- Home

- »

- Medical Devices

- »

-

U.S. Ligation Devices Market Size, Industry Report, 2033GVR Report cover

![U.S. Ligation Devices Market Size, Share & Trends Report]()

U.S. Ligation Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Appliers, Accessories), By Application (Gynecology, Cardiothoracic), By Procedure, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-638-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ligation Devices Market Size & Trends

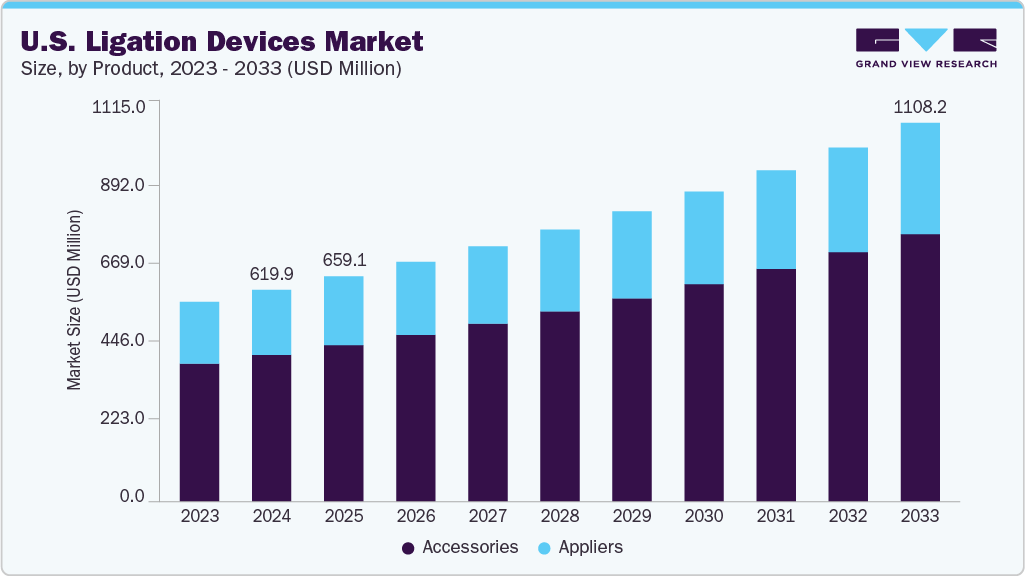

The U.S. ligation devices market size was estimated at USD 619.9 million in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2033 to reach a value of USD 1,108.6 million in 2033. The market growth is driven by several factors, including the increasing volume of surgical procedures, fueled by an aging population and the rising prevalence of chronic diseases such as cardiovascular conditions and cancer. Technological advancements, such as robotic-assisted ligation systems and the development of innovative materials, enhance surgical precision and patient outcomes, further fueling market expansion.

The growing preference for minimally invasive surgical techniques also contributes to market growth, as ligation devices are essential. The U.S. is witnessing a significant rise in overall surgical interventions owing to the aging population and the rising prevalence of chronic and degenerative diseases. As the proportion of Americans aged 65 and older continues to increase, there is a corresponding rise in age-related conditions such as cardiovascular disease, colorectal cancer, and urologic disorders, which significantly increases demand for surgical treatment involving ligation. According to the Population Reference Bureau (PRB), the elderly population in the U.S. aged 65 years is expected to increase from around 58 million in 2022 to approximately 82 million by 2050. Geriatric patients undergoing procedures such as bowel resections, hernia repairs, and prostatectomies benefit from the reduced operative time and lower risk of complications offered by advanced ligation systems.

