- Home

- »

- Medical Devices

- »

-

Suture Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Suture Market Size, Share & Trends Report]()

Suture Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surgical, Barbed, Gut, Microsutures), By Wound Type (Acute, Chronic), By End-use (Ambulatory Surgery Center, Skilled Nursing Facility), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Suture Market Size & Trends

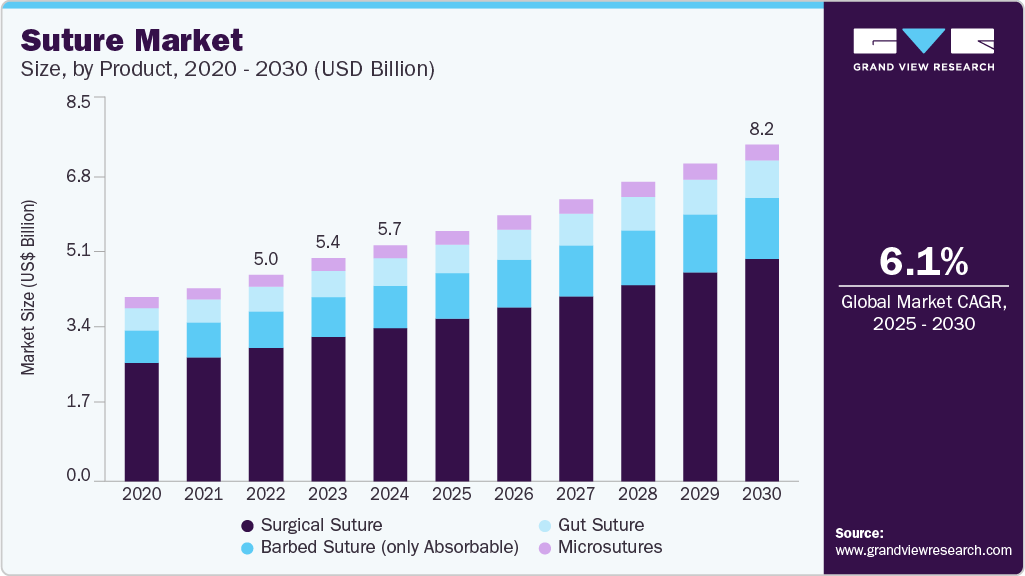

The global suture market size was estimated at USD 5.74 billion in 2024 and is projected to grow at a CAGR of 6.09% from 2025 to 2030. This market growth is largely attributed to the rising number of surgical procedures across key specialties such as orthopedics, cardiovascular, and general surgery.

Key Highlights:

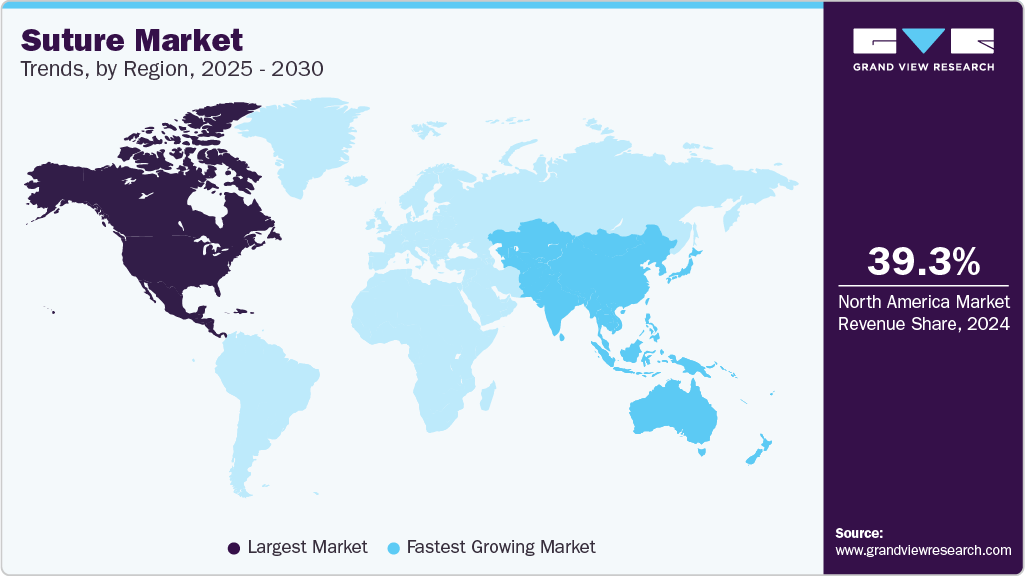

- The North America market dominated and held the largest share of 39.29% in 2024.

