efficient, and high-brightness displays, companies invest in upgraded fabrication lines to deliver superior glass substrates and panel assemblies. Evolving lifestyle patterns and digital consumption habits continue reinforcing demand nationwide. Automotive applications are playing a significant role in expanding the scope of LCD usage in the U.S. market. Modern vehicles increasingly feature infotainment systems, heads-up displays, digital instrument clusters, and rear-seat entertainment units, all powered by LCD technology.Integrating interactive and adaptive display panels is becoming standard as electric vehicles and autonomous driving systems gain traction. In 2024, U.S. EV sales reached approximately 1.3 million units, representing around 8.1 percent of total light‑duty vehicle sales, while more comprehensive estimates indicate about 1.56 million plug‑in EVs, battery and plug‑in hybrids, accounting for nearly a 10 percent share of all new vehicles sold. This shift encourages automakers and component suppliers to collaborate with display manufacturers to deliver greater durability, visibility, and performance under varying driving conditions.

The U.S. healthcare and industrial sectors also contribute significantly to the LCD market’s growth. Medical imaging systems, diagnostic monitors, surgical displays, and patient-monitoring devices require high-definition, glare-resistant, and color-accurate screens. Industrial applications such as factory automation interfaces, control room panels, and ruggedized monitors demand durable and reliable LCD solutions. These non-consumer segments provide consistent volume demand, particularly as digitization and smart technologies become central to operations in these industries.

The trend toward digital signage and public information systems across airports, malls, retail outlets, and educational institutions further fuels demand. LCD screens are preferred for their cost-efficiency, brightness, and ability to display dynamic content. As businesses aim to enhance customer engagement and communication, display networks powered by LCDs are being rapidly deployed. Furthermore, the ongoing replacement of static posters and LED displays with high-resolution LCDs is accelerating market penetration in the signage segment.

Technological advancements in LCD panel production are improving efficiency and reducing production costs, making the technology more accessible. U.S.-based firms and R&D centers continue to develop thinner glass, higher refresh rates, and enhanced contrast technologies, maintaining competitiveness against OLED and other emerging display formats. Domestic investment in display manufacturing infrastructure and strategic partnerships with global suppliers reinforce supply chains, which is essential given increasing geopolitical sensitivities and the need for resilient sourcing.

Drivers, Opportunities & Restraints

The U.S. LCD glass market is driven by rising demand across consumer electronics, automotive, and healthcare sectors. The popularity of high-resolution, energy-efficient displays in smartphones, televisions, tablets, and monitors continues to push panel manufacturers to enhance glass substrate quality and durability. The trend toward remote work, online learning, and digital entertainment has increased screen usage across households, directly fueling LCD glass consumption. Technological advancements such as ultra-thin glass, reduced reflectivity, and higher thermal stability further improve product value and expand application potential.

Opportunities in the U.S. LCD glass industry are emerging through the growing adoption of LCDs in smart vehicles, industrial automation, and public display systems. Automakers are adopting advanced displays in electric and autonomous vehicles, boosting LCD glass demand for dashboards, control panels, and infotainment units. Retail, healthcare, and transportation sectors are investing in digital signage and smart kiosks, creating sustained demand for durable and bright LCD panels. Collaborations between domestic tech companies and global display manufacturers open up innovation opportunities, especially as demand shifts toward customized and application-specific glass formats.

Despite favorable growth conditions, the market faces restraints such as competition from OLED technology, high production costs, and supply chain vulnerabilities. OLED panels, offering better contrast and flexibility, are steadily gaining share in premium devices and may limit LCD demand in specific segments.

Substrate Material Insights

The borosilicate glass segment under the substrate material category is gaining steady traction in the U.S. LCD glass market, due to its excellent resistance to thermal shock, chemical corrosion, and mechanical stress. With a lower thermal expansion coefficient than conventional soda-lime glass, borosilicate substrates offer higher durability during high-temperature processing steps involved in LCD panel fabrication. This makes it suitable for specialized applications such as industrial displays, medical imaging systems, and outdoor digital signage, where environmental stability and longevity are essential. Its ability to withstand harsh operational conditions makes it a reliable choice for demanding end use environments.