Prevalence of Uterine Fibroids in U.S. States (2019 - 2021)

States

2019

2020

2021

California

717,720

718,448

730,140

Colorado

81,427

82,077

88,202

Oregon

55,364

55,858

60,072

Michigan

180,774

180,338

181,982

Arizona

122,499

123,616

127,037

Alaska

8,611

8,570

9,342

Nevada

65,893

67,026

67,748

Texas

521,729

524,912

544,877

Wyoming

5,733

5,707

6,489

Montana

12,121

12,256

13,296

Source: IHME, Grand View Research Analysis

Moreover, procedures in gastrointestinal, gynecological, cardiovascular, and urological specialties are witnessing a surge due to the growing burden of conditions such as cancer, diabetes, and heart disease. According to the American Heart Association (AHA), in January 2024, someone dies of a stroke every 3 minutes and 14 seconds, highlighting the urgent need for timely surgical management. This expanding surgical demand is prompting medical device companies to invest in advanced ligation technologies that support efficiency and patient safety in high-volume surgical environments. For instance, in February 2024, Ethicon (a Johnson & Johnson MedTech company) announced enhancements to its surgical stapling and ligation devices, optimized for precision and tissue management during minimally invasive surgeries. Similarly, Medtronic is expanding its vessel sealing product line to support broader applications in laparoscopic and open surgeries, addressing the needs of growing procedure volumes.

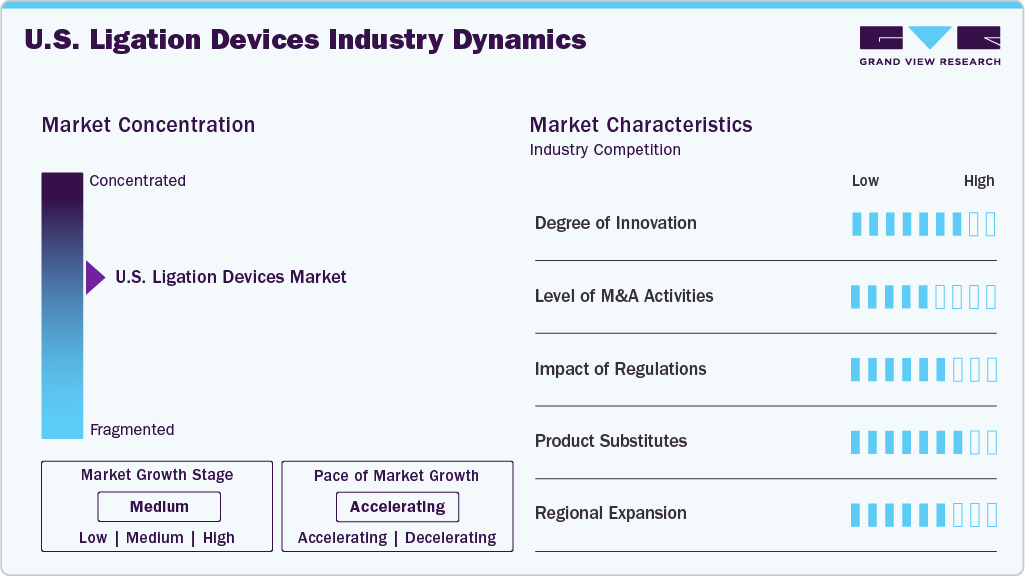

Market Concentration & Characteristics

The U.S. ligation devices industry is characterized by an increasing preference for minimally invasive procedures, a growing geriatric population, and an increasing prevalence of diseases requiring surgical interventions. Moreover, technological advancements in ligation devices improve their effectiveness and application, further contributing to market growth.

The U.S. ligation devices industry is witnessing a significant degree of innovation, driven by advancements focusing on enhancing ease of use, improving patient outcomes, and minimizing complications. Key areas of innovation include the development of devices with enhanced biocompatibility and improved clip designs for stronger and more secure ligation. Competitive landscape encourages innovation, with companies aiming to differentiate their products through features such as enhanced clip materials, ergonomic designs, and integration with robotic surgical systems.