- The U.S. dominates North America market with the revenue share of 77.10% in 2024.

- By product, the surgical suture segment captured the largest market share of 64.81% in 2024.

- By wound type, the acute wound segment held the largest market share of 71.48% in the suture market in 2024.

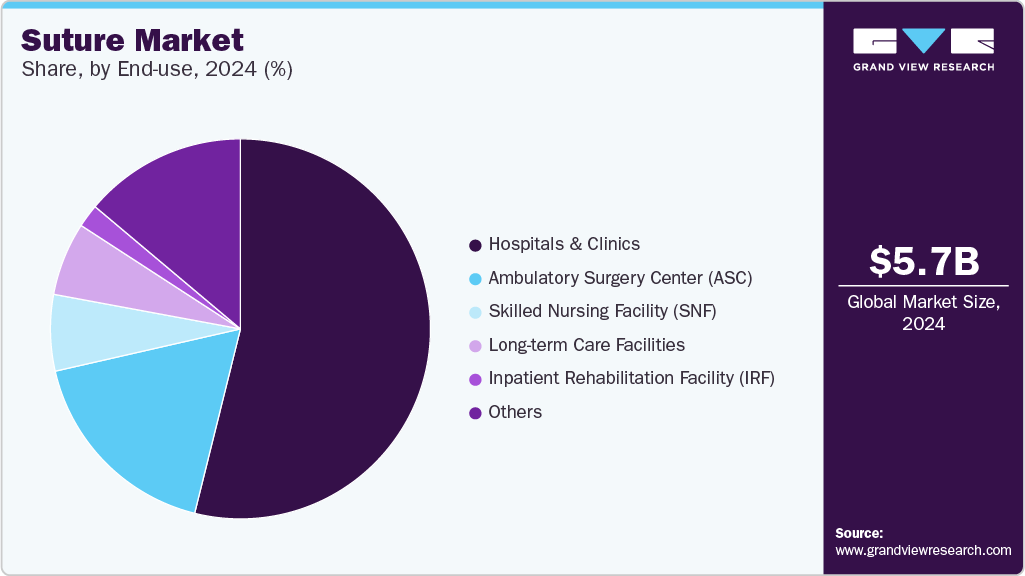

- By end-use, the hospitals and clinics segment held the largest market share of 53.88% in 2024.

Technological advancements in suture materials aimed at improving healing outcomes and reducing complications further drive market demand. As minimally invasive and precision procedures grow in popularity, demand for innovative, effective, and patient-friendly wound closure solutions is expected to grow consistently throughout the forecast period.