The alkali-free glass, typically composed of aluminosilicate without alkali oxides like sodium or potassium, ensures high dimensional stability and minimal ion migration, making it ideal for high-performance LCD applications. Its use is particularly prominent in smartphones, tablets, televisions, and industrial monitors, where critical optical clarity and heat and corrosion resistance are critical. As demand rises for compact, energy-efficient, and high-resolution displays, alkali-free glass is becoming the preferred choice for panel manufacturers focused on reliability and long-term performance.

Application Insights

The LCD TVs segment represents a major application area in the U.S. LCD glass industry, driven by consistent consumer demand for larger screen sizes, 4K and 8K resolution formats, and smart connectivity features. Households continue to upgrade to more advanced televisions, prompting panel manufacturers to use high-quality glass substrates that deliver enhanced brightness, contrast, and energy efficiency. The shift from plasma and CRT displays to flat-panel LCDs remains a strong contributor to glass consumption in this segment. Additionally, the growing popularity of wall-mounted ultra-thin TVs encourages the use of durable yet lightweight glass materials to support performance and aesthetics.

The desktop monitors segment is critical in supporting the U.S. LCD glass market, particularly with the continued expansion of remote work, gaming, and professional content creation. Users increasingly prefer larger screens with higher refresh rates, ultra-wide formats, and improved color accuracy, all requiring high-quality LCD glass substrates. Whether for home offices, graphic design, software development, or financial trading setups, the demand for advanced monitors drives panel makers to adopt glass that supports precision pixel alignment, glare reduction, and thermal resistance during prolonged usage.

Key U.S. LCD Glass Company Insights

Some of the key players operating in the market include Coresix Precision Glass and Corning Incorporated.

-

Coresix Precision Glass is a U.S.-based manufacturer specializing in high-precision glass components for industries requiring tight dimensional tolerances and optical clarity. With core expertise in cutting, polishing, coating, and fabricating a wide range of glass types, Coresix serves applications across display technology, biomedical devices, aerospace, and semiconductor equipment. The company operates cleanroom production environments to maintain stringent quality standards, allowing it to deliver ultra-flat and defect-free substrates tailored for high-performance applications.

-

Corning Incorporated is a global leader in specialty glass and ceramics, and it is known for its pioneering work in display technologies. Headquartered in New York, Corning has played a foundational role in the evolution of flat-panel displays, developing advanced glass substrates through its proprietary fusion-draw manufacturing process. The company serves a broad spectrum of the electronics industry, supplying glass for smartphones, TVs, monitors, tablets, and automotive displays.

Key U.S. LCD Glass Companies:

- Corning Incorporated

- LXD Incorporated

- Planar Systems, Inc.

- Orient Display Ltd.

- JNS Glass & Coatings

- Coresix Precision Glass

- One World LED USA LLC

- IVC Displays, Inc.

- Newhaven Display

- Phoenix Display

U.S. LCD Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,726.1 million

Revenue forecast in 2033

USD 2,260.0 million

Growth rate

CAGR of 3.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Substrate material and application

Country scope

U.S.

Key companies profiled

Corning Incorporated; LXD Incorporated; Planar Systems, Inc.; Orient Display Ltd.; JNS Glass & Coatings; Coresix Precision Glass; One World LED USA LLC; IVC Displays, Inc.; Newhaven Display; Phoenix Display

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. LCD Glass Market Report Segmentation

This report forecasts the revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. LCD glass market report based on substrate material and application:

-

Substrate Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Alkali-free Glass

-

Borosilicate Glass

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

LCD TVs

-

Desktop Monitors

-

Notebook PCs

-

Smartphones & Tablets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. LCD glass market size was estimated at USD 1,679.1 million in 2024 and is expected to reach USD 1,726.1 million in 2025.

b. The U.S. LCD glass market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2033 to reach USD 2,260.0 million by 2033.

b. The borosilicate glass segment dominated the market with a revenue share of over 61.0% in 2024.

b. Some of the key players of the U.S. LCD glass market are Corning Incorporated, LXD Incorporated, Planar Systems, Inc., Orient Display Ltd., JNS Glass & Coatings, Coresix Precision Glass, One World LED USA LLC, IVC Displays, Inc., Newhaven Display, Phoenix Display, and others.

b. The key factor driving the growth of the U.S. LCD glass market is the increasing demand for high-resolution display panels across consumer electronics, automotive systems, and advanced industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.