Mergers and acquisitions in the U.S. ligation devices industry involveconsolidating companies through various transactions, including mergers and acquisitions. Market players engage in M&A for various strategic reasons, such as expanding market share, diversifying product offerings, and acquiring new technologies. Companies can benefit from M&A through increased revenue and enhanced competitive positioning.

The U.S. ligation devices industry is significantly influenced by regulatory frameworks, primarily those enforced by the Food and Drug Administration (FDA). The FDA's stringent premarket approval (PMA) or 510(k) clearance processes for these devices directly impact market entry timelines and associated costs. Furthermore, post-market surveillance requirements, such as adverse event reporting and device tracking, add ongoing compliance costs and influence product design and manufacturing processes. The FDA's emphasis on device safety and efficacy further influences the market.

The U.S. ligation devices industry faces a significant threat from substitutes. The most significant substitutes include advanced energy devices such as ultrasonic and radiofrequency surgical systems, which offer the ability to seal vessels and tissues with heat, potentially reducing the need for clips and ligatures in certain procedures. Furthermore, suture-based techniques remain a viable alternative, particularly in procedures where surgeons have a preference or where the cost of advanced devices is a concern. However, ligation devices still hold advantages in terms of cost-effectiveness for certain procedures and the familiarity of surgeons with these established techniques.

The U.S. ligation devices industry's regional expansion is fueled by increasing demand for minimally invasive surgical procedures, which inherently require these devices. Furthermore, the presence of specialized medical centers and the concentration of skilled surgeons significantly impact the market's regional expansion, leading to strategic investments in various regions. A shift towards value-based healthcare models also characterizes the regional expansion. This shift encourages the adoption of cost-effective and efficient surgical solutions, which influences the regional preferences for specific ligation devices.

Product Insights

The accessories segment accounted for the largest revenue share of 69.7% in 2024 and is expected to grow fastest over the forecast period. Ligation clips and clip removers are vital surgical accessories that ensure effective vessel closure and enable correction of misplaced clips when needed. These devices are commonly used in procedures such as laparoscopic, gynecological, urological, and general surgeries. Available in metallic, polymer, and absorbable variants, each clip type offers unique advantages in terms of strength, biocompatibility, and imaging compatibility. These technological advancements in clip design and material science have led to the development of more biocompatible and efficient clips, further driving their adoption.

The applier segment is expected to witness significant growth as appliers are essential tools for these procedures, enabling surgeons to efficiently and effectively ligate vessels and tissues with minimal trauma to the patient. Appliers, which are instruments used to apply ligating clips or sutures, are seeing increased adoption due to their enhanced precision and ease of use, particularly in minimally invasive procedures. Delivering consistent and secure ligation is a key driver, reducing the risk of complications such as bleeding or leakage, which is crucial for patient safety and recovery times.

Application Insights

The gastrointestinal and abdominal segment accounted for the largest revenue share of 29.0% in 2024. Ligation devices play a pivotal role in gastrointestinal (GI) and abdominal surgery, particularly in endoscopic and minimally invasive procedures, ensuring secure closure of vessels, ducts, and tissue defects. According to the 2024 “Burden and Cost of Gastrointestinal, Liver, and Pancreatic Diseases” report, U.S. expenditures in 2021 reached USD 111.8 billion, with 14.5 million emergency department visits, 2.9 million hospital admissions, and 315,065 new GI cancer diagnoses-reflecting extensive use of ligation devices for both therapeutic and diagnostic interventions. Further, GI diseases caused 281,413 deaths in the same year, underscoring the importance of effective surgical technique. This increasing demand for effective surgical solutions in gastrointestinal and abdominal surgeries is expected to fuel the segment's growth.

The urological segment is expected to grow fastest at a CAGR of 7.62% over the forecast period. This can be attributed to the increasing prevalence of urological conditions, such as prostate cancer, kidney stones, and urinary incontinence, necessitating a rise in surgical interventions. The need for improved patient outcomes and reduced complications also influences the adoption of advanced ligation devices in urology. Developing specialized ligation devices tailored to the unique anatomical challenges of urological procedures, such as those designed for use in the confined spaces of the pelvis, also contributed to the segment's growth.