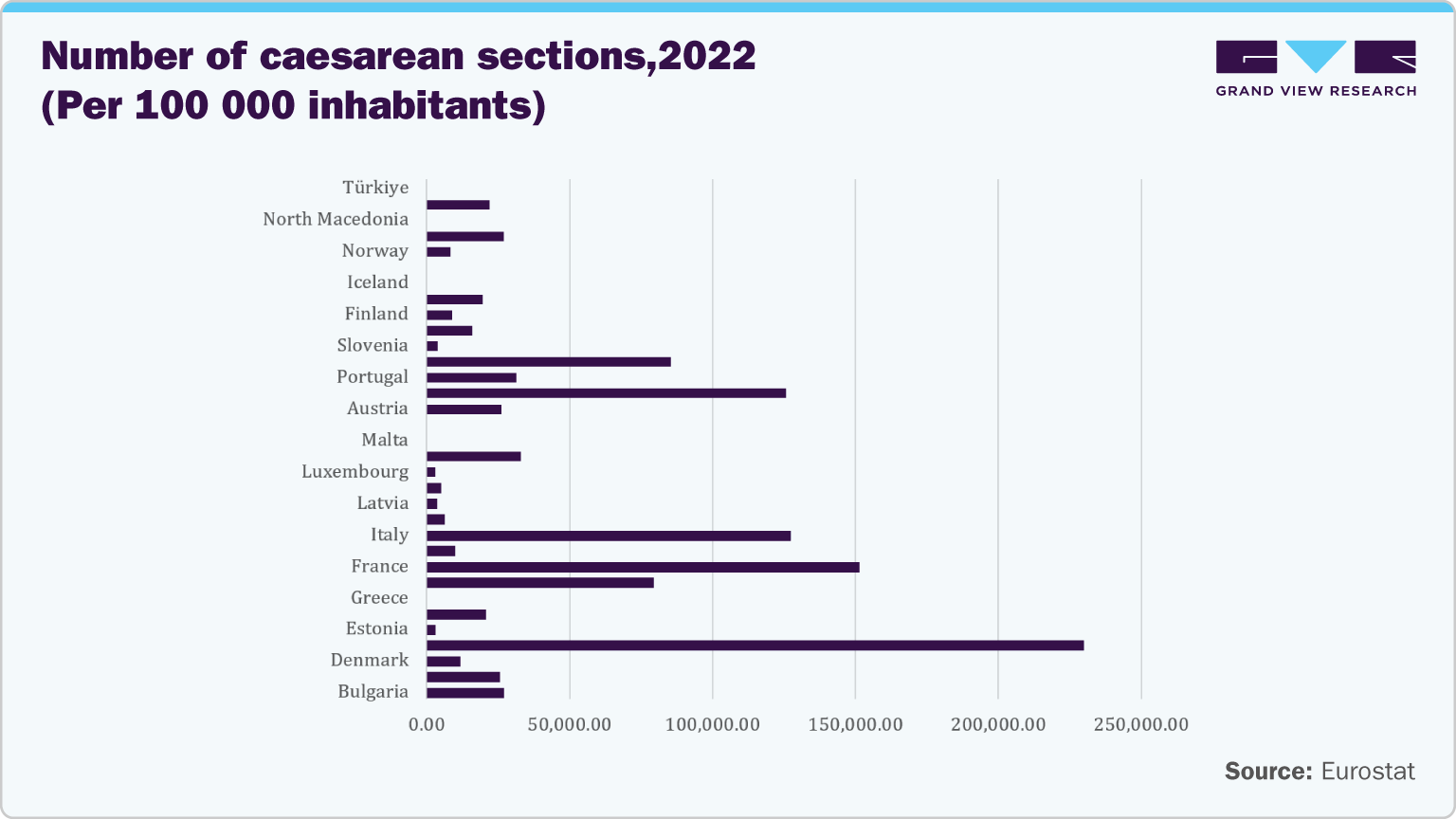

The increasing number of surgeries worldwide is a primary demand driver in the global suture industry. Improving health systems, advancements in surgical technology, and an aging population have resulted in increased surgical procedures across various specialties. For instance, according to the data published by the Global Survey 2023, Liposuction was the most common surgery in 2023, with over 2.2 million, followed by breast augmentation, eyelid surgery, abdominoplasty, and rhinoplasty. All these increased procedures directly influence the demand for sutures, which play a significant role in wound closure and post-surgery recovery.Beyond cosmetic surgeries, the demand for sutures is also propelled by essential medical procedures such as cesarean sections, orthopedic surgeries, and cardiovascular interventions, further expanding the market’s growth potential.

In addition, according to the World Health Organization (WHO) report published in December 2023, approximately 1.19 million people die each year due to road traffic crashes, making these incidents one of the leading causes of mortality, particularly among children and young adults aged 5 to 29 years. In addition, in 2023, private industry employers reported approximately 2.6 million nonfatal injuries and illnesses, reflecting a decline of 8.4% from the previous year, according to the Bureau of Labor Statistics (BLS) and the National Safety Council. The growing incidence of road accident injuries is further driving the market growth.

Furthermore, the growing incidence of sports-related injuries is one of the primary driving factors fueling market growth. For instance, according to the National Safety Council (NSC), exercise equipment was associated with approximately 482,886 injuries in 2023, marking it as the leading cause of injuries among all sports and recreation categories .

Sports Injuries by Number of Injuries, 2023

Sport, activity or equipment

Injuries, 2023

Exercise, exercise equipment

482,886

Bicycles and accessories

405,688

ATV's, mopeds, minibikes, etc.

269,657

Basketball

332,391

Skateboards, scooters, hoverboards

221,313

Playground equipment

190,942

Baseball, softball

139,940

Soccer

212,423

Swimming, pools, equipment

166,011

Trampolines

111,212

Lacrosse, rugby, misc. ball games

72,096

Skating (excl. In-line)

69,833

Source: National Safety Council

Advancements in suture technology significantly drive demand in the suture market by improving surgical outcomes and patient recovery. Innovations such as biodegradable and absorbable materials, enhanced knot security, and the rise of smart sutures with sensors or drug delivery systems are improving the precision and safety of surgeries. For instance, in May 2023, engineers at the Massachusetts Institute of Technology, U.S., developed innovative drug delivery sutures to reduce inflammation and enhance healing, marking a significant advancement in suture technology.

The rise in road accidents worldwide is a significant growth driver. With increasing traffic-related injuries, such as deep lacerations, fractures, and internal injuries, the demand for quick surgical intervention and wound closure is higher. According to the World Health Organization (WHO), approximately 1.19 million people die each year from road traffic crashes. Although they have only 60% of the world's vehicles, low- and middle-income nations account for 92% of the road deaths in the world. This increasing rate of road accidents, particularly in these regions, drives the demand for sutures to effectively manage the injuries resulting from such accidents. Moreover, continued innovations in the suture market enhance patient outcomes by improving healing times, minimizing scarring, and reducing the risk of infection, further fueling the demand for sutures in trauma care.

Number of worldwide surgical procedures performed by plastic surgeons, 2019 - 2023

Rank

Surgical Procedure

Total Procedures (2023)

% of Total Surgical Procedures

Total Procedures (2022)

Total Procedures (2019)

% Change 2023 vs. 2022

% Change 2023 vs. 2019

1

Liposuction

2,237,966

14.2%

2,303,929

1,704,786

-2.9%

31.3%

2

Breast Augmentation

1,892,777

12.0%

2,174,616

1,795,551

-13.0%

5.4%

3

Eyelid Surgery

1,746,946

11.0%

1,409,103

1,259,839

24.0%

38.7%

4

Abdominoplasty

1,153,539

7.3%

1,180,623

924,031

-2.3%

24.8%

5

Rhinoplasty

1,148,559

7.3%

944,468

821,890

21.6%

39.7%

6

Breast Lift

903,266

5.7%

955,026

741,284

-5.4%

21.9%

7

Lip Enhancement/Perioral Procedure

901,991

5.7%

699,264

N/A

29.0%

N/A

8

Buttock Augmentation

771,333

4.9%

820,762

479,451

-6.0%

60.9%

9

Fat Grafting - Face

741,061

4.7%

648,894

598,823

14.2%

23.8%

10

Breast Reduction

686,125

4.3%

632,860

600,219

8.4%

14.3%

11

Face Lift

646,482

4.1%

541,491

448,485

19.4%

44.1%

12

Neck Lift

452,639

2.9%

400,593

260,747

13.0%

73.6%

13

Brow Lift

386,427

2.4%

352,324

270,917

9.7%

42.6%

14

Gynecomastia

352,302

2.2%

305,340

273,344

15.4%

28.9%

15

Breast Implant Removal

335,939

2.1%

320,765

229,680

4.7%

46.3%

16

Ear Surgery

327,990

2.1%

303,906

288,905

7.9%

13.5%

17

Upper Arm Lift

244,977

1.5%

204,011

168,289

20.1%

45.6%

18

Labiaplasty

189,058

1.2%

194,086

164,667

-2.6%

14.8%

19

Facial Bone Contouring

153,749

1.0%

138,115

108,536

11.3%

41.7%

20

Thigh Lift

146,264

0.9%

113,746

93,334

28.6%

56.7%

21

Lower Body Lift

128,998

0.8%

123,123

75,895

4.8%

70.0%

22

Buttock Lift

110,167

0.7%

95,174

54,894

15.8%

100.7%

23

Vaginal Rejuvenation

84,495

0.5%

70,645

N/A

19.6%

N/A

24

Upper Body Lift

70,306

0.4%

54,120

N/A

29.9%

N/A

Total Surgical Procedures

15,813,353

—

14,986,982

11,363,569

5.5%

39.2%

Source: International Society of Aesthetic Plastic Surgery, Grand View Research

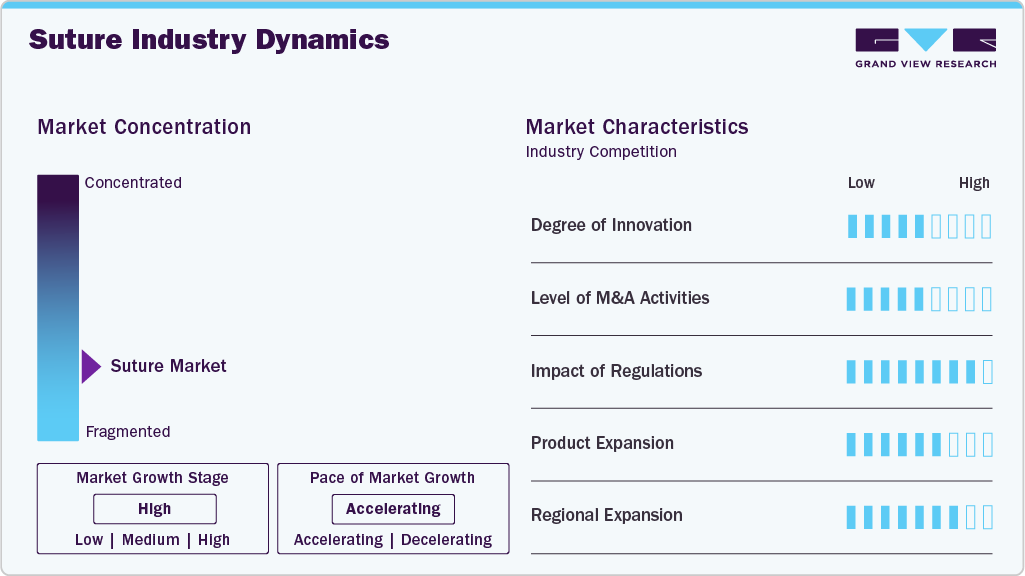

Market Concentration & Characteristics

The suture market has seen significant innovations to improve patient outcomes and surgical efficiency. Key advancements include antimicrobial-coated sutures to reduce infection risk, biodegradable materials that eliminate the need for removal, and natural-tissue-like sutures that ensure greater flexibility and strength. For instance, in October 2024, researchers in China developed a novel suture that electrically stimulates wounds to accelerate healing and reduce infection risk. The self-electrified, biodegradable material generates an electric charge through movement, enhancing cell migration and inhibiting bacterial growth. Such developments are driving improvements in both patient recovery and surgical precision.

The suture industry has witnessed moderate but growing mergers and acquisitions (M&A) activity in recent years. This trend is largely driven by the increasing demand for advanced surgical solutions, technological innovations in suture products, and the expanding healthcare infrastructure globally. For instance, in March 2023, Tube Investments of India (TII) and Premji Invest acquired 100% equity of Lotus Surgicals Pvt Ltd TII purchased a 67% stake, while Premji Invest acquired 33%. This strategic acquisition marks TII’s entry into the medtech sector and aims to establish a global platform for designing, manufacturing, and distributing innovative medical products at affordable prices. The partnership aspires to scale through organic growth and inorganic acquisitions, aligning with the “Atmanirbhar Bharat” vision.