Procedure Insights

The minimally invasive surgeries (MIS) dominated the market with 88.1% market share in 2024, owing to their several clinical advantages. The increasing adoption of MIS techniques, such as laparoscopy and robotic surgery, has fueled demand for specialized ligation devices designed for these procedures. These devices offer surgeons enhanced precision, improved visualization, and the ability to perform complex procedures through small incisions. The benefits of MIS, including reduced patient trauma, faster recovery times, and decreased post-operative complications, have made it a preferred choice for both patients and surgeons, thereby driving the demand for ligation devices for these procedures.

The open surgery segment is expected to witness significant growth in the procedure segment owing to the preference for open surgical techniques in certain clinical scenarios, particularly in resource-constrained settings or for complex procedures where direct visualization is considered crucial for optimal outcomes. The growth of open surgery is also driven by the need to address specific challenges associated with open procedures, such as the need for effective and reliable ligation in cases of significant bleeding or complex anatomical variations.

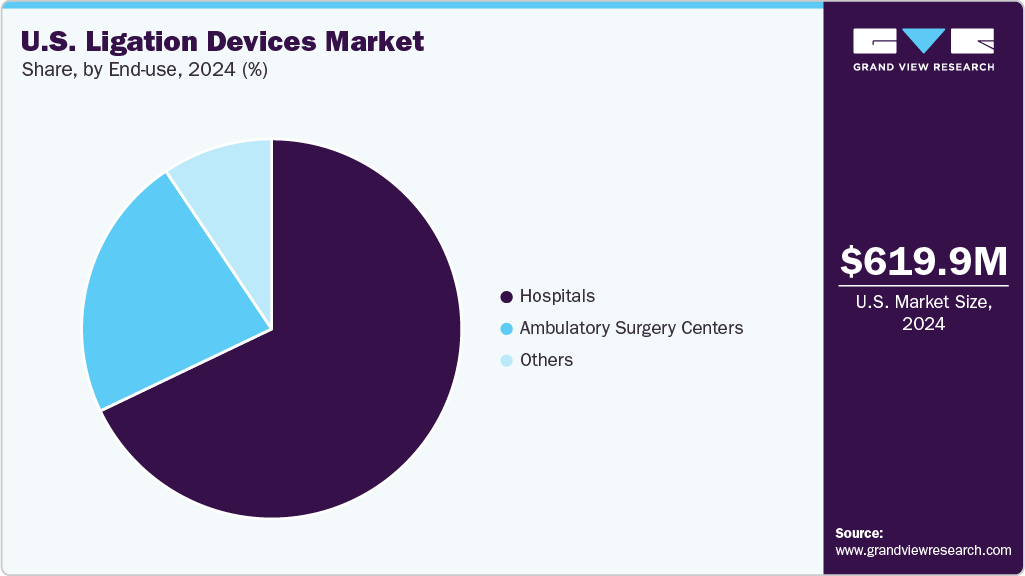

End Use Insights

The hospital segment accounted for the largest market share of 67.9% in 2024. Hospitals play a critical role in adopting and advancing ligation devices, especially as they increasingly perform minimally invasive and robotic-assisted surgeries. These devices, which include clip appliers, clips, and clip removers, are essential in various procedures to ensure secure vessel ligation, control bleeding, and manage soft tissue. Hospitals use them across general, gynecological, urological, gastrointestinal, and cardiovascular surgeries, integrating them into conventional and robotic systems to improve outcomes, reduce recovery time, and enhance surgical precision.