Regulatory frameworks play a pivotal role in shaping the development and commercialization of sutures, as they ensure safety, efficacy, and market confidence. In the U.S., sutures are classified as medical devices, and the FDA mandates that certain types of sutures, such as absorbable and non-absorbable options, undergo a 510(k) premarket notification process, demonstrating their equivalence to existing products. More complex suture types, especially those with antimicrobial coatings or smart functionalities, may require stricter Premarket Approval (PMA), which includes clinical trials to validate safety and performance. Such regulation can influence development time and cost, but it is essential to confirm safety and reliability in sutures and instill confidence in the market.

Traditional sutures, such as silk, cotton, and nylon, often face competition from alternative wound closure products like surgical staples, adhesive glues, and tissue adhesives. These substitutes are increasingly favored due to their benefits, including reduced procedure time, decreased patient discomfort, and minimized risk of infection. Additionally, advancements in bioabsorbable materials and innovative closure technologies are providing surgeons with more options beyond conventional sutures, further driving the substitution trend. As healthcare providers aim for more efficient and patient-friendly solutions, the demand for these substitutes is expected to continue growing, prompting manufacturers to innovate and diversify their product portfolios accordingly.

The suture industry is witnessing significant regional expansion, driven by increasing surgical procedures such as general surgery, oral surgery, and gynecological surgery. North America and Europe remain dominant, supported by established healthcare systems, high adoption of advanced medical technologies, and continuous research in surgical techniques. However, the Asia-Pacific is now a key growth region with expanding healthcare access, rising awareness of surgical wound care, and growing demand for advanced suture products. Continued development of healthcare infrastructure and mounting emphasis on quality care will keep driving regional growth in the sutures market.

Product Insights

The surgical suture segment captured the largest market share of 64.81% in 2024, driven by increased surgical procedures and higher demand in hospitals and clinics. Rising awareness among healthcare providers and advancements in suture technology contributed to the expansion. Growth in the aging population and the incidence of chronic diseases further supported the segment. For instance, A study published in Scientific Reports in February 2025 introduced a novel bone-anchoring annular suture technique to address annular defects at the vertebral body edge following lumbar discectomy. This approach significantly improved clinical outcomes, including reduced pain and disability scores, further expanding the suture industry.

The barbed suture (only absorbable) segment is growing significantly due to its unique advantages in surgical procedures. These sutures are designed with barbs that grip tissue without knots, making them easier to use and reducing the time required for suturing. For instance, in February 2025, researchers developed femtosecond laser-fabricated resorbable barbed sutures using catgut and P4HB polymers, enhancing mechanical properties with improved precision and consistency. The absorbable nature of the suture eliminates the need for removal, offering a convenient solution for both patients and healthcare providers. Moreover, their ability to enhance healing and reduce complications such as wound infection and scarring has further boosted their demand in the market.

Wound Type Insights

The acute wound segment held the largest market share of 71.48% in the suture market in 2024, driven by the high incidence of surgical interventions, trauma cases, and emergency wound treatments. The demand for rapid and effective wound closure in hospitals, especially in surgical and emergency settings, continues to fuel the use of sutures in this segment. Ongoing research and innovation also play a critical role in improving suture technology designed to manage acute wounds. For instance, in October 2024, researchers in China developed biodegradable sutures that generate electrical charge from body movement, significantly accelerating acute wound healing by enhancing cell migration and reducing infection risk.

The chronic wound segment is expected to grow at a significant CAGR due to the increasing prevalence of chronic conditions like diabetes, venous ulcers, and pressure ulcers, which often lead to non-healing wounds requiring specialized care. The aging global population and advancements in suture technologies, such as antimicrobial and biocompatible materials, further drive this growth by improving healing times and reducing infection risks. Moreover, the growing focus on minimally invasive procedures and cost-effective healthcare solutions, coupled with greater awareness and access to chronic wound care, drives demand for advanced suturing techniques and products in this segment.

According to an article published by MDPI, in March 2025, Diabetic foot is one of the most serious and challenging complications of diabetes, closely linked to high rates of lower limb amputation, as well as increased illness and mortality. Each year, around 18.6 million people globally are affected by diabetic foot ulcers, which are the leading cause of approximately 80% of diabetes-related lower limb amputations. It is estimated that up to 25% of individuals with diabetes are at risk of developing diabetic foot, and between 19% and 34% may experience foot ulcers at some point in their lifetime.

Moreover, according to a study published by the American Medical Association in November 2023, around 33.33% of individuals with diabetes develop a foot ulcer during their lifetime. Diabetic foot ulcers impact about 1.6 million individuals in the U.S. each year. Furthermore, according to an article published by Trios Health in October 2023, around 2 million Americans develop diabetic foot ulcers each year. Hence, the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is anticipated to propel the market growth in the coming years.

End-use Insights

The hospitals and clinics segment held the largest market share of 53.88% in 2024, driven by the high volume of surgical procedures performed in hospital settings. Hospitals are key centers for emergency surgeries, trauma care, and complex medical procedures, all of which require precise and reliable suturing for wound closure and healing. Moreover, the rising demand for specialized wound care, particularly in critical care units, has solidified the dominance of clinics and hospitals segment.

The Ambulatory Surgery Center (ASC) segment is experiencing rapid growth, driven by several key factors. ASCs offer cost-effective, convenient, and efficient surgical options, making them increasingly favored for outpatient procedures. Advancements in minimally invasive techniques have expanded the range of surgeries performed in ASCs, further boosting demand for high-quality sutures. Moreover, ASCs tend to use cutting-edge suture materials to ensure better patient outcomes and reduce complications, playing a significant role in their rapid growth in the sutures market.

Distribution Channel Insights

The Institutional Sales segment held the largest market share in 2024, driven by the significant demand for sutures in hospitals, clinics, and other healthcare institutions. These settings account for most suture usage due to the high volume of surgeries, trauma care, and wound management procedures performed. Institutional sales benefit from bulk purchasing agreements and long-term contracts with healthcare providers, ensuring a steady supply of sutures for various surgical specialties.

The retail sales segment of the suture market is expected to grow at the fastest CAGR of 6.59% over the forecast period, owing to the increasing trend of home healthcare and patient self-care. As more individuals manage minor injuries, wound care, and post-surgical recovery at home, the demand for sutures and related products in retail outlets is rising. Moreover, the growing awareness of wound care solutions, improved access to over-the-counter products, and the availability of user-friendly, sterile suture kits further drive the segment's growth. Retail channels like pharmacies, online shops, and specialized medical supply stores are making sutures much easier for consumers to access, which is driving the rapid growth of this market segment.

Regional Insights

The North America market dominated and held the largest share of 39.29% in 2024, arising from a combination of factors including a well-established healthcare infrastructure, high healthcare spending, and increasing demand for advanced wound care solutions. The region's strong focus on innovation, research, and development in medical devices, including sutures, has further contributed to its dominant market position. The presence of key industry players and robust healthcare policies supporting access to advanced treatment options are also significant drivers of market growth in the region.

U.S. Suture Market Trends

The U.S. dominates North America market with the revenue share of 77.10% in 2024. The demand for sutures in the U.S. is growing steadily, driven by factors such as an aging population, an increase in surgical procedures, and the rising prevalence of chronic conditions like diabetes and cardiovascular diseases, which often require surgical interventions. According to the U.S. Centers for Disease Control and Prevention (CDC), chronic diseases are the leading cause of illness, disability, and death in America, with 6 in 10 Americans having at least one chronic disease, and 4 in 10 having two or more. Moreover, continuous innovations in suture materials and techniques further fuel market growth. As a result, the U.S. market is expected to experience sustained growth in the coming years.