Ambulatory Surgical Centers (ASCs) play an increasingly vital role in the market as outpatient surgeries continue to rise in popularity due to cost efficiency and improved patient outcomes. With over 80% of surgeries in the U.S. now conducted in outpatient settings, ASCs have become essential for delivering same-day procedures across various specialties. Ligation devices such as clip appliers, ligation clips, and vessel sealing instruments are frequently used in minimally invasive surgeries conducted at ASCs, including laparoscopic cholecystectomies, hernia repairs, gynecological procedures, and urological interventions. For instance, as of 2024, there were around 9,600 active ambulatory surgery centers in the U.S. Thus, the segment is expected to grow significantly during the forecast period.

Key U.S. Ligation Devices Company Insights

Leading market players include Medtronic plc, Johnson & Johnson (Ethicon Inc.), and Teleflex Inc. These companies have utilized their technological expertise to enhance their presence in this growing market. Their strategies emphasize the development of effective solutions, improved accessibility, and ensuring widespread adoption of their advanced products.

Key U.S. Ligation Devices Companies:

- Medtronic plc

- Johnson & Johnson (Ethicon Inc.)

- Teleflex Inc.

- B. Braun Melsungen AG

- Olympus Corporation

- Boston Scientific Corporation

- ConMed Corporation

- Applied Medical Resources Corp.

- Wexler Surgical

- Medical Disposables Corp.

Recent Developments

-

In February 2025, Teleflex announced plans to spin off into two public companies by mid‑2026. RemainCo will retain its Surgical business, focusing on hospitals and ORs, with a product lineup that includes single-use and reusable devices such as metal and polymer ligating clips, fascial closure systems for laparoscopic surgery.

-

In November 2024, Medtronic acquired Netherlands-based Fortimedix Surgical to enhance its surgical and endoscopy portfolio. The deal adds Fortimedix’s flexible, articulating instruments originally developed for its symphonX (FMX314) Surgical Platform, including Clip Applier ligation tools, to Medtronic’s robotic lineup.

U.S. Ligation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 659.12 million

Revenue forecast in 2033

USD 1,108.16 million

Growth rate

CAGR of 6.71% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure, end use

Regional scope

U.S.

Key companies profiled

Medtronic plc; Johnson & Johnson (Ethicon Inc.); Teleflex Inc.; B. Braun Melsungen AG; Olympus Corporation; Boston Scientific Corporation; ConMed Corporation; Applied Medical Resources Corp.; Wexler Surgical; Medical Disposables Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ligation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. ligation devices market report based on product, application, procedure, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Appliers

-

Disposable

-

Reusable

-

-

Accessories

-

Clips

-

Clip remover

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal and abdominal

-

Gynecological

-

Cardiothoracic

-

Urological

-

Bariatric

-

Vascular

-

Other

-

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Minimally Invasive Surgery

-

Laparoscopic

-

Robotic Assisted

-

Others

-

-

Open surgery

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. ligation devices market size was estimated at USD 619.9 million in 2024 and is expected to reach USD 659.1 million in 2025.

b. The U.S. ligation devices market is expected to grow at a compound annual growth rate of 6.71% from 2025 to 2030 to reach USD 1,108.16 million by 2033.

b. The minimally invasive surgeries (MIS) segment dominated the market with 88.1% market share in 2024, owing to its several clinical advantages. The increasing adoption of MIS techniques, such as laparoscopy and robotic surgery, has fueled demand for specialized ligation devices designed for these procedures.

b. Some key players operating in the U.S. ligation devices market include Medtronic plc; Johnson & Johnson (Ethicon Inc.); Teleflex Inc.; B. Braun Melsungen AG; Olympus Corporation; Boston Scientific Corporation; ConMed Corporation; Applied Medical Resources Corp.; Wexler Surgical; Medical Disposables Corp.

b. Key factors driving market growth include the increasing volume of surgical procedures, fueled by an aging population and the rising prevalence of chronic diseases such as cardiovascular conditions and cancer. Technological advancements, such as robotic-assisted ligation systems and the development of innovative materials, enhance surgical precision and patient outcomes, further fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.