In addition, according to The Johns Hopkins University article, in the U.S., around 30 million children and teenagers engage in organized sports, experiencing over 3.5 million injuries annually that lead to some level of participation loss. Approximately one-third of all childhood injuries are attributed to sports. Among these, sprains and strains are the most prevalent types of injuries reported. In addition, according to the report published by U.S. Department of Labor, in calendar year 2023, more than 890,000 workplace injuries had occurred. Hence, growing sports related injuries is further fueling the market growth in the country.

Europe Suture Market Trends

Europe represents a key growth region for the suture industry, driven by factors such as an aging population, increasing healthcare expenditures, and advancements in surgical techniques. The region has a well-established healthcare infrastructure, with a strong focus on patient safety and high-quality medical products, leading to greater demand for reliable and effective sutures. Europe is also witnessing the growing adoption of minimally invasive surgeries requiring specialized sutures and continued innovation in suture technologies, such as absorbable and antimicrobial sutures, which is expected to fuel further market growth.

The UK suture market is well-established, driven by an aging population, increased surgical procedures, and a rising prevalence of chronic diseases. The country’s robust healthcare system, including the public National Health Service (NHS) and private healthcare sectors, supports a high volume of surgeries, which drives the demand for sutures. Additionally, there is a growing preference for advanced suture materials, such as absorbable sutures, due to their convenience and effectiveness. With continuous advancements in medical technologies and a strong focus on healthcare innovation, the UK’s suture industry is expected to experience steady growth in the coming years.

Asia Pacific Suture Market Trends

Asia Pacific suture industry is growing at a notable CAGR over the forecast period, owing to an aging population, increasing surgical procedures, and the rising prevalence of chronic diseases. The region's expanding healthcare infrastructure, coupled with advancements in medical technologies. For instance, in August 2024, AIIMS Jammu, in collaboration with Ethicon (Johnson & Johnson), conducted a Surgical Skills Course and Workshop in Jammu and Kashmir. The event aimed to enhance surgical skills and training. This event highlights the region's ongoing efforts to improve surgical practices , further driving the demand for quality suture products.

The suture market in China is driven by the country's rapidly evolving healthcare system, rising surgical volumes, and growing awareness of advanced medical treatments. With ongoing urbanization and improvements in healthcare access, more patients are undergoing surgical interventions such as plastic surgery, increasing the demand for reliable wound closure solutions. The government's continued investment in public health infrastructure and medical education also supports adopting modern surgical techniques that require high-quality sutures.

Latin America Suture Market Trends

The Latin America suture industry is experiencing steady growth, supported by improvements in healthcare access, rising investments in hospital infrastructure, and a growing number of surgical procedures across the region. Countries such as Brazil and Argentina are expanding public and private healthcare services, which is increasing the demand for surgical supplies, including sutures. Moreover, the rising burden of chronic diseases and trauma cases is leading to a greater need for both emergency and elective surgeries. Efforts to modernize medical practices, train healthcare professionals, and adopt advanced surgical techniques also contribute to the growing use of high-quality suture products across the region.

Middle East & Africa Suture Market Trends

The suture industry in the Middle East and Africa (MEA) is emerging and characterized by moderate growth driven by increasing healthcare investments and surgical procedures. Countries like the UAE, Saudi Arabia, and South Africa are leading the way, with expanding healthcare infrastructure and a growing demand for surgical interventions. However, in many areas of Africa, particularly in Sub-Saharan regions, significant hurdles exist. Limited access to advanced medical technologies and economic challenges often lead to adopting modern suturing materials on a larger scale. Despite these challenges, the region presents significant opportunities for growth, with international collaborations and investments aimed at improving healthcare access and quality.

Saudi Arabia's suture market continues to grow steadily, supported by the country's broader healthcare transformation under initiatives like Vision 2030, which emphasizes expanding access to quality medical care and enhancing local healthcare capabilities. The government is investing heavily in hospital infrastructure, medical education, and the localization of medical device manufacturing, all of which contribute to increased demand for surgical supplies, including sutures. Moreover, rising elective surgeries, cosmetic procedures, and medical tourism fuel market growth. With an increasing focus on modern surgical practices and international partnerships to bring advanced technologies, Saudi Arabia is positioning itself as a growing hub for the suture industry in the Middle East.

Key Suture Company Insights

Medtronic; Ethicon (Johnson & Johnson), B. Braun SE, Riverpoint Medical, Corza Medical, and Advanced Medical Solutions Group plc are some of the major players in the suture industry. Companies are expanding their portfolios of sutures to gain a competitive advantage in the coming years.

Key Suture Companies:

The following are the leading companies in the suture market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Lotus Surgicals Pvt Ltd

- Dolphin Sutures

- CONMED Corporation

- Teleflex Incorporated.

- Ethicon (Johnson & Johnson Services, Inc.)

- Smith + Nephew

- Integra LifeSciences Corporation

- Peter Surgical

- Healthium Medtech Limited

- Medline Industries, LP.

- Dynarex Corporation

- Corza Medical

- Advanced Medical Solutions Group plc

- Riverpoint Medical

- B. Braun SE

- Atramat

- DemeTECH Corporation

Recent Developments

-

In May 2025, Applied Medical launched two innovative suture-passing instruments, RHAPSO and GEMINI, designed to enhance minimally invasive surgical procedures. RHAPSO features a 5mm gauge and a curved needle, facilitating precise suture placement in confined anatomical spaces. GEMINI, equipped with magnetic technology, offers versatile suture handling capabilities, improving efficiency in various surgical applications. These advancements aim to streamline surgical workflows and improve patient outcomes.

-

In October 2024, Corza Medical launched its new Onatec ophthalmic microsurgical sutures during the American Academy of Ophthalmology (AAO) conference in Chicago in October 2024. These sutures are designed with advanced precision, utilizing high-tempered stainless-steel needles that enhance bending resistance and durability. The automated manufacturing process ensures precise needle geometry, which supports the delicate handling of fine tissues during ophthalmic procedures.

-

In February 2024, Novo Integrated Sciences' subsidiary, Clinical Consultants International (CCI), signed a Consulting Services Agreement with Futura Surgicare Pvt Ltd, an India-based manufacturer of surgical products. The partnership aims to assist Futura in obtaining U.S. FDA 510(k) approvals for its advanced surgical products and to introduce high-quality Dolphin Sutures and mesh products to the North American healthcare market. This collaboration seeks to offer cost-effective surgical solutions and improve patient care in the U.S.

Suture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.09 billion

Revenue forecast in 2030

USD 8.19 billion

Growth rate

CAGR of 6.09% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wound type, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Medtronic; Lotus Surgicals Pvt Ltd; Dolphin Sutures; CONMED Corporation; Teleflex Incorporated;Ethicon (Johnson & Johnson Services, Inc.); Smith Nephew; Integra LifeSciences Corporation; Peter Surgical; Healthium Medtech Limited; Medline Industries, LP.; Dynarex Corporation; Corza Medical; Advanced Medical Solutions Group plc; Riverpoint Medical; B. Braun SE; Atramat; DemeTECH Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Suture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global suture market report based on product, wound type, end-use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Suture

-

Absorbable

-

Non-Absorbable

-

-

Barbed Suture (only Absorbable)

-

Uni-directional barbed suture

-

Bi-directional barbed suture

-

-

Gut Suture

-

Microsutures

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical/ Procedure

-

Obstetrics / Gynecology

-

Colorectal

-

Cardiovascular

-

Bariatric and Upper GI

-

Plastic and Reconstructive Surgery

-

Urology

-

Hepato-pancreato-biliary (HPB)

-

Dermatology

-

-

Lacerations & Minor Cuts

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgery Center (ASC)

-

Long-term Care Facilities

-

Inpatient Rehabilitation Facility (IRF)

-

Skilled Nursing Facility (SNF)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global suture market was valued at USD 5.74 billion in 2024 and is estimated to reach USD 6.09 billion in 2025.

b. The global suture market is expected to grow at a CAGR of 6.09% over the forecast period to reach USD 8.19 billion in 2030.

b. The surgical suture segment captured the largest market share of 64.81% in 2024, driven by increased surgical procedures and higher demand in hospitals and clinics.

b. Medtronic, Lotus Surgicals Pvt Ltd, Dolphin Sutures, CONMED Corporation, Teleflex Incorporated, Ethicon (Johnson & Johnson Services, Inc.), Smith Nephew, Integra LifeSciences Corporation, Peter Surgical, Healthium Medtech Limited, Medline Industries, LP., Dynarex Corporation, Corza Medical, Advanced Medical Solutions Group plc, Riverpoint Medical, B. Braun SE, Atramat, and DemeTECH Corporation are some of the key players operating in the market.

b. The suture market growth is largely attributed to the rising number of surgical procedures across key specialties such as orthopedics, cardiovascular, and general surgery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.